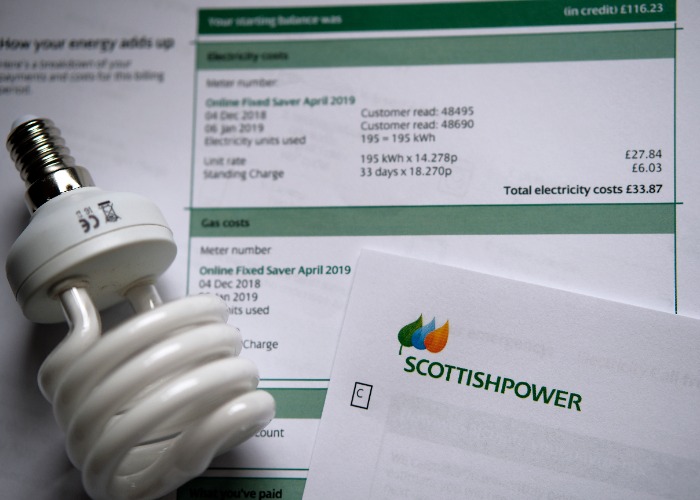

ScottishPower pays out £1.5m after some energy customers were overcharged

Small number of energy customers paid £149 more on average as a result of a billing error.

ScottishPower has agreed to pay £1.5 million in compensation after some of its customers were charged at a rate above the energy price cap.

Energy regulator Ofgem said that a total of 1,699 households were overcharged by an average of £149 between 2015 and 2023.

To make up for the error, the energy giant has paid £250,000 to the affected customers, plus an additional £250,000 in goodwill payments.

This works out to an average sum of £294 per customer.

This money has already been paid out and affected customers don’t need to do anything.

ScottishPower will also pay £1 million to the Energy Industry Voluntary Redress Fund, which benefits charities and community projects that help vulnerable customers with energy-related support.

Talking about the billing error, Dan Norton, deputy director for price protection at Ofgem, said: “The last few years have been challenging enough for energy customers facing increasing cost of living pressures, without the additional hardship of being overcharged.

“The price cap is there to protect consumers, and we take seriously any breaches of the safeguards we have put in place.

“Suppliers must be vigilant and act quickly to resolve billing errors that impact customers.”

|

PROMOTION

|

||

|

What ScottishPower has said

ScottishPower said it has now put additional controls and monitoring in place to reduce the risk of anything similar happening in future.

Andrew Ward, CEO of ScottishPower’s customer business, added: “We’re so sorry that a very small number of our customers were affected by this mistake and faced an increased financial burden – especially during a time when energy prices were reaching an unprecedented high and the government had to step in to provide support.

“Looking after our customers is at the heart of everything we do and our immediate notification to the regulator, swift corrective action and the compensation package agreed with Ofgem show both how seriously we take this matter and our commitment to making it right.”

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature