Energy companies keep £1.2 billion of our savings

Energy providers are not only pushing up prices, but hanging onto our cash and robbing us of our savings.

More than half of energy customers are overpaying their gas and electricity bills, allowing the energy providers to benefit from an extra £1.2 billion each year.

Per customer this works out as an average overpayment of £80 every year.

But while the energy companies are holding onto this extra cash, customers are being robbed of the interest the money could make if it was in a standard savings account.

Energy bills

Every year 53% of us are paying more than we need to towards our energy bills, according to research*.

As we use less energy in the summer, when paying by direct debit, a surplus is built up which can then be used to cover more expensive winter bills.

But after winter many people still remain in credit to their supplier, giving it free access to this extra money.

Paying by direct debit

Paying by direct debit is a cheaper way of paying for your bills. 62% of people pay their gas bills by direct debit while 70% pay electricity bills this way.

However, as utility companies estimate bills for a household, this can be overestimated leading to customers overpaying their bills.

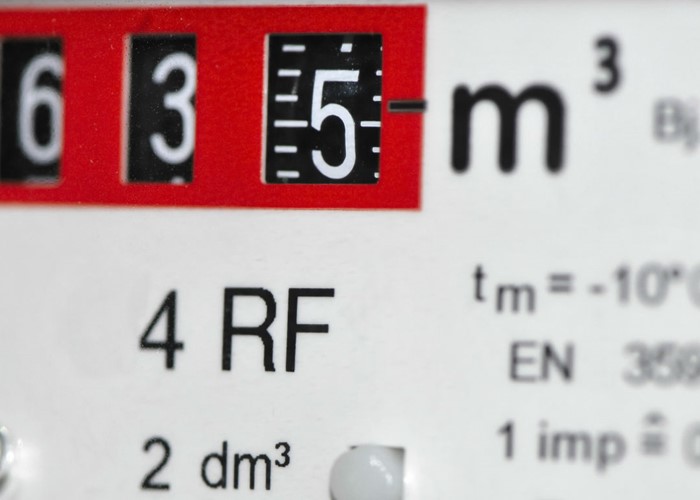

To avoid this, instead of blindly paying the direct debits, customers should regularly take their own meter readings. If you find your account is in credit to your supplier, you can ask for this money back.

Savings accounts

If this extra cash was put into a savings account it would at least start earning some interest. As you may need the money within a year, to cover higher payments, an instant-access account would work best in this situation.

The rates on instant access accounts are pretty poor at the moment and generally lie around the 2.5%, but it’s still better than nothing and you’ve got access to the cash when you need it.

Check out The best instant access savings accounts for more.

Confusing bills

Energy companies have been slated in the past for making their billing systems more complicated then they need to, as we highlighted in The best and worst energy bills.

If it was easier to understand what energy companies were charging, customers could see more clearly if they were paying more than they should.

Switching suppliers, if you can, will almost always save you money and it’s also a good way to avoid impending energy hikes. Our guide gives you a step-by-step guide to the switching process and you can compare energy costs across the market in our on our quote engine.

More on gas and electricity:

How to complain about your energy supplier

EDF announces biggest energy price rise yet

Is British Gas telling the truth?

*research from GoCompare.com

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature