Energy firm wrongly chasing you for a debt? Here's what to do

After British Gas wrongly chased a loveMONEY staff member for another household's energy debt, we explain what you need to do to avoid having your credit rating unfairly damaged.

Soaring energy bills will inevitably push more households into the red – but what happens if an energy supplier demands money that you definitely don't owe?

This happened to loveMONEY staff member Kevin* recently when British Gas repeatedly chased him for another household's energy debt.

Despite making attempts to rectify the error, the supplier continued to send him demands for money and even passed his details on to a debt collector.

If you find yourself being wrongly chased for an energy debt, this article will explain the easiest and fastest way to resolve the issue by drawing on my colleague's experience with British Gas.

*not his real name

Don't simply assume it's a scam

If you receive a notice saying you owe a company money despite not even being a customer, your first reaction might be to assume that it's a scam.

It's hardly a rare occurrence, after all: Citizens Advice estimates that around 36 million Brits were targeted by scammers in the first half of this year alone.

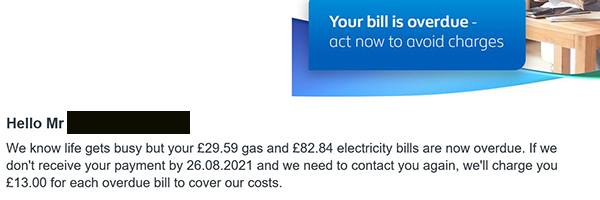

"The email said my bill was now overdue, but I hadn't been a British Gas customer for over a year," Kevin explained.

However, as the email looked convincing and included his full name, he shared it with me to investigate whether this was a convincing new scam we needed to warn readers about.

When I first got in touch with the British Gas press office, I was initially told this was indeed a scam email.

However, after informing me a few days later that it was supposedly a legitimate debt, my colleague Kevin contacted British Gas to see if he could resolve the issue himself.

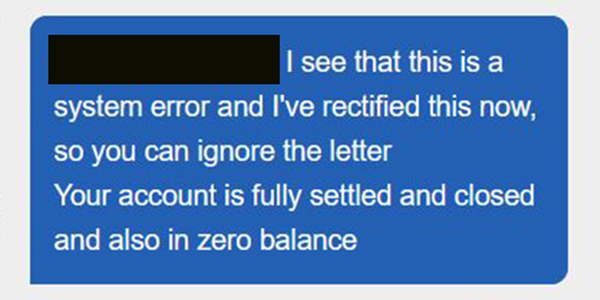

"I couldn't get through on the phone, so I used the webchat service on the British Gas site," he explained.

"After waiting a while, I shared my details and was told by a staff member that there was an error on the account and that it had now been fixed."

Sadly, the issue wasn't resolved as he was again chased by British Gas a few days later, this time with the threat of a debt collection agency.

I contacted the press office again on his behalf to learn more and was informed the debt related not to Kevin's current home, but one he had owned many years before.

"There was no mention of the property address in any of the communications I received, so there's no way I would have been able to guess what this was related to," he said.

"Once I knew it wasn't a scam, I had tried to follow the link in the mail and it asked me to enter a postcode for the property attached to the debt. Naturally, my current address didn't work."

By this stage, Kevin had also been contacted by a debt collection agency.

So how had he found himself as the person responsible for the bill? When he owned the former property, he had rented it out briefly to help pay for his wedding. Once the tenants had vacated, he sold the property through an estate agent.

It turns out the new buyer was a professional landlord and immediately rented the property out to new tenants.

However, British Gas retained Kevin's details as the landlord. Years later, when these tenants left with an unpaid bill, British Gas began chasing him for the bill rather than the actual owner.

Kevin insists he carried out all the relevant admin when selling the property and that the error lies with British Gas.

When asked for a comment on the story, a British Gas spokesperson simply told me: “They were still listed as the landlord of the property for which they were sent the bill.

“We have now updated those details and closed that account.”

Both Kevin and I have been assured the issue is now truly resolved and there has been no damage to his credit rating.

But the experience has left him with a sour taste.

"The whole situation was handled so poorly," he said.

"I've been chased for someone else's debt and tried to resolve the issue only to then be passed on to debt collectors.

"At the very least, an apology would have been nice!

"I'm pretty thick-skinned, but I can imagine this kind of situation would be really upsetting for a lot of people."

If your energy supplier is chasing you for money you don’t owe, it’s vital you take steps to get it sorted as it can negatively impact your finances.

What to do if you're wrongly being chased

If you receive an energy bill demanding money you don’t owe, contact that energy supplier immediately.

While you could use webchat as Kevin did, it might be worth making an online complaint to the utility provider as you’re more likely to get your complaint resolved.

You can make a complaint to British Gas here, but this is only open 9am-5pm Monday to Friday.

EDF Energy customers can find out more information and complain here, while E.ON has outlined its complaints procedure on this page. Alternatively, you can complain to Scottish Power here or SSE via this page.

It’s a good idea to ask that whoever is helping you emails you a confirmation of what has happened to date. This way you have someone to get in touch with directly should you need further help.

If you would rather chat online or call one of the major energy suppliers, live chat links are below (in the names) alongside phone numbers and opening hours.

- British Gas: 0330 818 4186 (Monday-Friday 8am-6pm);

- EDF Energy: 0333 200 5100 (Monday-Friday 8am-6pm, Saturday 8am-2pm);

- E.ON Energy: 0345 052 0000 (Monday-Friday, 9am-5pm);

- Scottish Power: 0800 027 0072 (Monday-Friday 8:30am-7pm, Saturday 8:30am-1:30pm).

- SSE: 0345 070 7373 (Monday-Friday 8am-6pm, Saturdays 8am-2pm)

If you’ve gotten in touch with the energy supplier and they are still pursuing you for money, go to Citizens Advice.

You can go to the Energy Ombudsman if you’re unable to get a resolution after eight weeks or you have a letter recommending you go to the Ombudsman.

What energy companies can legally do

Unfortunately, energy companies can add charges onto your bill for a perceived late payment and also pass your details onto a debt collection agency to reclaim any cash they think you owe.

For example, British Gas charges £13 to cover ‘collection activity,’ £7 to pass your account to a debt collection agency, £39 to visit your home or £56 to apply for a warrant to enter your home.

There are also more fees on top of this for carrying out the warrant and fitting a Pay As You Go meter, which is why it’s vital to get your energy supplier to stop pursuing you for money if they’ve made a mistake.

If a debt collection agency becomes involved and your case is being investigated, inform the company that you’re challenging the debt. You can send them details of the dispute with the energy provider.

Will my credit score be affected?

If an energy provider does turn to a debt collection agency, this could result in a mark on your credit file and can seriously damage your credit score.

Having a good credit score is vital as it affects your ability to borrow in the future.

So, if an energy supplier has made a mistake, it’s vital that they fix it as soon as possible – and correct any errors on your credit file if it’s due to their mistake.

How to improve your credit rating and get the best deals

Will I get compensation?

According to Martyn James, head of media and marketing at Resolver, you can ask for compensation for money you’ve lost if you’ve paid a bill when you didn’t owe anything.

You can also ask for compensation for the inconvenience and time it’s taken to fix the issue.

James says energy firms often make ‘very basic’ compensation for any inconvenience, so he recommends that people are clear about what they want and why.

If the energy firm is of little help, James says you can go to the regulator Ofgem.

Cut your heating bills: tips for your radiator, thermostat, boiler and more

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature