Sponsored: most Brits 'have no idea how much their assets are worth'

Motorway, the used car marketplace, is urging the nation to monitor the worth of one of their most valuable assets with the launch of their new Car Value Tracker.

The average Brit has assets worth £294,000, but almost half (48%) don’t track the value of anything they own, according to research carried out by Motorway, the used-car marketplace.

Second only to property, cars are the most valuable asset for a whopping 9.1 million Brits, whilst stocks and tech are also contributors to our ‘net worth’.

For almost three-quarters of those surveyed in Greater London (72%), their vehicle is the most valuable asset they own, compared to 50% of those surveyed in the North West, as property ownership is often higher outside of the Capital.

Despite the sizable value of Brits’ assets, almost half (48%) don’t track the value of anything they own.

The younger generation (ages 18 to 23) are savvier, with over half (59%) who own a car checking its value at least once a month.

On the contrary, more than a third of the older generation (ages 55 to 73) check the value of their car once every one to three years.

Aside from cars, the younger generation are most likely to track the value of their mobile phone (23%), whilst the older generation keeps a close eye on the value of their property (23%).

With tools and apps available such as Zoopla to track the value of a property and Monzo to track finances, it’s now easier than ever to manage the value of the items you own.

Despite this, two-fifths of respondents who own a car (41%) say they don’t know how much their car is worth, and more than half (52%) of Brits think that a car always goes down in value – which is not necessarily the case.

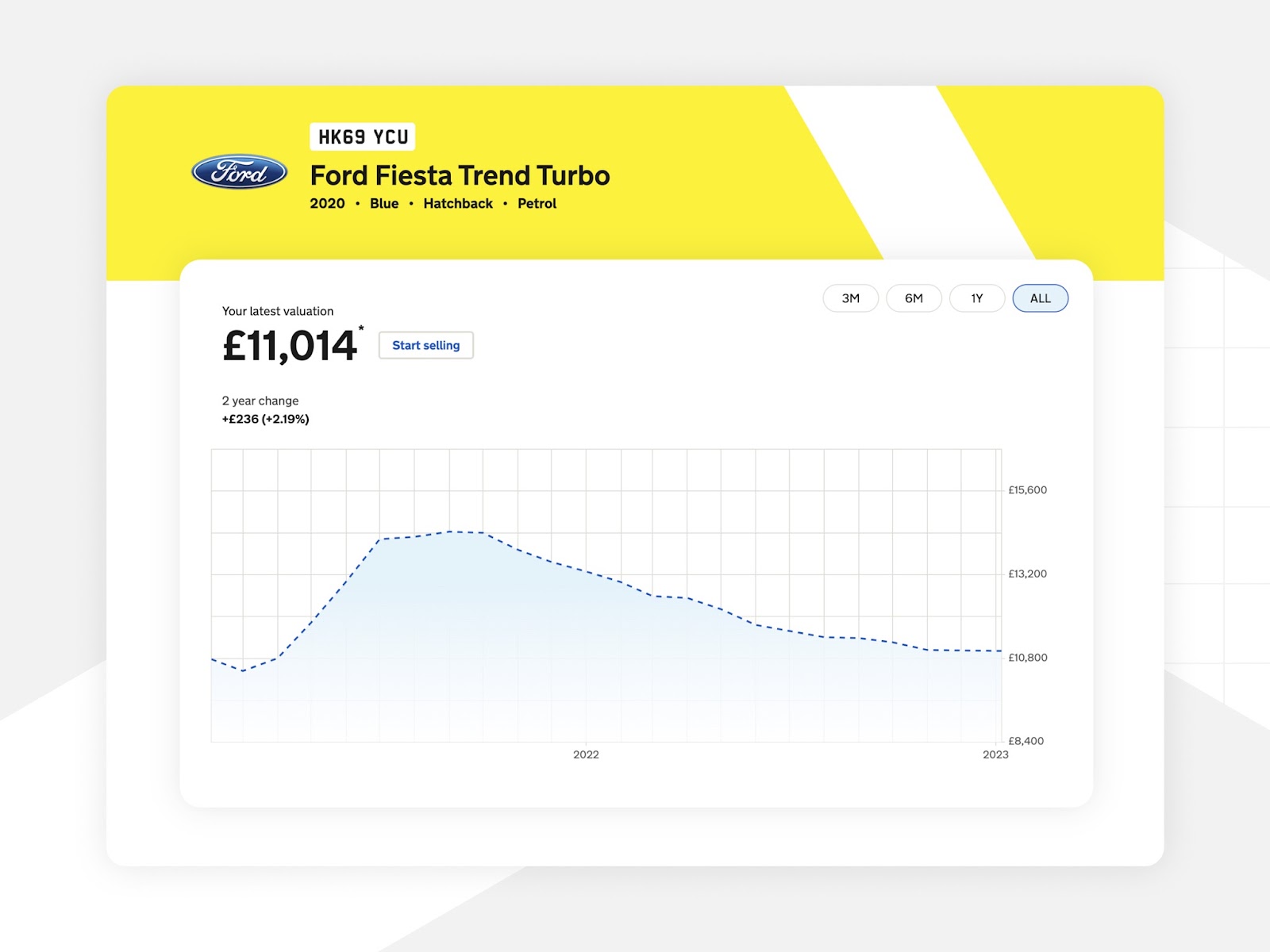

Motorway has launched its new free Car Value Tracker, helping the nation keep tabs on the worth of one of their most valuable assets, and ultimately giving them insight on the best time to sell.

With 43% of respondents who own a car not knowing when their car goes up or down in value, the new product aims to give car owners the inside track with insights on how their car depreciates or appreciates, including monthly email alerts on its value over time.

Previously, car depreciation almost always followed a downward trend but, over the past two years, the industry has experienced unprecedented changes.

Global supply chain shortages, a slowdown in new car production and a rapidly changing economy have resulted in used cars holding their value at a better rate - and sometimes even going up in value.

For example, between the end of 2020 and the end of 2021 the average price of a used Ford Fiesta sold on Motorway increased by over 50%.

While prices of the Ford Fiesta decreased over the course of 2022 by 8%, they are still significantly up on pre-pandemic prices (end of 2019).

Due to these changes, it’s now more important than ever for car owners to track the value of their vehicles to sell at the best time.

Motorway has teamed up with Rachel Riley MBE, maths genius and TV presenter, to reveal how tracking the value of our assets regularly could ultimately put more money in our pockets.

Rachel commented: “January is the perfect time to take control of your finances and the first thing you can do is take stock of your assets. Think about what you own that could be of material value: a car, a mobile phone, a gold necklace? All of these items could be considered assets and as such they depreciate and appreciate depending on market conditions and trends. An asset such as a car will see prices rise and fall, depending on demand in the used-car market, meaning it’s important to track the value of your car to understand the best time to sell.”

Alex Buttle, co-Founder of online used-car marketplace Motorway said: “For many people, their car is one of their most valuable assets. However, our research shows that too many car owners still don’t see their car as an asset and as such, are unaware of the value of their car or how it depreciates – or even goes up in value – over time. We’ve created the Car Value Tracker to help our customers keep track of their car’s value and to empower them with the knowledge they need to sell their car at the right time.”

To track the value of your car, visit motorway.co.uk/track.

This is a paid promotion on behalf of Motorway and does not necessarily reflect the views of loveMONEY.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature