NS&I Premium Bonds 60th anniversary: 21 winning facts

How many of these fun facts did you know about Premium Bonds?

To celebrate the 60th anniversary of National Savings & Investments (NS&I) Premium Bonds here are 21 fun facts you probably didn’t know about them.

‘Saving with a thrill’

Premium Bonds are a type of savings account that you can invest in through National Savings & Investments (NS&I). Unlike savings accounts they don’t pay interest. Instead your bonds are entered into a monthly prize draw for the chance to win prizes. Harold Macmillan introduced Premium Bonds in his Budget on April 17 1956, under the banner ‘saving with a thrill’.

I’ll have one of those

The very first Premium Bond was bought by Alderman Sir Cuthbert Ackroyd, the Lord Mayor of London, on November 1 1956 for £1. By the end of the day £5 million-worth had been sold.

Drum roll please

The first Premium Bonds prize draw took place on Saturday June 1 1957, with a prize fund of £82 million. There were 23,000 prizes with a top prize of £1,000.

Still in the running

41,000 Bonds that were sold in November 1956 are still eligible for the draw today.

How things have changed

The biggest prize in 1957 was £1,000. Today it is £1 million and there are two jackpot winners each month. The maximum you could invest 60 years ago was £500, it is now £50,000, while the minimum investment was £1, but today is £100.

Low risk

NS&I, unlike banks, is backed by the Treasury, which means any money you put in is 100% protected. Investing in Premium Bonds is a gamble but it’s a safe gamble with no risk of losing any money.

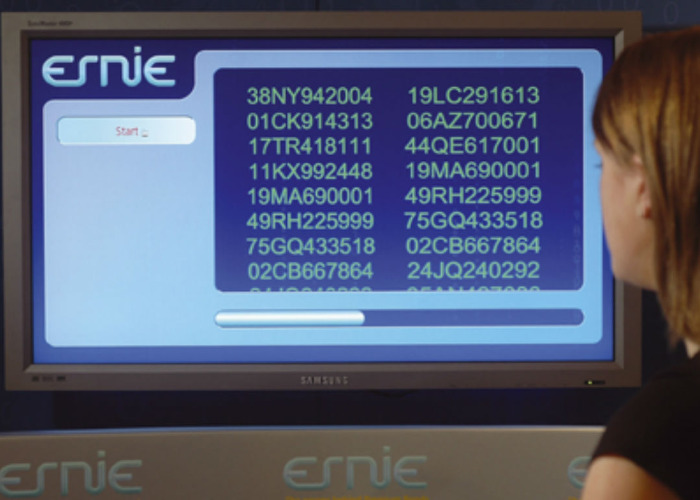

Everybody loves ERNIE

Electronic Random Number Indicator Equipment, aka ERNIE, picks out thousands of winners each month. The machine which dictates who wins what has become something of a national treasure.

Clever ERNIE

ERNIE ensures each and every bond number has a separate and equal chance of winning. The original ERNIE machine was invented by Tom Flowers, one of the Cold War codebreakers at Bletchley Park.

The modern ERNIE

Since 1956, there have been four generations of ERNIE. Advances in technology mean each has become faster and smaller. If ERNIE 1 were still in use today, it would take over 100 days to complete a draw. The current ERNIE 4, introduced in August 2004, only takes around five hours.

Millionaire maker

As of the October 2016 draw, NS&I has given out 353 million prizes since the first draw in July 1957, to the value of £16.9 billion. By November 1 2016 ERNIE will have created 350 millionaires since the first £1 million jackpot was introduced in 1994.

Nation's favourite savings account

Today more than 21 million people hold over £63 billion-worth of Premium Bonds.

In for the long haul

People that invest in Premium Bonds tend to stick with them. According to NS&I, Premium Bonds are held on average for 25 years!

Smallest investment to win big

The smallest Premium Bonds holding to win the £1 million jackpot was £17. That jackpot prize was won in July 2004, and the £3 Bond that won the prize was purchased in February 1959.

The luckiest area

The area that has had the largest number of Premium Bonds millionaires is London with 40 lucky punters winning the jackpot.

Savviest move

In the October 2016 prize draw, one of the jackpot winners – from Essex – scooped the £1 million prize from a £25 Premium Bonds prize that she had won in May 2016 and used to buy more bonds.

Best returns

The highest rate of return on Premium Bonds was between 1 November 1984 and 31 July 1987 where the prize fund rate was 7.75% and the odds 11,000 to one. Currently the prize rate is 1.25%.

Odds of winning

The odds of winning a prize in the Premium Bonds draw each month with one bond is now 30,000 to one. These lengthened in June 2016 from 26,000 to one. Each bond you buy has an equal chance of winning a prize. So the more you buy the better the chances of you winning something.

Tax-free prizes

All prizes won through Premium Bonds are tax-free. That means prizes aren’t subject to UK Income Tax or Capital Gains Tax. So whether you win £25 or £1 million you get to keep it all.

Prize checking

The way that people check and receive their prizes has changed over the years. Holders no longer have to wait for the prize numbers to appear in a newspaper or on Ceefax. Instead they can now go online to the Premium Bonds prize checker on nsandi.com or download the Premium Bonds app, which informs customers if they have won a prize in the latest draw, or in the last six months. loveMONEY also publishes a list of big money winners every month at our Premium Bonds winning numbers page.

Agent million

Premium Bonds prize winners are eventually automatically informed when they have won a prize but those that are lucky enough to win the £1 million jackpot get a visit from ‘Agent Million’, whose identity is kept a secret.

Unclaimed prizes

There are a whopping 1.3 million unclaimed prizes worth a staggering £53.9 million, with winners dating back over 50 years ago. Read How to find your forgotten money and assets for more on how you can go about finding out if you have any and how to claim them.

More on Premium Bonds:

NS&I Premium Bonds: how to buy, cash in, claim lost prizes and more

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature