Shares your parents should have bought the year you were born

Sensational high-yield shares you'll wish your folks had purchased

Thanks to the miracle of compound interest, stock splits, and bumper dividends, your parents could have set you up for life, or at the very least given you a significant headstart, had they invested in the right shares the year you were born, as long as they were prepared to be patient and hold on to the position. Click or scroll through the sensational returns you could have got from a prime stock (or in some cases another investment) for each year from 1940 to 2002, based on an initial investment of $1,000 ($18,600/£15,100 in today's money). All dollar values in US dollars.

1940 – Disney: $1,000 invested then is worth $20.8 million (£15.8m) + dividends today

Fresh from the success of Snow White and the Seven Dwarfs, the animation studio's first feature-length picture, Disney issued 600,000 shares on 8 March 1940 priced at $5 a pop. A $1,000 investment would have bought 200 shares at the time. Fast-forward to 2020 and those shares would have mushroomed into 153,600, worth a staggering $20.8 million (£15.8m), and had the dividends been reinvested, the holding would be worth significantly more.

Now read about Disney's journey to the top

1941 – PepsiCo: $1,000 invested then is worth $18 million (£13.7m) + dividends today

Sponsored Content

1942 – Pfizer: $1,000 invested then is worth $6.1 million (£4.6m) + dividends today

1943 – S&P 500: $1,000 invested then is worth $4.6 million (£3.5m) today

Holding onto shares for the long run can be highly lucrative even if the risk is spread. A $1,000 investment into the S&P 500 in 1943 would offer an average annualised return of 11.47%, which is well above the rate of inflation, giving you a bumper position of $4.6 million (£3.5m) today if you'd reinvested the dividends. This translates to a return of 462,584.68%.

1944 – Johnson & Johnson: $1,000 invested then is worth $9.9 million (£7.5m)

Sponsored Content

1945 – Dow Jones Industrial Average: $1,000 invested then is worth $2.6 million (£2m) today

1946 – Lafayette College Investing Club: $1,000 invested then is worth $266,666 (£200k) today

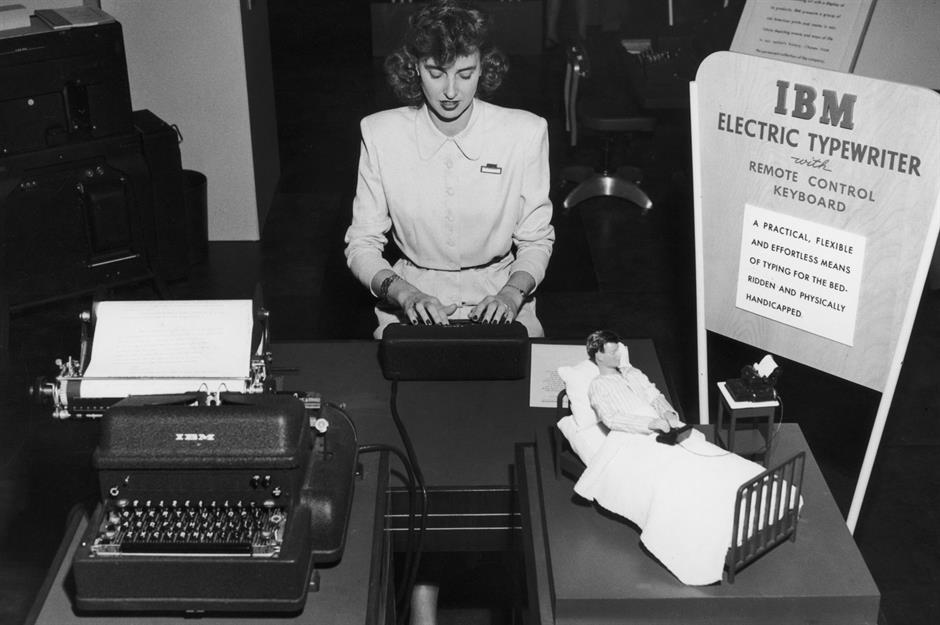

1947 – IBM: $1,000 invested then is worth $50.7 million (£38.5m) + dividends today

Sponsored Content

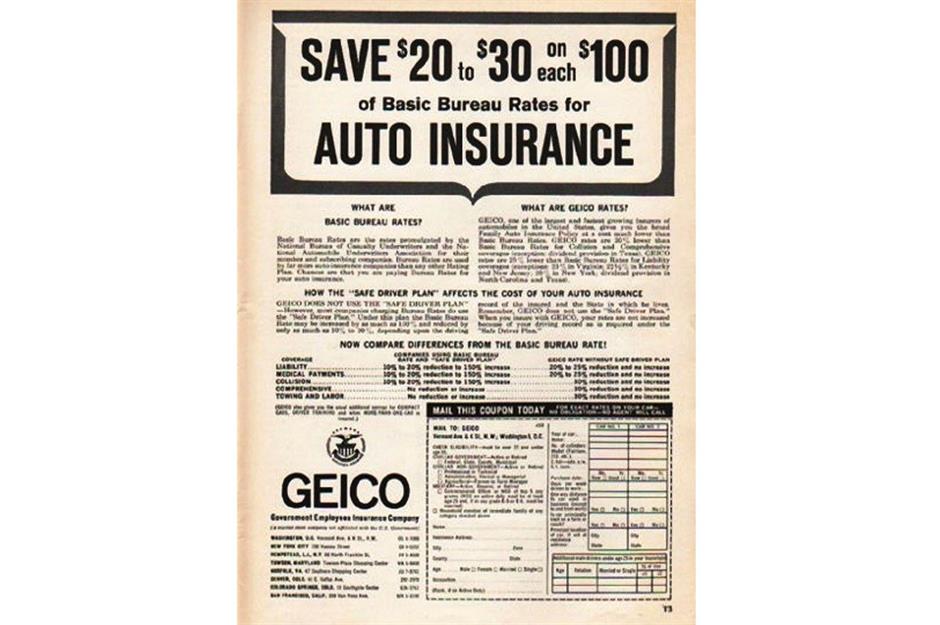

1948 – GEICO: $1,000 invested then is worth millions of dollars today

If your folks had been savvy enough to invest $1,000 in fledgling insurance company GEICO in 1948, you'd now be very rich indeed. The company's stock rose tenfold between 1948 and 1956 alone, and the firm went on to become a wholly-owned subsidiary of Warren Buffett's Berkshire Hathaway in 1996. And we all know how valuable that company's shares are.

1949 – A.W. Jones Partnership: $1,000 invested then is worth millions of dollars today

1950 – ExxonMobil/Standard Oil: $1,000 invested then is worth $1.15 million (£862k) today

Sponsored Content

1951 – silver: $1,000 invested then is worth $33,935 (£25.7k) today

1952 – gold: $1,000 invested then is worth $54,633 (£41.4k) today

1953 – Walgreens: $1,000 invested then is worth around $1 million (£757.9k) today

Sponsored Content

1954 – Templeton Growth Fund: $1,000 invested then is worth hundreds of thousands of dollars today

Globally diversified mutual funds were pioneered by Sir John Templeton, who set up his eponymous firm in 1954. A bona fide long-term cash generator, $1,000 (the price of a colour TV back then) invested the year of the fund's founding would have turned into $200,000 by 1992, and would likely be worth hundreds of thousands of dollars in 2020.

1955 – Aflac: $1,000 invested then is worth $14.1 million (£10.7m) today

1956 – Walter Schloss Associates: $1,000 invested then is worth millions of dollars today

In 1956, renowned value investor Walter Schloss was at the beginning of an exceedingly successful few decades of making mega-bucks for his clients. Putting $1,000 into his Midas touch fund that year would have turned into more than $1 million by 2002, and some millions of dollars today.

Sponsored Content

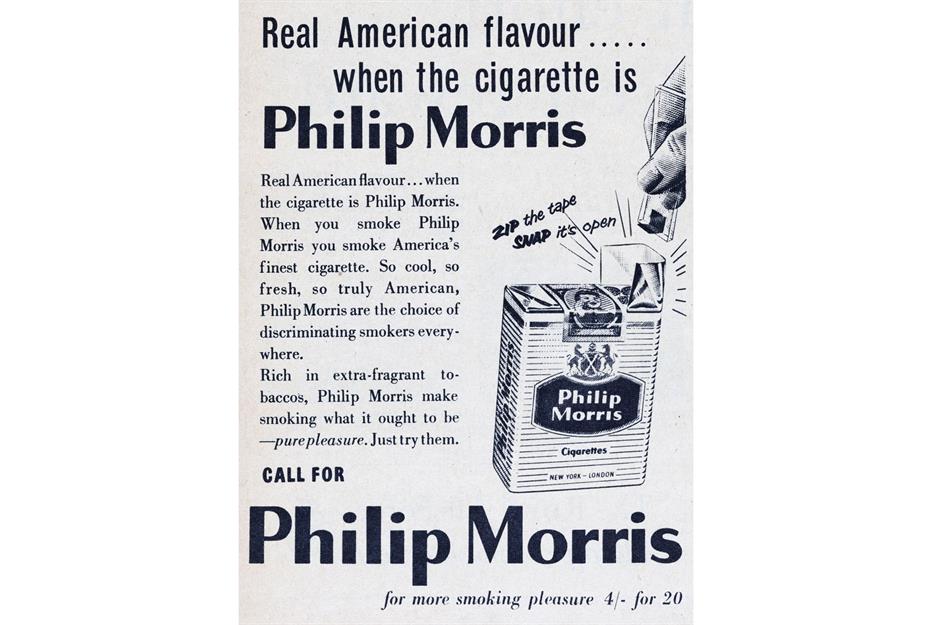

1957 – Philip Morris/Altria: $1,000 invested then is worth $6.5 million (£4.9m) today

Sinking cash into tobacco conglomerate Philip Morris, which is now known as Altria, may not have been the most ethical choice (though the dangers of the habit weren't widely known in the 1950s), but it would have been a financially sound decision, and then some. A $1,000 investment in 1957 would have transformed into $5.8 million by 2007. Today that investment would be worth over $6.5 million (£4.9m).

1958 – American Century Investments: $1,000 invested then is worth hundreds of millions of dollars today

1959 – Publix: $1,000 invested then is worth $16.2 million (£12.3m) today

Sponsored Content

1960 – Westfield: $1,000 invested then is worth $110 million (£83.3m) today

You'd have lucked out big time had your parents gifted you $1,000-worth ($8.8k/£6.7k in today's money) of Westfield shares back in 1960 when the chain was floated on the Australian Stock Exchange. That relatively modest investment in what went on to become a veritable shopping mall empire would now be worth an enormous $110 million (£83.3m), assuming all the dividends had been reinvested.

1961 – Lowe's: $1,000 invested then is worth $12.4 million (£4.2m) + dividends today

1962 – Boeing: $1,000 invested then is worth $1.46 million (£1m) + dividends today

Boeing stock has plunged this year due to COVID-19. Nevertheless, a $1,000 investment made at the aerospace company's IPO in 1962 would be worth a fortune today and that's not even taking into account reinvested dividends. Back then, $1,000 would have bought 1,215 shares. Following eight stock splits, the initial holding would have grown to 6,800 shares, which at the current price would be worth $1.46 million (£1m).

Sponsored Content

1963 – Coca-Cola: $1,000 invested then is worth $82 million (£62.1m) + dividends today

A single Coca-Cola share would have set your folks back around 25 cents back in 1963, so $1,000 would have snapped up 4,000. Following eight stock splits since then, those 4,000 shares would have turned into 1,536,000, which at the current price would be worth an amazing $82 million (£62.1m), and the position would be worth a lot more had the dividends been reinvested.

1964 – Berkshire Hathaway: $1,000 invested then is worth $26.7 million (£20.2m) today

1965 – McDonald's: $1,000 invested then is worth $7.2 million (£5.4m) + dividends today

McDonald's went public in 1965 and hasn't looked back. Investing $1,000 would have stretched to 44 shares at the fast food favourite's IPO, which would have grown to 33,014 shares worth $7.2 million (£5.4m) today. And your holding would be worth much more if you'd reinvested the dividends.

Sponsored Content

1966 – Winnebago Industries: $1,000 invested then is worth $2.67 million (£2m) + dividends today

1967 – General Electric: $1,000 invested then is worth $1.05 million (£787k) + dividends today

The General Electric share price averaged around a dollar back in 1967, so $1,000 would have snagged your parents 1,000 shares. Based on stock splits alone, those 1,000 shares would have turned into 99,840 shares today, worth a very respectable $1.05 million (£787k) and more if any dividends had been reinvested. Better still, if you had cashed in the holding in 2000 when the share price peaked at just under $60, you'd have walked away with $5.99 million.

1968 – Hasbro: $1,000 invested then is worth $380,080 (£285k) + dividends today

Sponsored Content

1969 – 3M: $1,000 invested then is worth $750,417 (£563k) + dividends today

The conglomerate behind Post-It Notes and Scotch Tape, 3M would have made for an outstanding investment back in 1969 when the firm produced products that were used by astronauts in the first Moon landing. At the end of that year, $1,000 would have got your parents 166 shares. Following four stock splits since then, those 166 shares would have transformed into a holding of 4,256 shares, worth $750,417 (£563k) at the time of writing.

1970 – Walmart: $1,000 invested then is worth $18.6 million ($13.9m) today + dividends

Walmart's remarkable growth since its IPO in 1970 has made some early investors mega-rich, particularly those who held onto their stock. Following 11 splits, 60 shares bought at the IPO for $1,000 ($6.7k/£5.1k in today's money) would have turned into 122,880 shares worth $18.6 million ($13.9m) by November 2020, and that's not taking into account if any of the dividends had been reinvested.

Now read about the big businesses battling to save the world

1971 – Southwest Airlines: $1,000 invested then is worth $5.2 million (£3.9m) today

Sponsored Content

1972 – Intel: $1,000 invested then is worth $2.3 million (£1.7m) + dividends today

1973 – W.R. Berkley: $1,000 invested then is worth $9.8 million (£7.3m) + dividends today

1974 – Texas Instruments: $1,000 invested then is worth $4.1 million (£3.1m) + dividends today

Sponsored Content

1975 – Target: $1,000 invested then is worth $1.1 million (£834k) + dividends today

One of America's most venerable retailers, Target was founded in 1902 and went public in 1967. Back in 1975, $1,000 would have purchased 138 shares according to the company's historical stock calculator. Those 138 shares would have turned into 6,666 over the years, which at current prices would be worth $1.1 million (£834k), and that figure doesn't even include reinvested dividends.

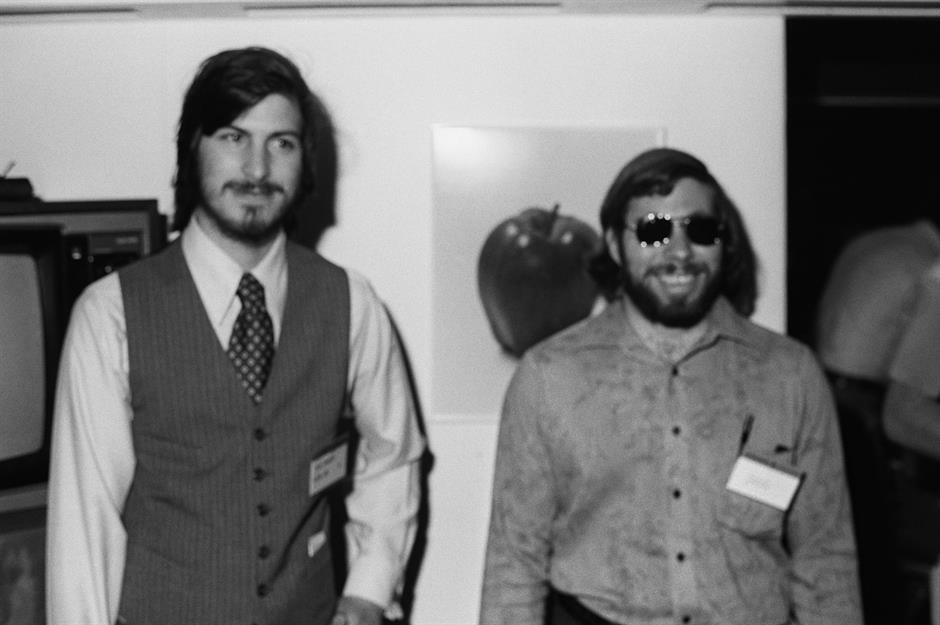

1976 – Apple: $1,000 invested then is worth $253.5 billion (£192.1bn) today

1977 – Kroger: $1,000 invested then is worth $1.38 million (£1m) + dividends today

Sponsored Content

1978 – FedEx: $1,000 invested then is worth $380,317 (£285k) + dividends today

1979 – Eaton Vance: $1,000 invested then is worth $3.3 million (£2.5m) today

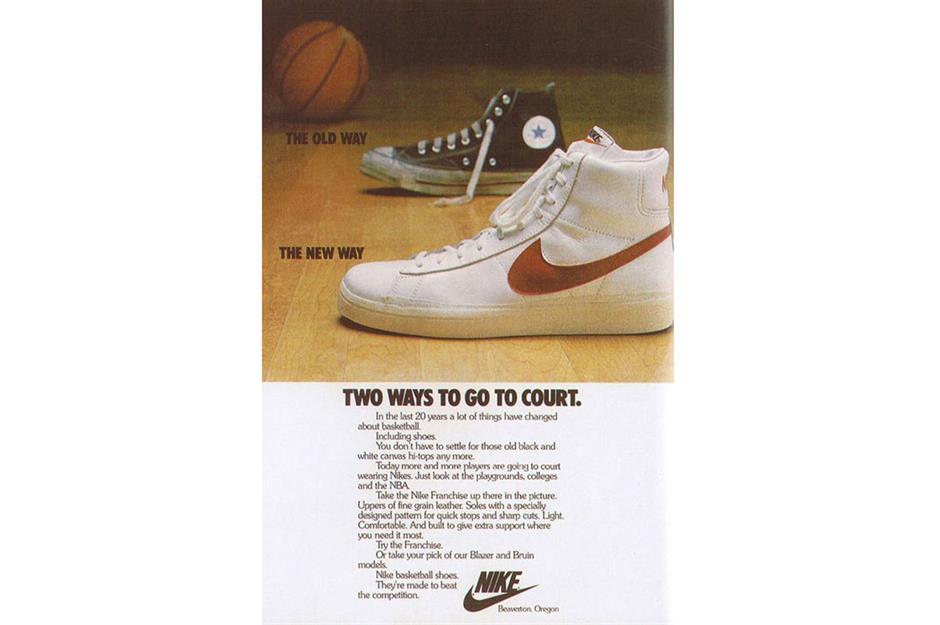

1980 – Nike: $1,000 invested then is worth $776,100 (£582k) + dividends today

Nike has risen to become the world's number one sportswear firm, having started out in the trunk of a car of all places. If you invested $1,000 ($3.2k/£2.4k in today's money) at the 1980 IPO where shares were selling at $22 per share, you could have bought 45 shares. Following seven 2 for 1 stock splits, today the holding would consist of 5,760 shares worth $776,100 (£582k), although that figure doesn't include reinvested dividends.

Sponsored Content

1981 – Home Depot: $1,000 invested then is worth $7.7 million (£5.8m) + dividends today

These days, Home Depot is second only to Walmart in terms of its valuation by US retail experts. Had your parents gifted you $1,000 worth of stock at the home improvement chain's IPO in 1981 – it would have purchased 83 shares at $12 each – you'd be sitting on 28,361 shares currently valued at $7.7 million (£5.8m), or a lot more if you'd reinvested the dividends.

1982 – Procter & Gamble: $1,000 invested then is worth $1.5 million (£1.1m) + dividends today

Procter & Gamble stock would have made for a fantastic investment back in 1982. Had your parents bought $1,000 worth of shares back then, they would have received around 346 shares. Following stock splits the holding would be 11,072 shares today, worth $1.5 million (£1.1m). This would be even higher if you reinvested the dividends.

Now read about the super-rich bankrolling villages, towns and even cities

1983 – M&T Bank: $1,000 invested then is worth $1.7 million (£1.3m) today

Sponsored Content

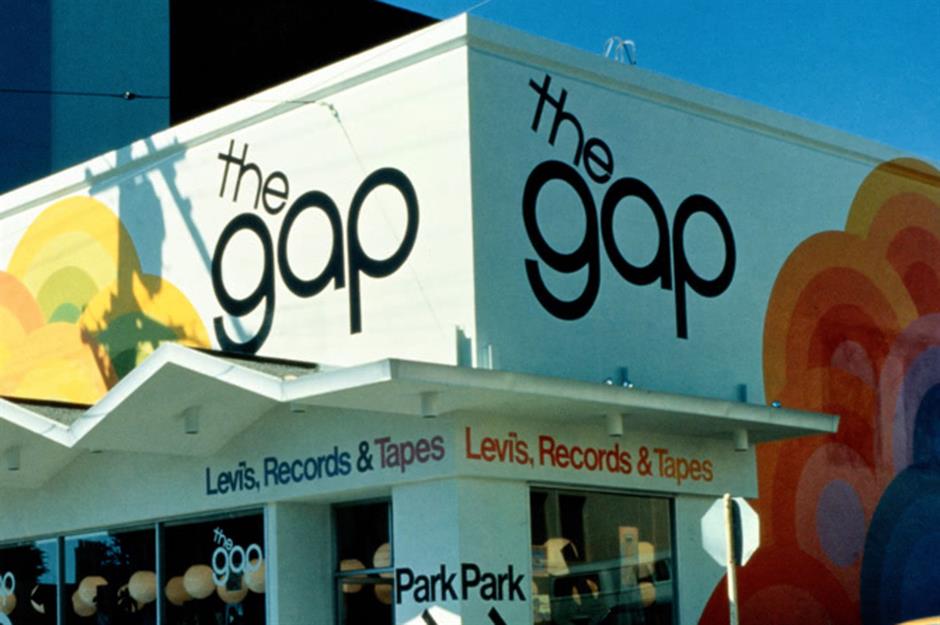

1984 – Gap: $1,000 invested then is worth $2.1 million (£1.6m) today

1985 – Danaher: $1,000 invested then is worth $2.7 million (£2.1m) today

1986 – Microsoft: $1,000 invested then is worth $2.9 million (£2.2m) + dividends today

Sponsored Content

1987 – Progressive: $1,000 invested then is worth $544,572 (£413k) today

1988 – TJX Companies: $1,000 invested then is worth $3.2 million (£2.4m) + dividends today

1989 – Robert Half International: $1,000 invested then is worth $550,980 (£413k) + dividends today

Sponsored Content

1990 – Cisco: $1,000 invested then is worth $669,082 (£507k) + dividends today

1991– Old Dominion Freight Line: $1,000 invested then is worth $1.645 million (£1.2m) + dividends today

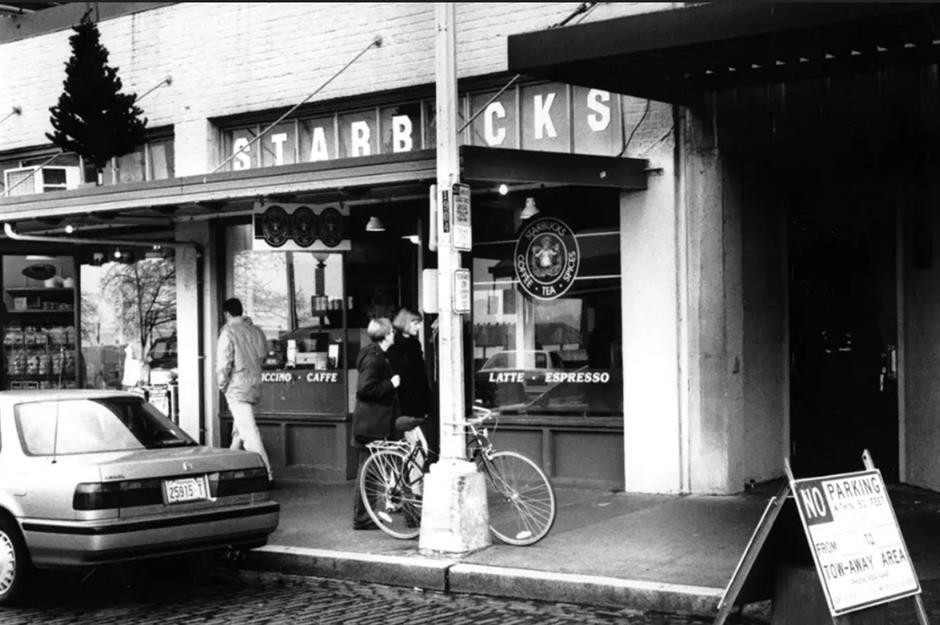

1992 – Starbucks: $1,000 invested then is worth $106,972 (£80k) + dividends today

Back in 1992, Starbucks, which at the time was a relatively small-scale outfit, went public offering shares at a reasonable $17 apiece, so $1,000 would have bought 58 shares. Since then, the stock has split 2 for 1 six times and the share price has shot up significantly in value. Today, the holding would comprise 1,088 shares worth $106,972 (£80k), and more if the dividends had been reinvested.

Sponsored Content

1993 – Infosys: $1,000 invested then is worth $1.4 million (£1.1m) + dividends today

1994 – Graco: $1,000 invested then is worth $1.4 million (£1.1m) today

Who knew investing in a company that produces fluid handling systems could be so lucrative? If only your parents had back in 1994. If they'd bought $1,000 worth of shares in Minneapolis-headquartered company Graco and reinvested the dividends, you'd now have a holding with a value of $1.4 million (£1.1m).

Now discover the richest family in every state

1995 – Monster Beverage: $1,000 invested then is worth $364,930 (£273k) + dividends today

Sponsored Content

1996 – NVR: $1,000 invested then is worth $415,518 (£311k) today

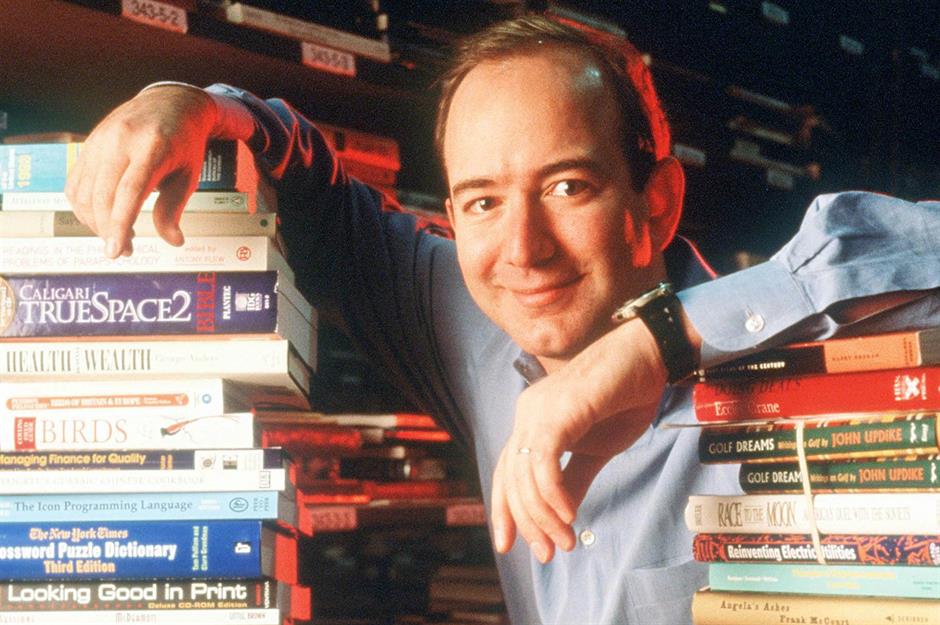

1997 – Amazon: $1,000 invested then is worth $2 million (£1.5m) today

1998 – eBay: $1,000 invested then is worth $151,500 (£115k) + dividends today

Sponsored Content

1999 – HollyFrontier: $1,000 invested then is worth $246,213 (£187k) today

2000 – Tractor Supply Company: $1,000 invested then is worth $259,276 (£196k) today

2001 – Intuitive Surgical: $1,000 invested then is worth $180,756 (£137k) today

Sponsored Content

2002 – Netflix: $1,000 invested then is worth $888,560 (£673k) today

If only your folks had sunk $1,000 into Netflix stock following the company's IPO in 2002. At the time the firm was far from the household name it is today, and made its money renting out DVDs by mail. A $1,000 investment into the burgeoning company, which has never paid a dividend, back in 2002 is now worth $888,560 (£673k).

Now read about the American giants that went from bust to boom

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature