Virgin Money launches first current account

Challenger bank offers basic account that pays interest.

Virgin Money has launched its first ever current account.

At the moment the Virgin Essential Current Account is only available to open in stores located in Scotland and Northern Ireland, but a national rollout is set to follow.

So let’s take a look at what this "challanger bank" has brought to the table.

The account

Virgin Money’s first offering to the market is a basic bank account.

These types of accounts are for people on low incomes or with a poor/non-existent credit history who aren’t able to get regular standard accounts. Read How to improve your credit rating if you've been rejected.

As the name suggests they are designed to be no-frills and don’t normally come with anything but the bare essentials, like being able to pay in money, pay out bills and withdraw cash.

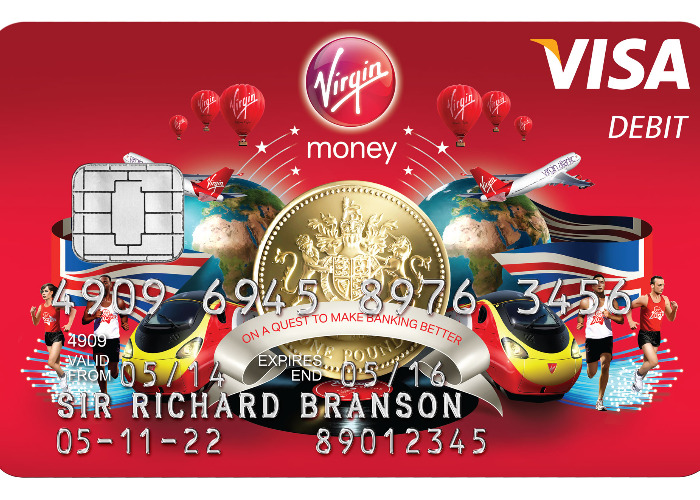

The Virgin Essential Current Account ticks all these boxes; you won’t be able to get an overdraft or chequebook, but you can set up Direct Debits and Standing Orders and you get a Visa debit card you can use in the UK and abroad (subject to fees) that gives you access to ATMs.

However, unlike other basic current accounts it also pays 1% variable interest on the full account balance up to £100,000. Plus the account doesn’t charge you for bounced payments; in fact it only comes with a handful of charges like overseas transaction fees (purchase fee of 2.99% and cash fee 2.99% + £1.50), a CHAPs fee (£35) and an additional paper copy statement fee (£10).

You’ll also get all the perks that come with being a Virgin Money customer like discounts on Virgin Trains, Virgin Experience Days and free access to Virgin Lounge rooms dotted across the country.

The Essential account can be opened solely or jointly and you can manage your money using the Post Office and Virgin Money stores as well as online, mobile and telephone banking.

How it compares

All of the big banks and building societies in the UK offer a basic bank account, but they don't tend to advertise them.

That's because these accounts don't make much money as they don't offer overdrafts and tend to be for people on low incomes or who have a poor credit history.

Take a look at our article Where to find a basic bank account to see what’s on offer across the market.

Virgin's first current account offering sets a new precedent in the market as it offers to pay interest and doesn't charge for bounced payments.

None of the big four banks (HSBC, Royal Bank of Scotland, Barclays and Lloyds ) or even Santander, Nationwide or the Co-operative Bank pay interest on basic accounts while only HSBC and Santander don't charge unpaid item fees.

So the Virgin Essential is certainly worth considering if you need a basic current account.

Alternative options

If you can't get a regular current account or a basic account you could try openening a bank account with your local credit union. You can find one near you here.

Alternatively, if you're paid in cash a prepaid card could help, while if you receive a pension or benefits you could try a Post Office Card Account.

Another alternative is the Ffrees Family Account, which doesn't require a credit check. There's no standard fee, though there is a £2 monthly dormancy charge if the account has not been used for two months.

More on current accounts:

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature