Cost of living crisis: 5 bills that have soared up to 76%

From energy bills to car insurance costs, our outgoings on virtually everything have increased substantially over the last couple of years.

It’s no secret that households face much higher bills than just a couple of years ago.

The amount of money we have to spend on those regular outgoings, like the food shopping, the energy bill and the mortgage, have all increased markedly over that period.

But the scale of those increases are easy to overlook.

Here we run through just how dramatic the jump has been, and why the increases in wages enjoyed by some will barely scratch the surface.

Energy bills - up £792

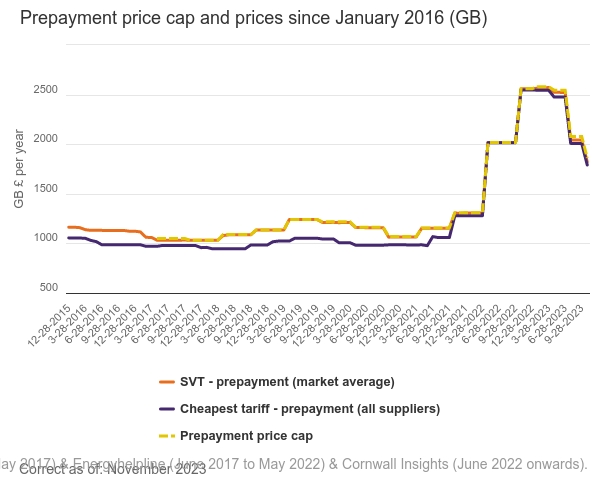

One of the clearest indications of how badly things have gone in the energy market is the simple fact that most of us are now on energy tariffs protected by the energy price cap.

Where once the cap was there to prevent suppliers from taking advantage of those unwilling to switch energy deals every couple of years, it is now a safety net that applies to most of us as a direct result of the disappearance of fixed energy tariffs.

Back at the start of 2021, the price cap was set at £1,042 for a household with average energy use.

Today, however, it stands at £1,834, and will rise to £1,928 in the new year.

Essentially our energy bills have virtually doubled over the last two years, while our ability to shop around for a potential saving has also been eliminated.

Throw in the fact that the Government support which has been in place over the last year or so to help with energy bills has been withdrawn and it’s a dreadful situation.

Typical increase: £792 / 76%

Mortgage costs - up £3,828

For those on a variable-rate mortgage or who had to remortgage this year, the rise in mortgage costs is probably the single biggest increase they've suffered.

In November 2023 the average two-year fixed rate stands at 6.29%, while the typical five-year fixed rate is around 5.86% according to data from Moneyfacts.

But back in January 2021, those averages were a much more attractive 2.52% and 2.72% respectively.

To put that difference into cash terms, let’s use the example of a £150,000 mortgage on a 25-year term.

The monthly repayments on a 2.52% rate come to about £674 a month, but on a rate of 6.29% you’re looking at shelling out a massive £993.

That’s an enormous jump ‒ over a year you’re coughing up the best part of £4,000 more.

Not many of us have the room in our budgets to cover such a payments jump, and it’s not just those looking to purchase a property that have been impacted ‒ millions of people have come to the end of their existing mortgage deal and so need to refinance, and have little choice but to swallow such mammoth repayment hikes.

Typical increase: £3,828 / 47%

Supermarket prices - up £605

Food is one of the great unavoidable expenses any of us face.

Food is one of the great unavoidable expenses any of us face.

After all, while you can cut out things like gym subscriptions or streaming services from your monthly outgoings, you can’t go without food.

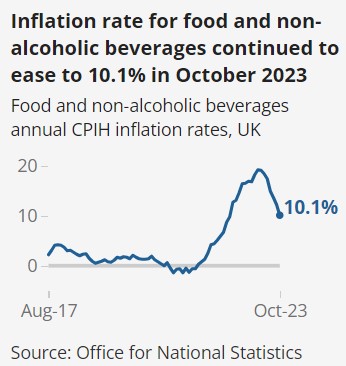

The cost of that food has grown at an extraordinary rate, one of the big drivers in the overall inflation rate being so high.

Back in March 2023 food price inflation hit a high of 19.2%, the highest level seen in over 45 years.

While it has dropped back, it still stands at 10.3% in the year to October 2023, while we are still paying the price of that previous rate of inflation.

Remember, the fact that inflation has dropped only means that prices are growing more slowly, not that price growth has stopped altogether.

That’s why the ONS reckons food prices today are around 30% higher than in October 2021.

The non-profit organisation Energy and Climate Intelligence Unit has put a monetary figure on it, estimating that annual food bills have jumped £605 between 2021 and 2023.

Typical increase: 30% / £605

Council Tax hikes - up £247

The new financial year brings with it a host of price rises to all sorts of bills, chief among them Council Tax.

And recent years have seen some significant jumps to our Council Tax costs.

Back in 2020/21 the typical Council Tax bill for a property in Band D cost £1,818.

But a host of councils since then have felt compelled to increase bills by the maximum allowed, so that by 2023/24 the typical bill for that same property sits at £2,065, with further sizeable increases likely from next year.

Typical increase: £247 / 14%

Fuel and car insurance prices - up £890

The cost of fuel has been a rollercoaster affair for drivers over the last few years.

The war in Ukraine, as well as the shortages following the opening up of pandemic lockdowns, has had a big impact on the cost of filling up our motors.

Back at the start of 2021, the cost of a litre of petrol was around 117.03p, while diesel would set you back 120.46p per litre, according to the RAC Foundation.

Since then it’s grown to 147.84p and 155.1p respectively, which is painful enough.

However, costs have fluctuated to such an extent that at times they have been much, much higher ‒ back in June they peaked at 191.5p and 199.02p respectively.

So if you’re filling up a 55-litre tank on your car with petrol, then you’ll pay an extra £17 now than a couple of years ago, though at points you may have had to stomach paying an extra £41.

The pain for drivers goes even further too, courtesy of car insurance premiums which have increased substantially.

According to the Association of British Insurers (ABI), the average cost of car insurance hit a new record high in the third quarter of 2023 at £561.

That’s up by 29% compared to the same period in 2022, while back at the start of 2021 the average was just £436, the lowest level in nearly five years.

Typical increase: £890 / 27% [based on filling up 45 times a year, plus car insurance increase]

Pay rises - up £5,368

Now it is important to include the fact that the last two years have seen decent average levels of pay growth.

Indeed, according to some those pay hikes have played a big role in inflation staying so high for so long, and means that, for some there is a little more headroom to deal with these rising costs.,

According to the Office for National Statistics, the average weekly earnings for total pay (so including bonuses and the like) in September reached £673.

By comparison back in January 2021 that figure stood at around £570, meaning that in general people have seen their pre-tax earnings grow by around 18%.

Of course, the reality is that plenty of people won’t have seen their wages increase at all over this time frame, leaving them having to make their existing salary stretch ever further to deal with the enormous jump in outgoings.

Typical increase: £5,356 / 18%

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature