UK Budget 2024: what it means for your money

A 2p cut to National Insurance is the headline announcement, but there are also big changes for landlords, investors, savers and parents. Here's what's changing for your money.

Budget headlines: NI and CGT cut, new ISA launched

Chancellor Jeremy Hunt unveiled tax cuts and a new British ISA in an upbeat Spring Budget ahead of this year’s General Election.

Another 2p reduction in National Insurance, a new type of ISA and a cut in Capital Gains Tax were among the other headline announcements.

Hunt claimed that this Budget put Britain "on a lasting path to growth with a revolution in childcare support, the biggest ever employment package and the best investment incentives in Europe.”

But did he actually deliver on that bold claim? And what will it mean for your pocket?

Here's a closer look at the main announcements affecting households.

National Insurance cut

As was widely expected, National Insurance for workers was reduced by another 2p – following a similar drop in last year’s Autumn Statement.

This will make a real difference to people, according to Sarah Coles, head of personal finance at Hargreaves Lansdown.

“The more you earn, the more you save, so someone on a salary of £30,000 will save £349 a year, someone making £40,000 saves £549, and someone on £50,000 saves £749,” she said.

Anyone making over the higher rate tax threshold will save £754.

“These kinds of figures are not to be sniffed at, particularly for anyone being squeezed by higher mortgage payments or facing the multitude of price rises coming in Awful April,” she added.

| 12% (pre Autumn Statement) | 10% (current) | Saving | Additional 2% | Total saving | |

| £30,000 | £2,091.60 | £1,743.00 | £348.60 | £348.60 | £697.20 |

| £34,963 | £2,687.16 | £2,239.30 | £447.86 | £447.86 | £895.72 |

| £40,000 | £3,291.60 | £2,743.00 | £548.60 | £548.60 | £1,097.20 |

| £50,000 | £4,491.60 | £3,743.00 | £748.60 | £748.60 | £1,497.20 |

Source: Quilter

However, Jason Hollands, managing director of Bestinvest, doesn’t believe enough is being done to ease rising taxation in the country.

“While the NI cut is welcome, the UK tax burden remains onerously high, with a vast number of people being increasingly drawn into the higher rates of income tax as a result of frozen thresholds,” he said.

New British ISA and NS&I savings bond

There were two big announcements for savers and investors.

We'll start with the announcement of a new 'British ISA' that will allow people to invest an additional £5,000 in UK assets.

Importantly, this would be on top of the existing £20,000-a-year ISA allowance, meaning investors can now set aside up to £25,000 tax-free a year.

However, the move drew a tepid response from many analysts.

Rachael Griffin, tax and financial planner at Quilter, pointed out that the launch of yet another ISA risked confusing people.

"The ISA is a simple idea, a tax-efficient place to grow your wealth, however, with various additions over the years it has now become a confusing area of personal finance," she said.

"Faced with the complexities of this consumers tend to just opt for what they know and that almost always is just a cash ISA.

More importantly, she highlighted how it would likely be of limited value to the typical UK investor.

"So few people use their total ISA allowance in a given tax year too so the allure of £5,000 more is only appealing to much higher net worth people.

"The reality is we need to better incentivise the millions languishing in cash ISA accounts to be put to work in the stock market.

"The measure is likely a politically motivated stunt ahead of upcoming elections, rather than a well-considered strategy aimed at sustainable economic growth.

New NS&I savings product announced

Along with the UK-focused ISA, we also learned of an upcoming British Savings Bond from NS&I.

We don't yet know what the rate will be, but we do know it will be a three-year fixed-rate bond that will be available from April.

The minimum investment will be £500 with the maximum deposit set at £1 million.

Capital Gains Tax cuts

The rate of Capital Gains Tax paid by Higher or Additional Rate taxpayers on residential property will be reduced from 28% to 24%, while the basic rate for CGT remains unaffected at 18%.

The move was one of the few surprises served up in the Budget, as Christopher Springett, tax partner at Evelyn Partners, explained.

“In terms of the direction of travel with property taxation over recent Budgets, we are more familiar with increases than reductions.

"The cut also goes against talk over the past few years that has centred around aligning CGT with income tax rates.

“The Treasury says that ‘this will encourage landlords and second home-owners to sell their properties, making more available for a variety of buyers including those looking to get on the housing ladder for the first time’ – but it remains to be seen whether a 4% change will achieve this desired effect.

“For those who are looking at property as an investment beyond their main residence, the CGT rate on residential property remains 4% higher than the rate applied to most other asset classes, meaning that property investments do need to return more in terms of capital growth to ensure post-tax returns are competitive with, say, a portfolio of equities.”

Lifetime Pension Model confirmed

While there was nothing new to report, but Hunt did reaffirm his commitment to the Lifetime Pension Model.

Helen Morrissey, head of retirement analysis at Hargreaves Lansdown, said: “This reform has the potential to reinvigorate the pensions market by giving people the opportunity to choose to save with the pension provider of their choice.”

Changes to Child Benefit for high earners

There was a big change for any parents earning more than £50,270, which the chancellor said would be worth £1,260 per family on average.

At present, Child Benefit is gradually scaled back for anyone earning more than that amount, with someone earning £60,000 receiving nothing.

This is known as the High Income Child Benefit Charge (HICBC).

It has long been criticised for being unfair because a household with two people earning £50,000 isn't affected while a single-income household earning £60,000 would get no Child Benefit.

To alleviate this, the chancellor has announced that the threshold for HICBC will rise from £50,000 to £60,000. What's more, the upper end at which it is completely tapered will rise from £60,000 to £80,000.

This will apply from April 2024 and last until April 2026, at which time a new system will be administered that looks at household income rather than an individual basis

Fuel freeze

Fuel Duty was once again frozen at its current rate for another 12 months – and the temporary 5p cut that was due to end this month was extended.

The chancellor said should save drivers around £50-a-year.

Nothing on Inheritance Tax

Once again, there was nothing about the widely-hated inheritance tax in Hunt’s speech, pointed out David Murray, financial planning expert abrdn.

“Inheritance tax (IHT) is no longer the wealth tax it once was,” he said.

“Rising asset values, coupled with frozen allowances and hugely complex rules, has increasingly put people at risk of being hit with an unexpected, and potentially considerable, tax bill after the death of a loved one.”

Support for families

The Household Support Fund, which allows local councils to help families via food banks, warm spaces and food vouchers, will continue for an extra six months to September 2024.

Hunt also pointed out that the focus of today was to help those falling into debt, with the average household having received £3,400 in cost of living support over the last couple of years.

To help make loans for household emergencies more affordable, the repayment period for new loans will be doubled to 24 months – and the £90 charge for debt relief orders abolished.

Property changes

Multiple Dwellings Relief for Stamp Duty will be abolished from June as Hunt claims it hasn't helped promote investment in the private rented sector.

He said this would raise £385 million a year.

In addition, the Furnished Holiday Lettings tax regime will also disappear from April 2025. It's hoped this will make it easier for local people to find homes.

Alcohol

Drinkers had every reason to celebrate with the freezing of alcohol duty being extended to next February. It had been scheduled to end in August.

“We value our hospitality industry and are backing the great British pub,” declared Hunt.

Smoking and vaping tax hikes

A duty on vapes will be introduced from October 2026 to protect young people and children from the harm of vaping.

In addition, there will be a one-off increase in tobacco duty to recognise the role vapes play in helping people quit smoking.

This will raise a combined £1.3billion by 2028/29.

loveMONEY verdict: sleight of hand that will leave many struggling

On the face of it, the NI cut is an incredible headline giveaway.

The chancellor was understandably bullish as he explained that the average worker would be some £900 better off when you factor in the earlier 2% NI cut announced last year.

That’s a remarkable figure and viewed in isolation you’d think it’ll leave Brits far better off.

But we must consider the wider context here.

Household budgets have been hammered over the last couple of years, not just because of the wider cost of living crisis, but our ever-growing tax burden as well.

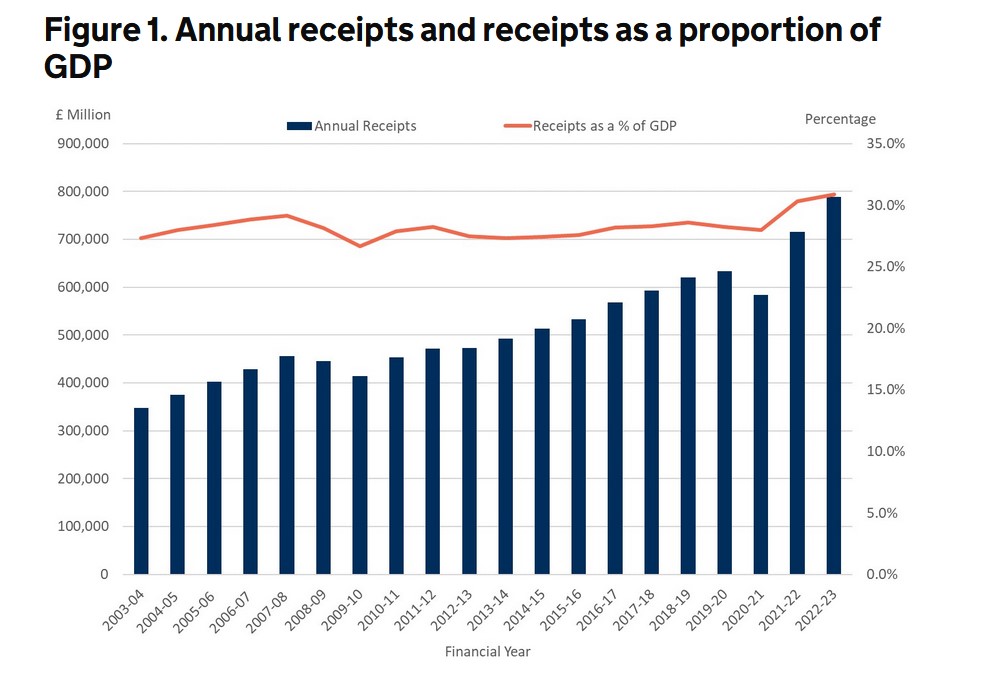

In the last complete financial year – April 2022-2023 – HMRC revealed an almost 10% increase in tax revenues, taking the total to just over £786 billion.

The increase for the current tax year that ends in April is expected to be even bigger, with earlier analysis by the Institute for Fiscal Studies putting the figure as high as £950 billion.

Of course, not all of that increase will have come directly from our pockets, but there’s no question most households have been trying to keep a lid on rising tax bills at the same time as juggling soaring food and energy bills.

This is largely down to the Government’s decision to freeze various personal tax thresholds between 2021 and 2027, which drags more and more people into higher tax brackets as their pay inevitably rises each year.

That means the Government’s headline NI tax cut is effectively giving with one hand and taking with the other.

Consider the following remarkable stat from the latest fiscal outlook from the Office for Budget Responsibility, which was published earlier today.

“The net fiscal impact of the personal tax threshold freezes and NICs rate cuts announced since March 2021 has been to increase tax receipts by £19.7 billion by 2028-29.”

In other words, the Government’s tax take from freezing allowances will far outweigh the cost of the NI cuts.

And, of course, these cuts only benefit those in work, leaving groups like pensioners out in the cold.

When viewed in this context, the Government’s big giveaway seems a lot less generous.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature