Financial news you'd never have predicted before the pandemic

The fiscal facts you wouldn't have believed before COVID-19

There's no denying it: COVID-19 has flipped the world's economies and stock markets on their heads.

Since the pandemic began in March 2020, countries have entered recession, companies have seen their profits nosedive, and some of the world's super-rich have seen their net worths tumble. On the flip-side, businesses such as Zoom have experienced incredible gains, while sectors like green energy are also enjoying a boom.

With that in mind, click or scroll through our gallery to discover some of the most surprising financial facts that you'd never have believed in the pre-pandemic world. All dollar values in US dollars.

Fact: Zoom would be worth more than the world’s top 7 airlines combined

Yes, you read that correctly. Zoom Video Communications, the once little-known video conferencing service that so many of us have turned to during the pandemic, reached a valuation of $48.8 billion (£38.6bn) on 15 May 2020. By contrast, it posted revenues of just $622.7 million (£493m) for the whole of 2019.

Meanwhile, the world's biggest seven airlines – Southwest, Delta, United, IAG, Lufthansa, American, and AirFrance-KLM Group – were worth a combined total of just $46.2 billion (£36.5bn) in May 2020, thanks to the effect of the global lockdown.

Fast-forward to the start of 2022 and, while Zoom stock prices are down by as much as 70% compared to the dizzying heights of the company's October 2020 peak, it's still thriving. Who'd have thought it?

Fact: Airbnb was worth more than the world's largest hotel chains

Strict lockdown orders and social distancing measures meant the hospitality industry was one of the worst hit during the pandemic. In fact, April 2020 saw Airbnb impacted so badly by cancellations that it laid-off a quarter of its workforce and requested $2 billion (£1.5bn) in emergency funding from investors.

It looked like recovery was going to be slow for the accommodation rental service. But despite the fact that many areas of the world have entered into second, or even third, lockdowns, Airbnb has managed to defy all odds the, going public in early December 2020.

It also achieved a valuation exceeding $100 billion (£74.4bn) - around double the value of two of the world's largest hotel groups combined. At the time, Marriott International had a valuation of $42.74 billion (£31.8bn), while Hilton Worldwide Holdings Inc had a market cap of $29 billion (£21bn).

Sponsored Content

Fact: Tesla would be worth more than the five biggest car brands

Despite the controversial tweets of its billionaire CEO Elon Musk – including one where his claims that its share price was "too high" saw the company's value plunge by nearly $15 billion (£11.9bn) in one day – Tesla's value has grown exponentially over the past year.

Its growth has been so rapid, in fact, that 2020 saw the company's valuation overtake that of the world's most valuable car brand, Toyota. As of 8 January 2021, Tesla is valued at $773.5 billion (£568bn) while Toyota is now valued at $249 billion (£183bn). In fact, Tesla today is worth more than Toyota, Volkswagen, Hyundai, GM, and Ford combined.

Fact: Elon Musk is the richest person in the world

Tesla CEO Elon Musk's net worth has been greatly boosted by the company's success in 2020, while SpaceX, his private spaceflight company, has also seen his wealth rocket.

CNBC reports that Musk was worth close to $30 billion (£22bn) at the start of 2020. By January 2021, he had become the richest person in the world, usurping LVMH CEO Bernard Arnault from the top spot. As of January 2022, Musk is worth an astonishing $269 billion (£196.7bn), according to Bloomberg's Billionaires Index.

Fact: Netflix was worth more than Disney

In April 2020, it was reported that Netflix was worth $187.3 billion (£148bn), which was fractionally higher than competitor Walt Disney Co.'s $186.6 billion (£147bn) valuation. Netflix's lead was short-lived but it certainly hasn't been the end of the rivalry, with the two streaming giants fighting it out since lockdown began.

Disney launched its own streaming service, Disney+, in November 2019 and has seen its subscriber numbers massively boosted by lockdown living. The service had over 118 million users as of October 2021, while Netflix currently has upwards of 209 million customers.

Netflix overtook Disney once more in November 2021, the first time it had done so since autumn 2020. Bloomberg reports that Netflix had a market value of $291 billion (£213bn), while Disney just fell behind at $288 billion (£211bn).

Sponsored Content

Fact: people were paid to use green electricity

Thanks to a reduction in energy use during lockdown – combined with sunny yet gusty weather – UK households on a particular energy tariff were actually paid to use electricity.

On the morning of 5 April 2020, wind power made up two-fifths of the UK's total electricity supply, while solar power contributed almost a fifth. Customers on the AgileOctopus tariff with renewable energy group Octopus Energy earned 0.22p-3.3p per kWh for using clean electricity between 10.30am and 4pm that day.

Fact: the oil price fell to its lowest level in 18 years

On Monday 30 March 2020, the price of brent crude oil fell to $22.58 (£18.19) a barrel, the lowest price since November 2002.

March 2020 saw oil prices fall by almost half, which was attributed to the gap between oil supply and demand, as well as the price war that broke out between Saudi Arabia and Russia. However, things were only about to get worse...

Fact: the oil price was negative for the first time

On 20 April, the price of West Texas Intermediate (WTI) oil fell to a historic low of -$38 (-£30) per barrel – the first time a negative price had ever been recorded. This meant that oil producers were literally paying buyers to take the oil off their hands.

The reason for the sudden crash? Demand for oil had plummeted, with road traffic drastically reducing due to lockdowns. Producers had continued to pump it out of the ground, however, resulting in an oil glut.

Sponsored Content

Fact: BP would cut 10,000 jobs

In line with the industry's temporarily bleak outlook, 8 June 2020 saw oil giant BP announce that it would be slashing 10,000 jobs worldwide, which equated to 15% of its total workforce.

The company, which had put redundancies on hold during the peak of the coronavirus outbreak, cited plunging global oil prices as a reason for the company's need to become "leaner", with CEO Bernard Looney explaining in an email to workers: "We are spending much, much more than we make – I am talking millions of dollars, every day."

Fact: the US stock market stopped trading four times

The US stock market had only ever paused trading twice prior to the coronavirus outbreak: once in 1987 and then again in 1997.

Yet in March 2020, the stock market was so volatile that the US Securities and Exchange Commission had to trigger not one, not two, not three but four market-wide circuit breakers, in order to halt all trading for 15 minutes in the hope of calming down the market.

These circuit breakers occurred on 9, 12, 16, and 18 March.

Fact: the 10 richest billionaires lost a fortune

On Monday 9 March 2020, which has come to be known as "Black Monday", the 10 wealthiest people on the planet lost a combined $37.7 billion (£29.5bn) as the two biggest stock markets, the S&P 500 and the Dow Jones, each sunk by almost 8%.

Bernard Arnault (pictured), CEO of global fashion conglomerate LVMH, was one of the hardest hit, with his fortune plunging by $6 billion (£4.7bn). However, don't worry too much: Arnault's fortune has since made a stunning recovery.

As of January 2022, he is both the richest person from Europe as well as the third-richest person in the world, according to Forbes' Real-Time Billionaires List, with an estimated fortune of $186.6 billion (£136bn).

Sponsored Content

Fact: Jeff Bezos got significantly richer

Despite also suffering losses on Black Monday, Jeff Bezos, now the world's second richest person, added $69.4 billion (£51.2bn) to his fortune during 2020. His total net worth is now at $185 billion (£136bn), according to Bloomberg.

The Amazon founder has benefitted from his company's stock price rising as a result of people staying home and turning to online shopping.

Fact: Nasdaq reached record highs

It hasn't all been bad news for stock markets, by the way. In fact, on 8 June 2020, the US Nasdaq stock market closed at a record high, fuelled by increases in technology and communications stocks.

The last-time Nasdaq had hit a record-breaking milestone was in February 2020, with the June achievement due to optimism about coronavirus and an expanding employment market. The US economy added 2.5 million jobs in May 2020, according to the Labor Department.

Fact: people sold hand sanitiser for fortunes

At the start of 2020, none of us could have imagined that hand sanitiser would become a hot commodity. Fast-forward to mid-March, however, and it had become unfathomably valuable: a 10-pack of 60ml Purell hand sanitiser bottles was listed on Amazon for $456 (£360), for example, while a 300ml Purell hand sanitiser bottle could set you back £54.99 (£43).

As it sold out around the world, crafty sellers seized the opportunity to try and cash-in on people's desperation. In response to the price-gouging of hand sanitiser, Amazon said that it had removed 530,000 price-inflated product listings.

Sponsored Content

Fact: Americans bought more guns than ever before

It wasn't just hand sanitiser people were stocking up on. March 2020 also saw US gun sales at their highest level since the FBI started recording them 20 years ago.

The FBI completed 3.7 million background checks in March '20, of which an estimated 2.4 million were for gun sales – a 36% increase compared to February 2020. It has been suggested that many of these sales were made to first-time buyers, suggesting the pandemic contributed to the panic-buying of firearms.

Fact: The US entered a recession

On 8 June 2020, the National Bureau of Economic Research (NBER) announced that the US had officially entered a recession for the first time since 2009. This downturn spelt the end of the country's longest period of economic expansion, which had lasted more than a decade and had, somewhat ironically, reached its peak in February 2020.

In the first three months of 2020, the US saw its economy drop by 5%, followed by a record 31.4% contraction in the second quarter. Since then however, the nation has bounced back with record growth of 33.4% in the third quarter. That said, there's been a human cost to the economy's plummet in the first half of 2020...

Fact: US unemployment hit record levels

US unemployment claims passed the 40 million mark at the end of May 2020, a level not seen since the Great Depression (1929-1933).

The Department of Labor recorded an unemployment rate of 14.7% for April, a record high that was up from 4.4% in March. It fell back to 13.3% in May and was steady at 6.7% by the end of 2020, according to the Bureau of Labor Statistics. As of January 2022, the US unemployment rate sits at 3.9%.

Sponsored Content

Fact: US workers resigned in their millions

But not everyone is leaving their jobs against their will. In August 2021, a record-breaking 3% of American workers handed in their resignation. According to CBS, 1.3 million people were laid-off while 4.3 million chose to leave their employment – a phenomenon economists have dubbed 'the Great Resignation'.

It's thought that the pandemic has encouraged people to take stock of their careers, inspiring them to trade-in unfulfilling roles to pursue their dream jobs or to focus on their families. For some, this has meant starting again from the ground up...

Fact: record numbers are launching their own businesses

According to US Census Bureau data, a record 1.4 million applications to launch new businesses were filed through September 2021.

This number swells to four million if you factor-in all the freelancers and other sole practitioners out there, which is an increase from three million in the same period last year.

Kenan Fikri, Research Director at the Economic Innovation Group, which analysed the data, said: "Part of this 'Great Resignation' was also Americans deciding that they didn't want to work for anybody – they wanted to work for themselves".

Fact: China’s economy shrunk for the first time since records began

China, where coronavirus first emerged, has certainly seen its economy hit hard, with reports suggesting it had contracted by 9.8% in the first quarter of the year. This marked the first period of economic decline since 1992, when China began recording quarterly figures.

Factors that contributed to the dip included large-scale lockdowns that led to job losses, as well as companies going bust and a reduction in retail sales. However, it wasn't all bad news: in the second quarter of 2020, China's economy actually saw growth of 3.2%, a much higher figure than experts predicted, followed by an even quicker growth of 4.9% in the third quarter.

Sponsored Content

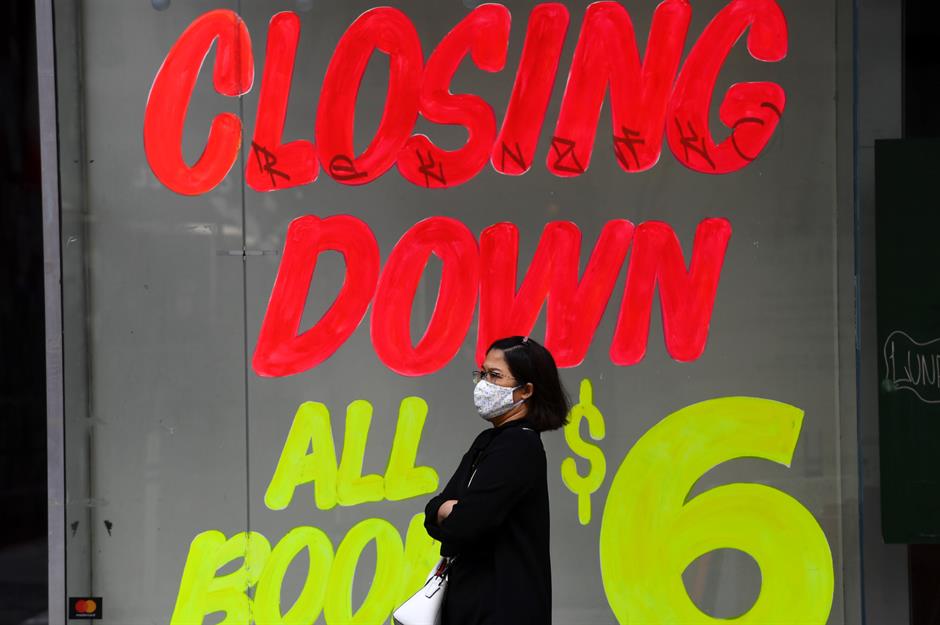

Fact: Australia went into recession

In Australia, the economy declined by 0.3% in the first three months of 2020 according to the Australian Bureau of Statistics, which saw the country fall into its first recession in 29 years.

Things got worse in the second quarter. Australia experienced its worst economic slump since records began, shrinking by 7%. However, it wasn't all bad news: the third quarter saw the economy begin to recover, with a growth of 3.3% reported.

Fact: the UK's economy had record highs and lows

The UK economy shrunk by a record 19.8% in the second quarter of 2020, putting the nation on-track for its worst recession in three centuries.

However, it grew by 15.5% in the third quarter of the year, setting yet another record for the largest quarterly expansion since records began in 1955.

Fact: Japan spent over $2 trillion to avoid unemployment

In a bid to protect workers from unemployment, the Japanese government pumped an unprecedented 234 trillion yen ($2.2tn/£1.7tn) into its furlough scheme. It paid employees 100% of their wages, making it one of the most generous schemes worldwide.

That's the equivalent to 40% of the country's GDP. The country extended its furlough scheme until February 2021.

Sponsored Content

Fact: the US spent nearly $3 trillion to stimulate its economy

As the pandemic began to spell trouble for the US economy, the government had to act fast to protect businesses. In an unprecedented stimulus package, the US government unveiled $2 trillion (£1.6tn) worth of funding in March 2020.

This included one-off payments for individuals of up to $1,200 (£950), loans to industries, a $150 billion (£119bn) Coronavirus Relief Fund, and a multi-billion-dollar bailout to airlines.

In December, a second pandemic relief bill of $900 billion (£675bn) was given the green light, comprising a grant program for theatres and live performance venues, small business loans, and vaccine funding, among others.

Fact: Bitcoin was worth over $66,000

Digital currency Bitcoin was launched in 2009 and its value has been notoriously volatile. The cryptocurrency peaked at $19,783 (£14.4k) on 17 December 2017, although the "great crypto crash" of 2018 – which was caused by the selling-off of digital assets – resulted in the cryptocurrency bubble bursting.

Bitcoin gradually regained momentum but as the pandemic caused widespread market uncertainty, March 2020 saw its price crashe to its lowest value in years. However, it soon skyrocketed when it became clear that virtual payments would become more important than ever in the post-COVID world.

Interest from investors such as Elon Musk combined with Bitcoin's integration with PayPal have helped to boost the cryptocurrency's profile. Despite ongoing regulatory concerns, Bitcoin hit headlines when it reached an all-time record high of $66,974 (£48k) in October 2021.

Fact: the Olympics was postponed, costing billions

Few would have predicted at the start of 2020 that the Olympic Games would be postponed. Since the first modern edition of the sporting festival took place in Athens in 1896, it has only been cancelled three times: once during World War I and twice during World War II.

Tokyo, the city due to host the 2020 Games, announced the event would be postponed to summer '21 instead – and adding $2.8 billion (£2bn) on to the event's already-huge price tag.

The total official budget for was said to have reached $15.4 billion (£11.7bn) by the time the event took place, which was around $3 billion (£2.2bn) more than the initial proposed spend. However, third-party estimates suggest the total spend was actually closer to $25 billion (£18bn).

Sponsored Content

Fact: 82% of Americans were worried about shipping delays

According to a study by Oracle in October 2021, a whopping 82% of Americans are worried that supply chain issues will impact their life plans. Before the pandemic, many of us took next-day delivery services for granted, yet severe shipping delays caused by backed-up ports resulted in speculation that Christmas would be ruined.

Of the 1,000 people surveyed, 92% said that they believed the problem will only get worse – something industry experts have agreed with. Just over 90% admitted that they now consider the supply chain before making an online purchase, compared to 45% in 2020.

Fact: a 99-year-old man raised £33m ($41.7m) from his garden

And finally, on a more positive note: who could have predicted that 2020 would be the year that a 99-year-old war veteran would raise £33 million ($41.7m) for the UK's National Health Service?

The late, great Tom Moore – known to the nation as "Captain Tom" – had the idea of walking 100 laps of his garden by his 100th birthday in order to raise £1,000 for the NHS.

The then-99-year-old became a national treasure after his charity campaign went viral. He was supported by more than 1.5 million donors and made an unfathomable amount for the NHS, and even received a Guinness World Record for raising the highest-ever total in an individual charity walk.

On his 100th birthday, Captain Tom received more than 150,000 birthday cards and was made an honorary colonel to mark the occasion. He also got to achieve his dream of meeting Queen Elizabeth, receiving a knighthood from her in July 2020.

Now discover the Heroic ways British people raised money for the fight against coronavirus.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature