Companies that have had a disastrous 2022

Why 2022 has been a year to forget for these big-name businesses

It's official: 2022 has been a disaster of epic proportions for several big-name companies, from Twitter and Meta to Balenciaga.

Rocked by everything from takeovers to shocking scandals, these hapless businesses have come spectacularly unstuck over the last 12 months.

As the dust settles on a year they'd rather forget, read on to discover the major companies that have fared the worst in 2022. All dollar amounts in US dollars, unless otherwise stated.

Elon Musk's takeover of Twitter has been nothing short of chaotic.

Musk, currently the world's wealthiest person according to Forbes, started buying up shares in the microblogging platform back in January 2022 and offered to purchase it in April for an inflated $44 billion (£36.1bn).

He then tried to backtrack out of the deal before eventually relenting and going ahead with it on 28 October, promptly taking the company private. Since then, mayhem has reigned...

Self-styled "Chief Twit" Musk has fired much of the workforce, fudged the rollout of the new Twitter Blue subscription service, and alienated advertisers, users, and remaining employees alike with his relentless pursuit of free speech.

The latter point has involved reinstating banned users – including Donald Trump – and ditching content moderation policies. Needless to say, advertising revenue, which is Twitter's big earner, has tanked.

The EU is threatening to ban the service, while US regulators are mulling a review of the takeover. There's even speculation that Twitter could go bankrupt.

Sponsored Content

Tesla

Musk's takeover of Twitter has also dented the fortunes of his other big company, Tesla.

The electric car company has seen its stock slip since 28 October, with unimpressed investors and customers jumping ship from the company. And in a perfect case of full-circle irony, some have even taken to Twitter to voice their grievances using the #NeverTesla hashtag.

But Musk's antics at Twitter aren't the only headwinds the electric vehicle maker is currently having to weather...

Tesla

Tesla is rapidly losing its dominance in the US, while fierce competition and zero-COVID lockdowns have upended business in China, its second-biggest market.

With the likes of rising prices and high interest rates further compounding these problems, it's little wonder that Tesla stock is down 50% since the start of the year, despite the company posting bumper profits.

Last year's trillion-dollar valuation probably feels like a distant memory...

Meta

Meta's issues have gone from bad to worse in 2022, with the company reporting its second consecutive quarterly revenue drop in October.

In November, CEO Mark Zuckerberg slashed the company's global workforce by 13%, cutting 11,000 jobs.

Apple's privacy update has made it harder for social platform to target ads and this, coupled with a general downturn in ad spending due to recession fears, is hammering profits hard.

Sponsored Content

Meta

Gen Z continues to shun Facebook and Instagram in favour of TikTok, further jeopardising Meta's long-term prospects.

And then there's the metaverse. A total money pit, the virtual world that Zuckerberg is betting big on lost $9 billion (£7.3bn) in the first three quarters of 2022. This spooked investors, who are getting increasingly anxious over the ever-mounting cost.

Unsurprisingly, Meta became this year's worst performer in the S&P 500 in November. The annual value of the company's stock is down by an excruciating 73% and the company's share price continues to plummet.

Match Group

The Dallas-based Match Group, which owns and operates the world's largest portfolio of online dating services, has faced similar issues.

Mirroring Facebook and Instagram's lack of Gen Z appeal, Match Group's flagship service Tinder is having a hard time attracting younger users.

Rather, this discerning demographic is swiping left on the app and opting for alternatives like Bumble and Thursday instead.

Match Group

Tinder has also run into trouble with the metaverse. Earlier this year, Match Group scaled back its plans to launch its very own "Tinderverse" due to disappointing earnings, which led to the departure of Tinder's then-CEO Renate Nyborg.

Company revenue, much of which is generated outside the US, has also suffered due to the strong dollar.

Needless to say, Match Group's stock has taken a massive tumble in 2022, with its share price down a painful 65% since the beginning of January.

Sponsored Content

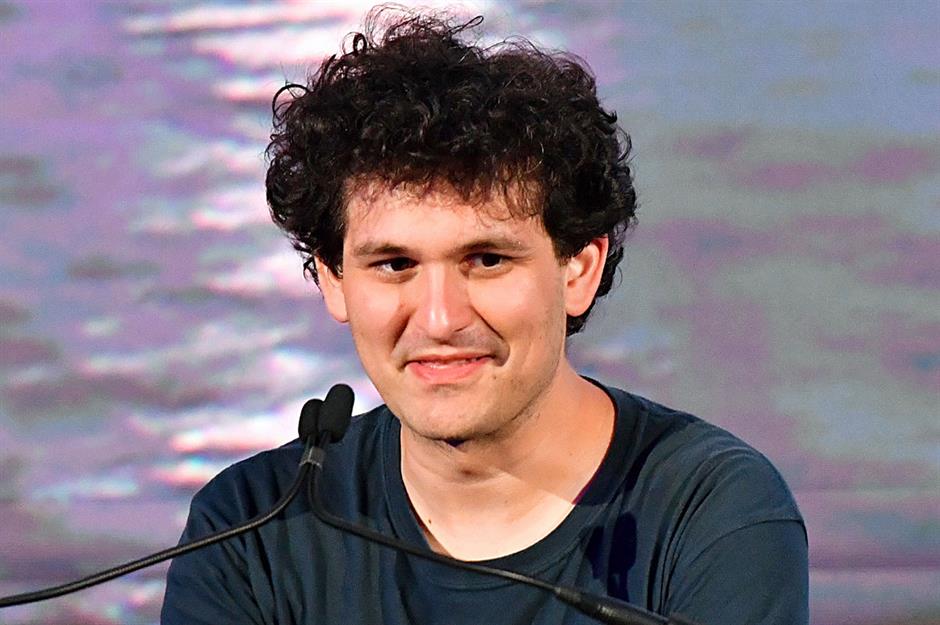

FTX

Founded in 2019 by the now infamous Sam Bankman-Fried and his mysterious sidekick Gary Wang, the Bahamas-based FTX swiftly grew to become the world's second-largest cryptocurrency exchange.

Once worth a staggering $32 billion (£26.1bn), the whole operation came crashing down in November. The collapse was triggered by a CoinDesk article on 2 November that claimed Alameda Research, the trading firm FTX grew out of, was holding a suspiciously large number of FTT, the exchange's digital currency.

FTX

Rival exchange Binance responded by selling its holdings of the FTT, leading to a run on FTX that left an $8 billion (£6.5bn) hole in its accounts.

After offering to buy the exchange, Binance backed out and FTX was plunged into bankruptcy on 11 November.

This scandalous chain of events has left many small-scale investors and major players out of pocket, as well as sparking US federal investigations and sending shockwaves through the entire crypto industry. Bankman-Fried has just been arrested by US authorities in the Bahamas on charges of fraud.

Credit Suisse

Mired in scandal, Credit Suisse is battling the biggest crisis of its 166-year history.

The beleaguered Swiss bank has been embroiled in numerous controversies of late, from failing to prevent money laundering by a Bulgarian drug ring to defrauding investors.

It's also been dealing with the fallout from the ignominious 2021 collapses of UK lender Greensill Capital and US hedge fund Archegos Capital, which have lost Credit Suisse's chronically underperforming investment arm billions.

Sponsored Content

Credit Suisse

In a bid to turn its luck around, the loss-making bank has embarked on an ambitious restructuring programme. However, this has yet to actually bear fruit and investors aren't convinced the plan will actually have the desired effect.

Amid all the bad news, customers have been leaving in droves, with $88.3 billion (£72bn), a hefty 6% of the bank's assets, withdrawn within the space of a few weeks this autumn.

Credit Suisse now projects a $1.6 billion (£1.3bn) fourth-quarter loss. Its share price is certainly floundering, having dived 68% since the start of the year.

Netflix

Netflix started to face some serious trouble back in April, when the streaming giant reported it had lost subscribers for the first time in more than a decade. A post-pandemic slump, surging inflation, and intensifying competition were all identified as key culprits.

The company's stock dipped as a consequence, wiping $55 billion (£44.9bn) off its value. A string of layoffs began, with hundreds of employees let go that spring.

Netflix

Netflix has responded proactively, introducing a clampdown on password-sharing and a new, lower-priced Basic with Ads plan, which launched in November.

But while sign-ups are beginning to pick up again, the streaming giant's struggles with growth are far from over.

It's doubtful whether it will ever be able to catch up with Disney+, with the rival service surpassing Netflix in terms of subscriber numbers back in August.

Sponsored Content

Amazon

It's a similar story for Amazon. The online retail giant, which thrived during the pandemic, posted its first quarterly loss since 2015 this year.

Company growth hit its slowest rate in two decades as customers opted to return to bricks-and-mortar stores, choosing to cut back on online spending due to inflation.

Higher prices have also put intense pressure on the e-commerce and cloud-computing titan's already tight margins.

Amazon

In October, Amazon rattled investors with its slowest-ever holiday quarter growth forecast and a lacklustre prediction for its cloud division.

The projection wiped around 20% off the company share price, which was already ailing; Amazon stock is down 44% since the beginning of the year.

In November, an Amazon rep confirmed that the business has recently instigated a freeze on hiring corporate staff.

Balenciaga

Edgy high-end fashion house Balenciaga provoked a furious backlash in November after it dropped a holiday ad campaign that featured children holding teddy bears.

So far, so inoffensive – bar the fact that the bears were wearing bondage gear.

Another ad campaign was subsequently called into question, and the brand and its creative director Demna Gvasalia were accused of condoning child abuse and exploitation.

Sponsored Content

Balenciaga

Celebrities including brand ambassador Kim Kardashian have spoken out against the images, while TikTok influencers have taken to destroying their Balenciaga products.

The luxury brand, which is owned by luxury goods corporation Kering, has issued an apology and is suing the production company responsible for $25 million (£20m).

Regardless, business is bound to suffer and Gvasalia's days as the brand's creative director could be numbered...

Stanley Black & Decker

Due to a bottom line-busting combination of factors, household hardware company Stanley Black & Decker has had to cope with a very tough 2022.

Supply chain issues, soaring prices for raw materials, and a slowdown in construction and DIY spending have all hit the company hard.

Other issues it's had to face have included poor weather and the strong dollar, which has impacted the firm's international profits.

Stanley Black & Decker

With overall revenue and profit down, the world's largest tool company has cut jobs and launched a restructuring plan to streamline the business and reduce costs.

Be that as it may, Stanley Black & Decker stock has still slumped 56% since the start of 2022, which represents its worst year-to-date performance since 1974.

However, hope could be on the horizon: its share price has recovered slightly from its lowest point in November.

Sponsored Content

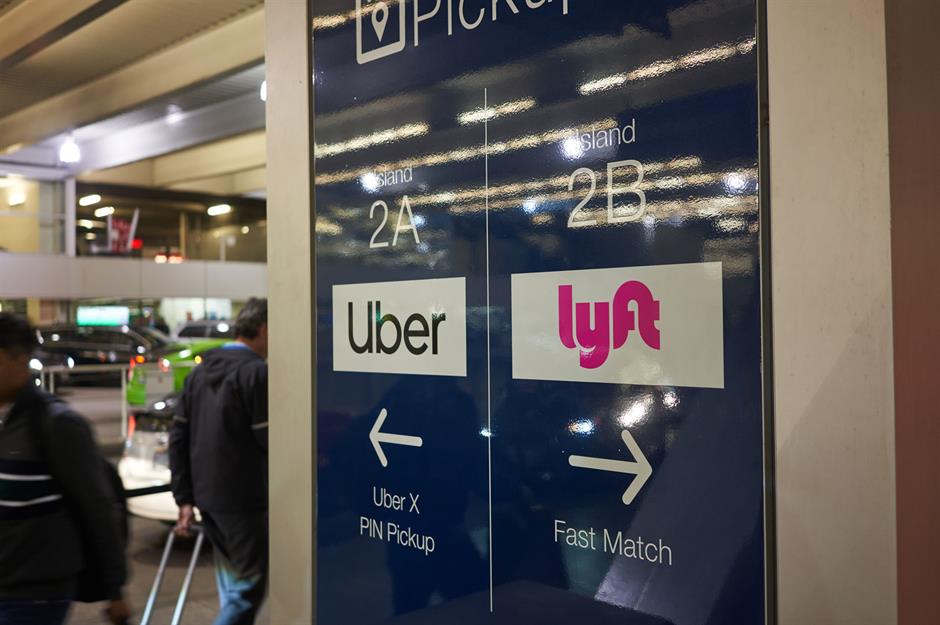

Lyft

Lyft has been beset by myriad issues this year, from driver shortages to disappointing customer numbers, which still haven't returned to pre-pandemic levels.

The ride-hailing company failed to make hay while the sun shone unlike its arch-rival Uber, which decided to diversify into other areas.

Lyft

This has put Lyft at a distinct disadvantage given that it's less insulated than Uber from economic downturns.

With fears of recession foremost in investors' minds, it stands to reason that Lyft stock has been sliding in 2022: in fact, the share price is down 75% since the start of the year.

Lyft has been making efforts to reduce costs, with the company confirming in November that it planned to cut almost 700 jobs. This accounts for around 13% of its total workforce.

Align Technology

The maker of clear Invisalign teeth straighteners has had a shocker of a year, with inflationary pressures and declining consumer confidence both dampening demand.

Align Technology's aligner products, which are viewed as a luxury by many, have been further hit by lingering supply chain issues, the war in Ukraine, and the strong performance of the US dollar.

Sponsored Content

Align Technology

The issues came to a head during the third quarter, when profits fell by half and sales declined by more than 12% compared to the same period last year.

As might be expected, the Californian company's stock has been through the wringer. It's lost around 70% of its value since the beginning of January.

PayPal

PayPal bid farewell to a staggering $50 billion (£40.8bn) – almost a quarter of its value – in early February, after the financial tech company released subdued revenue and profit forecasts for the rest of the year.

With rising inflation and higher interest rates making for lower transaction volumes, the firm has had a rough 2022.

And on top of dealing with economic issues, PayPal is contending with a number of other problems too...

PayPal

Issues based around fraud, financial censorship, and the seemingly arbitrary freezing of accounts are all turning users away from the company.

The firm also faced a social media backlash in October after details of a new policy fining users for "misinformation" was leaked. PayPal said it was a mistake, but the reputational damage had already been done.

Sponsored Content

Intel

Intel has been the worst performer in the Dow Jones Index for much of 2022, with its stock down almost 47% since January (at the time of writing).

This may seem surprising given the passing of the Creating Helpful Incentives to Produce Semiconductors and Science Act (also known as the CHIPS Act) in June to bolster US domestic semiconductor production, which Intel stands to benefit from big-time. But business has been far from buoyant.

Intel

Mounting competition and a diminishing PC market are hampering sales of Intel's processors, with the ongoing global chip shortage, supply chain issues, and product delays just some of the other challenges that the Silicon Valley company is facing.

Predictably, the powers that be have responded by launching a major cost-cutting drive, which reportedly includes thousands of redundancies.

Bed Bath & Beyond

When it comes to major retailers, few have had it worse this year than American giant Bed Bath & Beyond.

Sales have slumped and the chain's debts have piled up. In a nutshell, the big box retailer has put off customers by selling products they don't want, while struggling to stock high-demand items due to supply chain hold-ups and other problems.

Sponsored Content

Bed Bath & Beyond

In fact, things are so bad that Bed Bath & Beyond hasn't even been able to keep up with payments to key suppliers, resulting in embarrassingly empty shelves in some stores on Black Friday.

The company is in the process of closing 150 locations and is also laying off 20% of its workforce in a bid to balance the books.

However, bankruptcy still remains a distinct possibility and, despite Bed Bath & Beyond's popularity as a so-called 'meme stock' among younger investors, the firm's share price is down by more than 70% since the start of January.

Now discover the 50 companies that rule the world

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature