What Americans spent their COVID-19 stimulus checks on

Stimulus spending trends

Many American households have now received up to three stimulus checks in response to the COVID-19 pandemic, totaling more than $850 billion in government financial support. But what they spent each stimulus check on varied each time. Read on as we look as how America spent its stimulus payments, according to data from the US Census Bureau and the Peter G. Peterson Foundation (PGPF).

The first stimulus check

The CARES Act was signed into law back in March 2020 by President Trump. The average US adult received a payment of around $1,200 in April 2020, though factors such as the number of dependants under the age of 16 in a household and income levels impacted the exact figure. PGPF data suggests that most people spent the first round of money, with 74% of doing so. Just 14% chose to save their check, and 11% used it to pay off debts. According to PGPF, with a 14.7% unemployment rate due to the pandemic at the time of the first payment, three-quarters of recipients planned to use the first check towards household expenses. However, various reports suggest the actual number of people who used the money for that purpose was much lower.

First check: Rent

Around 43% of recipients put their first stimulus checks towards paying for housing costs, either rent or mortgage. Those on lower salaries were more likely to spend the money on rent, with 44% of those earning less than $75,000 putting their first checks towards paying their landlords. Only 14% of those earning more than $150,000 each year used their checks to cover rent costs. While the second stimulus check was also used towards housing costs, the numbers fell, with 19.96% of renters putting their second check towards payments.

First check: Mortgages

A quarter of those earning less than $75,000 each year used the first stimulus check to pay their mortgage. Perhaps unsurprisingly, a higher percentage of people on higher salaries were putting the payments towards their mortgage, with 42% of those earning between $75,000 and $149,999 using the first check in this way. However, both the Trump and Biden administrations have introduced other measures to help people with the burden of mortgage payments. As part of the CARES Act, borrowers were granted a 180-day forbearance, with the option to extend it by a further 180 days.

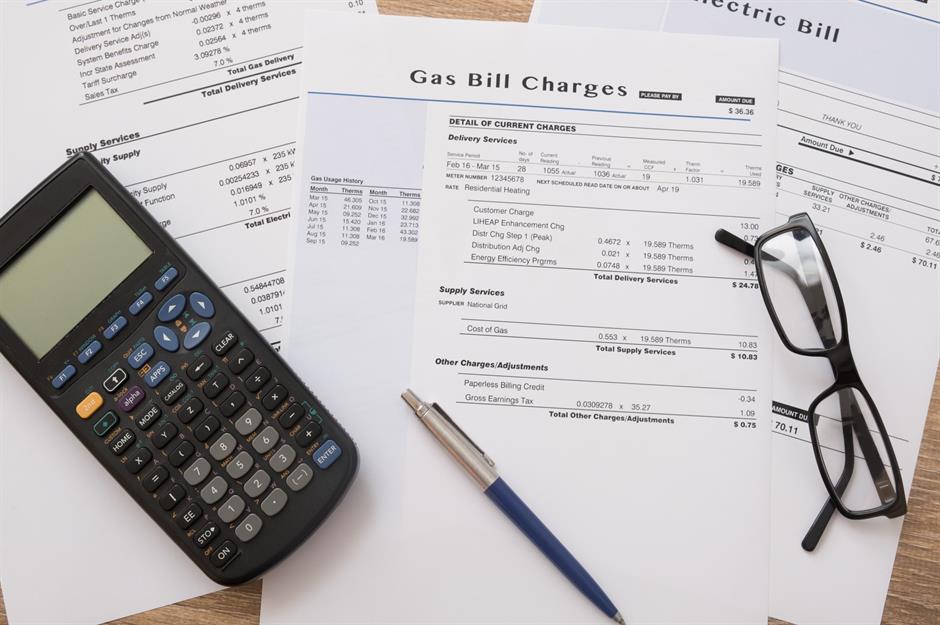

First check: Utilities

Paying the bills was at the top of many Americans’ to-do list upon receiving their first check. According to a YouGov survey, a third of people said they spent money on utilities in June last year. Unsurprisingly, many also used their second and third checks in this manner. When the next batch of checks started arriving in January, 59% of recipients said they would use the second instalment to pay household bills, according to a survey by bill-paying service doxo. This happened again with the third round of stimulus checks, and there was a 30% increase in the number of household bill payments in mid-March compared to the previous month, according to bill payment service doxo. The stimulus checks are likely to have only provided short-term relief for those struggling to pay for utilities, however, as the latest handout covered less than an average American household’s monthly bills, which typically stack up to $1,889, says doxo.

First check: Groceries

Groceries were a top purchase, with Walmart noting a bounce in spending when the first two stimulus checks hit people's accounts. That said, Walmart noticed that there was a change in the types of food shoppers were choosing, with an uptick in more expensive produce such as meat and fresh fruit and vegetables. Unsurprisingly, other grocery stores have also seen sales rise from stimulus checks. Buying food was also a popular way to spend cash with the rollout of the third payment. Stores overall saw a 0.5% increase in sales in March 2021 compared to the previous month, according to US Census Bureau data.

First check: Technology

Whether for work, entertainment or socializing, never before has the importance of technology been as clear as during the COVID-19 pandemic. When the first stimulus checks arrived, some Americans used the cash to upgrade their devices, and Apple CEO Tim Cook reported an “uptick really across the board” in the second half of April last year, although the company’s new line of products more likely influenced the boom. Electronics store Best Buy saw a similar bump in sales of products for computing and gaming for the first three weeks following the first check's distribution. The trend has continued into 2021, as 3% of check recipients planned to splash the money from their third stimulus payment on tech, according to Bloomberg research. One example is that PlayStation 5 console sales went through the roof on 17 March, when tens of millions of Americans received their checks, increasing an astonishing 511% compared to the previous week, according to Pattern.

First check: Recreational goods

Shoppers didn’t just splash out on electronics after receiving their first government checks, and Walmart reported an increase in spending on children’s toys and bikes for adults, as families sought to entertain themselves in the latter half of April 2020. Splashing cash on recreational goods was a trend that continued with the second and third payments with 2.5% of Americans using money from their second checks for this purpose, according to Census Bureau data. The sector saw another boost this spring following the third stimulus check, with stores selling recreational goods such as sporting equipment, musical instruments and books seeing a 23.5% uptick in sales in March.

First check: Home crafts

Long before mask mandates came into force, some Americans were stitching together their own face coverings to protect against the spread of COVID-19. Walmart executive Doug McMillon noted a spike in the sale of sewing machines and bandanas after the first stimulus checks were handed out, which he attributed to people being keen to make their own masks. This follows the upward trajectory of sewing machine sales throughout 2020.

First check: Clothing

Many Americans used money from their first stimulus checks to treat themselves to a new look, and Target saw a notable increase in both clothing and cosmetics sales in April last year. This pattern has continued with further checks too. Apparel retailers such as Lululemon, Crocs and Zumiez have also benefited from the second round of stimulus checks and announced much better sales figures in the last quarter of the year than originally anticipated. Following the third round of stimulus checks, clothing stores saw sales boosted by 18.3%, according to Census Bureau data.

First check: Home improvement

Forced to spend a lot more time at home, lots of people embraced home improvements, and both Lowe’s and Home Depot saw a boost in sales of items such as paint and DIY supplies once the first stimulus checks dropped. A popular choice with shoppers, sales at building material and garden equipment stores also increased by 12.1% following the third stimulus check, according to Census Bureau data.

First check: Takeout

The COVID-19 outbreak limited dine-in capacity, and many people didn't want to be out in public due to the virus. This has been to the benefit of takeout and drive-thru food outlets though. Following a big fall in sales in March and mid-April last year when the pandemic first hit, McDonald’s saw customers return to its restaurants in late April, which the company's CEO partially attributed to the stimulus checks. More customers flocked to the golden arches again at the beginning of this year following the second round of checks, and the chain acknowledged another uptick in sales following the third stimulus check handout. However, it has also said that the chain's growth goes "way beyond" just the stimulus payments.

First check: Eating out

Many Americans used their stimulus money to dine out, and the first round of extra cash gave major restaurant chains up to a 12% boost in sales, according to Revenue Management Solutions. A similar trend was seen this January following the second round of stimulus checks, including at fine-dining chain Fogo de Chão. Across the restaurant industry there was a 9.2% boom in customers compared to December, but it was short-term, however, as outlets quickly saw footfall drop by 2.5% in February, according to the National Restaurant Association. But restaurants and bars saw sales boosted again by 13.4% in March compared to the previous month following the arrival of the third round of stimulus checks, according to Census Bureau data. It's likely sales were also helped along by the vaccine rollout as confidence to dine out has increased.

The second stimulus check

The second round of checks, which were released in January of this year, came in the form of the Consolidated Appropriations Act. The payment was only half the amount of April’s stimulus check, with the average recipient receiving around $600, though again this varied due to factors such as household dependants and income. The use of the cash varied dramatically from the first checks, with only 22% spending the cash, 26% saving it, and over half (51%) using the money towards debts.

Second check: Holiday spending

The announcement of a second round of stimulus checks brought festive cheer to many American households, and holiday sales surged by 8.3% in 2020 compared to 2019, despite the financial difficulties many faced early on during the pandemic. The extra money didn’t arrive until January, but the promise of a financial boost increased consumer confidence, and therefore spending, according to Jack Kleinhenz, chief economist at the National Retail Federation.

Second check: Debt repayments

As previously mentioned, over half of Americans used the money from the second stimulus check to pay their debts. This figure rose to 60% in households that experienced a loss of income during the pandemic. People have continued to use their windfalls to settle their finances now that the third set of checks has been released, with a 29% increase in the number of credit card payments in the week of 17 March compared to the month before, and a 72% increase in the amount being settled, according to bill paying service doxo.

Second check: Charitable donations

When the second round of checks was announced, a journalist in Oregon, Allen Schauffler, created the Redirect the Check initiative, where people could donate their stimulus money to local non-profits and the money would be matched by Central Oregon Daily News. In January, Redirect the Check had raised more than $50,000 for causes such as food banks, rent relief and an outreach organization for veterans. Around 4.1% of recipients gave money from the second round of payments to charity or family members, according to the Census Bureau.

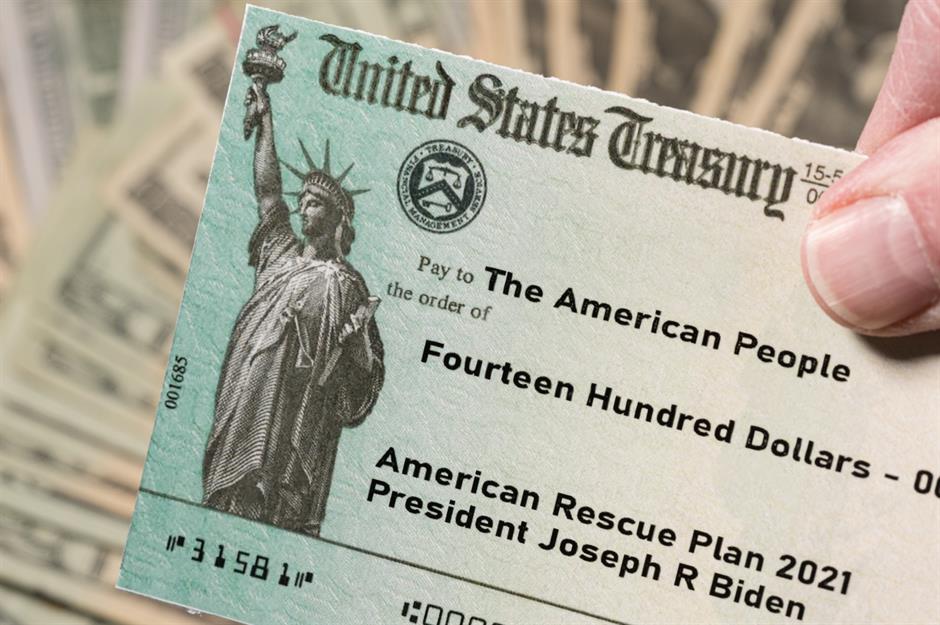

The third stimulus check

Arriving in March, the third round of stimulus checks was the largest amount, with the average American adult receiving around $1,400. However, just 19% opted to spend the money. Clearing debts remained a popular choice, with 49% choosing to do so. More people than ever decided to save the money, with 32% saving or investing their check. Unsurprisingly, higher-income households were more inclined to save money than lower-income households.

Third check: Savings and investments

As the name suggests, the stimulus checks were designed to stimulate the economy through promoting extra spending but, as previously mentioned, nearly a third (32%) of recipients chose to save or invest the third check. The US stock market could see a $170 billion boost from the stimulus checks, according to Deutsche Bank data. Let's take a look at what those who didn't save their checks spent their money on...

Third check: Apparel and electrical items

Walmart reported higher sales after the third round of checks was released, allowing the world's biggest retailer to beat its own sales forecasts last quarter. Sales at Walmart rose 6%, and operating income was up by nearly a third. However, the boost was seen most in-store, with online sales slowing as vaccination rates encouraged more people to venture outside. And what were people buying with their third stimulus check? Walmart reported that apparel and electronics were the items being snapped up this time round.

Third check: Medical care

As America undergoes the worst health crisis it has ever seen, it’s unsurprising that some people chose to put their stimulus checks towards their medical expenses. According to a Bloomberg survey, 9% of Americans said that they spend their third stimulus checks on healthcare.

Third check: Garden furniture

.jpg)

The third check arrived right before the summer and this prompted a boost in sales of outdoor furniture, such as patio tables and chairs. On 17 March, which is when most people received their third cash instalment, garden furniture set sales shot up by 241% compared to the previous week, according to e-commerce company Pattern.

Third check: Vacations and trips

Travel restrictions may still be in place but that hasn’t stopped people in the US from booking interstate vacations and trips abroad as vaccine developments start to signal a return to normality. Around 5% of Americans planned to spend their third stimulus checks on a vacation or trip, according to research published by Bloomberg.

Third check: Childcare

The COVID-19 crisis has brought enormous challenges to families with children, and working parents on an income of less than $50,000 are the most likely to say that they have struggled with balancing work and family life, according to CNBC. Parents in that bracket also reported increased spending on childcare and their children’s education since the start of the pandemic, and so it’s unsurprising that families are putting money from their stimulus checks towards care for their kids. Around 5% of recipients of the third round of stimulus checks intended to spend the money on childcare, according to research by Bloomberg.

Third check: Education

The second COVID-19 relief package set aside $82 billion for education, while the recent $1.9 trillion bill included $122 billion for K-12 students and $39.6 billion for higher education, but that didn’t stop people from using their own individual stimulus checks to fund their, or their children’s, learning. Around a third of parents reported that they were spending more money on their children’s education during the pandemic than they were before, according to CNBC, and 4% of stimulus payment recipients were planning to spend their third check on education, according to research published by Bloomberg.

Now take a look at the US states cutting taxes

Comments

Do you want to comment on this article? You need to be signed in for this feature