12 reasons why there’ll be another financial crash, 12 reasons why there won't

Daniel Coughlin

23 October 2018

The likelihood of a worldwide economic meltdown

Nicolas Asfouri/Getty Images

A decade after the most devastating financial meltdown in generations, the global economy appears to be in good shape. Yet some analysts have warned a crash could be on the horizon, blaming everything from rising interest rates and increasing oil prices to the US-China trade dispute. Thankfully, other experts are more positive. We take a look at both sides of the coin.

Reasons why there will be a crash #1: warnings of an impending crisis have been coming thick and fast

Sean Dempsey/PA

In recent months a succession of prominent individuals and major financial organisations have issued stark warnings of a looming global crisis, from George Soros and former UK Prime Minister Gordon Brown to the IMF.

Reasons why there will be a crash #2: global stock markets are falling and the price of gold is rising

Wang Ying/Xinhua News Agency/PA

Global stocks fell sharply this month with America's Dow and S&P losing over 4%. Despite a modest rebound, the downward trend continues, affecting stocks worldwide. Asian stocks are slumping, Australian shares are down and European stocks have hit a 22-month low. Worryingly, the price of gold, a traditional safe haven investment in times of trouble, is on the rise.

Sponsored Content

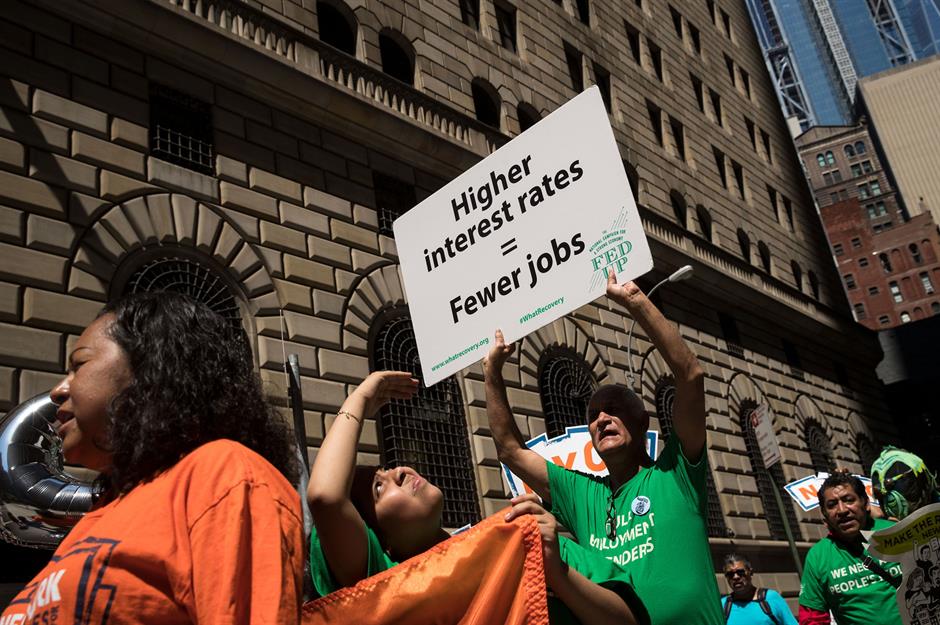

Reasons why there will be a crash #3: interest rate increases have made borrowing more expensive

Drew Angerer/Getty Images

A number of factors that hint at an impending crisis are behind the stock market slip. The US Federal Reserve has raised interest rates three times this year to avoid overheating the economy. Other central banks, including China's, have followed suit. These hikes have made borrowing more expensive.

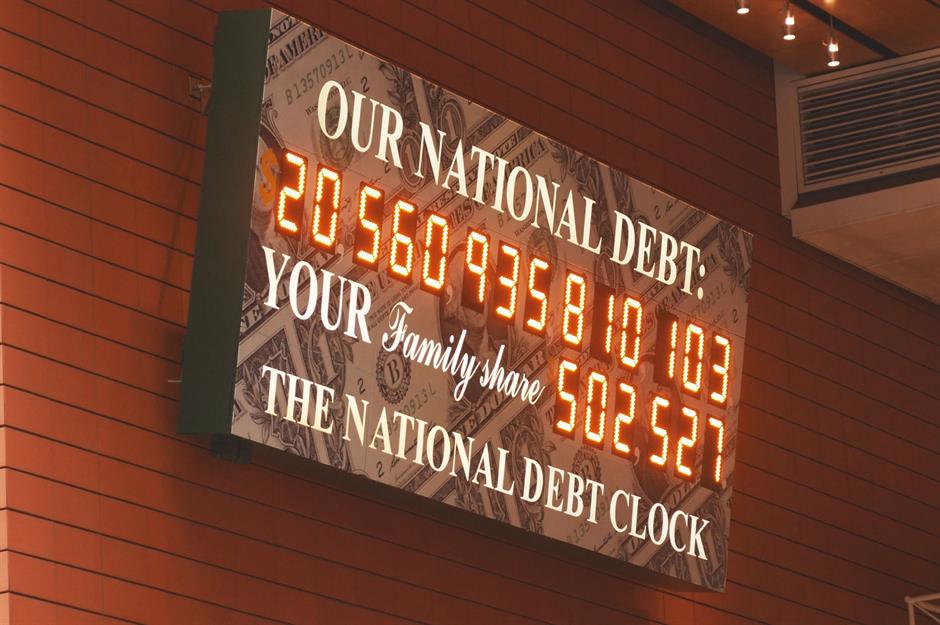

Reasons why there will be a crash #4: corporate and national debt levels are exceptionally high

Studio72/Shutterstock

Companies and countries have taken advantage of historically low interest rates and borrowed heavily over the past decade. Their chickens could be coming home to roost as these debts become more expensive and challenging to sustain.

Reasons why there will be a crash #5: household debt has hit record highs

Wayhome Studio/Shutterstock

It's not just corporations and governments that are up to their eyeballs in debt. US household debt rose to a record $13.3 trillion (£10.1trn) in the second quarter of this year, fuelled by growth in the mortgage, auto and student loan sectors. Household debt is at precarious levels in China, the UK, Australia, and scores of other countries too.

Sponsored Content

Reasons why there will be a crash #6: the price of oil is rising to economically damaging levels

Think4photop/Shutterstock

Since the global oil price has rebounded, everything has got a whole lot more expensive, putting pressure on the finances of governments, companies and individuals. Analysts fear the price of crude could hit $100 (£76) a barrel within months, harming economic growth and increasing inflation.

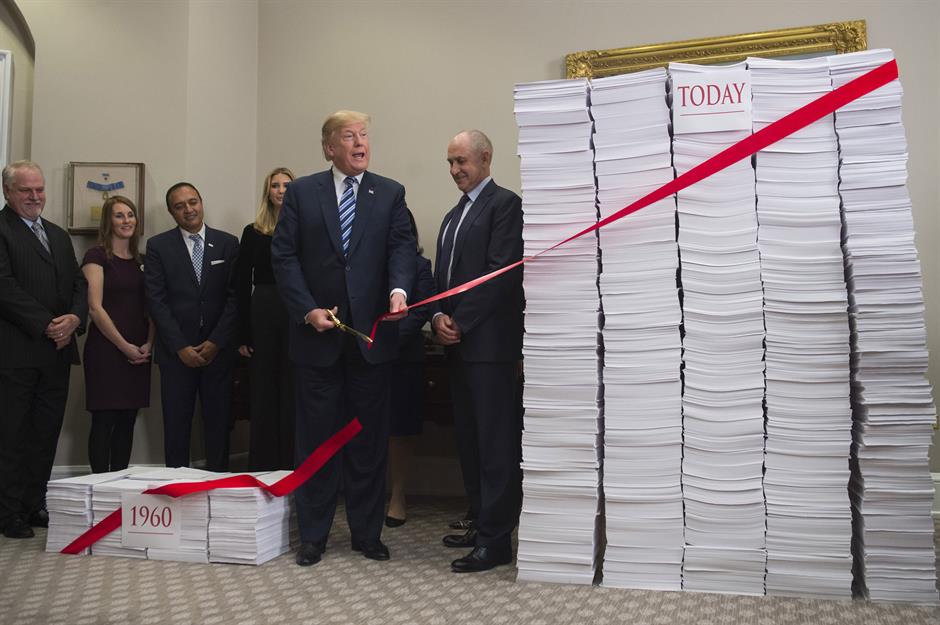

Reasons why there will be a crash #7: banking regulations are being relaxed in the US

Saul Loeb/AFP/Getty Images

Another red flag, the Financial CHOICE Act that was signed into law by President Trump in May has rolled back many of the Wall Street regulations that were safeguarded in the 2010 Dodd-Frank Act. This deregulatory move has made the US and wider world economy more vulnerable to economic crises.

Reasons why there will be a crash #8: shadow banking has grown explosively in recent years

Volodymyr Tverdokhli/Shutterstock

Adding to the concerns, the global shadow banking industry, which isn't subject to the stringent regulations the regular industry must adhere to, has enjoyed explosive growth in recent years. Now worth a staggering $160 trillion (£121trn), the unregulated sector has become dangerously big, and could provide the spark for the next meltdown.

Sponsored Content

Reasons why there will be a crash #9: emerging economies are tanking

Ozan Koze/AFP/Getty Images

Higher US interest rates have helped strengthen the dollar. One of the knock-on effects of this has been a flight of capital from emerging economies like Turkey, India and Brazil, leading to currency depreciations. Analysts worry these struggling economies could trigger a deeper global crisis.

Reasons why there will be a crash #10: China's economy is in big trouble

Nicolas Asfouri/Getty Images

The world's second largest economy is in big trouble. Government, corporate and household debt has reached unsustainable levels in the country. As interest rates rise and growth slows, the debt problems are set to intensify, and could very well set off a wider regional or even worldwide crisis.

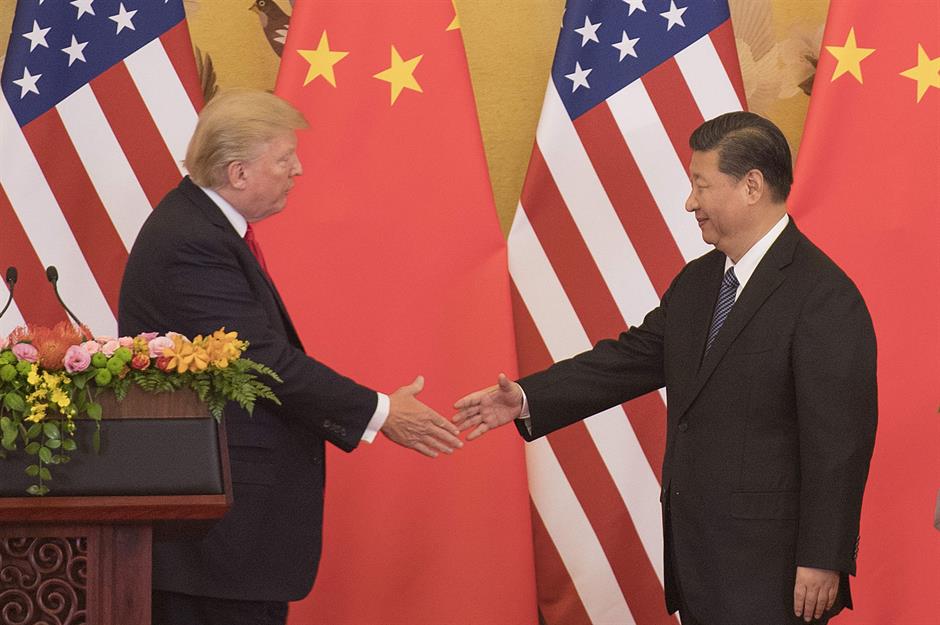

Reasons why there will be a crash #11: increased protectionism is harming the global economy

Nicolas Asfouri/Getty Images

The US-China trade dispute, the Trump administration tariffs on goods from countries like Canada, Brexit and newly elected anti-globalisation governments in Italy and elsewhere are disrupting global trade and may end up being catalysts for the next big downturn.

Sponsored Content

Reasons why there will be a crash #12: Italy could very well trigger the next global crisis

Alberto Pizzoli/AFP/Getty Images

Italy in particular is a major cause for concern. Though the country and its banks are drowning in debt, the recently elected right-wing populist government is planning to significantly increase public spending, which has the potential to cause a financial crisis that could spread within Europe and even globally.

Reasons why there won't be a crash #1: the market is simply correcting itself

Spencer Platt/Getty Images

However, not everyone is so pessimistic. Ignoring the doom and gloom merchants, plenty of experts are confident last week's sell-off and the continuing dip in global stock markets merely represent a much-needed correction. After all, the bull market has been artificially high for some time now.

Reasons why there won't be a crash #2: the US economy is rock-solid

Canbedone/Shutterstock

Underpinning this cheeriness is the mighty US economy, which is rock-solid. The fundamentals of the economy remain robust, with almost full employment, rising wages, resilient spending and increasing manufacturing output, all of which are driving strong growth.

Sponsored Content

Reasons why there won't be a crash #3: US banks are reporting bumper profits

Andriy Blokhin/Shutterstock

Three of America's largest banks, JP Morgan, Citigroup and Wells Fargo, reported impressive profit increases in October. Analysts expect the market to stabilise and the bull run to resume as more positive results are announced over the coming month or so.

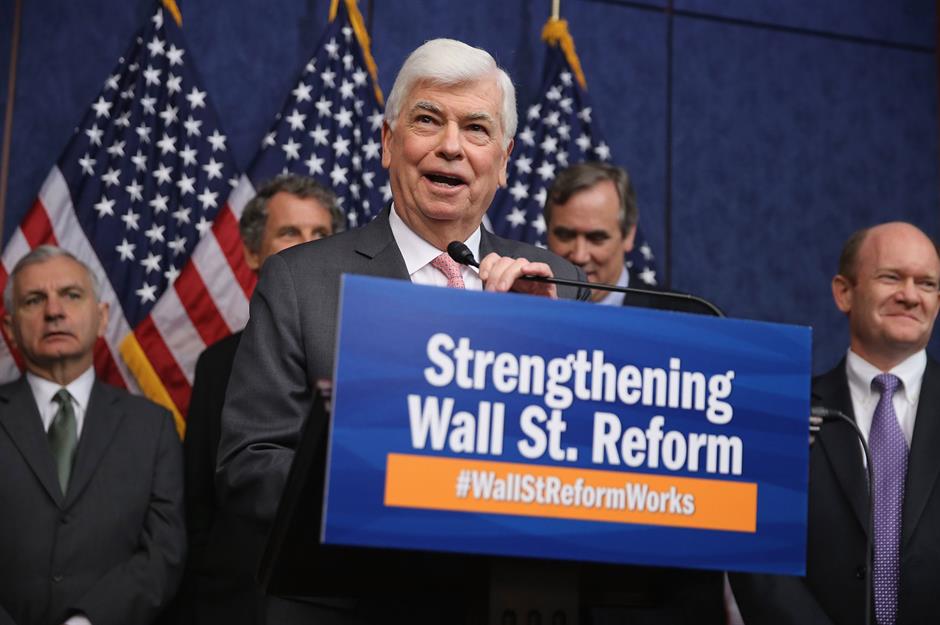

Reasons why there won't be a crash #4: regulation is much stricter now compared to 2008

Chip Somodevilla/Getty Images

Despite the rollback of a number of regulations safeguarded in the 2010 Dodd-Frank Act, the global financial system has far more oversight today than in 2008. Regulation remains tight worldwide, banks hold larger capital buffers and the system is a lot more protected overall.

Reasons why there won't be a crash #5: US shoppers' confidence hit an 18-year high in September

LittlenySTOCK/Shutterstock

Americans, who are benefiting from the ultra-low unemployment rate, lower taxes and rising wages, are in no hurry to curb their spending, which is working wonders on the economy.

Sponsored Content

Reasons why there won't be a crash #6: US household debt as a proportion of GDP has fallen 19% since 2008

Wavebreakmedia/Shutterstock

US household debt may seem perplexingly high, but as a proportion of GDP, it has actually fallen 19% since 2008. Plus, though the recent interest rate rises have squeezed US households, interest rates are still historically low. Household debt as a proportion of GDP has also decreased in many other countries.

Reasons why there won't be a crash #7: Americans are having no trouble paying their dues

Baranq/Shutterstock

In contrast to the situation in 2008, Americans are in a lot of debt, but they're not struggling to pay their bills. The rate of seriously delinquent loans is extremely low in the country and the student loan delinquency rate, which has always tended to be high, is actually falling.

Reasons why there won't be a crash #8: global economic growth remains robust

Fotohunter/Shutterstock

America isn't the only nation with a booming economy. While the IMF has downgraded its global growth prediction for 2018 by 0.2 percentage points, the revised figure of 3.7% is by no means weak and should really be something to celebrate.

Sponsored Content

Reasons why there won't be a crash #9: the price of oil won't hit triple figures

Don Emmert/AFP/Getty Images

Many analysts doubt oil prices would be allowed to surpass the $100 (£76) a barrel mark. "Major economies won't let oil prices rise to triple digits and harm economic growth,” says Commerzbank analyst Carsten Fritsch. “Once we see $90 [£69] I would expect decisive supply reaction.”

Reasons why there won't be a crash #10: the Chinese economy is doing just fine

BassKwong/Shutterstock

While debt levels have skyrocketed in the country, the Chinese economy, much like America's, is doing just fine, despite the trade dispute. This year's bumper growth target of 6.5% is likely to be met, retail sales and manufacturing output are buoyant and many other indicators are positive.

Reasons why there won't be a crash #11: an all-out trade war will likely be averted

Jim Watson/AFP/Getty Images

The Trump administration has reached a deal with Mexico and softened its stance on Canada and the EU. This raises hope of an agreement with China, which would mitigate any harm to the global economy.

Sponsored Content

Reasons why there won't be a crash #12: Brexit won't trigger global economic meltdown and the EU can contain Italy's economic woes

Alberto Pizzoli/AFP/Getty Images

Even a no-deal Brexit is unlikely to destabilise the global economy, though it would be massively damaging for the UK. Italy's economic problems are critical, but the EU is well-prepared for any eventualities according to German Finance Minister Olaf Scholz, and should be able to weather the storm.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature