US states where people have the most debt

The 20 states with the highest debt-to-income ratios

As the Federal Reserve looks to increase interest rates in the hope of slowing inflation in the US, the change could spell trouble for the many Americans living in the red. By the end of 2021, consumer debt had hit record levels at $15.6 trillion. And income hasn’t kept up: the level of debt relative to income – the debt-to-income ratio – has risen, and so a greater share of household income is used in paying off debt, leaving less for everything else.

Using data collated by Experian, we reveal the 20 states where people spend the highest percentage of their salary on their loan, credit card, mortgage payments and other debts.

20. Tennessee: 1.55 debt-to-income ratio

The national average debt-to-income ratio is 1.50 – that is, the typical household has debt equaling 1.5 times its income. Tennessee’s ratio comes in just above this average at 1.55. Skyrocketing house prices are helping to drive up household debt here as people take out ever larger mortgages. This is especially true in cities like Nashville and Memphis where property prices continue to climb as people with big budgets move in from out of state.

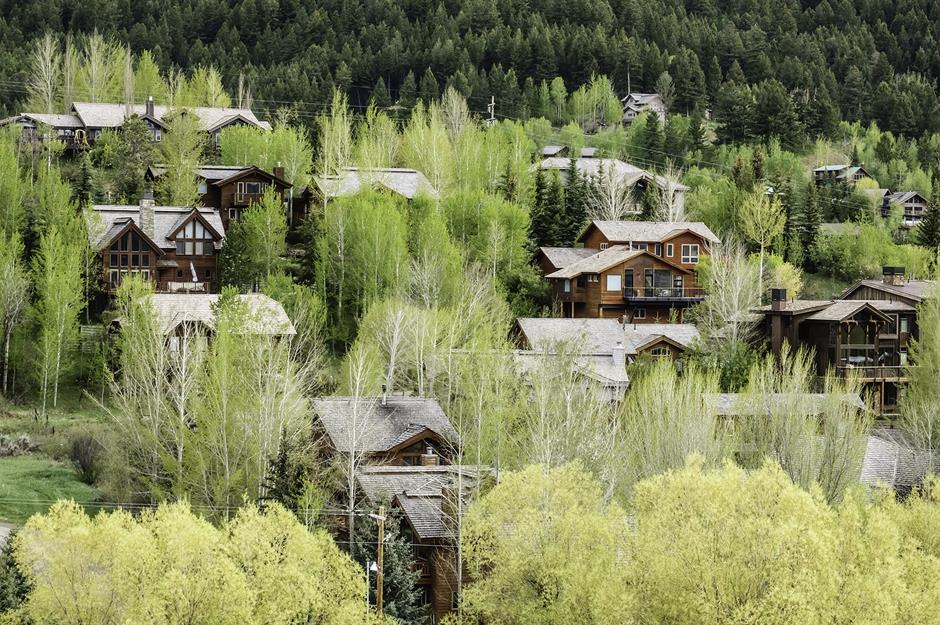

19. Wyoming: 1.60 debt-to-income ratio

It's a similar story in Wyoming: in the wake of the pandemic, increasing numbers of home workers have chosen to trade in city life for the breathtaking rural settings the Cowboy State has to offer, hiking up house prices. Along with an influx of newcomers to the state, house builders are struggling with labor shortages and supply chain issues, struggling to keep up with demand. This only drives up prices further. These increased values and the mortgages they require are increasingly common across all states. In 2021 mortgages were the fastest growing debt in the US, up by 7.6% to $10.29 trillion.

Sponsored Content

18. Georgia: 1.60 debt-to-income ratio

Georgia's debt-to-income ratio equals that of Wyoming at 1.60. Yet while the average consumer debt in Wyoming is $102,366, the figure in Georgia is just $87,131. This disparity reflects the lower incomes found in Georgia, where one-in-seven people work in agriculture-related jobs, many of which are poorly paid.

17. North Carolina: 1.63 debt-to-income ratio

At $87,160, the average consumer debt in North Carolina is lower than the national average of $96,371. Unfortunately salaries are lower than average too. As seen in many other states, the bulk of North Carolina residents' debt is mortgage and house-related.

16. New Mexico: 1.63 debt-to-income ratio

Among the top 20 most indebted states New Mexico has the highest rate of debt-free households at 29%, which is likely due to low homeownership rates. Salaries are also low here with more than 18% of the state living below the poverty line. Meanwhile nearly half of all households have credit card debt.

Sponsored Content

15. Alaska: 1.66 debt-to-income ratio

By contrast, salaries are high in Alaska. Unfortunately credit card debt is too. In fact it's the highest among all 50 states, chiefly due to the very high costs of goods and services in the isolated state. With cost of living expenses exceeding those of most other states, it's no surprise households here are more likely to have larger loans.

14. Montana: 1.66 debt-to-income ratio

Montana households also have some of the highest credit card debt in America, and mortgages are increasing too. As the pandemic has accelerated a shift towards remote working, many former city dwellers have chosen to locate their home offices amid Montana’s stunning scenery. This has made Montana one of the fastest-growing states, driving up house prices and living costs.

13. South Carolina: 1.69 debt-to-income ratio

Like many states there is a shortage of housing and increasing demand driving up house prices in South Carolina, increasing the amount of debt held in mortgages. To make matters worse, South Carolina’s households are more likely to carry student loan debt compared to those in other states, according to LendingTree. This is in part due to lower salaries.

Sponsored Content

12. Delaware: 1.71 debt-to-income ratio

Median household debt in Delaware is around $100,282, according to Experian estimates. Whether trying to pay off a mortgage, vehicle or home loan, Delaware residents owe more than the national average.

11. Maryland: 1.82 debt-to-income ratio

The people of Maryland earn a lot of money and spend a lot too. Median household debt is among the highest at almost $127,000, far exceeding the national average of $96,371. With much of the money owed tied up in mortgages it's no surprise that more than 40% of households reported debt of $100,000 or more in the 2020 Census.

10. California: 1.82 debt-to-income ratio

Like in Maryland, the average consumer debt in California is far above average at $137,301. Californians carry by far the largest loans when it comes to their homes, which even by the time of the 2020 Census had reached a colossal $250,000. Because homeownership has been in decline in California due to skyrocketing prices across the state, this mega mortgage debt is carried by just one-third of the state's households.

Sponsored Content

9. Nevada: 1.87 debt-to-income ratio

You'd imagine that people living in one of the two places in America where statewide gambling is legal would be up to their eyeballs in debt. However, Nevada barely makes it into the top 10 most indebted states. With tourism a major contributor to jobs in the state, the economy took a significant hit in the early weeks of the pandemic. Stimulus checks and unemployment benefits helped workers stay afloat, but Nevada still had one of the highest increases in debt collections in 2020. Local economists report that the state is seeing a recovery.

8. Virginia: 1.89 debt-to-income ratio

With its proximity to Washington, D.C., Virginia's salaries and the cost of living are both higher than average. In the 2020 Census Virginians reported $199,000 tied up in mortgages and home loans, and another $5,000 in credit cards typically. And that's not all. The state has one of the highest student loan debts at an estimated $42.4 billion.

7. Oregon: 1.90 debt-to-income ratio

With house prices well above the national average, and only growing steeper during the pandemic, it's no surprise that most of Oregon's household debt is in mortgages. Like neighboring California, homeownership is in decline in Oregon. Only 39% of households reported home loans in the 2020 Census, with average consumer debt standing at around $113,000 today.

Sponsored Content

6. Washington: 1.91 debt-to-income ratio

The situation is nearly identical for Oregon's northern neighbor Washington, with slightly more debt and higher salaries. About 40% of households reported home-related borrowing, with the state experiencing the fourth steepest soaring home values over the last 20 years, just edging out Oregon. At $136,170, the average consumer debt in Washington dwarfs the nationwide average of $96,371.

5. Arizona: 2.01 debt-to-income ratio

It's the same story in the Southwest. While the average consumer debt in Arizona doesn't far exceed the national average at $103,326, housing costs create a huge gulf between debts and income: more than one-third carry mortgages and home loans. At the same time credit card debt is slightly higher here and is held by half of the state's households.

4. Idaho: 2.05 debt-to-income ratio

Salaries are lower in Idaho, which makes the growing state's booming house market even more of a challenge. While house-related debt was lower than the national average, Idaho's home ownership rate is among the highest, reaching 70% at the time of the 2020 Census. So while people owe less for their mortgage, nearly 50% of households reported having debt tied to their homes.

Sponsored Content

3. Colorado: 2.06 debt-to-income ratio

Much like in Montana, the natural beauty of Colorado has been a major draw for remote workers seeking a more picturesque working environment. The resulting population increase has seen house prices soar and mortgage debts soar in turn. This is the principal cause of the massive average consumer debt in Colorado, which is the highest of any state at a colossal $140,327.

2. Utah: 2.22 debt-to-income ratio

Utah has a perfect storm of high poverty rates and rising housing costs. Money owed for housing and cars and spent on credit cards are all higher than average, and the average consumer debt of $122,474 far exceeds the national average. And the problem is getting worse, debt rising at a higher rate than in almost any state.

1. Hawaii: 2.25 debt-to-income ratio

Hawaiians are deep in debt. While salaries only slightly exceed the national average, living costs and real estate prices are notoriously high. And to make matters far worse, the state's vital tourist industry took an enormous hit due to the pandemic. The rate of borrowers behind on their mortgages in Hawaii tripled between July 2019 and 2020, and is still among the highest in the nation. The average consumer debt in the Aloha State stands is a jaw-dropping $138,274, more than 43 percent above the US average.

Now discover what the average household earns in every US state.

Sponsored Content

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature