Consumers face energy crisis

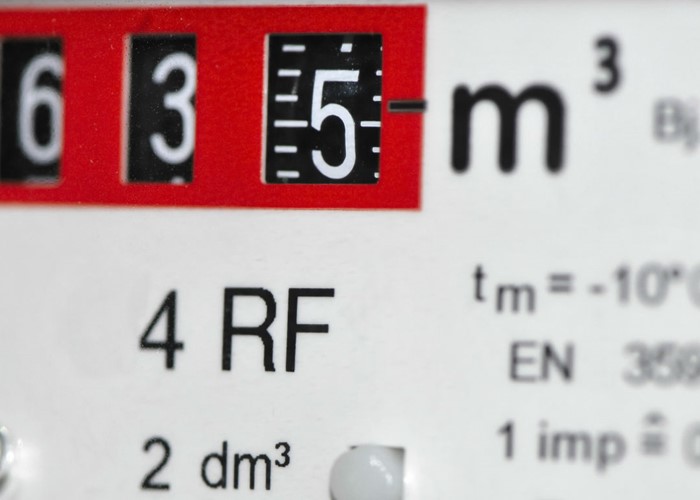

When it comes to energy, Britain is on the brink of an 'affordability crisis.'

Energy prices have soared this year and look set to keep rising for years to come. As a result, 28% of households are already struggling to afford their energy bills, according to USwitch.

What’s more, 62% of households say they would struggle to afford increases of as little as £30 a month. Such increase are very likely as the government continues its policy to push the industry to invest in more expensive ‘green’ forms of energy production such as wind power and nuclear.

It’s a scary prospect and raises the question of what consumers can do. At lovemoney.com we suggest two practical steps that could help:

1. Review your gas and electricity provider and check you’re getting the best deal. It’s easy to save if you compare energy providers at lovemoney.com.

2. Start tracking what you spend your money on and budget. We think the best budgeting tool is lovemoney.com’s Tracker. All your online bank accounts and credit cards are aggregated in one place, so you can see exactly how much money is coming in each day and how much is going out. Even better, your spending is categorised into different areas such as restaurants or housing costs.

Hopefully following these two steps will make a difference and help you meet the rising cost of energy.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature