Pension tracing: how to find your old pension pots

There are billions of pounds sitting in 'lost' pensions. Here's how to easily trace your old cash.

Sections

£31.1 billion in pension cash unclaimed

Pension savers have either lost or forgotten about billions of pounds in retirement cash that could easily be tracked down for free.

And the total number of lost pensions has only accelerated since auto-enrolment was introduced, as workers are now far more likely to have accumulated small savings pots at previous jobs.

Keeping track of all these pots over our working lives can be tricky, especially the smaller ones: research from pension firm Aegon suggests that almost one in seven (15%) of us don't even know if we have any savings pots worth £5,000 or less.

Read: how our own absent-mindedness is costing us

The true extent of the lost pension problem

Pensions UK, the pension industry trade body, estimates that a whopping £31.1 billion worth of pension cash is sitting unclaimed, with the total having soared 60% since 2018.

It adds that a total of 3.3 million pension pots are now considered lost, with each worth an average sum of £9,470.

Losing a pension is easier than you think

So how is it that so many people have 'misplaced' such huge sums that would no doubt transform their retirements?

With people moving house on average eight times in their lifetime and working at six different employers, it's all too easy for pension pots to go missing along the way.

“If you’ve moved house recently, there are a few techniques that can make it easier to keep on top of everything,” says Sarah Coles, personal finance analyst at Hargreaves Lansdown.

She suggests making a list of every company you have dealings with and work through them methodically, and also consider using the Royal Mail’s redirect service for a least a year.

“Then whenever you receive redirected post, make sure you contact the company to change your address immediately," advises Coles.

“And if it’s too late for all of that and you’re worried you’ve lost touch with a pension, there are a few steps that should see you reunited with your money."

A separate survey by wealth management firm Tilney found the main reasons for losing a pension were that they have ‘never kept an interest’, ‘lost paperwork’ or ‘forgotten to notify providers of address changes.’

Significantly, 20% of people said they would have no idea about how to find a missing pension, added Andy James, head of retirement planning at Tilney.

"Tracking down missing workplace pensions can be particularly problematic where a previous employer from many years past has been acquired or gone bust, moved or re-branded.

"But it really is vital to track down these pots of assets and to determine whether they remain fit for purpose."

So, how can you go about finding a long-lost pension – or saving some money by consolidating those you have?

Tracing old pensions: start with your paperwork

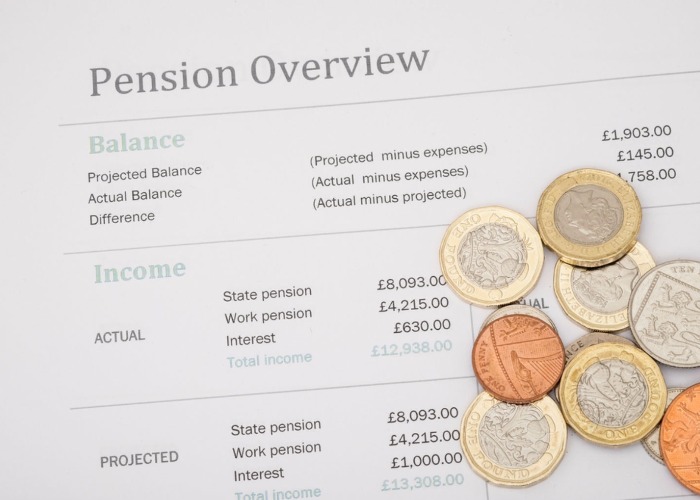

Most pension schemes will send you an annual statement that will tell you the balance of the pension at the time of the statement, and a projection of what income it might generate when you reach retirement age.

Go through your old paperwork and see if you have anything relating to your pensions.

If you find something, contact the pension provider to update your contact details and request an up-to-date statement.

Contact the pension provider

If you have no paperwork but can remember which company administered your pension, then get in touch with them and ask them to search their records to see if they can find your pension details.

Try to provide them with as much information as possible to increase their chances of finding your old account.

If you have it, give them the plan number, and the date your pension was set up.

At the very least, give them your full name, date of birth and National Insurance number.

Get the Government’s help

If you have no idea who your old pension provider was, then you can still hunt down old pension pots.

The Government’s Pension Tracing Service holds the details of over 300,000 pension schemes (you can also ring them on 0800 731 0193).

You just need to enter the name of a former employer and the service will search to see if you are registered with any pension schemes and provide contact details that you will need to go about claiming your cash.

Once you have the details, you can contact the provider to ask them to check their records and provide you with an up-to-date statement for your pension.

Contact old employers

If the Pension Tracing Service doesn’t uncover anything and you are convinced you had a pension with a previous job, contact your old employer.

Give them the details of when you were employed for them and your National Insurance number and ask if they could check their records to see if you had a pension.

You can find template letters for contacting an old employer about a lost pension on the MoneyHelper website.

Should you consolidate your pensions?

Once you've successfully located your old pension pot or pots, you need to decide whether you want to roll them all together with your existing pension or keep them as separate pots.

While you might think consolidating pensions is the obvious thing to do – why not keep all your funds in one place? – it might actually end up costing you a fair whack of money.

We explain the risks in more detail here, but in short, you could end up being hit with various charges and an extra tax bill that you could avoid by keeping funds where they are.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature