Chip app review: savings rates and bonuses, how to invite friends and more

We tried out the Chip app, which automatically takes money from your bank account to help get your saving on track. You can also get a savings bonus when you invite your friends to join.

There’s one big drawback to saving.

Of the many savings accounts out there – and some are better than others – all require some sort of discipline: you’ve either got to actively transfer money, or make sure you can afford regular payments.

The Chip mobile app is one of a new generation of products promising to do your saving for you.

It does this by regularly calculating how much you can afford to save, based on your spending, and withdrawing it into a savings account.

Chip is enabled by open banking, where you can give third parties secure access to your banking data.

In this review we tried out Chip and looked at how it works, it’s effectiveness for savers and the security concerns around open banking.

How does it work?

Chip is a mobile app which you connect to your current account.

After a few weeks monitoring your spending, an algorithm calculates how much you can afford to put away and transfers the money from your current account to an e-wallet account held by Barclays.

You can also choose to manually transfer money like a traditional savings account.

While it does take the 'legwork' out of saving, a big drawback is that money held in your e-wallet doesn’t usually earn interest. However, your money can be easily transferred back to your current account.

You can set savings goals and increase or reduce the amount of money the app takes from your account. You can also pause automatic transfers.

And before you ask, the app can’t accidentally put you into your overdraft, although you can give it permission to do this should you wish.

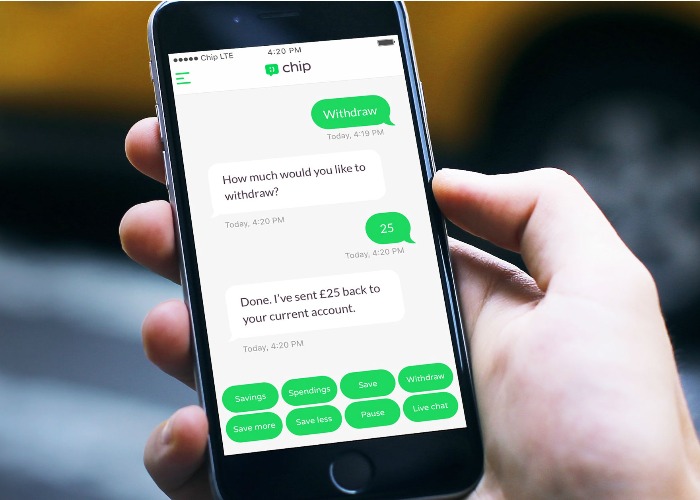

You control Chip using a slightly eccentric ‘chatbot’ which talks you through every option.

Who can get the Chip app?

You’ll need a bank current account: Chip says that the app works with 90% of banks.

These include Barclays, Co-Operative Bank, First Direct, Halifax, Lloyds, Metro Bank, Nationwide, NatWest, RBS, Santander and TSB.

Chip is free to use, with no fees.

What we like

Here’s what we liked about the Chip mobile app:

The Chatbot

A chatbot ‘talks’ you through almost every action on the app.

The experience is like texting an enthusiastic personal assistant, except that instead of writing a text back you select from a range of options.

Whilst the chatbot’s taste for memes and gif’s won’t appeal to everyone, it’s definitely a novel way of banking and is very straightforward.

Depositing and withdrawing money

Chip is much simpler than any banking app we’ve used before – to manually save, for example, you just click ‘save’ and then tell the bot how much, up to a limit of £100 per day and six saves per month.

Withdrawing money back to your current account is just as easy and happens on the same day, making Chip a useful back up for when you’ve got an upcoming payment.

Set up process

The app was easy to set up and took about five minutes; you just need your online banking login details to hand.

Goal setting

You can enter goals on Chip, such as ‘summer holiday’ and the amount you’d like to save.

Chip can then work out how long it’ll take you to save – so if you won’t be able to accumulate your summer holiday money until mid-November it’s time to up your saving.

What we don’t like

Chip doesn’t pay interest

At loveMONEY, we’re constantly writing about ways to beat inflation, so it’s disappointing that the Chip app doesn’t pay any interest.

The only exception is when you invite new people to the app: you can earn 1% on your savings over a year, up to a maximum of 5%.

Rewards and cashback credit cards

If you have a rewards credit card or a cashback credit card and try to do most of your spending on it, then the Chip app may not be so useful.

That’s because your spending patterns won’t be obvious from your current account – all Chip will see is the direct debit to your credit card going out once a month.

Lag time

When you or the app makes a saving, it takes two days to appear in your Chip account: you’ll see it listed as ‘pending’.

Chip says this is a legal requirement, which is in place to give you a chance to cancel the transfer.

Security

Giving your bank login details to a third party app who you’ve never heard of is certainly daunting.

Chip is regulated under the Data Protection Act and by the FCA. CEO Simon Rabin says Chip will “absolutely not” share any data with third parties.

The Chip e-wallet is in a ‘closed loop’ with your bank account, meaning that even if criminals got access to your Chip account they’d only be able to transfer money back to your bank account.

Money in Chip is not covered by the Financial Services Compensation Scheme (please note this guidance has been updated). Although Chip's funds are held with Barclays, as they are in an 'e-wallet' they are not covered by the FSCS.

We would, therefore, recommend you periodically transfer your accumulated Chip savings to a savings account, or take the risk and invest.

Our final verdict

Chip is a well thought-out and useful tool, but until it starts paying interest it can’t be considered a long-term savings solution.

Even on a ‘high’ setting, the automatic saving feature only moved a very small amount of money on my phone, possibly because of the reward credit card problem outlined above.

Instead, Chip’s stand-out feature is that it makes it incredibly easy to manually save money. This took just two taps with no passwords, codes or confusing menus – an approach the banks could learn from.

By making saving so easy, Chip helps you get in the habit. Once you’ve got used to saving, however, you’d be better off using traditional savings accounts that pay interest on your hard-earned cash.

If you already regularly save money, you should instead look at a regular savings account, which can pay up to 5% interest.

You can compare savings accounts here.

What do you think?

Have you got the Chip App? Please share your likes and dislikes in the comment section below.

If you already use mobile banking, read our tips on staying safe and secure

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature