The most severe recessions of all time

Catastrophic economic downturns that rocked the world

The coronavirus pandemic has triggered the deepest planetwide recession in decades with the World Bank warning global GDP could contract by a painful 5.2% this year. Yet while the slump is likely to be harsh, a number of past recessions were significantly worse. Click or scroll through to find out the 10 most severe economic downturns of all time.

10. Early 1990s recession

First up is the early 1990s recession. A whole host of factors contributed to the downturn, from the end of the Cold War and the Iraqi invasion of Kuwait, which precipitated the 1990 oil shock and Gulf War, to a tightening of monetary policy. Other direct and indirect causes include stock market volatility, the bursting of the late 1980s real estate bubble and the US savings and loan crisis.

10. Early 1990s recession

America got off relatively lightly in the end. The recovery is characterised as being V-shaped, meaning the return to growth was rapid and the downturn only lasted from July 1990 to March 1991. During this time America's GDP fell by a not-too-horrendous 1.5% but unemployment remained high, climbing to 7.8% in June 1992 before finally falling back. But other countries fared less well. Canada was in particularly bad shape financially and the crisis resulted in a change of government there, while Japan entered an L-shaped period of economic malaise, the so-called lost decades, from which it has never truly recovered.

Sponsored Content

10. Early 1990s recession

The UK economy was battered by tanking house prices, high interest rates and a hiked-up sterling exchange rate. Britain's GDP declined by 2.5%, unemployment spiked and home repossessions surged during the recession, which started in January 1990 and continued until September 1991. However, Finland was the most affected nation. Reeling from the collapse of the USSR, a key trading partner, the Scandinavian country experienced its worst downturn in history with a fall in GDP of 13% between mid-1990 and mid-1993, and unemploment neared 20%.

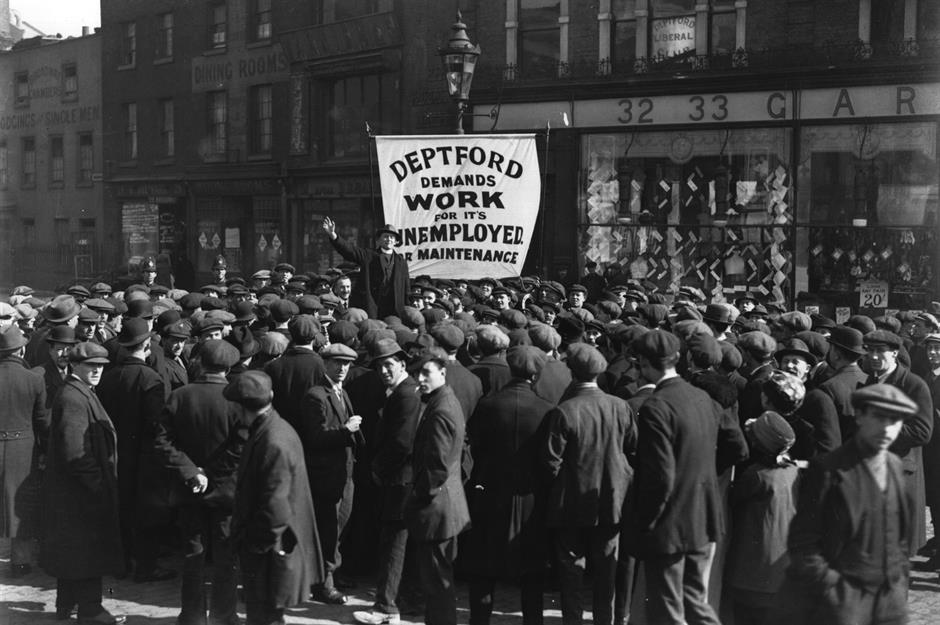

9. Post-World War I recession

9. Post-World War I recession

Already in a fragile state, the global economy was hit in 1918 with something we've become all too familiar with: a devastating pandemic. As well as killing at least 50 million people worldwide, Spanish Flu had a deleterious effect on countries' finances. Much like today, many businesses had to shut down for an extended period of time. In fact, the pandemic likely resulted in a decline in global GDP of around 6% between 1918 and 1921 according to economists Robert Barro, José Ursúa and Joanna Weng.

Sponsored Content

9. Post-World War I recession

Needless to say, the world was in recession by 1920. The downturn lasted from January 1920 to July 1921 in the US, which saw unemployment rise to 11.4% and GDP growth sink into negative territory by several digits. Fortunately the country recovered swiftly, without any intervention, and the nation went on to experience a boom in the "Roaring Twenties". Other nations weren't quite so lucky. Australia didn't emerge from recession until 1923, while in Britain GDP is estimated to have fallen 22% between 1920 and 1921, with the rest of the decade marked by rampant joblessness and stagnant growth.

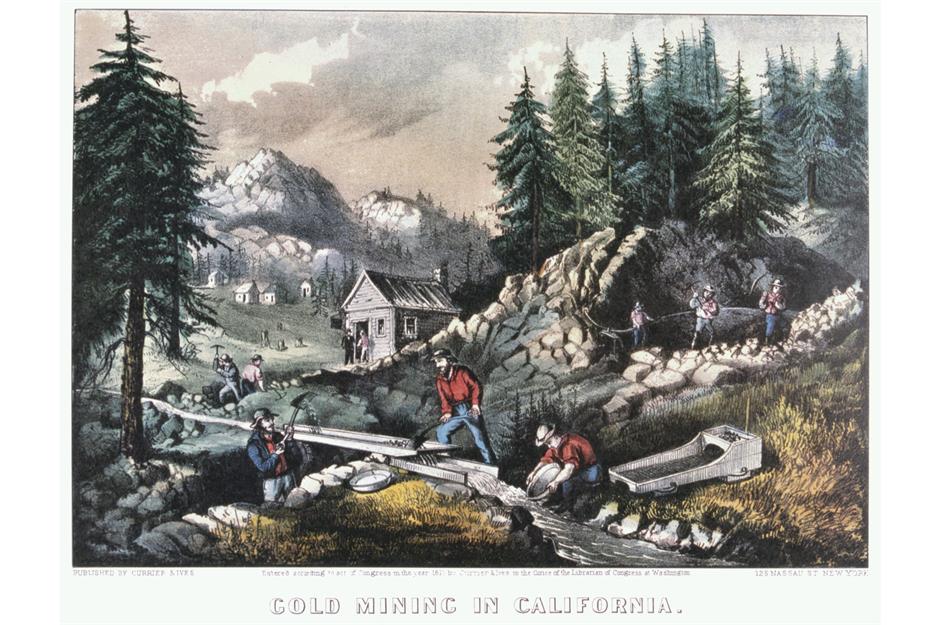

8. Panic of 1857 recession

The California Gold Rush of 1849 flooded the US economy with money, which inflated a railway, land and stock market bubble that began to grow perilously big during the early 1850s. Banks readily lent investors bumper loans and the stock market skyrocketed, but when the quantities of gold mined started to decline in the middle part of 1850s, financial institutions and investors alike lost confidence.

Now read about the biggest economic bubbles of all time

8. Panic of 1857 recession

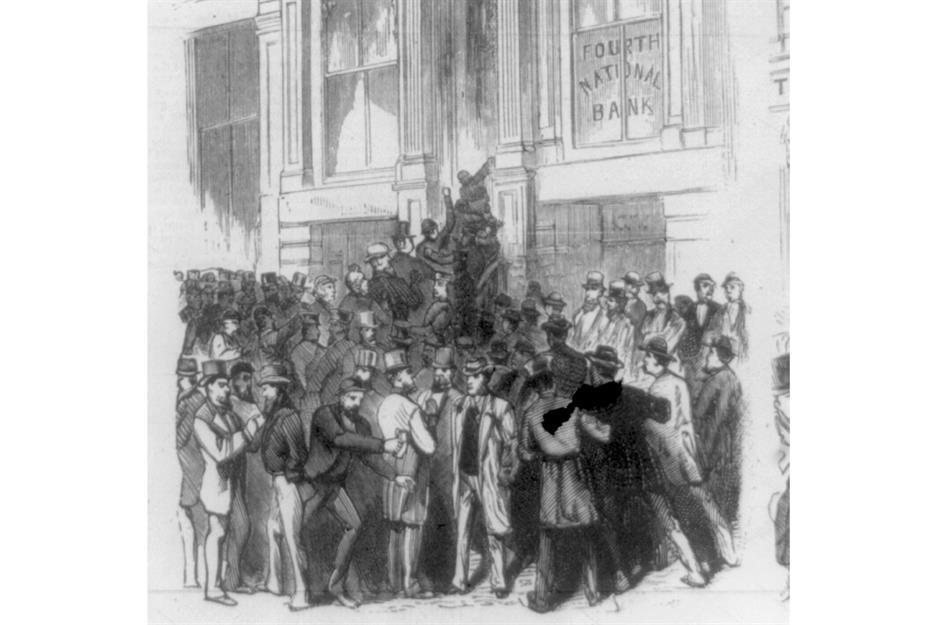

The failure of a major New York commodities firm and Ohio bank in August 1857 led to a large-scale sell-off and run on the banks, bursting the bubble. The sinking of the SS Central America, which was carrying a vast cargo of gold to help offset the panic, intensified the crisis and credit dried up. International trade upsets and weak demand in Europe for American grain only made matters worse. A damaging recession followed.

Sponsored Content

8. Panic of 1857 recession

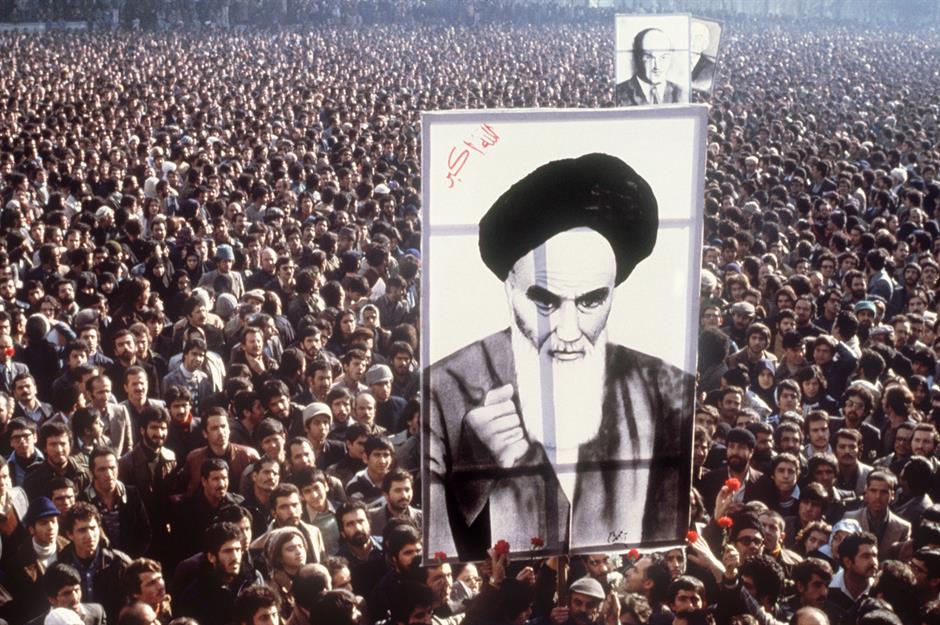

7. Early 1970s recession

The post-World War II economic expansion came to a grinding halt in the early 1970s. US price and wage controls, the 1973 and 1974 oil shock, global steel crisis and a nosediving stock market sent the world hurtling into recession. The downturn differs from others in that stagflation was the overriding feature: inflation and unemployment remained high while GDP growth slowed.

7. Early 1970s recession

Sponsored Content

7. Early 1970s recession

6. Early 1980s recession

6. Early 1980s recession

Sponsored Content

6. Early 1980s recession

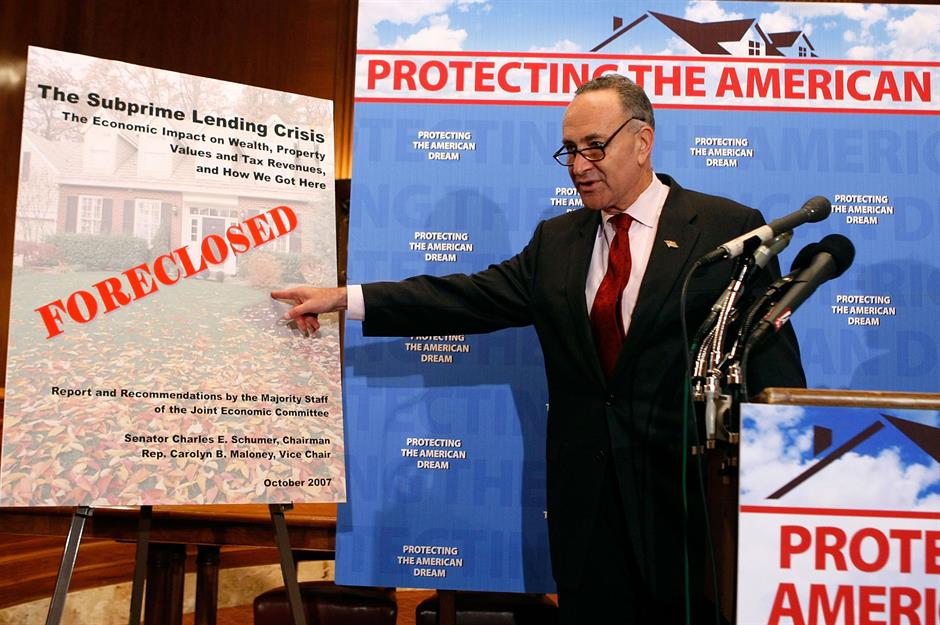

5. Great Recession

The deepest and most long-lasting economic downturn since the Great Depression, the Great Recession dragged on from December 2007 to June 2009 in the US, an agonising 18 months, with other countries experiencing similar durations. Although some nations including Spain were trapped in the mire for a considerably longer period. At its root cause was the the US housing bubble, which, buoyed on by everything from deregulation to risky lending practices, developed in the early 2000s and reached its peak in 2006.

5. Great Recession

Sponsored Content

5. Great Recession

Japan's output decreased even more dramatically with GDdP uring the recession down by 8.7%. GDP fell 6.9% in Italy, 6.8% in Germany and 6.4% in the UK. Governments and central banks responded with multi trillion-dollar bank bailouts, massive quantitative easing and other potent mitigating measures, but a number of countries were slow to recover and some such as the UK went on to endure years of biting austerity.

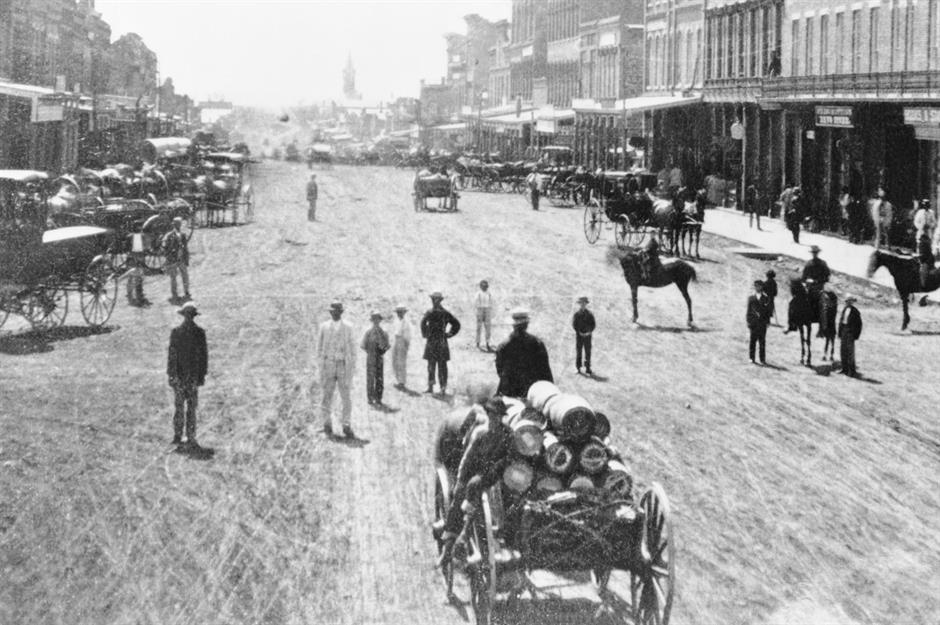

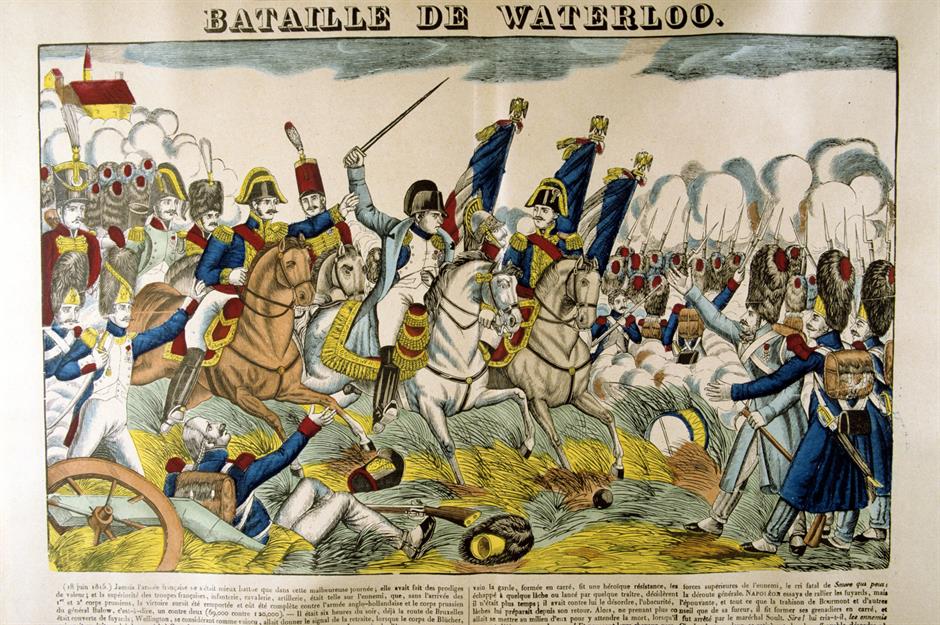

4. Post-Napoleonic depression

4. Post-Napoleonic depression

Sponsored Content

4. Post-Napoleonic depression

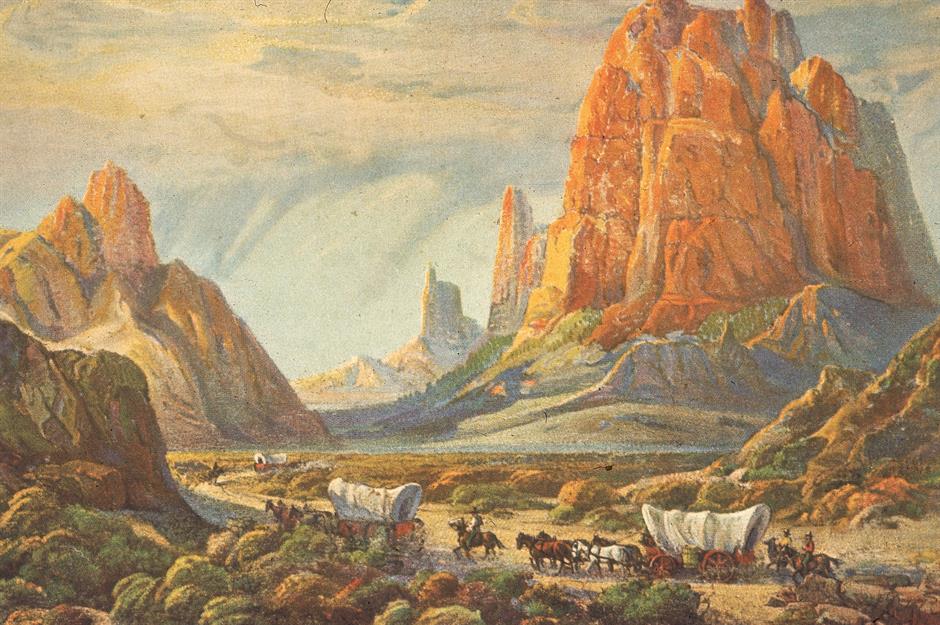

The poor harvests in Europe prompted US farmers to borrow heavily and buy up and invest in land in the West to grow grain for export to the Old World. When European agriculture recovered in 1818, demand for US exports dried up. Concerned farmers wouldn't honour their loans, US banks initiated a mass loan recall, setting off the Panic of 1819, which led to widespread foreclosures, business failures and unemployment. The then-unprecedented crisis persisted until 1822.

Now read: how government COVID-19 cash handouts compare around the world

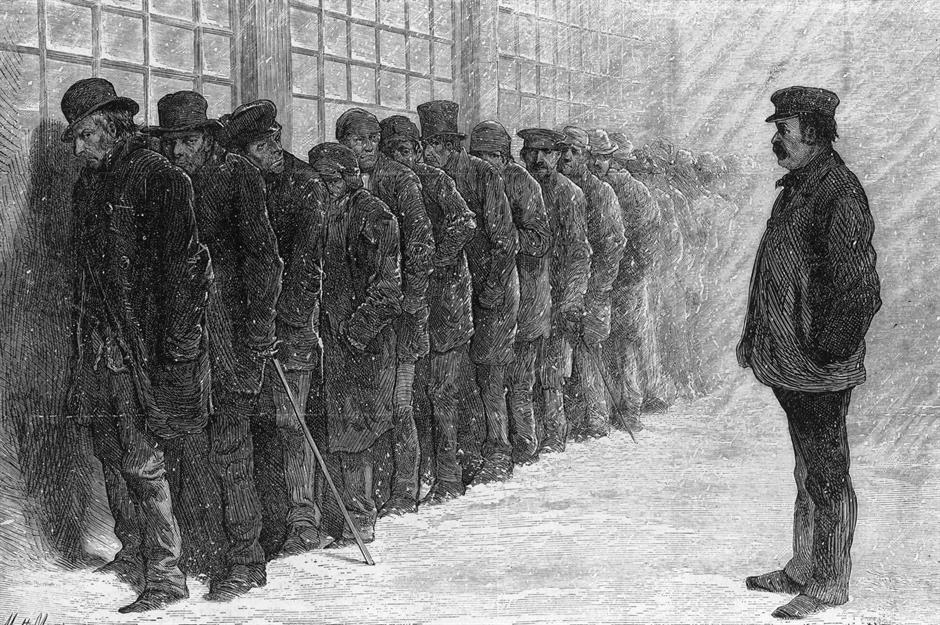

3. Long Depression

3. Long Depression

The panic was provoked by all sorts of factors, from over-the-top speculation and demonetisation of silver to major fires in Boston and Chicago, the bursting of a real estate bubble in central Europe and the fallout from the Franco-Prussian War. During the resulting depression US productivity fell by 24%, thousands of American businesses went under and unemployment in the country almost doubled or even tripled if some estimates are to be believed.

Sponsored Content

3. Long Depression

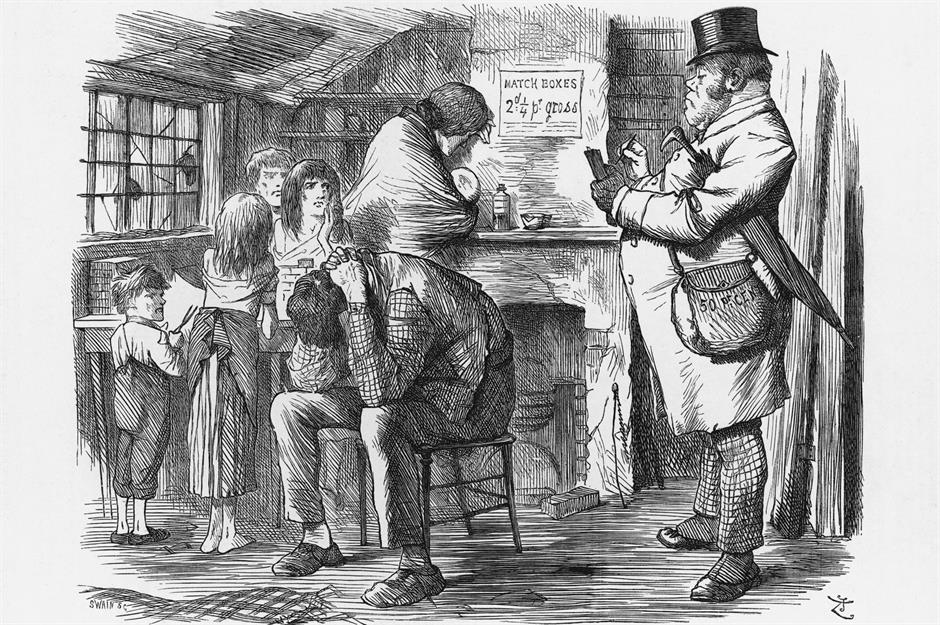

2. Great Depression

The most infamous global economic downturn of them all, the Great Depression lasted from 1929 to 1939. Triggered by the Wall Street Crash of 1929, the depression, which was exacerbated by the Dust Bowl calamity of the 1930s where dust storms damaged agriculture in the US and Canada and caused many to move to cities for work, devastated the American economy, culminating in a contraction of 26.7%. Countless banks and other businesses failed, unemployment peaked at a staggering 24.9% and the poverty rate hit a record 45%.

2. Great Depression

Sponsored Content

2. Great Depression

1. General Crisis

1. General Crisis

Sponsored Content

1. General Crisis

The crisis resulted in striking population declines in Europe, and the height of the average person on the continent shrank by almost an inch. Despite its downsides, which are numerous, history buffs contend the crisis was key for the transition from a feudal social, political and economic system to a capitalist one and that the years of hardship planted the seeds for the industrial revolution and untold prosperity.

Now read: how coronavirus has affected the world's economies

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature