NS&I Premium Bonds: how to buy, cash in, claim lost prizes and more

Interested in buying NS&I Premium Bonds? We take a look at what they offer, the odds of winning and whether they are worth going for.

Sections

What are Premium Bonds?

Premium Bonds are a type of savings account which can be purchased from National Savings and Investments (NS&I).

You can invest from £100 (falling to £25 in March 2019) and can hold up to a maximum of £50,000 worth of Premium Bonds.

The money you hold in Premium Bonds can be withdrawn at any time with no notice or penalty and is 100% protected by HM Treasury.

What they offer

A key difference to traditional savings accounts is that Premium Bonds don’t pay regular interest.

Instead, the Bonds are entered into a monthly draw where you have the chance to win tax-free prizes.

The prize fund was £67 million in December and there were more than 2.1 million prizes, ranging from £25 to £1 million.

Who picks the winning numbers?

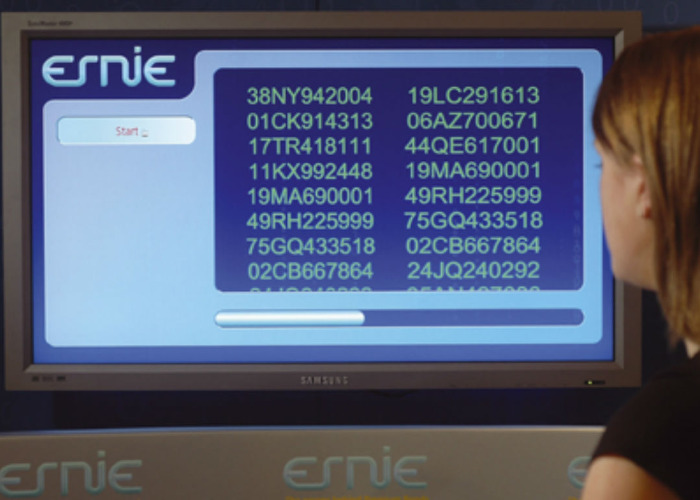

Each month the Electronic Random Number Indicator Equipment, or ERNIE, picks out thousands of winners at random.

The machine was invented by one of the original Bletchley Park code breakers in 1956.

Alderman Sir Cuthbert Ackroyd, the Lord Mayor of London, bought the first Premium Bond on November 1, 1956 and by the end of the day £5 million worth had been sold.

The first draw took place on Saturday June 1, 1957, with an £82 million prize fund.

Want a better return on your cash savings? Compare high interest current accounts

The odds of winning

Your odds of winning a prize with a Premium Bond are currently 30,000 to 1.

For every £1 you invest, you get a unique bond number that is entered into the draw one calendar month after purchase.

Each bond you buy has an equal chance of winning a prize. So the more you buy the better your chances of bagging a tax-free cash sum.

How to check if you have won a prize

If you are registered with NS&I online, you will get an email to tell you that you’ve won a prize each month.

The two £1 million jackpot winners are announced on the first working day of the month.

NS&I also have a prize checker website as well as an Android and Apple app that is normally updated by the second working day of each month.

loveMONEY along with other media outlets get the details of all the winning bond numbers a day before they’re revealed to the public.

So make sure you keep our Premium Bonds winning numbers article we update with the big money winners bookmarked to get the good news sooner.

How to buy Premium Bonds

Individuals aged 16 or over can buy Bonds online or by phone.

Parents, legal guardians and grandparents can invest on behalf of their child or grandchild aged under 16.

Parents or legal guardians can buy premium Bonds online, by phone or by post. But grandparents and great grandparents can only purchase them by post after downloading a form.

If you live outside the UK, you will need to make sure you can hold Premium Bonds.

Some countries like the US have strict gaming and lottery laws that could impact your ability to keep them.

How to claim Premium Bond prizes

You can choose to have any prizes you win paid directly into your bank account as long as you are registered for the online and phone service.

Money should be paid within seven working days of the draw if it's being sent to a bank account.

Alternatively, you can choose to automatically invest in more Bonds, to boost your chances of winning the main jackpot.

NS&I also offer to notify you by post and offer a cheque, which should be with you by the end of the month.

For prizes over £5,000 NS&I will send a claim form before paying out or reinvesting the prize.

If you’re lucky enough to scoop a jackpot, a representative dubbed ‘Agent Million’ will visit you in person.

What happens to unclaimed Premium Bond prizes?

NS&I will hold onto unclaimed prizes until you get in touch and there’s no time limit on claiming what you are owed.

In total, there are over 1.2 million unclaimed prizes, worth over £53 million, some of which date back over 50 years.

You can use the prize checker online or through the app to check for unclaimed prizes or you can write to NS&I if you know most of your details.

Alternatively you can apply for the free Tracing Service online at mylostaccount.org.uk or fill out this form to reclaim or reunite with your money.

Want a better return on your cash savings? Compare high interest current accounts

Is it worth putting savings into Premium Bonds?

Premium Bonds are a great way to earn more tax-free income and the money you put in is 100% protected by HM Treasury.

However, Premium Bonds aren’t great if you are looking for a regular income, guaranteed returns and concerned about inflation eating into your savings.

Take a look at Where to earn most interest on your cash for a round up of where to find the best rates instead.

Or, if you're willing to take on more risk, you could try investing in the stock market. Take a look at your options in the loveMONEY investment centre.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature