Savings allowance: why Premium Bonds are about to get worse

Millions of us have Premium Bonds, but their attractiveness will take a dent as a result of the new savings allowance.

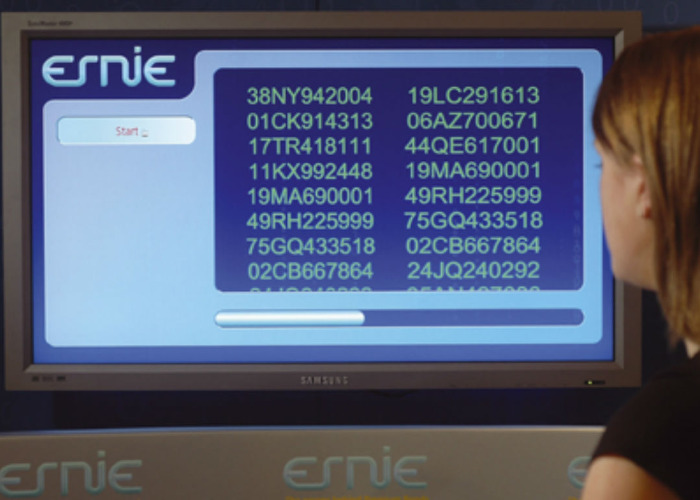

Premium Bonds are the UK’s most popular savings vehicle. Nearly half of us have one, with over £59 billion invested in them. But really, they are a bit rubbish. And they are about to get even worse!

The attraction of Premium Bonds has always been the possibility of winning a large cash prize. Each month thousands of prizes, ranging from £25 to a cool £1 million are handed out tax-free. But, that is the only return you might make as there is no interest paid on Premium Bonds.

The odds of winning a prize are 26,000 to one – so many people make no return on their savings at all. However, if you do win the money is tax-free, which is the reason many people stick with Premium Bonds. You may make no guaranteed return, but if you do win anything you don’t have to share it with the taxman, unlike a normal savings account.

But that is about to change. From April everyone will get a Savings Allowance – that is an amount of interest you can earn each year from your savings accounts before you have to pay tax on the returns. Basic rate taxpayers will be able to earn a whopping £1,000 a year before tax is due, while higher rate taxpayers can pocket £500.

That means a basic-rate taxpayer can have tens of thousands of pounds in savings before they have to start paying tax. As a result, one of the big attractions of Premium Bonds – the tax-free returns – will be lost.

You will make a far better return from putting your money into the best-paying savings accounts and making tax-free cash that way.

You can keep up to date with the best savings deals in Where to earn most interest on your cash.

Want to be a millionaire? Buy a lottery ticket

If you keep investing in Premium Bonds in the hope of becoming a millionaire, you’d be better off buying a lottery ticket.

While the headline odds of winning with Premium Bonds is 26,000 to one, that is for winning ANY prize at all. The chances of winning the £1 million are an astronomical 29.2 billion to one in a typical draw. In contrast the odds of picking the winning Lotto numbers stand at 14 million to one.

Find a better savings account with loveMONEY

Check for old winnings

Before you abandon Premium Bonds completely check to see if you’ve any forgotten winnings. There is more than £50 million sitting in unclaimed prizes dating back to the 1960s.

You can check by entering your certificate numbers on the NS&I website. And don't forget that loveMONEY publishes the big prize winning numbers every month.

Find a better savings account with loveMONEY

Be better off with loveMONEY:

Are you making this money mistake?

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature