Megaprojects around the world bankrolled by China

Megaprojects around the world paid for by China

In 2013, China’s President Xi Jinping launched the Belt and Road Initiative (BRI) with the goal of linking Asia to Europe through a series of massive infrastructure developments. The programme later expanded around the globe, particularly in developing countries.

Financing these megaprojects over the last decade – from high-speed rail to power plants and ports – hasn't come cheap. The debt built up for BRI investments is thought to be at least $1 trillion (£752bn), and many of these projects have not met expectations, hindering the host country’s ability to pay back its debt to China.

Read on to discover 15 massive megaprojects bankrolled by China. The projects have been ordered in terms of cost based on available figures, although as you'll see, those aren't the only sums at play...

All dollar amounts in US dollars.

Vietnam – Cat Linh-Ha Dong Sky Train: at least $868 million (£688m)

The first metro line in all of Vietnam opened in the capital city Hanoi in November 2021. The elevated train runs roughly north to south across the city for eight miles (13km) with 12 stations.

Though construction started in 2011, various delays caused the China-backed project to run for a decade when the original completion date had been scheduled for 2015. The price skyrocketed in the process, too.

Vietnam – Cat Linh-Ha Dong Sky Train: at least $868 million (£688m)

While cost and schedule overruns are commonplace on megaprojects around the world, part of the issue for the Cat Linh-Ha Dong line came from political disputes in 2014 related to the South China Sea between Vietnam and China, which supplied the project’s contractor along with funding for the works.

In 2008, the project had been priced at nearly $553 million, the equivalent of around $824 million (£619m) today. However, in 2014, that figure jumped to $868 million ($1.3bn/£977m today), and the Vietnamese government had little choice but to take out additional loans from Chinese-backed banks to complete the project, according to research firm AidData.

Sponsored Content

Tanzania and Zambia – TAZARA: $1 billion (£792m)

The Tanzania Zambia Railway Authority, known as TAZARA, is a multinational railway linking the two countries with freight and passenger services. While the project's construction started in 1970, decades before the BRI, China had a pivotal role in making the line happen. It offered the two countries an interest-free 30-year loan to build the 1,155-mile (1,860km) line and stations and cover the cost of the locomotives and staff training.

State-owned China Civil Engineering and Construction Corporation (CCECC) constructed the line, as well as 320 bridges, 22 tunnels and 2,225 culverts, in a massive undertaking involving as many as 50,000 workers.

Tanzania and Zambia – TAZARA: $1 billion (£792m)

Over the last 40 years, financial constraints have meant the railway was not properly maintained.

In September 2024, heads of state from China, Tanzania and Zambia signed an agreement to fund the rehabilitation of both the line and its rolling stock, and the rail authority is negotiating with CCECC to return once more and work on the line. The contractor estimates the project could cost around $1 billion (£792m) and that the work could be completed as early as 2027.

This upgrade should substantially increase operational capacity, enabling it to transport two million tonnes of cargo a year, compared to the current average of 500,000 tonnes.

Sri Lanka – Hambantota International Port: $1 billion (£792m)

Sri Lanka’s Hambantota Port is another megaproject that predates the BRI. However, China had a heavy hand in the financing and construction of the facility. Opening in 2012, the 10-berth deep water port struggled for many years, failing to attract business and generate enough revenue to repay its loans. It’s estimated to have cost around $1 billion (£792m) to build and, in 2012, drew in only 34 ships despite being adjacent to one of the world’s busiest shipping lanes.

China took over the failing port in 2017, along with 15,000 acres of surrounding land on a 99-year lease.

Sponsored Content

Sri Lanka – Hambantota International Port: $1 billion (£792m)

The deal raised concerns about China’s influence and increasing control through the BRI. However, under new management, the port began to flourish, becoming one of the fastest-growing in the region.

Meanwhile, Sri Lanka is one of several countries that have defaulted on their Chinese loans, reaching a point in 2022 where it could not even make the interest payments on the debt.

Research organisation AidData has estimated Sri Lanka has amassed a total debt to China of $19.5 billion (£16bn) for BRI investments between 2000 and 2021.

Peru – Chancay Port: $1.3 billion (£1bn)

Chinese President Xi Jinping and Peruvian President Dina Boluarte celebrated the opening of Chancay Port, the largest in South America, in November 2024. With 15 berths and the capacity to handle the world’s largest container ships, it's hoped the megaport will become one of the main routes for trade between Asia and the continent. China is already Peru’s largest trading partner, and the new facility will enable the flow of Chinese goods into the country while bolstering its agricultural and mining exports.

China is the main investor and will operate the port through its Cosco Shipping Ports company. The initial phase cost $1.3 billion (£1bn), with plans for expansion and a $3.5 billion (£2.8bn) rail link to neighbouring Brazil.

Peru – Chancay Port: $1.3 billion (£1bn)

Not all have welcomed the megaport. It’s a huge change for residents of Chancay, a city that has been dominated by the fishing industry, with people already reporting their livelihoods have been disrupted by the construction. Nearby homes have been damaged by building works such as blasting, and occupants report increased dirt and air pollution, which have also caused problems to adjacent wetlands and nature reserves.

Meanwhile, US officials expressed concerns that the Chinese will use the new port for spying, which China has denied, calling it a "smear".

Sponsored Content

Bangladesh – Bangabandhu Sheikh Mujibur Rahman Tunnel: $1.6 billion (£1.3bn)

The Bangabandhu Sheikh Mujibur Rahman Tunnel opened in October 2023. This ambitious underwater expressway, which travels beneath the Karnaphuli River, is more than 2 miles long (3.4km) and cost $1.6 billion (£1.3bn) to build, including other road infrastructure to access the tunnel.

As with other megaprojects in the BRI, a Chinese contractor built the tunnel and roadway, and state-owned banks lent the project as much as $705 million (£558m).

Bangladesh – Bangabandhu Sheikh Mujibur Rahman Tunnel: $1.6 billion (£1.3bn)

To help repay the project's costs and cover tunnel operations, the Bangabandhu Sheikh Mujibur Rahman Tunnel operates as a toll road. However, in its first year, the infrastructure handled a fraction of the expected traffic: only 3,910 out of a predicted 18,500 journeys.

Toll collection has resulted in just $87,000 (£69k), which is less than a third of the money needed to pay for the tunnel’s operation and maintenance, according to Global Construction Review. Meanwhile, local media called the tunnel a “white elephant haemorrhaging money”.

Uganda – Karuma Hydropower Station: $1.7 billion (£1.3bn)

In June 2024, Uganda officially started operations for its long-awaited Karuma Hydropower Station, located upstream of the White Nile.

The megaproject included extensive construction of facilities, including a dam, powerhouse, surge chamber and a multitude of tunnels, as well as an on-site substation and high-voltage power lines connecting nearby towns.

Sponsored Content

Uganda – Karuma Hydropower Station: $1.7 billion (£1.3bn)

Construction started in 2013 and was scheduled for completion within five years. Instead, the works were plagued with delays due to land deals, vandalism and other issues on the China-backed project, which relied on a BRI loan to finance nearly $1.4 billion (£1.1bn) of the $1.7 billion (£1.3bn) total cost.

Despite the six-year delay during the construction process, which was led by Chinese firms, there was no reprieve in the loan’s terms. As owner of the facility, the Ugandan government had to start repayments in 2022 even before the plant was completed, let alone operational.

Nigeria – Lagos Blue Line: at least $1.8 billion (£1.4bn)

As part of the BRI, China built the first light rail network in West Africa, which is being rapidly expanded. Lagos’ eight-mile (13km) Blue Line and five stations began commercial operations in October 2023.

It’s a much-needed infrastructure investment for Nigeria’s biggest city, which has an estimated population of around 25 million people and notoriously bad traffic congestion.

Nigeria – Lagos Blue Line: at least $1.8 billion (£1.4bn)

In 2010, during the planning phase, Nigerian officials reported the project would cost $1.2 billion ($1.8bn/£1.4bn today). However, as with most megaprojects, the cost likely increased over the more than 10-year construction period, and a revised figure has not been released.

An inflated price tag is especially likely to be the case considering that, in 2016, the Chinese government also pledged $2.5 billion ($2.7bn/£2bn today) for the Lagos Red Line of just 17 miles (27km) and eight stations. China Civil Engineering Corporation started construction for this megaproject in April 2021, and it became fully operational in October 2024.

Sponsored Content

Iran – Qom-Esfahan High Speed Rail: at least $2 billion (£1.6bn)

China has poured billions of dollars into infrastructure investments for Iran, according to research group AidData, which reports that Iran has acquired a total debt of $28 billion (£22bn) to China over the last 20 years. Little of this funding is publicly acknowledged, so it's difficult to track where and how it's been spent.

It has been confirmed that, in 2015, a Chinese contractor landed the construction package for a 150-mile (240km) long high-speed rail line between Qom (pictured) and Esfahan. At that time, Iranian officials reported the value of the contract at around $1.9 billion (£1.5bn), saying “scope and value are expected to expand”.

Completion had been planned for 2021, but the work is moving slowly, and only two-thirds of the foundations were in place as of 2023.

Iran – Qom-Esfahan High Speed Rail: at least $2 billion (£1.6bn)

China has lent at least $2 billion (£1.6bn) to Iran for the line, which is part of a 255-mile (410km) railway that will connect to the capital city of Tehran. Critics have slammed the project, claiming it has little economic justification, especially when existing lines could use improvement.

There are also concerns that Iran will struggle to pay back the loan, and, as seen with other projects on this list, China may be setting itself up to seize other assets such as oil and mining rights.

Project completion has been moved to 2025, but the loan is already due for repayment thanks to the delays in construction.

Kenya – Mombasa-Nairobi Standard Gauge Railway: $4 billion (£3.2bn)

At least 85% of the funding for Kenya’s Standard Gauge Railway (SGR) came from China as part of the BRI, just shy of $4 billion (£3.2bn) for the first section from Mombasa to Nairobi. The main contractor for the project was the China Road and Bridge Corporation.

While under construction, the project faced criticism over its treatment of Kenyan labour and its environmental impact, as it cut through national parks designated to protect wildlife. However, since it started operating in 2017, passenger traffic has been plentiful along the line.

Sponsored Content

Kenya – Mombasa-Nairobi Standard Gauge Railway: $4 billion (£3.2bn)

On the other hand, freight transport, which was expected to be the line’s main source of revenue, is struggling. Initial railway plans called for three sections; the second opened in 2019, but the third has effectively been cancelled. This final link would have helped boost the line’s viability, bringing cargo from Mombasa’s port to neighbouring countries Uganda, Rwanda and the Democratic Republic of the Congo.

When the first section opened in 2017, the construction cost was equivalent to 6% of the nation’s GDP – an enormous sum of money. Factor in the shortfall from missing cargo revenue, and Kenya has struggled to meet its repayments to China. The railway defaulted on a $1.3 billion (£1bn) loan in November 2024.

Uzbekistan – Oltin Yo’l GTL: $4.3 billion (£3.2bn)

Often called Uzbekistan GTL (gas-to-liquid), Oltin Yo’l, which means 'Golden Road', is a fuel plant project envisioned as a path to a clean and sustainable energy for the nation. The facility converts natural gas into synthetic liquid fuels, including diesel and aviation kerosene.

Construction started in 2017 and finished in late 2021 at a total cost of $3.6 billion ($4.3bn/£3.2bn today). As part of the BRI, Chinese banks have issued several loans for the construction of the processing plant, amounting to at least $2.4 billion (£1.9bn).

Uzbekistan – Oltin Yo’l GTL: $4.3 billion (£3.2bn)

However, Russia is among the other lenders funding the project. In response to the war in Ukraine, the US issued sanctions in February 2022 against various state-owned Russian entities, including Gazprombank, one of the Oltin Yo’l GTL lenders, potentially complicating the plant’s ability to repay loans in US currency.

Oltin Yo’l GTL has since announced that loans to Gazprombank were repaid in full in February 2023.

Sponsored Content

Laos – Boten–Vientiane Railway: $6 billion (£4.8bn)

Previously, travelling from the capital of Laos, Vientiane, to the Chinese border required a 15-hour car journey. As of December 2021, this has been reduced to just four hours thanks to a new 260-mile (414km) high-speed railway.

It’s a huge step for the country, which only had 2.5 miles (4km) of railway used as a river crossing before construction of this new line and 32 stations started in 2016.

Laos – Boten–Vientiane Railway: $6 billion (£4.8bn)

The Lao section of the larger Laos–China Railway has not come cheap. At $6 billion (£4.8bn), it’s the equivalent of one-third of Laos’ GDP. As part of the BRI, China lent assistance to its neighbour and owns 70% of this new connection between the two countries.

However, researchers have labelled this a “hidden debt”. Laos owns the remaining 30% of the railway, but owes 60% of the total project costs in loans from a Chinese bank.

And there are further issues. Now that the train is running, trade is reportedly heavily in China’s favour, with fewer exports coming from Laos. To top it off, China’s loan guarantees include the railway assets and unrelated mining areas where it can extract resources as payment.

Indonesia – Jakarta-Bandung High Speed Railway: $7.3 billion (£5.8bn)

Indonesia borrowed close to $5 billion (£4bn) to build the Jakarta-Bandung High Speed Railway, a project worth $7.3 billion (£5.8bn). However, AP reported that around $4 billion (£3.2bn) of the loan had been hidden away from public accounts.

When construction surpassed the budget by $1.5 billion (£1.2bn), the Indonesian government had to use state funds to bail out the railroad. China Development Bank loaned the government $560 million (£444bn) to ensure the railway could launch in October 2023.

Sponsored Content

Indonesia – Jakarta-Bandung High Speed Railway: $7.3 billion (£5.8bn)

Since the Jakarta-Bandung line opened, the state-owned rail authority has asked the Indonesian government for support in paying back its debts to China and is expected to face deficits of around $200 million (£157m) in its first year of operation.

Despite this, the Indonesian government is studying the feasibility of extending the line to the port city of Surabaya and is courting Chinese investors to finance the construction.

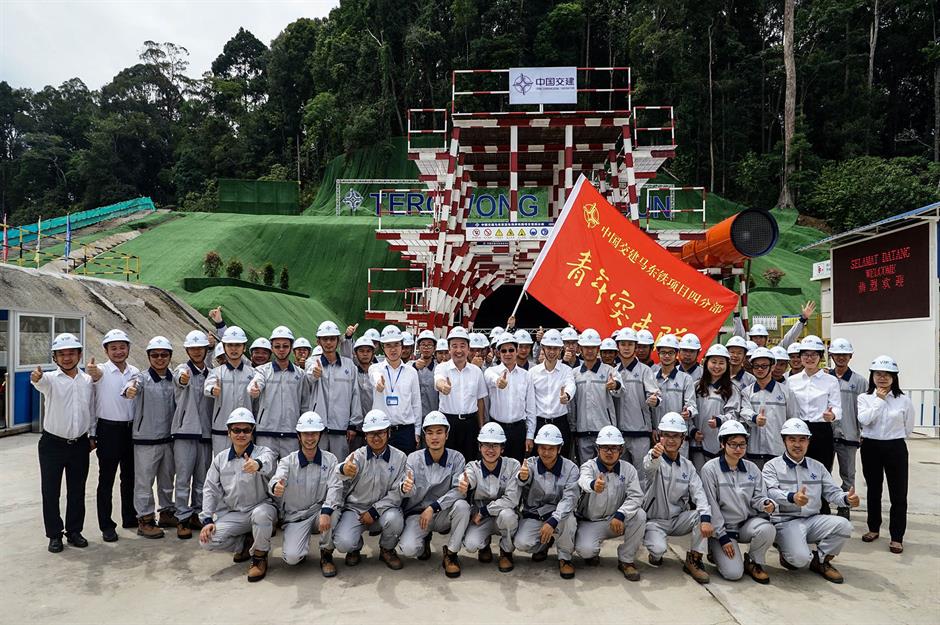

Malaysia – East Coast Rail Link: $18.5 billion (£15bn)

This east-to-west rail link, currently under construction, is primarily financed by one of China’s state-owned banks. With the agreement reached in 2015, it’s one of the BRI’s earliest projects.

The rail line is around 400 miles (640km) long, and as it traverses the peninsula’s mountain range, much of the alignment must be built in tunnels – many of which are now complete. The project is currently on track to open in 2027, but has experienced numerous delays.

Malaysia – East Coast Rail Link: $18.5 billion (£15bn)

Just a year into construction, the East Coast Rail Link ground to a halt for 12 months when the project discovered that $700 million (£555m) from government funds had been siphoned off into private accounts for then-Prime Minister Najib Razak, who's now in prison.

Eager to maintain momentum, Chinese firms involved in the project offered to renegotiate the terms. The project’s total cost had been estimated at $18.5 billion (£15bn). However, that number has shifted over the last 10 years as new governments came into power in Malaysia and changed the scope of the project, while negotiations with China over project specifications have been ongoing.

Sponsored Content

Egypt – New Administrative Capital: $59 billion (£47bn)

Home to around 22 million citizens, Cairo is one of the most densely populated cities in the world, with as many as 50,000 people per square mile (2.6sq km). Hoping to ease pressure on the city and reduce congestion and pollution, President Abdel Fattah el-Sisi announced the construction of the New Administrative Capital (NAC) in 2015. It would eventually be home to government ministries and ample residential properties.

Located in the desert about 25 miles (40km) east of Cairo, construction started immediately with an estimated cost of $59 billion (£47bn) and an ambitious completion date of 2020.

Egypt – New Administrative Capital: $59 billion (£47bn)

Few details about the financing of this massive megaproject are publicly available, though it has been confirmed China is lending Egypt money for the NAC.

China State Construction Engineering Corporation has also been overseeing much of the building works, including the city’s centrepiece: a skyscraper called the Iconic Tower, the tallest building in Africa at 1,293 feet (394m).

The COVID-19 pandemic inevitably resulted in delays, and the city is still under construction, with very few residents moving in. Critics have expressed concern about building such an expensive project while the nation faces mounting debts. Egypt’s financial health is poor, with inflation rates as high as 30% and its currency rapidly losing value.

Pakistan – China-Pakistan Economic Corridor: $62 billion (£49bn)

Pakistan has been one of the biggest recipients of the BRI. Through the China-Pakistan Economic Corridor (CPEC), a series of new transport and energy developments have been planned. The goal is to connect the port city Gwadar in the west to Kashgar, a Chinese city just past Pakistan’s northeast border, with highways, railways and pipelines.

The two countries partnered on this visionary project well before the BRI. Construction finished on the new Gwadar port in 2007, with China taking over operations in 2013 after a Singapore-based operator struggled to turn a profit.

Sponsored Content

Pakistan – China-Pakistan Economic Corridor: $62 billion (£49bn)

Over the last decade the CPEC has also constructed the new 12-mile (19km), six-lane Eastbay Expressway through Gwadar to connect the port with the highway network, along with other transport infrastructure. Numerous coal-power plants have also been built.

Works that started out with a five-year timeline are still ongoing, with the deadline now moved to 2030. Meanwhile, though costs were initially anticipated to sit between $10 to $20 billion (£7.8 to £15.7bn), the CPEC has ballooned to an estimated $62 billion (£49bn), and Pakistan is struggling to cover its debt to China for many of the programme’s projects.

Now discover the 22 major brands with a big China problem

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature