Cost of living crisis: Lidl 'hikes prices fastest, Ocado slowest'

Food prices are rising at the fastest rate in more than 45 years with discount supermarkets Lidl and Aldi the worst culprits, new research suggests.

The pain being inflicted on shoppers shows no sign of slowing with food price inflation hitting its highest level since 1977.

New data from the Office for National Statistics shows food prices have jumped 18.2% in the last 12 months.

You'll no doubt have noticed the change in prices when doing your weekly shop.

But not all supermarkets are hiking prices at the same rate.

Lidl 'hiking prices the fastest'

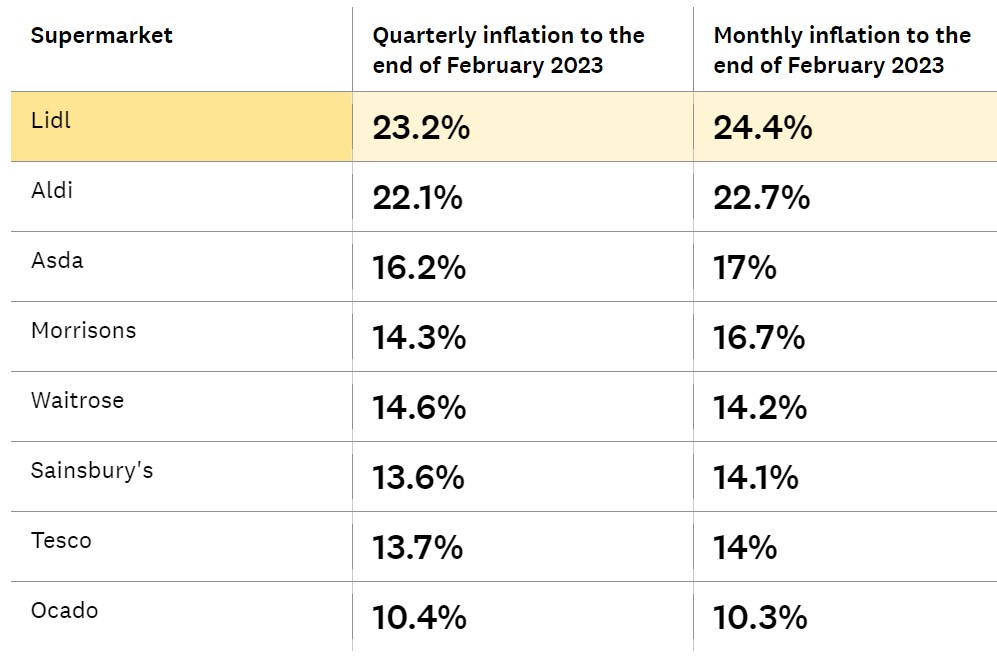

The team at Which? have analysed prices on more than 25,000 products at the eight biggest stores – Aldi, Asda, Lidl, Morrisons, Ocado, Sainsbury’s, Tesco and Waitrose.

One of the most worrying findings to come out of the research was that many everyday staples are among those to have seen the biggest hikes, with some more than doubling in price over the course of the last year.

This highlights just how difficult it can be to keep a lid on costs; when some daily staples are actually rising faster than the overall rate of inflation.

The research also looked at the supermarkets that are hiking prices the fastest.

Somewhat surprisingly, it was the discount supermarkets that were the worst culprits – as the table below shows.

Prices at Lidl have jumped a whopping 24.4% in the 12 months to end February 2023.

To put that into context, if you were spending £90 a week on groceries last year, the same shop will set you back around £112.

In second place on the list was rival discounter Aldi, where prices have typically jumped 22.7% over the last year.

Of the traditional major supermarkets, Morrisons has been hiking prices the fastest (17%) and Tesco the slowest (14%).

Of all eight supermarkets analysed, Ocado has been increasing prices at the slowest rate (10.3%).

The pain of food price inflation

The rising prices we pay for our food has been one of the big factors in the record rates of inflation seen over the last year.

Dealing with those sorts of price hikes would be bad enough if it was an isolated case, if the supermarket was the only area of our lives where we are seeing costs increase.

The trouble is that it has actually become the norm to see massive price hikes everywhere, on virtually everything we buy.

And with the factors driving these price rises, like the energy crisis and the war in Ukraine ongoing, it seems likely that food price inflation in particular will continue for some time yet.

Which is why it's important you take steps to minimise the impact of these rises.

How to fight back against rising supermarket prices

There are plenty of other steps you can follow, like making shopping lists and utilising supermarket loyalty cards, which will help you save a few quid.

Check out our full guide to cutting the cost of your food shopping and keep an eye on our weekly supermarket deals roundup (updated every Friday).

You should also take a look at this guide to help you reduce the amount of food you throw away each week.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature