Google launches Gmail payment service in the UK

Gmail users can now send money to friends and family by ‘attaching’ it to an email.

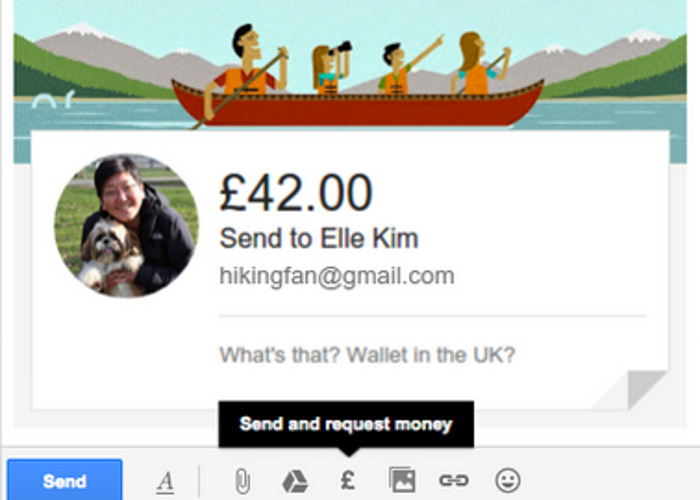

Gmail users in the UK can now send money to friends and family by “attaching” it to an email message.

The service, which launched in the US in 2013, works using Google Wallet, a free mobile payment service which has been around since 2011. It securely stores debit cards, credit cards, loyalty cards, gift cards, offers and more in one place for quick and easy transactions in store and for Google purchases online.

How the Gmail money 'attachment' works

Gmail users can now send money from their Google Wallet to an email contact in the UK by clicking the £ icon in their attachment options, entering the amount and pressing send.

The transfer will work even if the recipient doesn’t have a Gmail address, but they will need to sign up for a Google Wallet account in order to claim the cash.

Once the money is in your recipient’s Google Wallet, they can keep it there, spend it on Google Play, or transfer it to their bank account for free.

Gmail users can also make requests for money owed from friends and family by sending an email with an attachment for the required amount.

The service is free for those that request and receive money as well as those that send money direct from a bank account or their Google Wallet balance. But transferring money to a recipient or adding money to the Google Wallet using a debit or credit card incurs a 2.9% fee.

The new Gmail feature is only available to use on desktop computers.

Google is rolling out the new feature in the coming weeks to all Gmail users over 18 years old.

Keep on top of your finances at a glance with lovemoney's new Plans service

Alternatives to Google Wallet

The launch of a Gmail payment service powered through Google Wallet is the latest innovation in simplifying how we move our money around.

Paym, which launched in April last year, allows users to send and receive payments directly from a current account using just a mobile number. Over 1.8 million users have signed up to the free service and £26 million has been transferred since it launched.

Apple Pay is also due to launch in the UK very soon. It will allow users to upload their credit or debit card details to their smartphone and make contactless payments. Unlike Google, which requires users to transfer funds into their Wallet before making payments, Apple Pay will take money directly from a user’s bank account, for a fee.

Will you be using Gmail to send money to friends and family? Let us know in the Comment box below.

Keep on top of your finances at a glance with lovemoney's new Plans service

More on payments:

More banks join Paym mobile payment service

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature