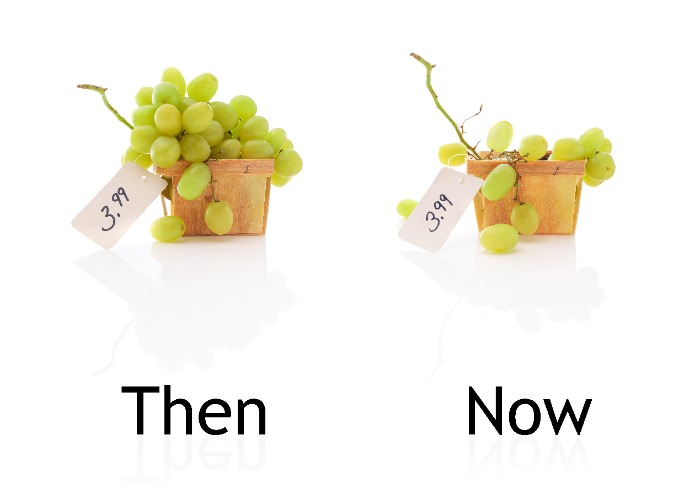

Food price con: brands cutting back on ingredients while hiking prices

Study reveals the proportion of meat, vegetables and fruit included in popular products is being reduced while the price of those items is rising.

Food shopping is one of the big expenses faced by most households every month.

And with our money becoming ever more stretched as a result of the cost of living crisis, it is ever more important to ensure that you are getting a decent bang for your buck at the supermarket.

The trouble is that it appears the food we buy today may cost more, but actually contains less of the most crucial ingredients compared with just a few years ago.

A study by the Mail on Sunday dug into the ingredients in hundreds of food items at major supermarkets, comparing them with virtually identical products on sale over the last couple of years.

And the investigation suggests that there are plenty of examples where the premium ingredients have been cut down substantially over that period.

In other words, while the costs have likely gone up, the best bits of those food products have shrunk.

For example, Covent Garden Chicken Soup was available in 600g cartons for £2 and contained 36g of chicken.

However today that carton only contains 580g of soup for the same price, while the chicken content has dropped to 28g.

Here are some of the other examples pinpointed by the Mail on Sunday team:

|

Product |

What you got then |

What you get now |

Price change |

|

Fanta Orange Zero 500ml |

35ml orange juice from concentrate |

20ml orange juice from concentrate |

From £1.45 to £1.60 |

|

Tesco Finest Cottage Pie 400g |

128g beef |

112g beef |

From £3.50 to £4 |

|

Vesta Chow Mein |

11g dried cooked beef |

4g dried cooked beef |

From £1.75 to £2.75 |

|

Tesco Finest Creamy Fish Pie |

96g fish |

80g fish |

From £3.50 to £4 |

|

Jacob’s Mini Cheddars Original |

18g dried cheese |

14g dried cheese |

From £1.45 to £1.75 |

|

Ella’s Kitchen Chicken Casserole |

14g chicken |

13g chicken |

From £1.60 to £1.70 |

|

Piccola Cooking Classic Tomato Pasta Sauce |

61g chopped tomatoes |

52g tomato passata |

From £1.50 to £1.70 |

As you can see, in some cases the ingredient changes are quite substantial and potentially saving the food producers big money.

Yet rather than pass those savings on to shoppers, they are actually cashing in even further with more costly headline prices.

Consumer rights advocates pointed out this is a pretty cynical tactic, given most shoppers don’t go through the individual ingredients of their favoured food items, and certainly don’t track how those ingredients might change over time.

Paying the price of shrinkflation

This approach has been dubbed ‘swap-flation’ by some, given the food producers remove some of the more costly, premium ingredients ‒ the meat, fruit and vegetables ‒ are traded out for cheaper alternatives to fill up the space.

It comes alongside the practice of shrinkflation, where items get smaller in size yet remain for sale at the same price.

It’s another painful tactic employed by food producers looking to maintain their profit margins, with shoppers having to pay the price without necessarily realising it.

The pain at the till

Finding that we are paying for less would be galling at the best of times, but it’s important to bear in mind that the price of our food has rarely been so keenly felt by households across the UK.

Over the last year, we have seen the rate of inflation on our food increase by a frankly incredible rate.

The latest study from Kantar World Panel suggested that grocery inflation is now above 17%, its highest-ever level.

If shoppers aren’t changing their food-buying habits, then they are looking at paying an extra £811 a year on their food, which is not exactly small change.

However, it’s clear that shoppers are changing those habits. Kantar found that sales of own-branded items are up by 13.2%, for example, as people drop the premium brands and move to supermarkets cheaper alternatives.

Plenty of us are changing where we shop as well.

Kantar tracks the market share of the big supermarkets, and it’s notable that big names like Tesco, Sainsbury’s and Asda have seen substantial falls over the last year.

By contrast, Aldi and Lidl have seen big gains, as households move to the deep discounters in a bid to help their money stretch further.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature