Fractional ownership: how anyone can own a share of expensive items

Share and share alike

Classic cars

Classic cars are often touted as a great personal investment, but the cost of keeping a vintage vehicle is on the up. However, if you haven’t got the cash to buy one outright, there is another way to get involved. By investing in a share of a classic car, you can cash in on its potential resale value or simply enjoy the feeling of owning part of a sought-after vehicle. If you're a serious investor, you could take the money it would cost to buy one car and spread it among several different models to diversify your portfolio.

Classic cars

Companies offering these shares are on the rise. American start-up Rally offers equity in collector cars, and recent offers have included a $400,000 (£314k) 1980 Lamborghini Countach Turbo at $80 (£63) per share. Meanwhile, leading UK-based company The Car Crowd has offered shares in a Peugeot 205 GTi beginning at £18.90 ($25). When you invest in a car, you become a shareholder in a special purpose entity set up specifically to purchase that car and store it, and it's owned 100% by the investors.

While you can't drive it, there are additional perks – for example, if a museum wanted to showcase a vehicle, the shareholders might receive a one-time dividend. And if the car has appreciated in value you can sell your share(s) and take the profit.

Sponsored Content

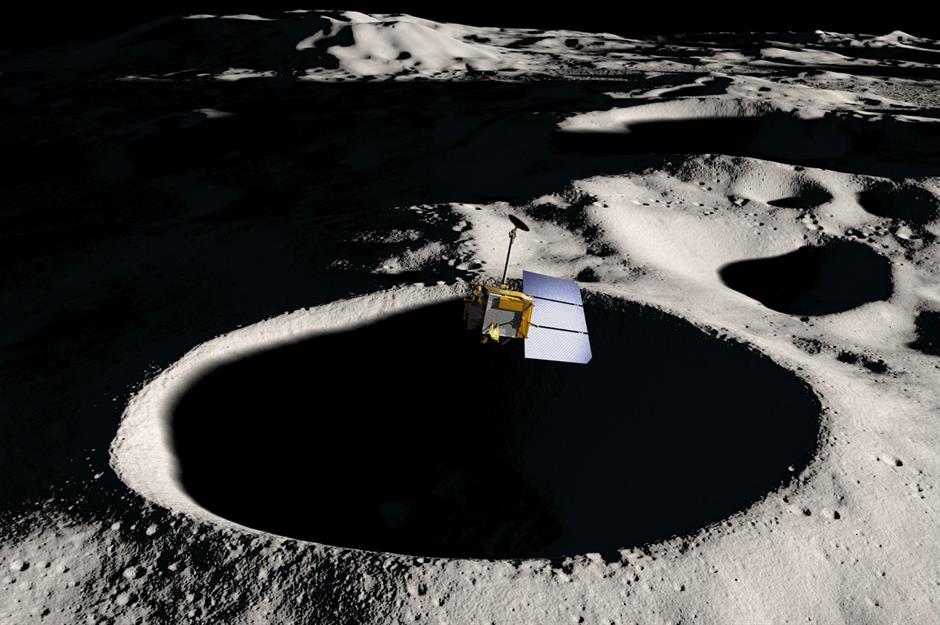

The moon

Prefer something a little less grounded? The bargain price of £24.25 (around $30) will buy you a one-acre lunar plot on the moon via moonestates.com (having your ownership certificate framed will cost you almost double that). For £100.95 ($110), you can purchase 10 acres of land on the moon, Mars, or Venus – including a certificate frame.

The moon

Tom Cruise, Tom Hanks and George Lucas are said to be among the six million-plus investors in interplanetary real estate. But the biggest winner is surely the man behind Moon Estates, ‘planet overlord’ Dennis Hope, who is thought to have made more than $10 million (£7.90m) since 1980 by selling off portions of our solar system through his company the Lunar Embassy. Legal experts have dispelled the idea that you can really own any part of the moon at all, but the certificates arguably make a nice gift.

Sports teams

Lots of sports fans dream of owning their favourite team, and for those of us who can't stump up the multimillion-dollar price tags, fractional ownership could be the answer. A select number of teams sell stock directly to the public; in 2011, for example, the Green Bay Packers sold 250,000 shares for $250 (£188) each, raising a total of $64 million (£48m).

Sponsored Content

Sports teams

Others list shares through third-party exchanges. As an investor, you'll get paid dividends on every win – so if your team does well on the field, you do well at the bank. The Global Sports Financial Exchange, dubbed the world’s first sports stock market, launched in 2017. Instead of companies, the exchange's 6,000-plus network of investors buy shares of teams in the four sports on offer so far: basketball, American football, baseball and hockey. The company operates as a non-profit, tax-exempt organisation and is currently valued at $39.8 billion (£28.6bn).

Sporting memorabilia

From sports teams to sports memorabilia, which can be highly collectable and sell for sky-high prices. This is another area covered by New York investment platform Rally, which allows people to invest in all manner of sporting and gaming keepsakes. Recently up for grabs was a 1971 Willie Mays SF Giants jersey (pictured) worth a massive $82,000 (£63k). Most of us wouldn’t be able to afford to spend that kind of money on a sports top, but at $41 (£31) a share, fans could own a piece of the historic item before choosing to sell their shares or add to their position after 90 days.

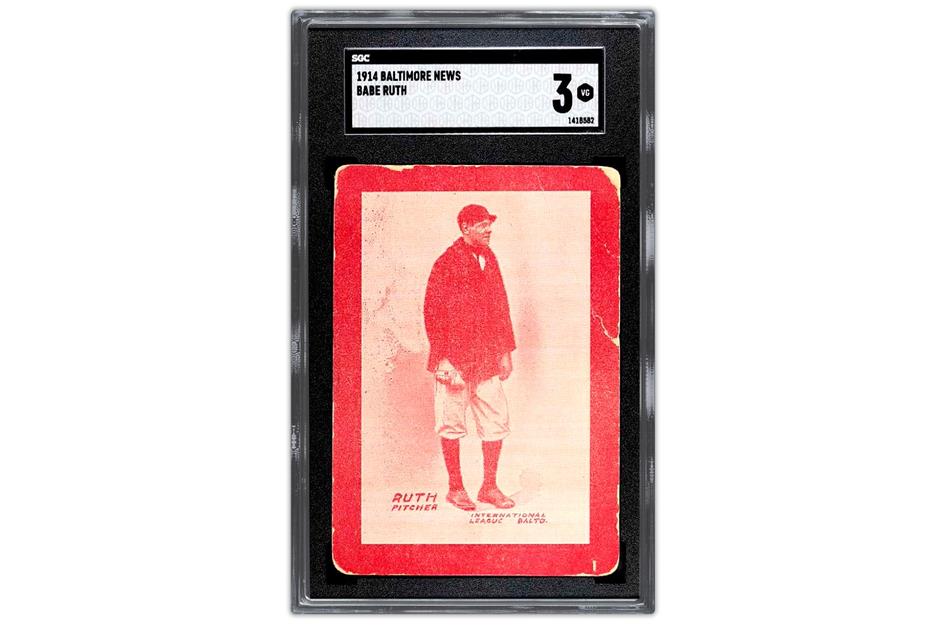

Sporting memorabilia

A particularly pricey piece of memorabilia that was recently listed on the site was a Honus Wagner “T206” baseball card. It's valued at $700,000 (£536k) but investors could purchase a share for as little as $70 (£54). Fractional investment site Collectable.com is also giving fans a chance to own a piece of this Babe Ruth 1914 Baltimore News pre-rookie card, which was reportedly bought for more than $6 million (£4.3m). In January this year, one share cost just $4.35 (£3.20).

Sponsored Content

Fine wine

Publicly-listed companies such as Naked Wines or bigger brands, for example Constellation, allow people to invest money in alcohol businesses. But what if you want to invest in vintage and unique drinks directly? Alcohol also falls under Rally's remit and allows the trading of shares in rare bottles of wine that would otherwise be unobtainable to the everyday investor.

Fine wine

One example of the site’s recent offerings was two cases (12 bottles) of 2016 Chateau Petrus, which have a value of $46,800 (£33.6k), divided into 9,000 shares at $5.20 (£3.75) each. Investors won't get to taste the fruits of their investment literally, but wine stocks are growing in demand and the market is predicted to grow by 5.8% before 2024.

Whisky

Wine isn't the only alcohol being snapped up by investors. The first ‘stock exchange’ for whisky, WhiskyInvestDirect opened in 2015 selling Scotch in the barrel. Investors buy the spirit from distillers once it's mature, which takes a decade on average. Having hopefully appreciated in value, it's then bought back for bottling and sale. Investors buy a package (such as malt or young whisky) for a minimum of $125 (£100), with a minimum storage fee of $3.80 (£3) a month.

Sponsored Content

Whisky

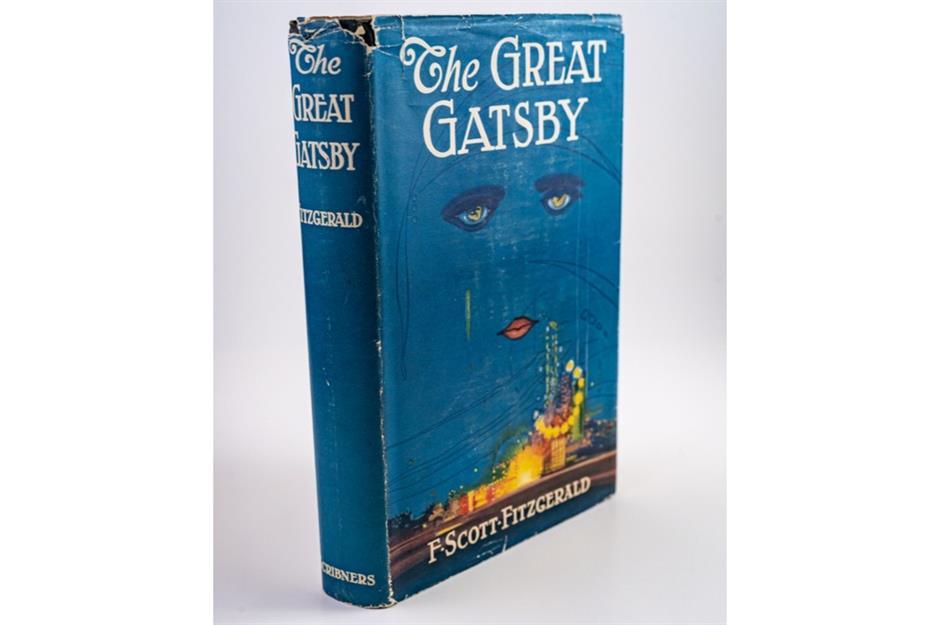

Rare books and comics

Rally has another interesting investment opportunity up its sleeve: books and comics. The most exciting pieces tend to be priced in the tens of thousands or more. Take a signed first edition of F. Scott Fitzgerald’s The Great Gatsby for example, which is worth around $200,000 (£153k). Shares in this are on sale at $50 (£38) apiece.

Rare books and comics

According to Rally, comic books were its second most popular category last year. Like its selection of books, the comics listed on the site would be worth huge amounts of money outright. This 1963 Marvel Tales of Suspense copy, valued at $135,000 (£103k), sold at $45 (£34) per share to 391 different investors. If the value of the comic goes up, so does the value of the shares owned by investors, who can then sell their portion on to a new buyer.

Sponsored Content

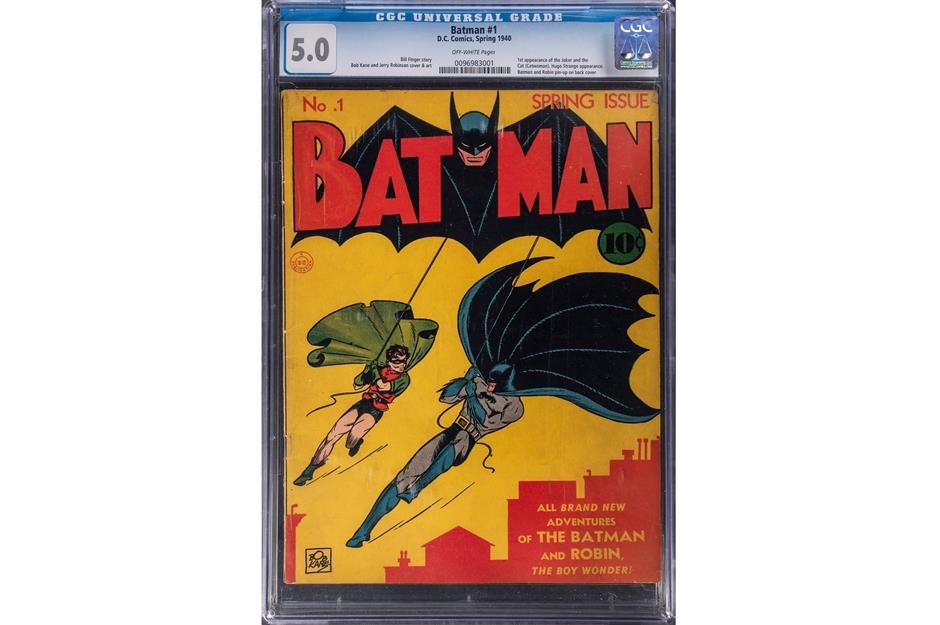

Rare books and comics

In February this year, Rally also listed a rare Batman comic on its site. In total, the comic – which has been described as "one of the most important comic books of all time" – has been valued at $1.8 million (£1.3m), making it the second most expensive Batman comic ever. From 11 March it's been possible to buy shares in Batman #1 for $10 each. Investors can buy up to 10% of the 180,000 shares available.

Fine art

Fine art

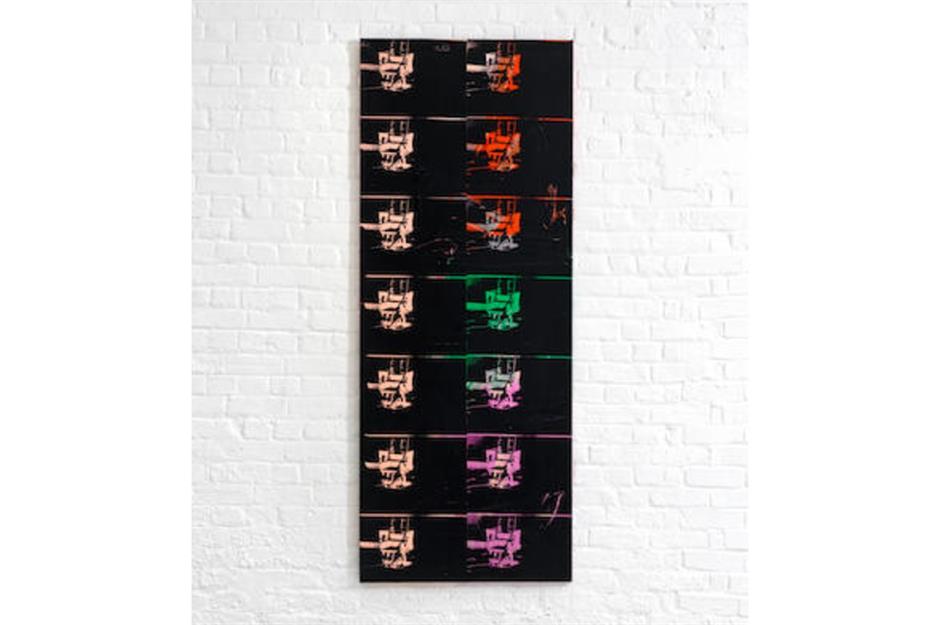

In 2018, Maecenas sold 31.5% of Andy Warhol’s 14 Small Electric Chairs, raising $1.7 million (£1.3m) of the painting's $5.6 million (£4.4m) valuation through its token asset system – although that was short of the 49% of the painting the company had put up for offer. It's a budget-friendly means of dipping your toe into the world of art buying and can make you a little bit of extra money, as well as giving you the cachet of saying you own a (small piece of a) masterpiece.

Sponsored Content

Fine art

And 14 Small Electric Chairs isn't the only Warhol artwork that's been put up for fractional ownership. In May this year, just days after Warhol's painting of Marilyn Monroe broke auction records, fractional ownership platform Showpiece.com announced that it had bought one of the pop artist's screen prints of Queen Elizabeth II (pictured). To celebrate the Queen's Platinum Jubilee in July, Showpiece will offer 3,500 shares in the artwork for £100 ($125) each.

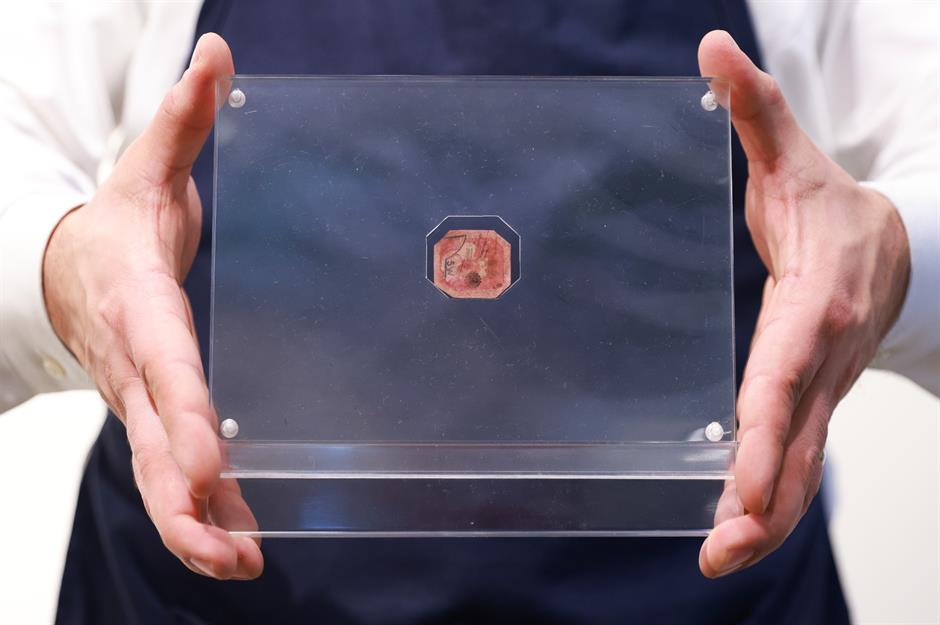

One of the world's most valuable stamps

Dubbed the world’s most valuable stamp after it sold for $9.5 million (£8.1m) in 2014, the British Guiana 1856 1 cent magenta is not an example that every philatelist can afford to have in their collection.

One of the world's most valuable stamps

Stamp collecting business Stanley Gibbons purchased the magenta for $8.3 million (£5.9m) in June 2021 and announced plans to launch a fractional ownership scheme, which allows stamp collectors to own part of this record-breaking Mona Lisa of the stamp world for £100 ($135) per piece. Currently, a staggering 80,000 'pieces' have been sold, leaving 35.2% of the total value up for grabs.

Sponsored Content

Rare shoes

Shoes may not be the first thing that springs to mind when you think of something you’d happily share with other people, but these are no ordinary shoes. These Nike Air Yeezy 1 Prototypes were designed by rapper Ye (previously known as Kanye West) during his 2007-2009 collaboration with Nike and they were the company’s first non-athlete celebrity collaboration project. The shoes were actually worn by Ye and as a result achieved an incredible final sale price of $1.8 million (£1.3m) when they sold at a Sotheby’s auction in April 2021.

The winning bidder was a rare footwear investment platform called RARES, which allows people to invest in “sneaker culture”. According to CNBC, RARES listed Ye's Yeezys on its mobile app in June 2021, enabling people to buy a share for as little as $15 (£11.30).

Rare shoes

Shoes currently listed on RARES include vintage Air Jordans and Apple sneakers (pictured). Back in 2010, the company sold 2,000 shares in a pair of Jay-Z's Air Force 1s for $13 (£9.80) each, giving the shoes a total value of $260,000 – the equivalent of $331,400 (£250k) today.

Meanwhile, Rally has listed a 1972 Nike Prototype Moonshoe, one of just 12 ever made. Between 2016 and 2020, the value of the shoe apparently increased by 1,200% from $11,200 to $150,000, with 7,000 shares listed at $25 (£19) each.

Cameras

Sponsored Content

Cameras

Guitars

Guitars

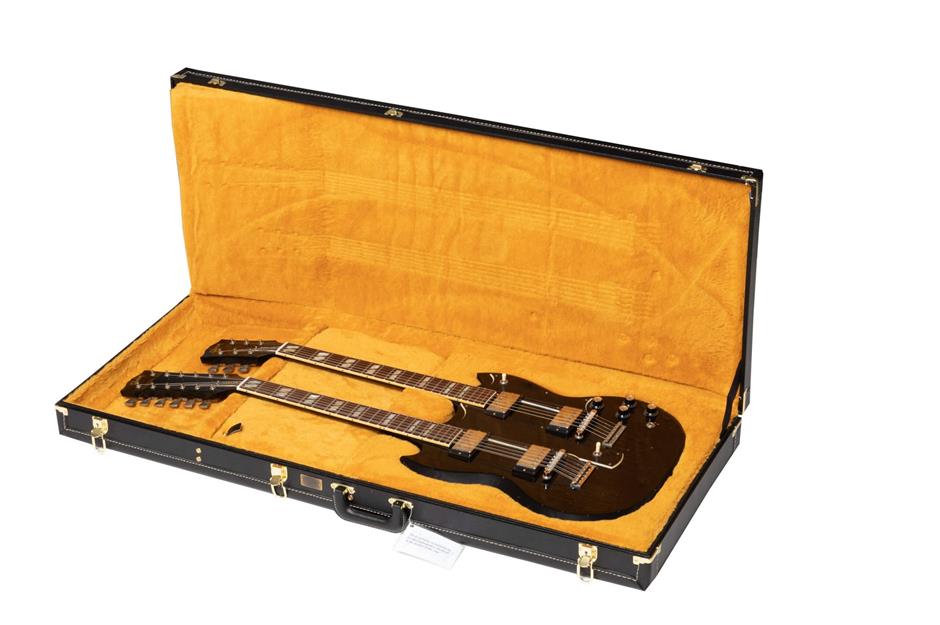

This guitar was the prototype for a limited edition run of 125 guitars modelled on Slash's own instrument. The instrument was sent to Slash for his approval in 2019, with the musician describing it as "hands-down... better than the original from the '60s." Rally acquired the prototype in March last year, with 13,000 shares available at $5 (£3.80). Other guitars listed on the platform include a prototype for a replica batch of Tony Iommi 1964 'Monkey' SG guitars, modelled on an instrument belonging to Black Sabbath guitarist Tony Iommi.

Sponsored Content

Rare technology

Rare technology

A man's life

Sponsored Content

A man's life

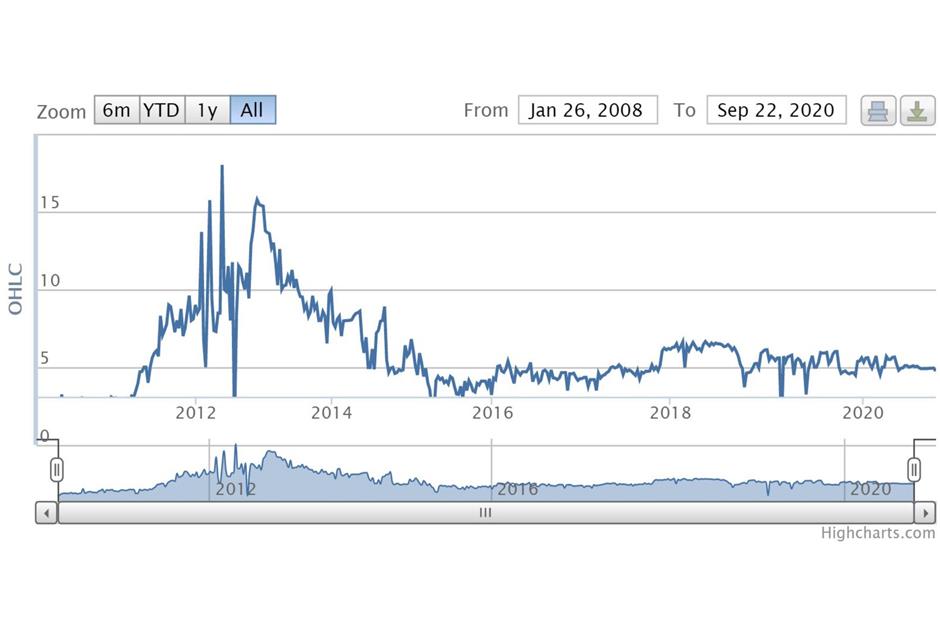

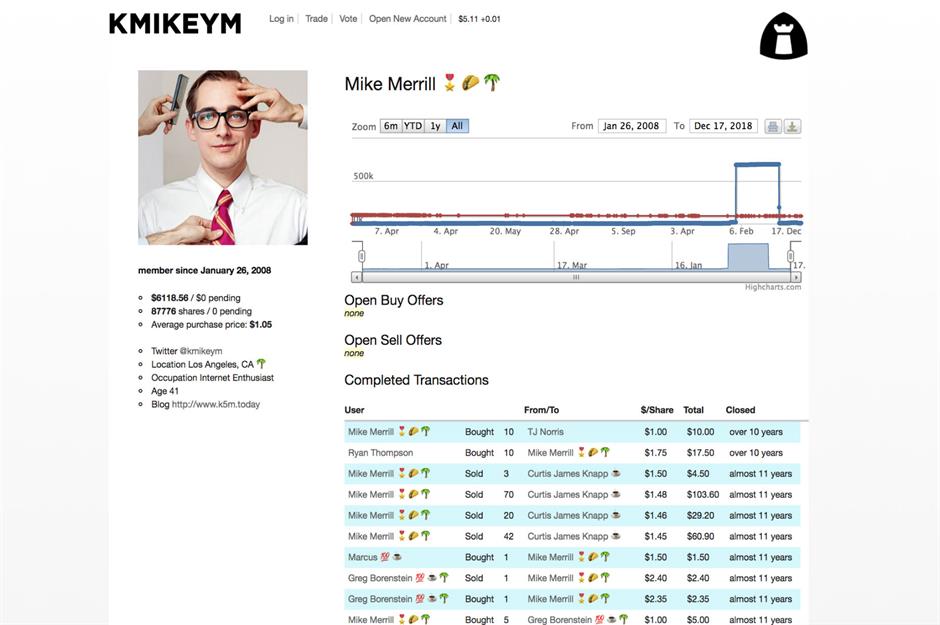

A share in Mike Merrill can vary wildly in price, dropping as low as $0.99 (78p) and soaring as high as $18 (£14) in the last decade. Would-be investors can buy and vote at KmikeyM.com; Merrill’s own shares are non-voting so shareholders have all the say in his life decisions. A recent life choice posed to shareholders was whether or not Mike should go to a party given the Omicron variant of COVID-19 – 96% of shareholders said no...

NFTs

NFTs

Even serious artists are turning their hands to NFTs including Damien Hirst, whose NFT series The Currency poses an unusual conundrum. Hirst has painted 10,000 unique physical artworks, each one of which is attached to a NFT. When somebody buys the NFT, they can decide whether to trade it in for the genuine artwork or keep the NFT and have the painting destroyed. Rally acquired the NFT #HIRST1 in January this year, with 5,000 shares available at $4 (£3).

Now take a look at the world's most valuable paintings

Sponsored Content

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature