Four things you didn't know about Premium Bonds

Did you know your odds of winning a million in the Premium Bonds draw fall each month? We look at that, and some of the other surprising facts about the NS&I bonds.

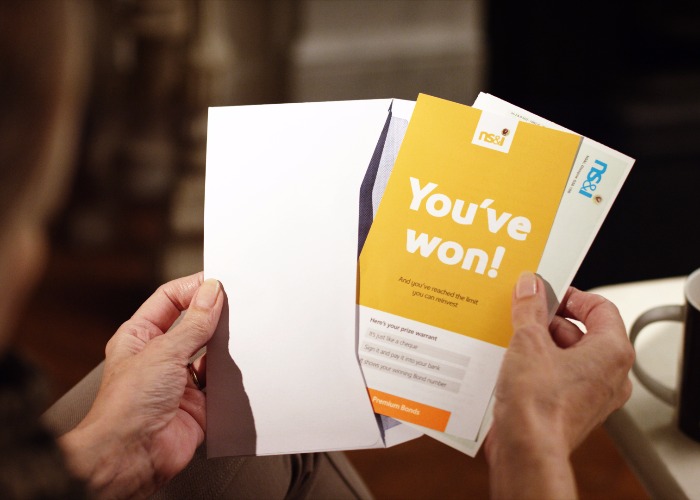

They are the nation’s favourite savings product, with more than 22 million of us buying Premium Bonds.

But, here are four things you (probably) didn’t know about your bonds.

Your odds of winning £1m falls each month...

Spend £100 on your first Premium Bonds this month and you’ll have a one in 356 million chance of winning £1 million. But, if you don’t buy more bonds each month the odds of you winning the jackpot will decrease.

That’s because the number of jackpots rarely rises – two £1 million prizes are given out each month – but the number of people holding Premium Bonds does as more and more people put money in.

For example, the odds of a single bond being selected for a million-pound prize increased from one in 35.4 billion in September to one in 35.6 billion in October. Granted, it's not a huge increase in percentage terms, but it does make that long shot that little bit longer.

Find the best savings account for you

....but your chances of winning £25 increases

In order to maintain the average prize rate of 1.15% National Savings & Investments (NS&I) changes the amount paid out in prizes every month to reflect how many Premium Bonds are held.

But, they don’t tend to increase the number of big prizes.

Instead, they increase the number of £25, £50 and £100 prizes, meaning your odds of bagging a small size could increase slightly.

For example, six months ago in the May prize draw, NS&I handed out 2,240,160 prizes worth £25. In the November draw, the number of £25 prizes had increased to 2,325,993.

Over that six-month period, there was an increase in the number of prizes handed out in the £10,000, £5,000, £1,000, £500, £100 and £50 categories too.

Find out your odds of winning with Premium Bonds

3. The gap is narrowing between savings rates and the payout rate

While you may not receive a straightforward interest rate with Premium Bonds the NS&I does try to keep the average prizes won in line with the interest rates offered by traditional savings accounts.

Ten years ago, the average savings account paid 5.5% annual interest. At that time, the average payout rate on Premium Bonds was 4%.

Even once you factor tax in (remember this was before the Personal Savings Allowance) the average basic-rate taxpayer was getting a 4.4% return on their savings. So, if you had average luck, Premium Bonds still wouldn’t offer the same return as a savings account – but you stood the chance of winning a big prize.

As interest rates have fallen over the past decade so has the average payout rate on Premium Bonds.

Now the gap between the average return on a savings account and the average payout rate is negligible with the average one-year fixed savings account paying 1.14% and the Premium Bond payout rate at 1.15%.

The big difference now is that the payout rate is ahead of the average interest rate.

4. The last time Premium Bonds average rate beat inflation was…

It has been 12 months now since the average prize rate was ahead of inflation. Back in November 2016 inflation was 1.2% and the prize rate was 1.25%.

Since then inflation has more than doubled while NS&I has cut the prize rate leaving an averagely lucky person’s premium bonds spending power shrinking.

Inflation is currently 3% while the Premium Bond payout rate has dropped to 1.15%.

Now that you're better informed about Premium Bonds, why not check out some of the common myths and misconceptions.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature