NS&I Premium Bonds: how winners and prizes are picked

NS&I’s long-running Premium Bonds can make you a millionaire overnight. Here we explain when and how the winners are picked, the security involved, the importance of the prize checker and more.

Premium Bonds are one of the most well-known financial products in the UK, and perhaps the only product to regularly generate public excitement.

Government-backed National Savings & Investments, which issues the bonds, says there are 23 million Premium Bond customers with approximately £2 billion invested.

As regular readers will know, we cover the big prize winners in an article at the start of each month. Most of the time we run that piece, we receive emails and comments questioning the legitimacy of the monthly draw process.

So we thought we'd put together a piece on how Premium Bond winners are picked and respond to your concerns about security and tampering as best we could.

Before we jump in, we should clarify a lot of what we discuss in this is from a Freedom of Information (FOI) request received by the NS&I (and something loveMONEY regular MikeGG1 posted as a comment on an earlier article).

We also caught up with the NS&I to see what additional information they could share, which we have added, but those who have already read the FOI probably know most of what's below.

How are the prizes sliced up?

Your odds of winning a prize is 24,500 to one for each £1 invested.

Bear in mind that the vast majority of prizes awarded are £25 prizes; around 2.988 million of the 3.043 million prizes awarded in April’s draw.

Who picks Premium Bond winners?

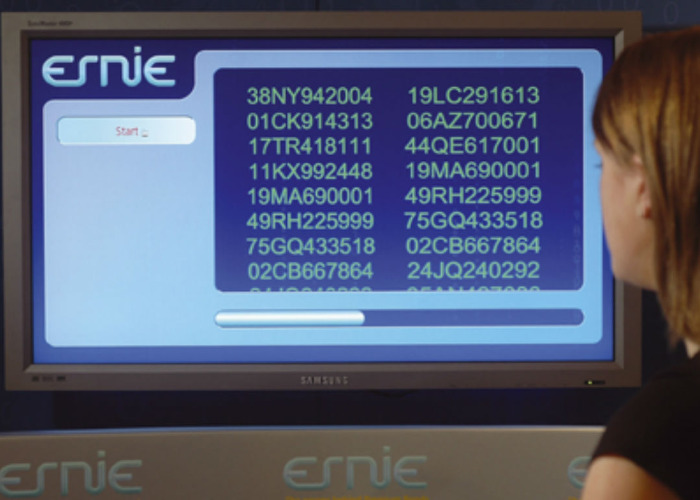

NS&I has a machine which generates random numbers

Called ERNIE (Electronic Random Number Indicator Equipment), it was invented by one of former Bletchley Park code breakers.

ERNIE generates a series of random numbers. Some of these may correlate to Premium Bond numbers but many do not, and these are discarded.

The first and second numbers eligible selected get the £1 million prizes, the third to eighth win £100,000 each and so on.

It is possible for a number to be generated twice by ERNIE; however, only the first appearance will count (earning the higher-value prize) as a single bond can only win one prize per draw.

When do Premium Bond winners get selected?

The selection is made in the last week of the month before the draw.

May’s draw, for instance, was actually made in the final week of April.

This means that if you’re investing in Premium Bonds you’ll have to wait one calendar month before they’re eligible for the draw.

So, if you bought a Premium Bond in the first week of May you’d have to wait until the draw on 1 July.

Is the selection process secure?

According to NS&I, the ERNIE machine cannot be manipulated in any way.

That means ERNIE cannot exclude any numbers – for example, older bonds – or distinguish between any numbers.

The Government Actuary’s Department and the National Audit Office conducts regular and spot-checks of ERNIE, as does NS&I itself.

The process of matching ERNIE’s numbers with actual bonds is also supervised by both offices and security software.

How does NS&I decide what prizes are offered?

NS&I decide the number and breakdown of prizes to reflect the increasing value of the fund and to maintain the current odds of winning.

At present, the target interest rate of the fund is 1.4% and the odds are 24,500 to 1.

The interest rate and odds can be changed by NS&I, which means the value, number and breakdown of prizes are also subject to change.

This has happened recently, in November 2017, when NS&I increased the number of lower-value prizes at the expense of higher-value prizes.

How can you check if you’ve won?

Go to NS&I’s website on the first working day of the month – you’ll need your holder’s number.

You can also use the Prize Checker App for iOS and Android devices.

Here at loveMONEY, we publish a list of prize-winning numbers above £5,000: subscribe to our newsletter to get the results in your inbox.

NS&I contacts every winner using the details they have on file, but in some cases, this will be old addresses and landline telephone numbers that are no longer correct.

You can instruct NS&I to pay bonds straight into your account or automatically reinvest them in more bonds.

If you do neither they’ll send you a warrant (essentially a cheque) to take to your bank branch.

What if I’ve changed address?

NS&I says there is £54m in unclaimed Premium Bond prizes.

The prize checker page on NS&I’s website includes the last six months of draws.

All bond numbers with prizes unclaimed after 18 months are listed in a downloadable document.

Simply enter the document, type Ctrl-F, enter your bond number and search.

If you have an unclaimed prize you’ll need to contact NS&I by post, including your holder’s number, name and address.

You can also ask NS&I for a ‘Bond Record’ of bonds you hold if you have lost your documents and details.

If you change address contact NS&I here.

What happens if you win a big prize?

The lucky winners of the two £1m prizes get personally contacted by NS&I’s ‘Agent Million’.

Prize winners can choose to remain anonymous.

If you’ve won over £5,000 NS&I will send you a form to fill in before you can receive your prize.

Are there better ways of saving?

As it’s impossible to guarantee you’ll ever win a Premium Bond prize, it is difficult to equate with interest rates.

The fund’s rate of 1.4% is not a reflection of what you’ll actually earn, as ultimately it comes down to luck of the draw.

How do I learn more about NS&I

For further demystifying, head this way to read about the four most common Premium Bond myths.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature