Stocks with benefits: when investing comes with perks

Shareholder perks you need to know about

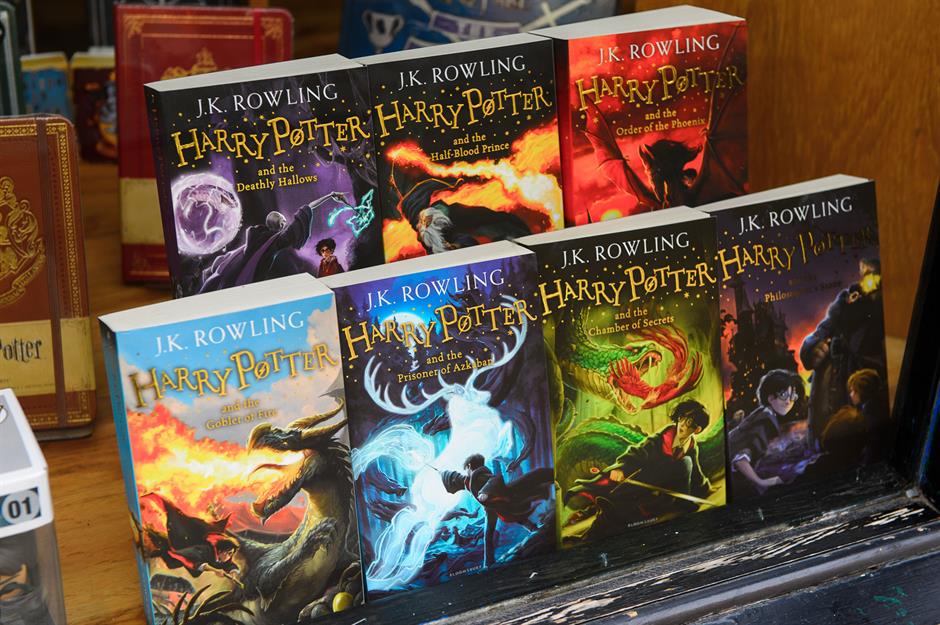

Bloomsbury Publishing PLC (BMY)

Bookworms might want to look into snapping up Bloomsbury Publishing stock. Shareholders in the British company, which has offices in London, Oxford, New York, Sydney and New Delhi, qualify for a super-generous 35% discount on titles published by the firm including novels by Virginia Woolf and E. M. Forster, not to mention the Harry Potter series.

Intercontinental Hotels Group (IHG)

Sponsored Content

Repsol (REP)

If Spain is at the top of your holiday destination list, consider investing in Madrid-based oil and natural gas company Repsol. Shareholders receive a privilege card that gets them discounts on hotel stays in the country, restaurant meals, activities such as horse riding, and if you hire a car you can also get discounted petrol.

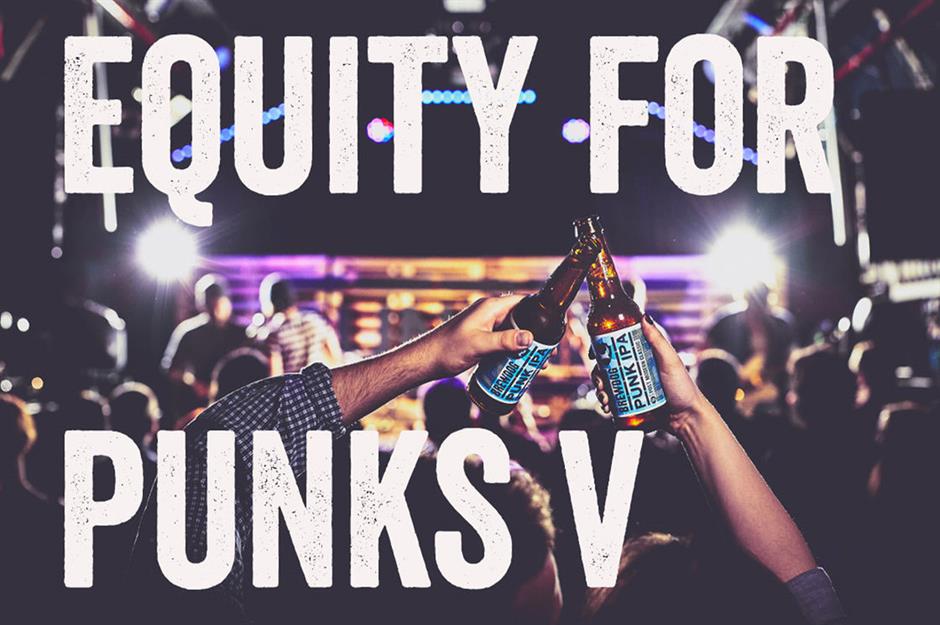

BrewDog Plc

The Scottish-based multinational craft brewery company BrewDog is owned by more than 100,000 investors. The beer business raises cash via its Equity for Punks scheme, at a minimum investment of one share priced at $32 (£25) and there are no dealing fees. In exchange for their money, investors get a multitude of benefits including discounts in BrewDog bars – there are five in the US with two more opening soon, over 50 across the UK, and a further 26 in Europe and the rest of the world – and the online store. Shareholders also get a free birthday beer and early access to new beer launches. However, the most inticing offer could be the access to Brewdog's Millionaire Competition, which investors in the latest round can enter: every person who invests has the chance to win £1 million-worth ($1.3m) of shares in the business.

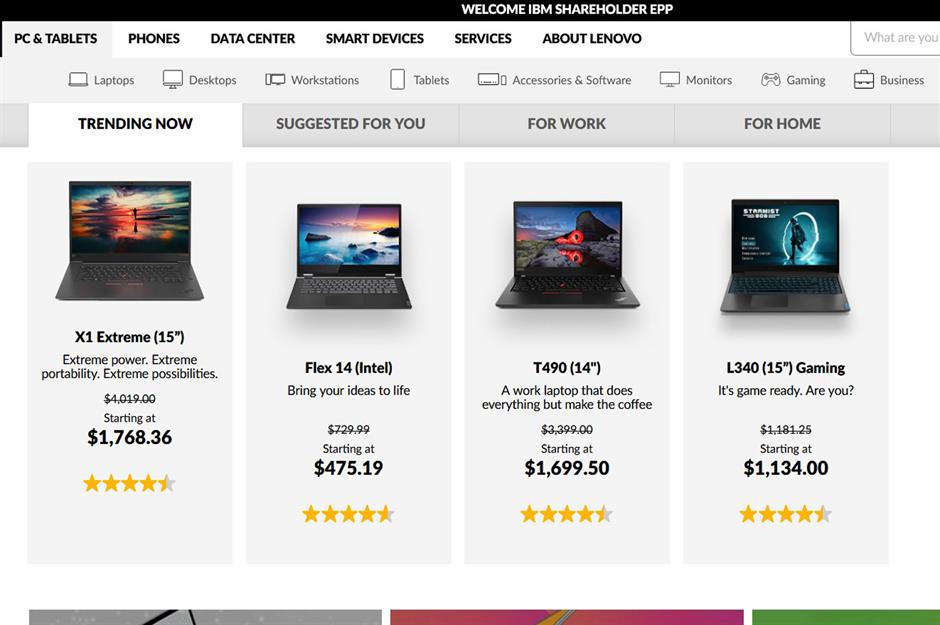

IBM (0992)

IBM, which is owned by Hong Kong's Lenovo Group, offers shareholders big discounts. Lenovo has even created a dedicated website with a variety of attractive deals. Right now, the company is offering up to 67% off Think notebooks, up to 40% off Yoga laptops and 15% markdowns on monitors.

Sponsored Content

Kimberly-Clark (KMB)

Kimberly-Clark has put together a special shareholder's gift box every year since 1957. Available for a limited period around the holiday season, the box of goodies contains massively discounted samples of the company's personal care products as well as a selection of coupons. The 2019 offering was priced at $25.99 (£19.90).

Now discover America's most successful franchises that will make you want to invest

3M (MMM)

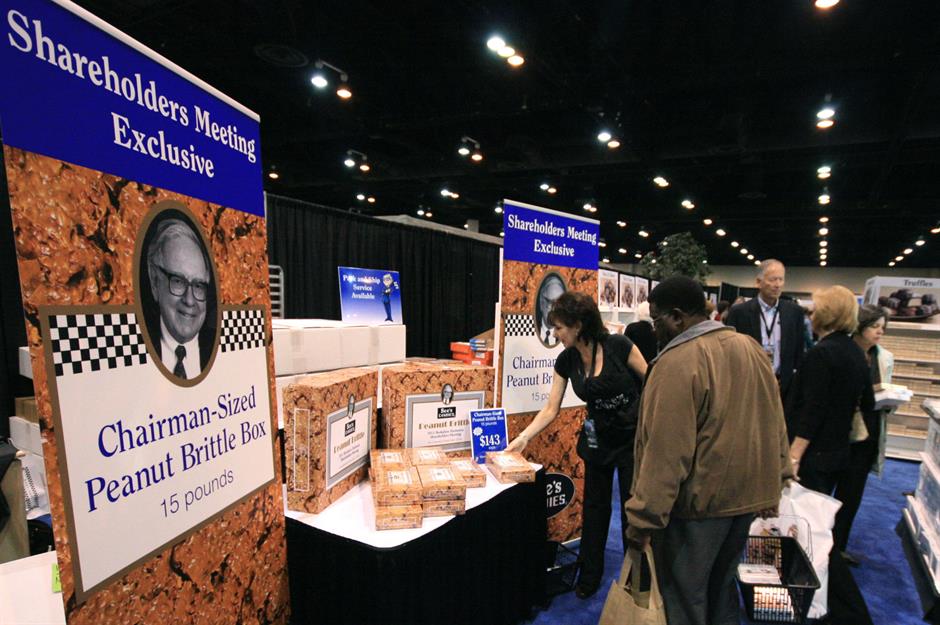

Berkshire Hathaway (BRK.B)

Berkshire Hathaway shareholders don't do too badly at all when it comes to investor perks. For starters they qualify for an 8% markdown on Geico auto insurance, even if they only have one share in the company. Shareholders who attend the company's legendary annual meeting are also lavished with a slew of discounts on everything from furniture and jewellery to underwear.

Sponsored Content

LVMH (MC)

SAS (SAS)

Williamette Valley Vineyards (WVVI)

America's first customer-owned crowdfunded company, Williamette Valley Vineyards has more than 16,000 proprietors. The Oregon winery offers investors who hold 100 or more shares a ton of perks. They include 25% off wine purchases on and offline, invites to exclusive events and VIP winery tours.

Sponsored Content

Ford (F)

Japan Airlines (JAPSY)

Japan Airline's Shareholder Benefit Program has some very lucrative benefits. The airline offers investors who own at least 100 shares 50% discount coupons on regular one-way flights within Japan. The more shares you own, the more discount coupons you receive.

Online Vacation Center (ONVC)

This Florida-based internet travel company offers investors who hold at least 500 shares a 5% discount on bookings, so you'll currently need to stump up a minimum of $1,700 (£1.3k) to qualify. The company, which has been in business for more than 45 years, specialises in cruise holidays.

Sponsored Content

Mulberry (MUL)

One for the fashionistas, British luxury goods company Mulberry rewards investors who hold at least 500 shares with a swish discount card that entitles them to 20% off up to $6,500 (£5k) worth of purchases a year. No doubt a status symbol in its own right, the card can be used in selected stores across the world.

Read about the most and least successful celebrity investors

Accor (AC)

Carnival Cruise Lines (CCL)

Carnival Cruise Lines gifts shareholders who own at least 100 shares with onboard credit that they can spend on the company's cruises. The most deep-pocketed gifts are reserved for the firm's North America brands including Princess Cruises, Cunard, Holland America Line, and Seaborn among others. They start at $50 (£38) per stateroom for cruises of up to six days and go up to $250 (£192) for vacations of a fortnight or longer.

Sponsored Content

Norwegian Cruise Lines (NCLH)

Royal Caribbean (RCL)

The Royal Caribbean has a similar scheme. The Miami-based cruise line offers investors with at least 100 shares onboard credit of $50 (£38) per stateroom on cruises of five nights or less, $100 (£77) for sailings of six to 13 nights and $250 (£192) for trips lasting a fortnight or longer.

Lindt & Sprüngli (LISN)

Each year Swiss chocolatier Lindt & Sprüngli presents certain shareholders with a blue briefcase-sized box of its prized chocolates. The downside if you're tempted to invest is that you'll need to buy a share with attached voting rights and they cost an eye-watering $93,421 (£71,530) a piece. Plus you'll have to attend the firm's annual meeting in Switzerland to vote so that you can receive your box, or alternatively find someone in the country to vote on your behalf and mail you your gift.

Now discover the stocks your parents should have bought the year you were born

Sponsored Content

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature