Energy price cap forecast to fall more than £200 in boost for household finances

Energy bills are forecast to fall more than 10% this Autumn, but prices are expected to rise again in 2024.

Households could see their energy bills fall even further this October, analysts have predicted.

Earlier this month, the energy price cap fell sharply from £2,500 to £2,074 in response to lower wholesale oil prices.

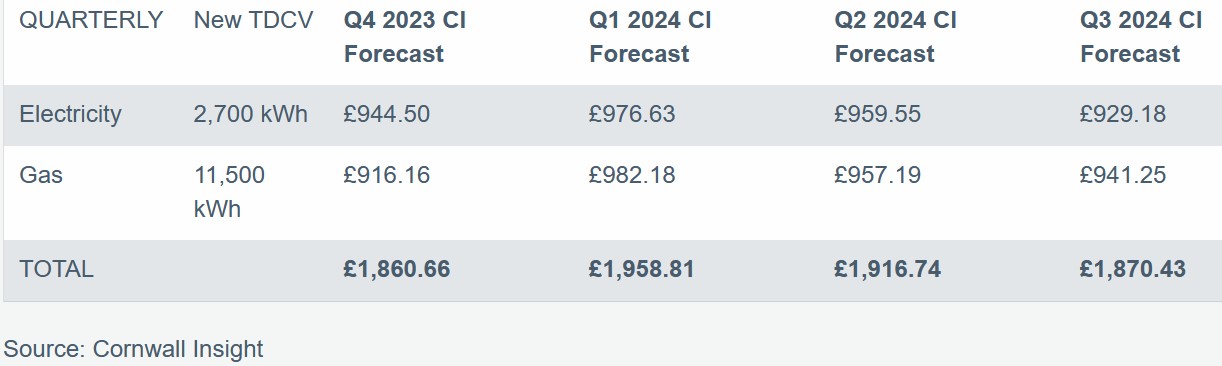

And energy analysts at Cornwall Insight are now predicting the cap could fall by more than £200 in October to £1,860.

That would be a welcome boost to households struggling to make ends meet during the ongoing cost of living crisis, especially as that's typically when our energy usage starts rising as temperatures fall.

However, the firm did caution that the price cap would likely rise to almost £2,000 in January.

A quick note on the energy price cap

Every three months, the energy regulator amends the energy price cap in response to changing wholesale energy prices.

The most recent change occurred on 1 July and the next change will take place on 1 October.

While the cap is currently set at £2,074. it's important to stress this is not the absolute maximum you can pay for energy.

Rather, it’s the most a household with average use will pay over the course of a year.

If your usage is higher, or lower, than average then your bill will be adjusted accordingly.

As mentioned above, the price cap is forecast to fall by around 10% in October, so that's how much your bills will likely fall by.

However, given that bills are likely to rise again in January - right in the middle of the high usage months - you should think carefully before cutting your monthly Direct Debits in the Autumn or you could risk falling into energy arrears.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature