Premium Bonds odds: your chances of winning

What are your odds of winning a prize with Premium Bonds? Read on to see your chances of bagging each prize in the monthly draw, depending on how much you have invested.

Sections

Your Premium Bonds winning odds

Since the Premium Bond prize rate was cut last year, your odds of winning the top prize with your holdings have gotten a lot longer.

That's because the Premium Bond prize rate was cut from 1.4% to just 1%.

As a result, each individual £1 bond has a one-in-34,500 chance of winning any prize, compared to one-in-24,500 in the November 2020 draw (the last before the cut).

The next section takes a look at your latest odds of bagging each of the various Premium Bond prizes, but first, make sure you check our regularly updated Premium Bond winners article to find out if you've already won big.

The odds of winning each prize in the Premium Bonds draw

Here’s how prizes were distributed in the September 2021 draw (the distribution of prizes changes each month to keep the odds of winning any prize the same) along with what the odds were of winning each prize for a holding of a single £1 bond.

Since we last updated this article with the July draw odds, it’s become more difficult to bag the top prize, but the odds are slightly better for most of the smaller prizes (as the number of prizes have also increased).

|

Prize value |

No. of prizes |

Odds of winning with a £1 bond |

|

£1,000,000 |

2 |

1 in 56.2 billion |

|

£100,000 |

5 |

1 in 22.48 billion |

|

£50,000 |

11 |

1 in 10,218 million |

|

£25,000 |

22 |

1 in 5,109 million |

|

£10,000 |

55 |

1 in 2,043 million |

|

£5,000 |

107 |

1 in 1,050.46 million |

|

£1,000 |

1,872 |

1 in 60.04 million |

|

£500 |

5,616 |

1 in 20.01 million |

|

£100 |

30,445 |

1 in 3,691,872 |

|

£50 |

30,445 |

1 in 3,691,872 |

|

£25 |

3,189,365 |

1 in 35,242 |

|

Any prize |

3,257,945 |

1 in 34,500 |

Source: NS&I

Could you increase your odds of winning?

We’ve now established that it’s hard for a single bond to win even a £25 prize, let alone any of the top awards.

So, what can you do to increase your chances of winning?

Live in the south of England is one often-trumpeted solution.

But there are only more winners down south because more people live there, and more of them hold Premium Bonds.

So, statistically, there are likely to be more winners from there.

For more demystifying check out: Premium Bonds: common myths busted and have a read about how the Premium Bond winners are chosen.

In fact, the only way you can boost your chances of winning more prizes is to simply buy more Premium Bonds, so don't believe anyone who claims to have a trick or secret strategy.

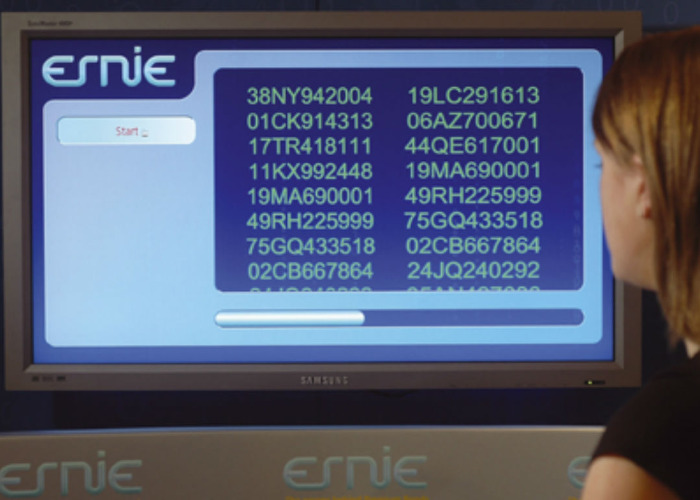

This is because each prize-winning Bond number is selected randomly by ERNIE (which stands for Electronic Random Number Indicator Equipment), so there is no way to beat the system.

Premium Bonds explained: how to buy, how to cash in, when prizes are announced and more

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature