The Budget: what it means for YOU

The Chancellor has finished delivering the 2016 Budget. What did he announce, and what does it mean for YOU?

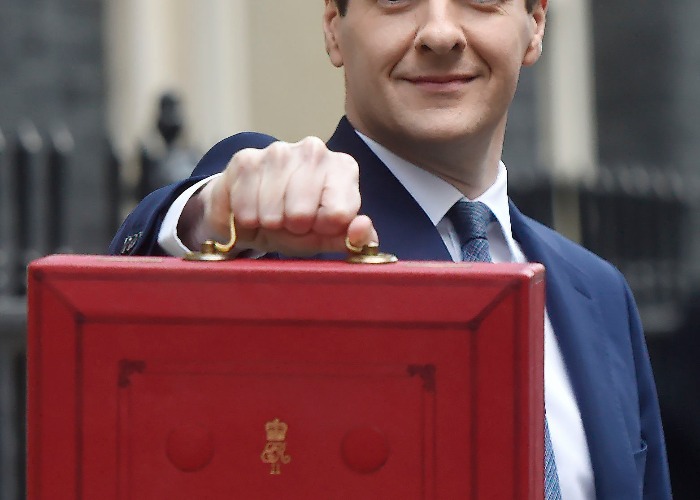

George Osborne has finished delivering the 2016 Budget, and there was a lot of talk about “putting the next generation first”.

But what did he announce? And what does it mean for your financial wellbeing?

Personal tax-free allowance

The personal tax allowance is how much you can earn each year before you have to pay Income Tax, and has been regularly increased by Osborne. From April it increases to £11,000, but the Chancellor announced that it will jump to £11,500 next year.

This move will remove 1.3 million of the lowest paid workers from paying Income Tax altogether.

Higher rate tax threshold

The point at which you begin to pay the 40% higher rate of Income Tax currently stands at £42,385, and will increase to £43,000 in April.

However, this will be increased sharply to £45,000 from April 2017.

Fuel duty

The Government has ditched the fuel duty which was timetabled for this year, meaning fuel duty will be frozen for the sixth straight year. This will save the typical motorist £75 a year, according to the Treasury.

Lifetime ISA

A new Lifetime ISA is to be introduced from April 2017 for all those under 40.

For every £4 you save, the Government will top up your balance by £1, up to a maximum of £1,000 a year.

You can use the Lifetime ISA to help towards a deposit for your first home, worth up to £450,000 across the country. So, for example, two first-time buyers can combine their accounts – and the bonus – when buying together. If you already have a Help to Buy: ISA, you can transfer those savings into a Lifetime ISA in 2017, or continue saving into both, though you will only be able to use the bonus from one to buy a home.

Alternatively, you can use the Lifetime ISA to save for retirement. You can take out all of the cash without paying any tax after you turn 60. You can even withdraw money at any time before you turn 60 if need be, though you will lose the Government bonus (and have to pay a 5% charge).

ISAs

Currently savers can save up to £15,240 a year in an ISA, which allows them to enjoy tax-free returns whether from cash or from stocks and shares.

However, this limit is to get another large bump up to £20,000 from April next year.

Corporation Tax

Corporation Tax has been cut repeatedly by Osborne during his time as Chancellor – it stood at 28% when he took office, and now stands at 18. It will be cut again, falling to 17% from April 2020.

Stamp Duty

One year on from the Chancellor’s significant revamp of the Stamp Duty system, moving away from the hated ‘slab’ system, we had another couple of noticeable changes.

Firstly, the 3% surcharge on second and holiday homes will now apply to large property investors – initially they had been excluded from the additional charge.

Secondly, the way Stamp Duty is calculated will apply to commercial properties the same way that it does to residential properties. From midnight tonight 0% will be charged on transactions of up to £150,000, 2% on the value of a transaction between £150,001 and £250,000 and 5% on the value above £250,000.

The Chancellor claimed that 90% will see their tax rates fall or stay the same as a result.

Insurance Premium Tax

The Chancellor increased the Insurance Premium Tax back in the Autumn Statement from 6% to 9.5%, and in the Budget he confirmed a further increase to 10%.

The extra £700 million this will raise will all go towards extra flood defences.

Sugar Levy

From April 2018 soft drinks firms will have to pay a levy on drinks with added sugar. There will be two bands – one which will apply to drinks with total sugar content above five grams per 100 millilitres, and a higher band for those drinks with sugar content above eight grams per 100 millilitres.

However, the levy will not need be charged on milk-based drinks or fruit juices.

The money raised will be put into funding for school sports.

Cigarettes and alcohol

Duties on beer, spirits and most ciders will be frozen this year.

Tobacco duty will continue to rise as set out in previous Budgets, moving 2% above inflation from midnight tonight (Wednesday), while hand-rolling tobacco will increase by an additional 3%.

Capital Gains Tax

Capital Gains Tax is charged when you sell an ‘asset’ that has gone up in value. The rate you pay depends on your Income Tax band. Currently basic rate taxpayers pay a rate of 18%, while higher rate taxpayers have to pay a rate of 28%.

From April this is to be cut to 10% for basic rate taxpayers and 20% for higher rate taxpayers.

However, the rates will remain unchanged on residential property and ‘carried interest’ (which is the share of profits paid to asset managers).

National Insurance

Class 2 National Insurance contributions for the self-employed will be scrapped from April 2018.

Currently, the self-employed have to pay Class 2 contributions of £2.80 per week if they make a profit of £5,965 or more per year.

Infrastructure

Infrastructure projects like HS3, which will cut journey times between Leeds and Manchester, and Crossrail 2, have been given the go ahead. The Chancellor announced funding worth a combined £140 million for these projects.

The ‘sharing’ economy

From next April, the Government will introduce two new £1,000 tax-free allowances which cover the ‘sharing’ economy.

The first will cover those people who make up to £1,000 from occasional jobs, such as sharing power tools, providing lift share or selling hoods they have made. No tax will need to be paid on that income.

The second allowance covers the first £1,000 of income made from ‘sharing’ property, such as renting out your home via a site such as Airbnb, renting out your driveway or loft storage.

Help to Save

This was one measure announced ahead of the Budget. It’s a new scheme which the Government hopes will help people on low incomes to start saving more, but it won’t launch until April 2018.

People receiving in-work benefits, like Universal Credit or Working Tax Credits, will qualify for a Government boost to their savings. If you save up to £50 a month, then after two years the Government will bump up your balance by 50%, so as much as £600.

If you save for a further two years, then you can claim another £600 boost from the Government.

Business rates

From April 2017, small businesses that occupy property with a rateable value of £12,000 or less will not be liable to pay any business rates, a doubling of the current allowance.

There will be a tapered rate of relief on properties worth up to £15,000. The Treasury claims that 600,000 businesses will pay no rates as a result.

Picture credit: Hannah McKay / PA Wire/Press Association Images

More on Budget 2016:

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature