Tax credit cuts explained

Find out how the upcoming tax credit changes will affect you.

Cuts to Working and Child Tax Credit are fast approaching, with changes coming into force as early as April 2016.

The Government says that tax credit cuts will save £4.5 billion a year from 2016, claiming that working families will be better off.

Tax credits are benefits introduced by the last Labour government to help low income families. They’re broken down into two groups: Working Tax Credits and Child Tax Credits. Both are gradually being moved into Universal Credit, which is being phased in across the country.

At the moment you can claim some Working Tax Credits if you work a minimum of 16 hours per week and earn a maximum salary of £13,252. Those earning less than £6,420 receive the full entitlement.

Working Tax Credits

The income threshold for someone earning Working Tax Credits will fall from £6,420 to £3,850 from April 2016. The rate at which payments get cut, or ‘taper’, will increase too. At the moment, claimants lose 41p for every pound they earn above the threshold, but from April this will rise to 48p per pound.

Claimants whose household income increases by up to £5,000 during the tax year currently don't lose out. But from April any increase in income over £2,500 will be taken into account.

Child Tax Credits

Families will only be able to claim for two children from April 2017 and the flat £545 'family element' paid for each child will be abolished. No existing claimants will lose out because of the change.

If you’ve been affected you’ll receive a letter just before Christmas.

Who is hit the hardest?

Unsurprisingly, it’s the families with lowest incomes that will lose out the most.

Figures from the Institute for Fiscal Studies (IFS) show that three million families are likely to lose an average of £1,000 a year because of the changes. The Resolution Foundation thinktank estimates that a family with a single earner couple and two children will be at least £985 worse off next year.

New personal allowance thresholds means that many people will pay less income tax. From April 2016 it will rise from £10,600 to £11,000, with the aim of reaching £12,500 by 2020. The Government is also doubling the amount of free childcare available to working parents of three- and four-year-olds. It says that 600,000 families will benefit.

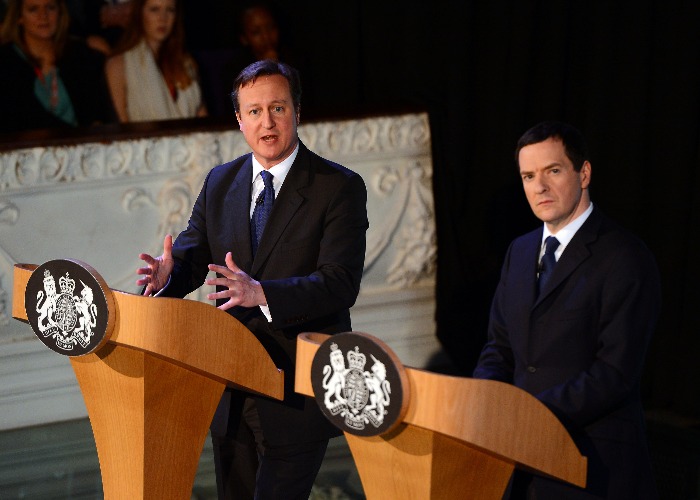

And Chancellor George Osborne says that anyone working full-time on the National Living Wage will be better off.

However, there’s a big gap between the tax credit cuts and the worker benefits being introduced, creating a potential shortfall in income for the next few years for many households.

The Institute for Fiscal Studies estimates that 8.4 million households with someone in paid work and receiving benefits or tax credits will lose £750 a year and only gain £200 a year from the National Living Wage.

What you should do now

Work out your budget and figure out what you can afford to cut if the changes come in.

You might save a decent amount of money by switching your gas and electricity provider or shopping around for your car and home insurance. For outgoings like your mortgage, you could speak to your bank or building society to see if you can change your repayment plan and reduce your monthly payments. However, be aware that this will mean you're paying it off for longer.

Switch to a better energy supplier with loveMONEY

What others are reading:

11 everyday essentials that are cheaper than last year

The room you could rent for £1 a month

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature