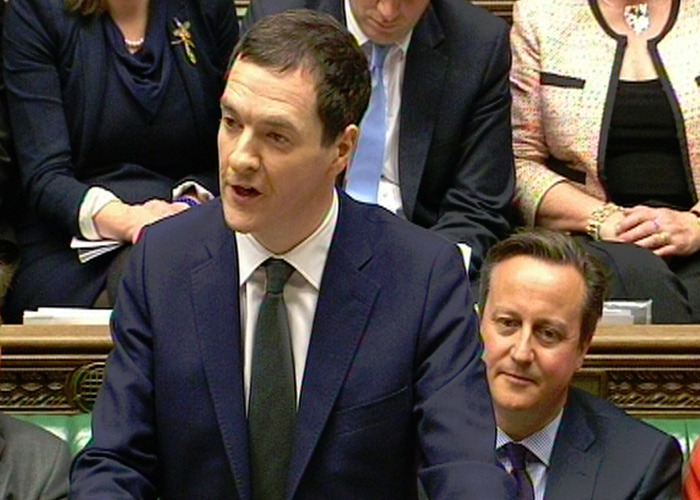

Autumn Statement 2015: what it means for you

George Osborne has delivered his annual Autumn Statement. Here's what he said, and how it affects your bank balance.

George Osborne, the Chancellor of the Exchequer, has delivered the 2015 Autumn Statement, along with his latest Spending Review, in what is in effect the third Budget of the year.

Here’s what he had to say.

Tax credits

Tax credits have been something of a disaster for the Government of late. In the Summer Budget the Chancellor announced significant cuts, as part of the Government’s drive to find £12 billion of savings within the welfare budget. However, the plans were defeated in the House of Lords.

The Government promised a rethink, which led to the cuts being abandoned entirely. The Chancellor pointed to the fact that tax credits will be phased out over the next few years anyway, due to the introduction of Universal Credit, and an improvement in the public finances meaning the cuts are no longer necessary.

Housebuilding

The Chancellor promised the biggest housebuilding programme since the 1970s, promising to build more than 400,000 new homes across England, with half of them to be ‘starter homes’ for first-time buyers.

These will have a maximum value of £250,000 outside of London and £450,000 inside the capital. Developers will be given cash by the Government to build them and to fund the regeneration of brownfield land for their construction.

A further 135,000 of the new homes will be available on a shared ownership basis via the Help to Buy scheme, to make it easier for people to take the first step onto the housing ladder. All households earning less than £80,000 outside London or £90,000 inside London will be eligible.

In addition, 10,000 new homes will be designed for tenants to save for a deposit while they rent and 8,000 homes for older people or those with disabilities.

Stamp Duty

New Stamp Duty rates will be introduced from April next year, which will see a 3% higher rate paid on second homes and buy-to-let investments.

This follows the restriction of tax reliefs for landlords announced by the Chancellor in the Summer Budget.

Pensions

The Chancellor announced that the Government will be maintaining the ‘triple lock’ on the basic State Pension. This ensures that the state pension increases each year by the largest of the following three measurements:

- inflation as measured by the Retail Prices Index;

- wage growth;

- 2.5%.

As a result, the basic State Pension will increase by £3.35 – the largest rise in 15 years – to £119.30 a week from April. Some economists have suggested that the triple lock will become unaffordable in years to come.

From next April the Government will be introducing a “fairer and clearer” flat rate New State Pension. We finally have confirmation of what the maximum weekly payment will be: £155.65. However, as has become clear in recent weeks, huge numbers of people retiring after next year will actually receive far less than that. For more read Why you will be worse off with the New State Pension.

Council Tax

Local authorities are to be given the freedom to hike Council Tax bills by more than 2%. This money will then have to be devoted towards social care.

Free childcare

The free 30 hours of childcare, to be introduced in 2017, will only be available to parents working more than 16 hours a week and earning less than £100,000 a year.

The scheme will see eligible parents get 20% of their annual childcare costs covered by the Government. For more read Tax-Free Childcare: what you need to know.

Water bills

South West customers will continue to receive £50 off their water bills. Read What does the average water bill cost?

Energy bills

The Government will be introducing a replacement for its green energy scheme ECO, which ends in March 2017. The Chancellor claims that this new energy scheme will mean that 24 million households will save £30 a year on their energy bills.

Cut your energy bills further by comparing the best deals in your area with the loveMONEY gas and electricity centre.

Car insurance

Rules around claiming compensation for injuries sustained in car accidents are to be changed in an effort to tackle the rampant levels of fraud that currently take place. Claimants will no longer have the right to cash compensation.

The Chancellor said he expects the savings that insurers make as a result to be passed on in full to drivers, meaning they will save up to £50 in premiums.

Make further savings on your car insurance premiums by comparing deals with the loveMONEY car insurance centre.

Tax

Everyone will have digital tax accounts by the end of the decade. The Chancellor said that it was daft for people in the current world to be filing paper tax returns.

This will mean Capital Gains Tax on residential property is paid much earlier, bringing it more in line with Stamp Duty.

Potholes

We now have a permanent pothole fund, devoted to repairing the nation’s damaged roads.

London Help to Buy

London is getting its own version of the Help to Buy scheme. With the existing scheme, so long as a borrower can provide a 5% deposit, the Government will hand over a loan worth 20% of the property, meaning the buyer only needs a 75% loan-to-value mortgage.

However, in recognition of the higher prices in the London property market, a special London Help to Buy equity loan will be on offer, where the Government will stump up a whopping 40% loan. As a result borrowers will only need a mortgage of up to 55% loan-to-value.

More details on exactly how it will work will be published in early 2016.

Picture by: PA / PA Wire/Press Association Images

Boost your bank balance with loveMONEY:

Best Black Friday 2015 sales, deals, discounts and freebies

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature