Contents insurance: a third of us don't have cover

A Government report has revealed that 16 million people don’t have contents insurance. With Christmas approaching here’s how to make sure your belongings, and gifts, are covered.

An astonishing 35% of the population don’t have contents insurance, according to a new report from the Government’s Financial Inclusion Commission (FIC).

The report found that people on low incomes in particular tend to forego home insurance, with 60% of those with an annual income of £15,000 or less not insuring their possessions. This is despite the fact it is this group who can least afford to replace their belongings as they have few, if any, savings.

“Being young, having a low income or living in a rented property are all factors for not having home insurance,” the report says.

A separate study by the Financial Conduct Authority found that 81% of the so-called ‘Generation Rent’ don’t have contents insurance.

The insurance policies you need to have

Access to the information needed to get contents insurance is also a growing problem, according to the FIC. Older people, who don’t have the computer skills needed to tackle the insurance industry’s wide move online, are falling behind with insurance.

The report reveals that almost a fifth of the population say they find the information provided by insurers difficult to understand.

“The findings in this report are a reminder of the challenge we face in furthering financial inclusion,” says Sir Sherard Cowper-Coles, chair of the FIC.

“For many, insurance is an unaffordable or unobtainable safety net. Government must push for a strategy that widens access to quality cover, so that everyone has immediate access to a capital buffer in case of loss.”

How to cut your insurance costs

There are a number of ways you can bring your contents insurance premiums down. Here are three of the best.

- Fit a burglar alarm: It’s an upfront cost but having a working burglar alarm can trim your premium costs as insurers believe it reduces the risk of you being robbed.

- Fit a smoke alarm: Unsurprisingly, taking steps to protect your home from fire will cut your insurance costs as it cuts the risk for insurers.

- Pay upfront: Pay for your insurance annually and you’ll pay a lot less than if you pay monthly. That’s because the insurance firm is effectively lending you the money for your premium and you are paying them back, so they charge you a hefty interest rate. If you can’t afford the whole year upfront put it on a 0% purchase credit card instead. Then you can spread the cost for free. Just make sure you can pay off the cost in full before the interest-free period ends.

Find the best credit card deal today

Festive insurance

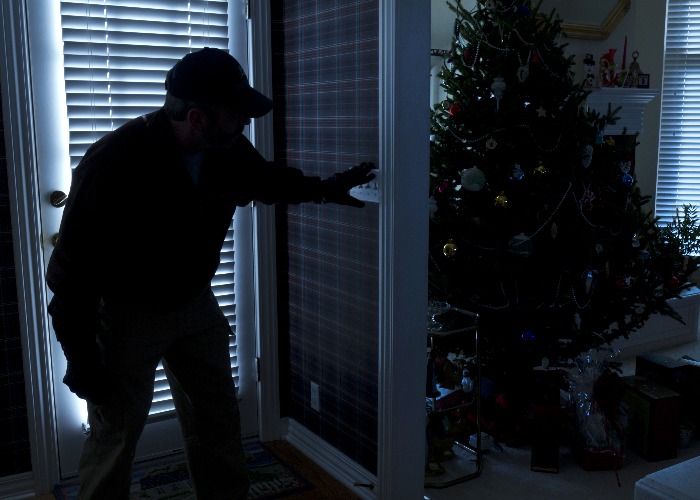

Christmas is an important time to make sure you have contents insurance in place. Presents under the tree can attract burglars and there tends to be more break-ins during the winter months when long dark nights give criminals more opportunities to break in.

Make sure your insurance is up to date and you lock all your doors carefully when you go out and don’t leave any windows open.

Also, after Christmas make sure you add any expensive gifts you’ve received to your insurance policy.

Looking to remortgage? Get a free, no obligation quote with loveMONEY

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature