Depop clothing and fashion app: fees, how to sell and how to shop

Depop is an alternative to eBay Shpock that lets you buy and sell things simply. Here’s what you need to know about buying, selling, fees and more.

Depop is a social shopping app available on iOS and Android.

It offers a simple way to sell your stuff using social media, but is mainly focused on clothing.

Take a photo and list the item on Depop then share it on Facebook and Twitter and wait for someone to buy.

In terms of fees and charges, it’s free to list on Depop but you’ll have to pay them 10% of the total sale price.

The app was launched in Italy in 2011 and is proving popular with the app-savvy, social media addicts of the millennial generation.

More than two million people downloaded the app in the first four years and it now has six million users.

“We have something like 350,000 to 400,000 users a day,” the founder Simon Beckerman says in the Financial Times, “70% of whom are female, and a majority of whom are aged 16 to 26.”

Avoid interest on new purchases with these credit cards

How it works

Depop is like a cross between eBay and Instagram.

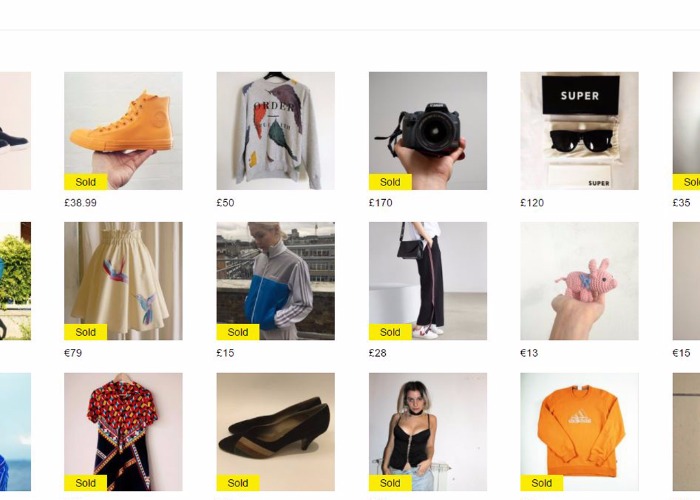

Users post pictures of things they want to sell and once they are sold a little yellow ‘sold’ label appears in the image.

The difference with eBay is once an item has sold the user can choose to keep the picture online so they build up a mass of images that other users can ‘like’ and comment on.

The more followers a user has, the more money they are likely to make from selling items.

Depop fees

The app is free to download and listing an item is also free.

Once you sell something Depop take a 10% fee from the total price.

This is automatically taken from your PayPal account, and you could be charged PayPal fees as well.

Avoid interest on new purchases with these credit cards

How Depop compares to Shpock and eBay

The site is proving popular with fashion bloggers and so there are a variety of high fashion one-off pieces on there, so it could be a quirky place to shop.

Equally, if you are wanting to build up a little online emporium and have the time and skill to take cool photos of your items and build up followers, Depop could be a lucrative hobby.

How likely you are to sell items and how much people will pay though is affected by how many followers you have.

So, if you are just having a household clear out eBay might be a better bet.

Likewise, boot sale app Shpock allows you to sell a far wider range of goods than just clothes.

It's free to use and doesn’t charge any listing or transaction fees However, you can pay to promote an item, with fees ranging from 69p to £13.99.

Read more on loveMONEY:

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature