Governments around the world that blew massive windfalls

Windfalls that fuelled spending sprees and scandals

Nauru's phosphate windfall: $1.2 billion (£894m)

Nauru's phosphate windfall: $1.2 billion (£894m)

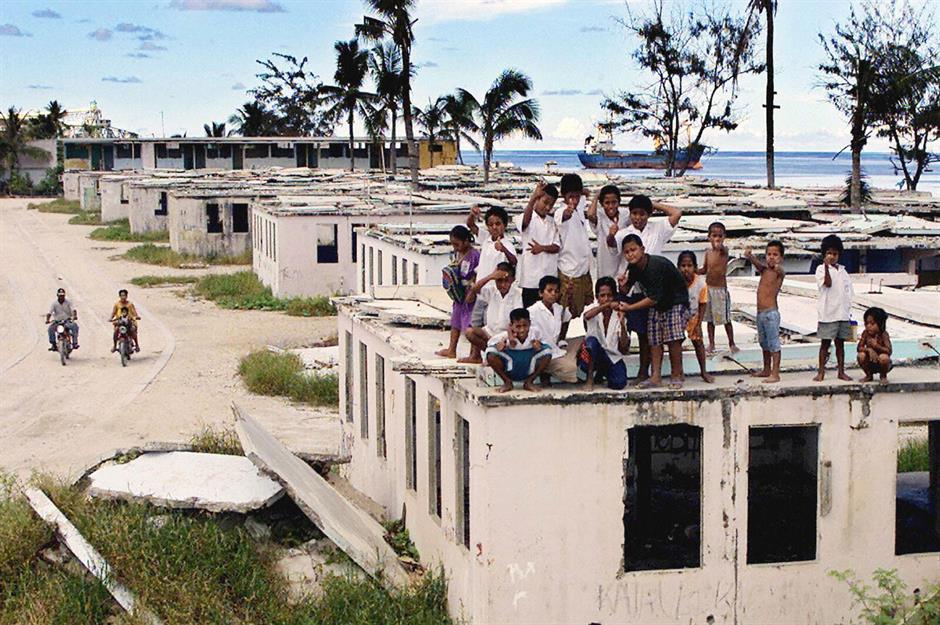

When the island's phosphate reserves ran out in the 1980s, Nauru was drowning in debt and severe austerity measures followed, though they didn't stop the nation going bankrupt in the early 2000s. Since then, the country has been reliant on Australian aid in return for housing an asylum centre for refugees. Mired in poverty and threatened by climate change, it faces a very bleak future indeed.

Sponsored Content

Zimbabwe's diamonds windfall: $2.2 billion (£1.7bn)

The discovery of colossal quantities of diamonds in Zimbabwe's Marange fields back in 2006 should have worked wonders for the country's battered economy. Instead, the find was characterised by severe human rights abuses, wholesale looting and widespread corruption.

Zimbabwe's diamonds windfall: $2.2 billion (£1.7bn)

Human rights organisation Global Witness alleges that the state earned $2.5 billion (£1.9bn) from exports of the precious stones but just $300 million (£230m) made it into public funds, leaving $2.2 billion (£1.7bn) unaccounted for. In fact, the late President Mugabe himself claimed that a staggering $15 billion (£11.5bn) of the country's diamond wealth had gone missing, although he later claimed he was misled by officials.

South Sudan's oil windfall: $4 billion (£3.1bn)

In 2012, Salva Kiir (pictured front), the president of newly independent South Sudan, accused scores of public officials of stealing $4 billion (£3.1bn) from the nation's coffers. Almost 100% of the country's budget derives from oil.

Sponsored Content

South Sudan's oil windfall: $4 billion (£3.1bn)

Chad's oil windfall: $13 billion (£10bn)

Chad's oil windfall: $13 billion (£10bn)

Sponsored Content

Equatorial Guinea's oil windfall: $45 billion (£34.5bn)

Equatorial Guinea's oil windfall: $45 billion (£34.5bn)

Trinidad and Tobago's oil windfall: $77 billion (£59bn)

Sponsored Content

Trinidad and Tobago's oil windfall: $77 billion (£59bn)

Hosein has stated that, out of the $90 billion (£68.9bn) collected, only $5 billion (£3.8bn) was allocated to the nation's Heritage and Stabilization Fund, while $8 billion (£6.1bn) was placed in international currency reserves. That leaves a discrepancy of $77 billion (£59bn), which Hosein believes was “poorly spent” and didn't help move the country away from its reliance on oil.

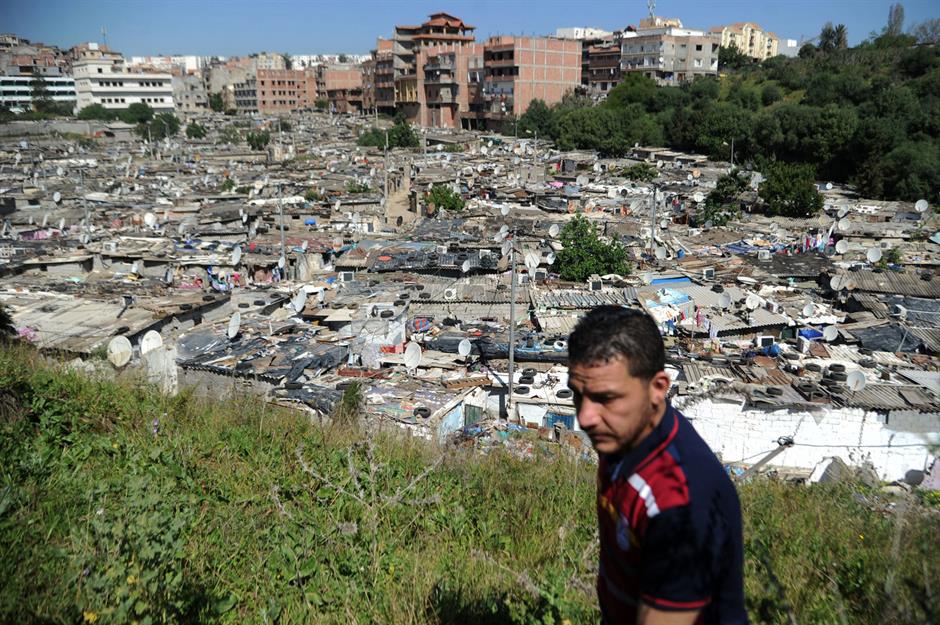

Algeria's oil windfall: $99.2 billion (£76bn)

Having put all its eggs in one basket, Algeria is heavily dependent on oil. Hydrocarbons represent 95% of its exports and 75% of government revenues according to the World Bank. Though the nation's reserves have generated plenty of cash, the bulk of the proceeds has been effectively squandered.

Algeria's oil windfall: $99.2 billion (£76bn)

Algeria had currency reserves of $179 billion (£137bn) in 2014 but the figure has since dwindled to $79.8 billion (£61.1bn), according to the Bank of Algeria. Instead of using the $99.2 billion (£76bn) to alleviate poverty, diversify the economy and prepare for the future, the money has been poorly managed with much of it spent on subsidies and offsetting lower oil prices.

Sponsored Content

Azerbaijan's oil windfall: $100 billion (£76.6bn)

As of January 2019, Azerbaijan's State Oil Fund has received a huge $138.2 billion (£105.9bn) from the country's main oil reservoir, the Azeri-Chirag-Gunashli (ACG). Yet despite the massive windfall, ordinary citizens aren't reaping the benefits.

Azerbaijan's oil windfall: $100 billion (£76.6bn)

Of that money, $100 billion (£76.6bn) has been spent but the country has very little to show for it, apart from a number of flashy infrastructure projects and glitzy skyscrapers in the capital Baku. Poverty remains widespread, unemployment is at its highest rate in 20 years and social services and healthcare are abysmal.

Canada's non-renewable resources windfall: $145 billion (£111bn)

Sponsored Content

Canada's non-renewable resources windfall: $145 billion (£111bn)

The Alberta Heritage Savings Trust Fund (HSTF) was set up in 1976 to save for a rainy day, bolster the province's economy and improve the life of its citizens, yet in 2013 the value of the fund was just CA$17.3 billion (US$13.2bn/£10.1bn). Instead of putting the revenue cash aside, successive Albertan governments channelled most of the money into capital projects and operational expenses.

Australia's mining boom windfall: $199 billion (£152bn)

Australia could well have boasted a sovereign fund similar to that of Norway or Kuwait had successive governments ring-fenced the extra cash received as a result of the country's mining boom. From 2003 to 2017, the boom boosted the Aussie economy to the tune of AU$290 billion (US$199bn/£152bn), according to a study by forecasting firm Macroeconomics.

Australia's mining boom windfall: $199 billion (£152bn)

Instead of banking the additional cash, sucessive governments used the money to fund tax cuts, stimulus spending and handouts. Ironically, the Australian government advised East Timor in 2005 to set up a sovereign wealth fund following Norway's example. If the Aussie powers that be had followed their own advice, the country would be sitting on a huge pile of cash.

Take a look at a prediction of the world's richest countries in 2030

Sponsored Content

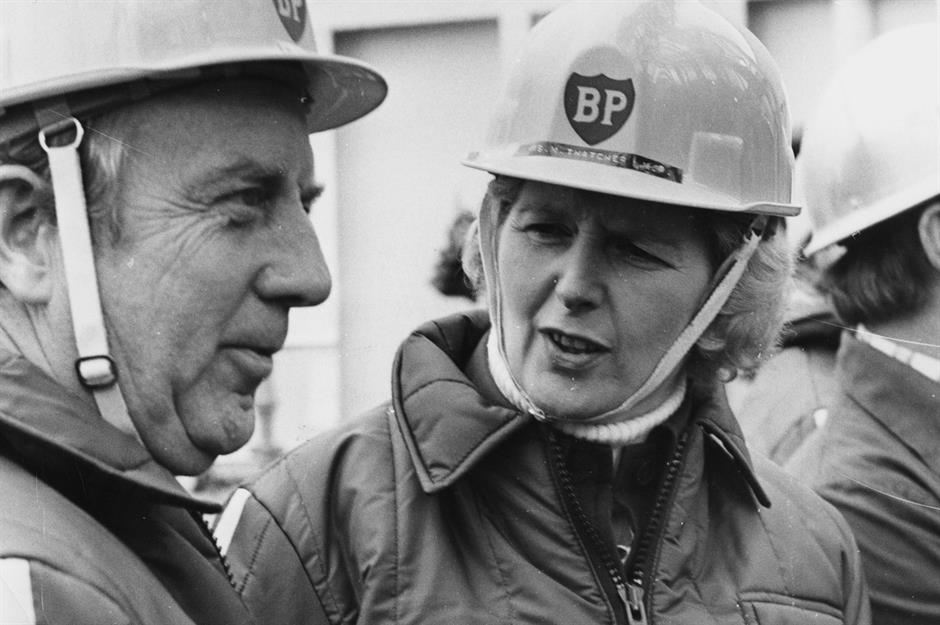

The UK's oil windfall: $391.7 billion (£300bn)

The UK's oil windfall: $391.7 billion (£300bn)

Both the Thatcher administration and the governments that have followed failed to establish a sovereign wealth fund like Norway's. If the UK had done so and the $391.7 billion (£300bn) received up to 2014 had been invested wisely, the fund might well have inflated to over $1 trillion (£850bn) argues Sukhdev Johal, an accounting professor at Queen Mary University of London.

Nigeria's oil windfall: $1 trillion (£766bn)

A report published in 2018 by the Shehu Musa Yar'Adua Foundation and authored by a former World Bank vice president and other esteemed analysts revealed that Nigeria wasted a total of $1 trillion (£766bn) earned from the five major oil booms that took place from 1970 to 2014.

Sponsored Content

Nigeria's oil windfall: $1 trillion (£766bn)

The money, which was either brazenly stolen or misspent, could have gone a long way towards diversifying the economy and making a real difference to the lives of ordinary Nigerians, many of whom live hand to mouth and struggle to find work.

Discover more about why oil- and gas-rich countries need to change

Venezuela's oil windfall: $1.3 trillion (£996bn)

Venezuela's oil windfall: $1.3 trillion (£996bn)

This vast fortune was all but wasted. Grossly mismanaged, much of the cash disappeared due to corruption, while a significant proportion was funnelled into ill-judged welfare programmes. In spite of the eye-watering amount of money spent, poverty is rife in the country, which is in dire straits financially and socially.

Venezuela is one of several countries that used to be rich but are now poor

Sponsored Content

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature