Virgin Money introduces Sex Pistols credit card designs

Punk tribute part of bank's quest to "shake up banking".

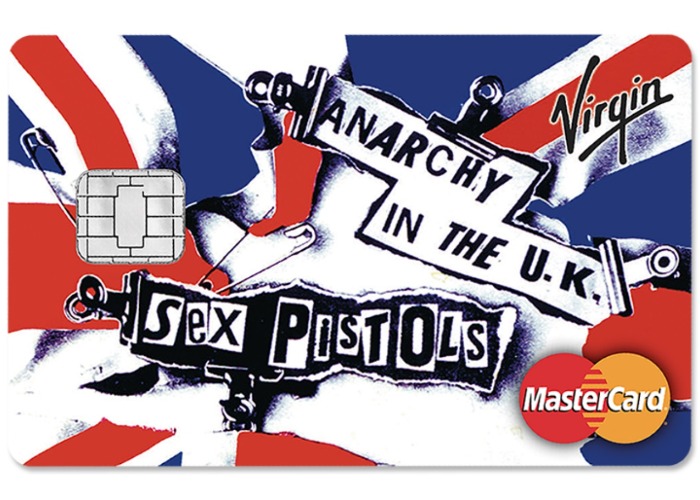

From today borrowers can take out a Sex Pistols-branded credit card from Virgin Money.

There are three designs to choose from, featuring the Never Mind The Bollocks album and Anarchy In The UK single artwork.

Michele Green, director of cards at Virgin Money, said that banks in the UK have “all been the same” for a long time now. She added: "The Sex Pistols challenged convention and established ways of thinking – just as we are doing in our quest to shake up banking.”

‘Edgy’ banking

I appreciate what Virgin is trying to do here. High street banks are not exactly bastions of trustworthiness, or cool for that matter. Setting its brand apart as something completely different is a way to win over those sick of the antics of the biggest banking names.

And nothing screams rebellion against the system more than the Sex Pistols, right?

Well not to me. There's something a little tragic about aligning yourself with punk rockers from four decades ago in a bid to seem relevant in 2015, even if they were on the Virgin record label.

Never mind the bollocks

But let’s get past the marketing guff – or bollocks as John Lydon would probably refer to it, before he started making adverts for butter anyway. Nobody should ever pick a credit card based on what it looks like, iconic artwork or not, unless you don't plan on ever using it.

If you are going to borrow on a credit card, it needs to be for the right reasons and on the right deal.

Virgin Money offers a host of credit cards, and while they are all pretty good, none are the absolute best around.

For example, Virgin has a 36-month 0% balance transfer card, with a 2.50% balance transfer fee. Make no mistake, that’s a brilliant deal. But you can get the same three-year 0% period, with a smaller transfer fee, from both Barclaycard (a 2.39% fee) and Halifax (a 2.49% fee).

Or there’s the 18-month 0% card, with a 0.75% fee. Again, a good option if you don’t want to pay a massive transfer fee and can clear the debt relatively quickly. But Tesco Bank offers a card with the same 0% period, and no transfer fee at all.

It’s all well and good talking about doing things differently to the established banks, but that’s somewhat meaningless if the products you offer are similar but inferior to those from the 'dreaded' high street banks.

I’d love Virgin to really shake things up and act as a true challenger bank. But the way to challenge and push the established banks is with the products on offer, not jazzing up your card designs with artwork linked to some of Sir Richard Branson’s mates from back in the 1970s.

To keep on top of the best credit cards around, irrespective of the designs on the cards themselves, be sure to follow our best buy articles below.

The best 0% purchase credit cards

The best 0% balance transfer credit cards

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature