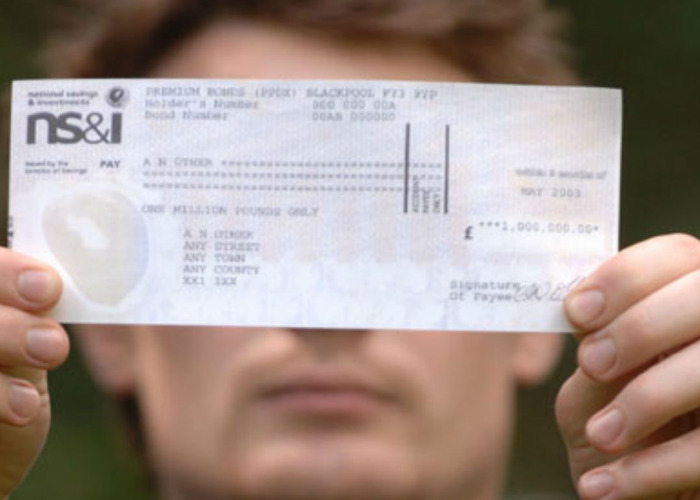

Premium Bond cheques: NS&I says you CAN keep getting your winnings in the post

NS&I will no longer be phasing out cheques, a welcome boost to the millions of savers who want or need their prizes in the post.

Many vulnerable and elderly NS&I savers will be delighted to hear that the savings institution has backtracked on plans to scrap prizes being sent by cheque.

It announced plans back in September 2020 to make everyone have their winnings paid directly into bank accounts by the end of the year, despite acknowledging that many had an "understandable affection" for this payment method.

However, many savers able to make the switch found they couldn't get through to NS&I and faced long call waiting times.

It initially responded by delaying the deadline until April 2021, but it has now scrapped the requirement altogether.

Announcing the change in its annual report, NS&I chief executive Ian Ackerley said: "Regrettably, as the deadline approached, we began to receive a large number of calls from concerned customers, some of whom were frustrated that they could not provide their bank account details to NS&I as they could not get through to our customer service team on the phone.

He added: "On reflection, we regret that we undertook this change at a time when our operations were already under strain."

It's worth noting that NS&I has said it will "continue to encourage" savers to switch to direct bank payments, so if you do receive any further communication or pamphlets from the NS&I about this matter it's important to understand there's no requirement to do so.

Why so many people still like NS&I cheques

At present, almost one in eight (12%) savers choose to receive their Premium Bond winnings in the mail.

Many will simply prefer getting it: a big part of the allure is the potential for a special letter to drop through the letterbox at the start of each month, to inform you that your number came up and you’ve won a prize.

My wife has Premium Bonds so I’ve seen first-hand the excitement that comes from realising who that letter is from and the way that cheque is held aloft like the FA Cup.

Going online to find the winning numbers – you can find our regularly updated article in the big winning Premium Bond numbers each month – will be less appealing to some.

More importantly, many savers are either unwilling or unable to update their bank details online or over the phone.

Before NS&I announced its u-turn, This is Money published these heartfelt letters from readers explaining how it would affect them.

It really highlighted how vital it is for many savers to keep getting winnings in the post, and why there was so much opposition to the move.

Ditching cheques could reduce unclaimed prizes

While it might seem like the push towards bank payments is just NS&I trying to make life easier for itself, there are genuine benefits to savers who do so.

Not only is it better for the environment, but the fact is significant sums of money ‒ sums that could genuinely be life-changing ‒ have gone unclaimed because details were no longer correct.

According to NS&I the best part of £63 million of prizes remain unclaimed, with more than £8 million worth of cheques returned to NS&I last year.

It can easily happen ‒ you move house and while you update your normal bank and credit card accounts, you forget to notify NS&I. As a result, you never receive those big money prizes.

That’s one issue that will be eased by moving towards direct payment of prizes, although it still relies on us updating those banking details as and when necessary.

Read: how to check if you've any unclaimed Premium Bond prizes

How to get prizes paid into your bank account

For those happy and able to switch, the first step is making sure you are registered with NS&I’s online and phone services, which you can do through nsandi.com/online-registration.

From here you can add your bank account details to your profile, while you should also head to ‘Your prize options’ and choose for them to be paid directly into your bank account or reinvested in more bonds.

For those without internet access, NS&I can be contacted on 08085 007 007. Savers can then provide NS&I with their bank details.

Remember, NS&I will never contact you and ask for your bank details, so be vigilant against scammers who might be looking to take advantage of the cheque switching debacle.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature