Big bosses who profited when their businesses were going under

Fat cat executives who cashed in as their companies fell

Rewarding CEOs and other senior staff members for failure is all too common in the corporate world. As WeWork founder Adam Neumann and the bosses of collapsed UK travel firm Thomas Cook come under fire for their excessive payouts, we take a look at the executives who made a killing while their companies were hitting the skids.

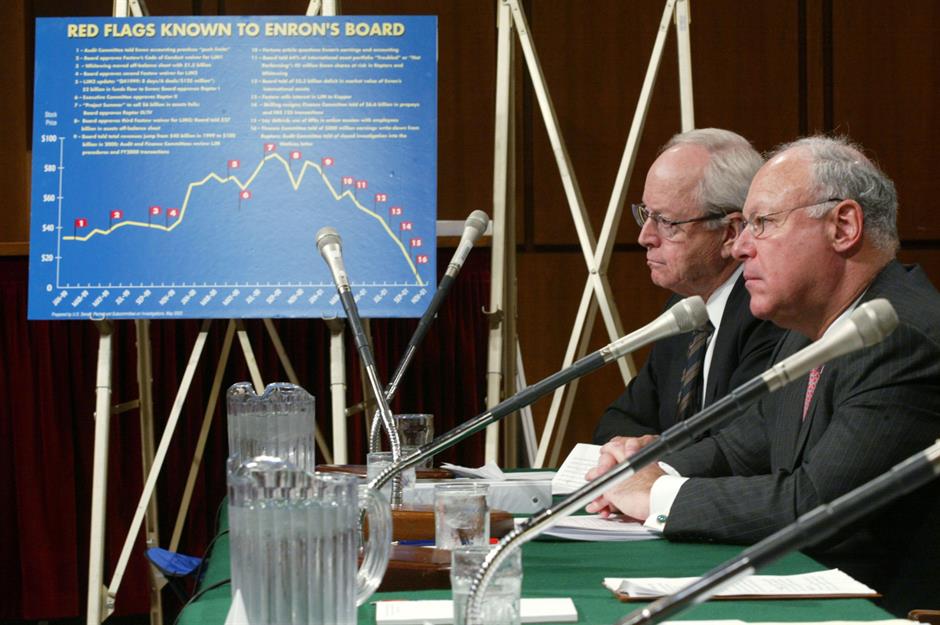

2000: Enron

In the year leading up to failed energy firm Enron's bankruptcy in 2000, the company paid out $681 million to 140 of its top managers, according to The Guardian. This was while shareholders, including ordinary workers, lost billions of dollars as the business collapsed. The bonus rewards were for attaining price targets in 2000, the year accounting staff were cooking the books and illegally inflating the firm's profits.

2001: One.Tel

Australian telecoms company One.Tel racked up losses of A$291 million after tax in 2001, which led to the winding down of the heavily indebted business. That's A$454.3 million (USD$314.6m/£243.8m) in today's money. Despite the firm's abysmal performance, its founders Jodee Rich and Bradley Keeling received bonuses of A$6.9 million each, the equivalent of A$10.8 million (USD$7.5m/£5.8m) in today's money. However, the pair did eventually pay the money back following legal action.

2001: Polaroid

Incredibly, mere weeks before Polaroid entered into Chapter 11 bankruptcy in 2001, its executives were rewarded with millions of dollars in bonuses. At the time, the struggling instant camera maker had debts that totalled a staggering $1 billion.

2001: JDS Uniphase

Optical communications company JDS Uniphase reported a loss of $56.1 billion in 2001, which at the time was the biggest in corporate history, yet its CEO Jozef Straus wrangled a 60% pay rise and an estimated $150.3 million in 1.6 millon stock options that same year. That's the equivalent of $218 million (£169m) in today's money. Not only that but his annual salary increased by 59.2%. At least three top executives also received stock options in the millions as the company fell apart.

2002: Tyco

Together with the senior management team, Tyco boss Dennis Kozlowski plundered as much as $600 million in unauthorised bonuses and loans from the company during the 1990s and early 2000s. This funded a very extravagant lifestyle, including a Manhattan apartment on Fifth Avenue with an infamous $6,000 gold-and-burgundy shower curtain. The fraud came to light in 2002 when the firm was experiencing financial problems and Kozlowski served six-and-a-half years in jail for his crimes. However, there was some good news for investors when they successfully brought a class action lawsuit against the company, claiming they were not made aware of the firm's criminal activity when they invested. In 2007 Tyco agreed to pay out $3 billion to investors, the equivalent of $3.7 billion (£2.9bn) in today's money.

2005: MG Rover

Dubbed 'grand theft auto' by the UK's Mirror newspaper, failing automotive firm MG Rover saw four directors know as the Phoenix Four who had bought the company from BMW for just £10 in 2000, pay themselves and MG Rover's CEO as much as £42 million. That's £69.5 million ($89.7m) in today's money. MG Rover collapsed in April 2005, with 6,500 people losing their jobs. In contrast, the firm's workers walked away with just £3 ($4) each. But the Phoenix Four didn't get away unscathed; following a UK government investigation into the company's finances they were banned from holding the position of company director for a combined total of 19 years.

2006: Farepak

Customers of UK Christmas hamper provider and savings club Farepak lost all the money they'd saved for the festive period when the firm went bust in 2006, but the company directors weren't quite so unlucky. They managed to award themselves hefty salaries and bonuses prior to the collapse of the business. And Farepak's directors weren't the only ones to benefit. In 2012 a high court judge accused bankers at the bank HBOS (which had leant the firm £31 million) of forcing the firm to collapse, as they made the directors keep taking customers' money when it was clear the firm was going to fold. While the bank's loan was fully repaid, the 116,400 Farepak savers only got 15p back from every £1 they had saved.

2008: Lehman Brothers

Shortly before Lehman Brothers went bankrupt in 2008, and while it was begging the US government for bailout cash, the financial services company's US executives pledged a share of $2.5 billion in bonuses set aside by Barclays Capital when it bought the American side of the Lehman Brothers operation. However, this caused controversy across the Atlantic Ocean as British Lehman Brothers staff did not receive bonuses.

2008: Citigroup

Citigroup lost a bewildering $27 billion in 2008 and was given $45 billion in TARP Funds by the US government to stay afloat. Nevertheless, the investment bank still found $5.3 billion that year to pay its top employees ample bonuses, the equivalent of $6.3 billion (£4.9bn) today. In fact, 738 members of staff received more than $1 million (£776k) each.

2008: Merrill Lynch

Likewise, senior executives at Merrill Lynch didn't do too badly at all at the height of the financial crisis in 2008. Weeks before the company posted record losses of $27 billion and received a government bailout, 700 of the bank's 39,000 employees collected a share of the very respectable $3.6 billion in extra pay. These payments were made earlier than usual, as Merrill Lynch was set to be sold to the Bank of America in December of that year.

2008: Northern Rock

An investigation by the Mail on Sunday newspaper in January 2008 revealed that the bosses of failed UK bank Northern Rock had received 'secret' bonuses amounting to millions of pounds. At the time, the bank owed UK taxpayers an eye-watering £26 billion. That's £34 billion ($43.9bn) in today's money.

2008: RBS

Another bank that played fast and loose with taxpayers' money, RBS, which was saved from collapse by the British government, paid out £775 million in bonuses in 2008 according to a report in The Guardian newspaper. That's as much as £1 billion ($1.3bn) in today's money.

2009: American Express

2009: American International Group (AIG)

The very same American International Group (AIG) executives who ran the insurance titan into the ground in 2009 were incredulously rewarded with $165 million by the end of the year. This was after the company had received $170 billion in taxpayers' money as part of a bailout by the Treasury and the Federal Reserve. However, most of cash, which was paid to just 73 people, was eventually (and no doubt reluctantly) paid back.

2009: Nortel Networks Corp.

Canadian telecoms giant Nortel Networks Corp. filed for bankruptcy protection in 2009 and pulled severance payments to many junior employees. Shareholders and pension fund holders (shown here protesting) lost out massively too. The firm's senior staff on the other hand received C$45 million in bonus payments. That's the equivalent of C$53.4 million (USD$40.7m/£31.5m) in today's money.

2009: Blockbuster

Losing out to rivals such as Neflix, Blockbuster was on the brink of collapse by the end of 2009 having reported losses that year of $500 million. Still, its chairman and CEO Jim Keyes along with several other executives netted $1.5 million in "discretionary" bonuses.

2009: Lear Corporation

Top executives at US automotive parts manufacturer Lear Corporation were rewarded with bonuses totalling $20.6 million in 2009, the year the firm went bankrupt, closing 28 locations and and shedding as many as 20,000 employees.

2009: Circuit City

2012: Kodak

Kodak posted losses of $300 million (£233.8m) in 2012 after filing for Chapter 11 bankruptcy. In spite of the camera-making company's dire performance, its CEO Antonio Perez received $3.3 million (£2.6m) in salary and performance-related bonuses.

2012: Hostess Brands

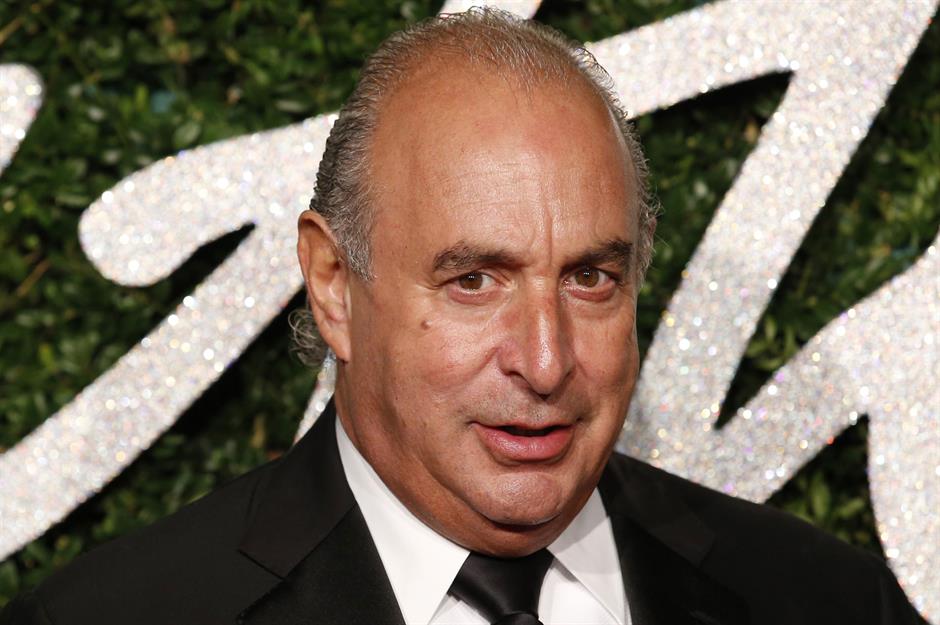

2015: BHS

Arcadia boss Sir Philip Green acquired UK high-street retailer BHS in 2000 for £200 million, but along with other shareholders went on to extract more than £580 million ($744m) in dividends, rental payments and interest on loans to fund his opulent lifestyle. Green offloaded the business in 2015 for £1 ($1.30) to avoid liability for the pension scheme, and BHS collapsed the following year.

2017: Cumulus Media

As reported by the New York Post, Cumulus Media was on the brink of collapse in 2017, but its CEO Mary Berner continued to receive large bonus payments, cannily opting for quarterly rather than end of year payments just in case the radio broadcaster had collapsed and left her out of pocket. Berner received a bonus of $3.8 million (£2.9m) in 2017.

2017: Toys R Us

Toys R Us lavished executives with $8.2 million (£6.4m) in 'retention' bonuses a week before it entered bankruptcy in September 2017. The CEO David Brandon received $2.8 million (£2.1m). But it was a different story for the 30,000 laid-off workers who had to fight for severance pay, which the company eventually agreed to cough up in November of last year.

2018: Sears

Sears' store employees weren't so fortunate. Their severance pay was cut when the department store chain went under while the directors of the company walked away with $25.3 million (£19.6m) in bonuses. Adding to the controversy surrounding the business, Sears filed a lawsuit against former CEO Eddie Lampert and a slew of ex directors of the company earlier this year. Sears' lawyers allege that the executives "looted" the company of "billions of dollar of assets".

The famous name stores that could disappear in the next 10 years

2018: Carillion

According to evidence submitted to a UK House of Commons Select Committee hearing last year, bosses at the now defunct construction and facilities management company Carillion prioritised pay over company performance and paid themselves fat bonuses as the firm faltered.

2018: Rite Aid

Rite Aid shareholders staged a revolt last year when it emerged that CEO John Standley was set to receive a large pay rise and a $3 million (£2.3m) bonus. In fact, 84% of shareholders voted against the executive pay package, a move which actually boosted the US drugstore chain's share price. As a result Standley agreed to step down from his role. Rite Aid had had a particularly bad year as its share price plummeted and the firm found itself at risk of bankruptcy.

2019: PG&E

California utility firm PG&E, which was blamed for the wildfires that swept through the state's northern regions in 2017 and 2018, filed for Chapter 11 bankruptcy in January. Though the company is in dire straits financially, it was still able to pay its new CEO Bill Johnson a $3 million (£2.3m) "transition payment".

2019: Cloud Peak Energy

American coal mining firm Cloud Peak Energy declared bankruptcy in May and promptly awarded CEO Colin Marshall a one-off bonus of $1.15 million (£891k) for steering the company through the process. The company's other top executives also bagged substantial payouts.

2019: Thomas Cook

UK travel agent Thomas Cook was underperforming for almost a decade before its dramatic collapse in September, yet its top executives reaped millions of pounds in bonuses, which disgruntled redundant staff and former customers have demanded they pay back. Chief executive Peter Fankhauser was challenged over his £500,000 bonus by a cross-party committee of MPs in October, where he stated that he had not received a bonus the previous year. The company's collapse led to 9,000 UK job losses, and left 150,000 holiday-makers stranded in their destinations. It cost £100 million ($129m) of UK taxpayers' money to bring them back.

2020: WeWork

WeWork founder and former CEO Adam Neumann ran the firm he started into the ground. But after accepting Japanese conglomerate SoftBank's rescue deal Neumann is in line to receive a $1.7 billion (£1.3bn) golden handshake – effectively to get rid of him. Yet the future may not be so bright for the 4,000 staff of the shared workspaces real estate company who face redundancy.

Now discover the entire towns and cities dominated by one company

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature