11 millennial money myths that simply aren’t true

Millennial myth-busting

The term millennials is one that crops up all over these place these days. It technically refers to those people born between 1981-1996 (aged 23-38) although broader definitions include those as young as 18. Among other criticisms, this group is often derided as self-obsessed, entitled, lazy and bad with money. But actually millennials are far more savvy than you might suspect, as we'll show you.

Myth 1: Millennials aren’t prioritising long-term saving

Truth: Millennials are saving in certain areas

Yet dig a little deeper and a more complex picture emerges. Broadly speaking, wages are stagnating while rent costs and student debt are increasing, meaning that many young people are too preoccupied with the cost of living to save. Nonetheless, millennials are racking up long-term savings in certain areas. In the UK, just 4% of them have opted out of workplace pensions, compared to 14% in older age groups, while 30% of people who opened Individual Savings Accounts (ISAs) in 2016/17 were under 34.

Sponsored Content

Myth 2: Buying non-essential items prevents millennials from saving

In 2017, Tim Gurner (pictured), an Australian real estate mogul and millionaire, went viral after making the claim that young people were unable to save enough to buy a home because they were spending too much on fancy avocado toast and coffees. The comments, made in an interview with 60 Minutes in Australia, sparked outrage among young people.

Truth: Living expenses, not avocado toast, prevent millennials from saving

According to research by F&C Investment Trust, in the UK just 17% of 18- to 35-year-olds say that buying 'non-essential items' such as takeout food and drinks prevents them from saving, while paying essential bills (61%), lack of earnings (41%) and debt (39%) were far bigger obstacles. In order to afford a 20% deposit on a house in Sydney, you’d have to buy 9,291 avocado toasts at AU$22 (US£15/£12) a pop. In other words, unless you’ve got a hardcore brunch habit, it’s unlikely that avocado toast is a significant barrier to saving.

Myth 3: Millennials don’t have traditional life goals

Sponsored Content

Truth: Millennials are reaching these goals later in life

Myth 4: Millennials are drowning in debt

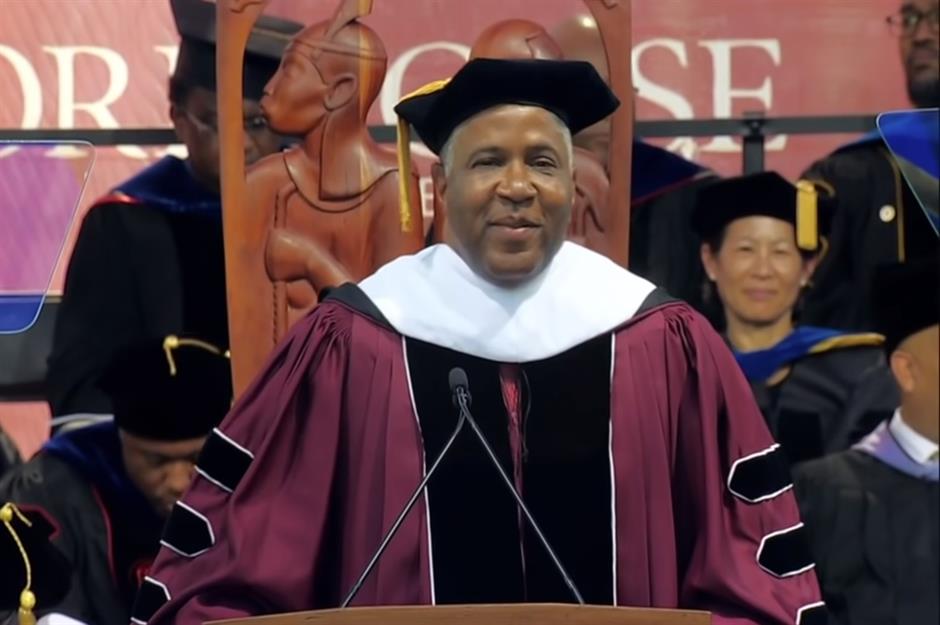

Millennials are more in debt than any other generation in history – US millennials owe a staggering $1 trillion (£800bn) in total. Yet it’s mostly student debt. According to a 2018 report from the St. Louis Federal Reserve Bank, millennials’ student debt is 300% higher than Gen Xers (those born between the mid-1960s and early 1980s), although their mortgage and credit card debt is significantly lower. No wonder billionaire Robert Smith (pictured) was so popular when he agreed to pay off an entire graduating class’ student loans at Morehouse College, Atlanta this year.

Truth: Millennials do have a lot of debt – but it’s unavoidable

So yes, millennials are in a lot of debt, but are they to blame? Over the past few decades we’ve seen massive "degree inflation". In the 1970s just 30% of jobs in the US required a degree, while by 2020 it’ll be 65%, according to a report by Georgetown University. Plus, tuition and living costs are increasing, meaning that millennials must take out bigger student loans. Politicians who promise to ban tuition fees such as Bernie Sanders (pictured) have become popular among millennials.

Sponsored Content

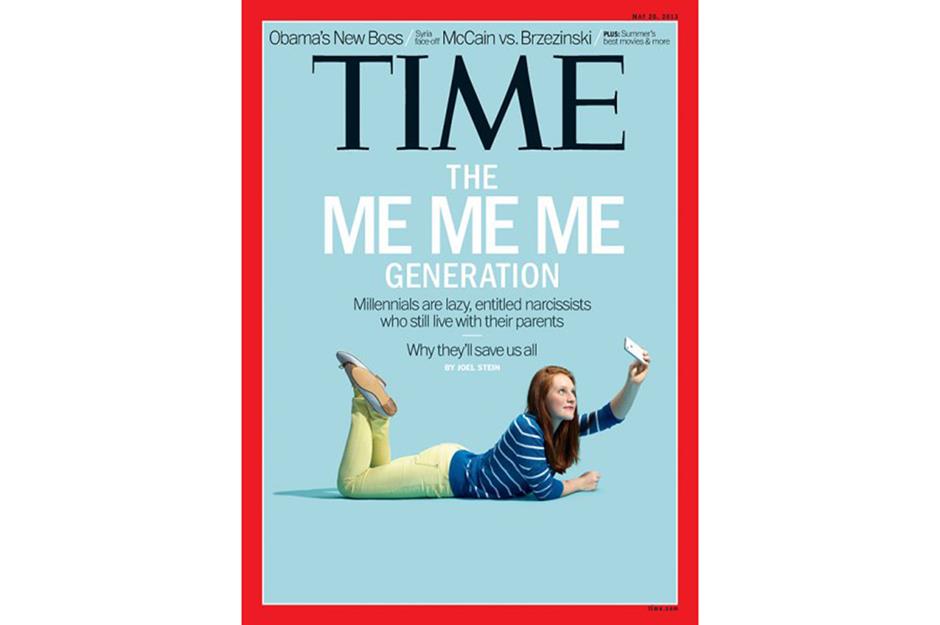

Myth 5: Millennials are entitled

In 2013, a Time magazine cover was emblazoned with the headline "The Me Me Me generation", stating that millennials are "entitled". There are some stats supporting this: a University of Hampshire study found that millennials born between 1988 and 1994 scored 25% higher in entitlement-related issues than 40- to 60-year-olds, and 50% higher than over-60s. Millennials are also more likely to want to work from home and have flexible hours than previous generations.

Truth: Millennials want to do things differently

Myth 6: Millennials are killing off business

Sponsored Content

Truth: Millennials are creating new ones

Yet millennials are turning away from more traditional businesses and opting for newer ones. Prices are often cheaper online – 65% of the time there’s a price difference, with the online option being cheaper, according to a report by Anthem Marketing Solutions. So it's no wonder many businesses millennials prefer are based online, including banks and stores. When it comes to dining, millennials are more likely to opt for "fast-casual or quick-serve restaurants" or order takeout, according to Buffalo Wild Wings CEO Sally Smith. While traditional dining chains like Applebee’s are facing sales slumps, the ones with a fast-paced concept still win.

Take a look at the online companies killing off household names

Myth 7: Millennials use credit cards recklessly

Millennials had an average of $4,712 (£3,785) of credit card debt for Q1 of 2019, according to data from credit reference agency Experian, a figure which increased by 7% in the past year – making it easy to assume millennials are reckless with their credit card spending. Credit card debt was higher for older millennials.

Truth: Millennials have less credit card debt than other generations

Yet according to a report by the St. Louis Federal Reserve Bank, millennials have two-thirds lower credit card debt than Gen Xers had at the same point in their lives, and 15% lower mortgage debt. And the current figure is still lower than the national average of $5,474 (£4,397) and much lower than Gen Xers’ average of $8,023 (£6,445). As already mentioned, this is eclipsed by the massive student loan debt millennials have hanging over them, but the point still stands that millennials are broadly wary of credit card spending.

Sponsored Content

Myth 8: Millennials don’t care about their credit rating

On the flipside, some millennials are allowing credit card debt to rack up for years, and with the average interest rate on credit cards currently at 17%, this can be detrimental to their credit rating. By age group, millennials also have the lowest credit score at an average of 652 in the US (credit scores range from 300-800 and most scores fall in the 600-750 range) compared with 679 for Gen Xers and 727 for Baby Boomers (those born between 1946-1964).

Truth: Millennials don’t trust credit cards

While rising credit card debt among millennials is alarming, it’s important to look at the bigger picture. The majority have a total aversion to credit cards. According to a survey by Bankrate, 63% of 18- to 29-year-olds don’t have one at all. It’s thought that growing up during the financial crisis has driven distrust towards big banks, with debit cards and prepaid cards remaining preferred payment options.

Myth 9: Millennials don’t work hard

Sponsored Content

Truth: Millennials work long hours and have side hustles

What Sinek didn’t point out, however, is that the so-called 'gig economy' has completely reshaped the way millennials approach work. It’s meant that many spend less time in a position on average, but it also means that 44% of 25- to 34-year-olds have a side hustle, compared with 22% of 45- to 54-year-olds and 19% of those aged 55+, according to a 2016 CareerBuilder Report. So they’re not actually working less, just differently.

Here are 20 ways to make extra money today that you couldn't 20 years ago

Myth 10: Millennials don’t plan for the future

Truth: Millennials already have a lot on their plates

There’s no doubt that millennials have not been dealt a great hand, having come of age during a recession, with increasing living costs and overblown student fees. Considering those factors, it’s a wonder that millennials can make long-term plans at all. According to a study by Merrill Edge, 63% of millennials said they prioritised saving towards becoming financially independent rather than retirement. Given that so many are cash-strapped and sometimes resort to parents’ help, short-term strategies make sense. Companies offering house shares, in order to reduce living costs, have been hugely popular among this age group.

Sponsored Content

Myth 11: Millennials are too interested in keeping up with the Kardashians

A 2018 survey by Credit Karma found that two in five US millennials spend money they don’t have in order to keep up with their friends. Reality TV stars such as the Kardashians (pictured) and social media have allowed us to be constantly bombarded with consumerism, and millennials spend the most time on social media. On average, 16- to 24-year-olds spend three hours a day on social media and 25- to 34-year-olds two hours 37 minutes, according to a report by Global Wealth Index.

Truth: Millennials aren't behaving any differently to past generations

But millennials aren’t the only ones to buy things because of their peers. After all, the phrase "Keeping Up with the Joneses" came about way back in 1913. Every generation has had its sweeping trends, fads and status symbols. What’s different is that millennials have grown up around social media, many of them not knowing a time before it, and that's brought about a sea change. Millennials see targeted advertising, and are sold products and services by their favourite influencers and even their friends.

Now meet the pet animals earning their owners a fortune online

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature