IFS: 'sudden' tax rises or spending cuts needed to hit Budget target

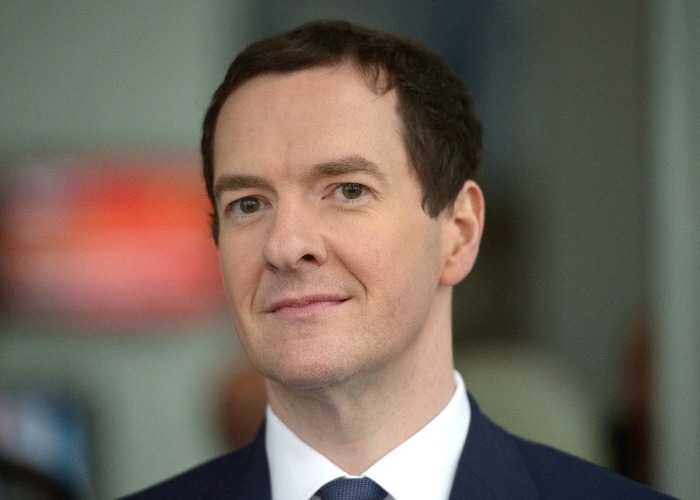

Chancellor warned he may need to raise taxes or cut public spending with little notice in order to deliver surplus.

Fuel duties are among the taxes the Government may need to increase in order to hit its target of eliminating the deficit by the end of this parliament.

That’s according to the Institute for Financial Studies (IFS) thinktank, which has published its Green Budget looking at the state of the economy ahead of the official Budget on 16th March.

And it made clear that by committing to an “inflexible” target of delivering a budget surplus, the Chancellor now faces a “precarious balancing act”.

It says that could mean big spending cuts or tax rises with very little notice.

Delivering a surplus

According to the Office for Budget Responsibility (OBR), the deficit now stands at £70 billion. Committing to turn that around in the next four years is a big ask. Indeed, in the words of Paul John, the IFS director: “Osborne’s new fiscal charter is much more constraining than his previous fiscal rules.”

The problem is that only small changes to various forecasts can blow a huge hole in the Government’s plans. The Chancellor has essentially bet the house on tax receipt forecasts, and he may be forced into some tough – and sudden – decisions if those forecasts are off.

For example, the turmoil seen in the financial markets so far this year and disappointing pay growth have significantly undermined the plans, with tax receipts now likely to be much weaker than forecast by the OBR just a couple of months ago.

The IFS reckons that subdued pay growth will hit tax revenues by around £5 billion over the next four years, compared to the OBR’s existing forecasts.

With a likely further £2 billion lost in capital tax receipts, unless share prices recover, the Chancellor has a lot of work to do in order to deliver that surplus.

As the report states: "There is a significant chance that the Government's current fiscal plans will not deliver the targeted surplus without further tax rises or spending cuts."

Make up to £150 by switching bank account today

So what can he do?

Fuel duties are one area the Chancellor can look to address the problem. The OBR’s forecasts are based on fuel duties increasing in line with the Retail Prices Index (RPI) measurement of inflation, but that hasn’t happened in recent years. Indeed, every fuel duty increase that had been pencilled in since 2011 has been cancelled.

Freezing duties for a further five years would cost around £3 billion a year, according to the IFS, money that the Government can evidently ill afford to be without. The next fuel duty rise is scheduled for April 2016, an increase of 1.16p per litre. With oil prices currently low it may be an area the Chancellor feels confident about taxing more heavily without it hitting our pockets too hard.

Pensions will also be an area the Government will have to look at. It already seems clear that the tax relief offered on pension contributions will be revamped in some way in the Budget, to cut back on the generous reliefs that higher and additional rate taxpayers enjoy. For more on this, read Pension tax changes: what should higher rate taxpayers do NOW?

However, the Government needs to be careful to distinguish between what is a permanent increase in revenues, and what is only a temporary windfall, according to the IFS. “Relying on temporary revenues to achieve a budget surplus in 2019/20 would not be in keeping with the rationale underpinning the Chancellor’s stated fiscal objectives,” the IFS said.

Then there is public spending. The cuts planned for many Government departments in this parliament come on top of cuts of an average of 10.4% in real terms in the last parliament, and it’s many of those departments that will see the biggest cuts again. But is there room for further cuts?

The IFS points out that, given the magnitude of cuts to working-age benefits in recent years and the U-turn on the planned cuts to Tax Credits, further savings in the welfare budget may be hard to find.

Make up to £150 by switching bank account today

Picture credit: Anthony Devlin/PA Wire/Press Association Images

Be better off with loveMONEY:

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature