Americans could be significantly poorer because of these threats

The economic headwinds people in the country are facing

COVID-19 woes

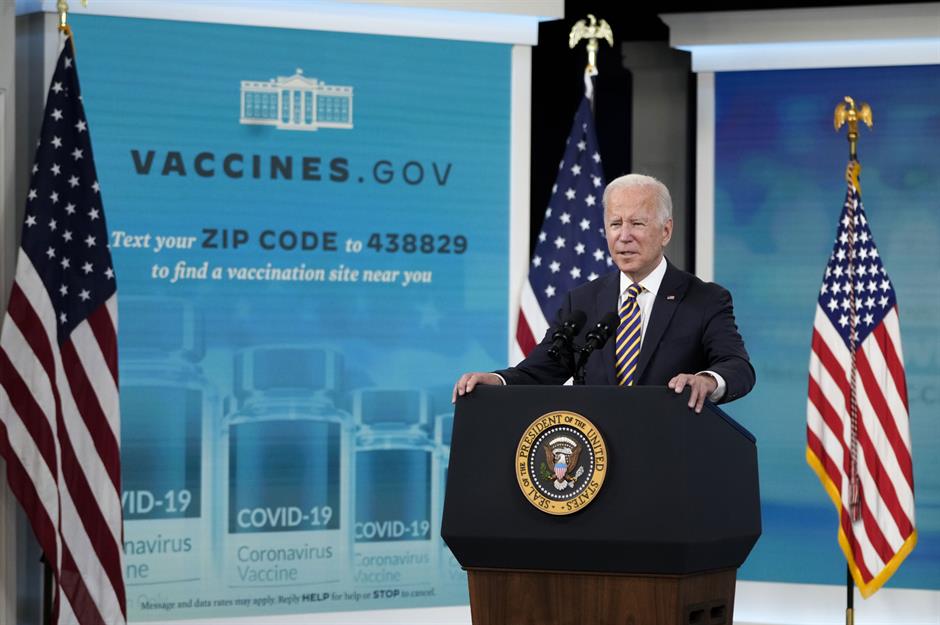

Exacerbated by the highly infectious Delta and Omicron variants – and the reluctance of many Americans to get vaccinated – COVID-19 continues to be a serious threat to the country's economic health.

COVID-19 woes

Among the world's high-income countries, the US is second only to Russia in terms of vaccine hesitancy, with around a quarter of Americans refusing to get inoculated. In some states, including Idaho and Wyoming, less than half the population has received both doses of the vaccine.

COVID-19 woes

Despite a slew of incentives to get the shots – as well as bans on vaccine misinformation on sites such as Twitter, Facebook, YouTube, and TikTok – anti-vax sentiment is still rife in the US. And anti-vaxxers aren't just putting their fellow Americans' health at risk. They're also costing the country dear, with the sluggish vaccination rollout now the biggest drag on the US economy, according to a recent survey of business leaders.

COVID-19 woes

Unvaccinated Americans are up to 12 times more likely to be hospitalized with COVID-19, putting a huge strain on the country's health system and prolonging the general economic disruption. They're estimated to have cost the US health system a whopping $13.8 billion from June to November 2021, while the overall economic impact of the new variants is set to slash GDP growth by $70 billion – a full 1%.

COVID-19 woes

Whether President Biden's sweeping vaccine mandate, which is set to extend to the private sector and cover two-thirds of the country's workforce, will be allowed to mitigate the financial damage that the anti-vax movement is causing remains to be seen. The policy has been described by one prominent economist as “the most powerful economic stimulus ever enacted," but is currently being challenged in the Supreme Court.

Supply chain issues

The ongoing global supply chain crisis is also a major impediment to economic growth, according to the most recent update of the Federal Reserve Board's Beige Book. And it doesn't look as though the situation will improve any time soon.

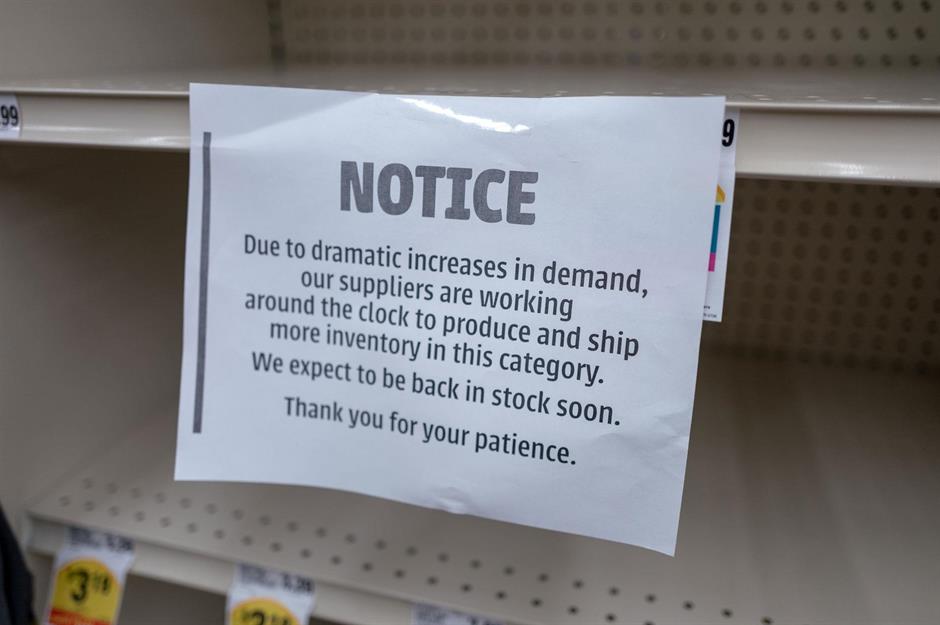

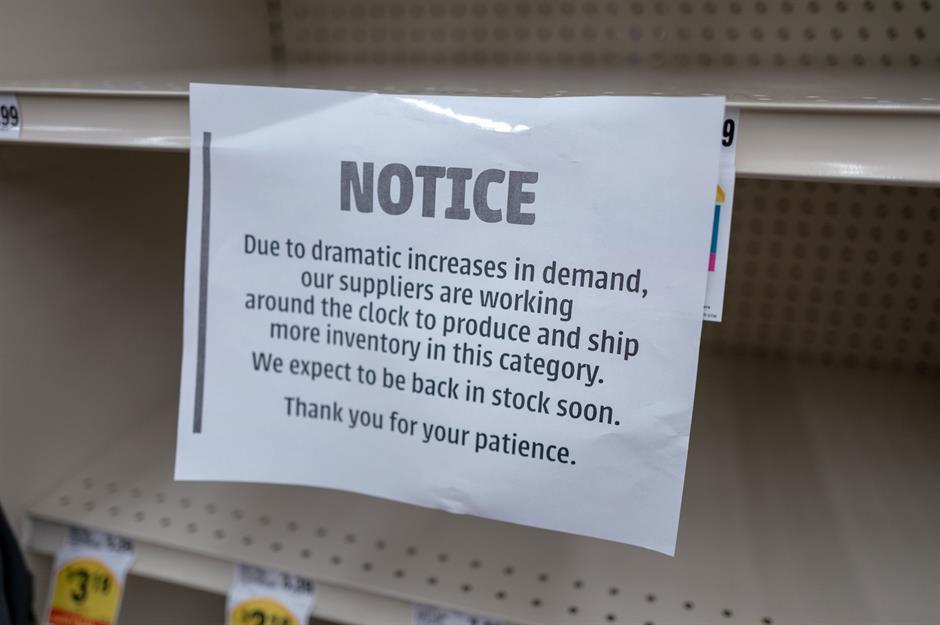

Supply chain issues

There are various factors behind the recent disruption, but in a nutshell it comes down to one simple thing: demand is massively outstripping supply. Many wealthy Americans are currently flush with cash, after holding off from making purchases during the pandemic. Now that people are actually spending the money they've amassed, supply chains are having a hard time coping with the sudden surge in demand.

Supply chain issues

From China to California, the world's ports have experienced major disruption due to COVID-19. To make matters worse, the cost of shipping containers has reached records highs, leading to service rations in some cases. According to Fox Business, the median price of a shipping container hit $20,586 at its highest, more than four times the median price back in January 2021, while the recent holiday period was marred by delays in the global supply chain. (Despite this, holiday sales in 2021 reportedly rose at the fastest pace for 17 years).

Supply chain issues

Other factors that are disrupting the planet's supply chains include severe worker shortages (we'll discuss this shortly), the power crunch halting production in China, the upswing in energy shortages and prices elsewhere, the ongoing dearth of semiconductors, and the worrying rise in mainly climate change-driven natural disasters.

Supply chain issues

Although container prices are starting to plateau, shipping problems are likely to persist through 2022, according to experts. In late October 2021, more than 100 ships were waiting to offload billions of dollars worth of goods outside the ports of LA and Long Beach, which process around 40% of all shipping containers that enter the US. Despite staff working 24/7 to clear the backlog, ongoing delays led to widespread shortages and rising costs, which are being passed on to the US consumer.

Labor shortages

Adding to this perfect storm of economic headaches is the labor shortage that's plaguing America (and many other parts of the world). The pandemic has been the key driver but the issue runs a lot deeper, with additional causes including the aging population, curbs on immigration, and calls for better employment conditions and flexible working arrangements.

Labor shortages

A record 4.5 million Americans bid farewell to their jobs in November 2021, with the phenomenon being dubbed 'the Great Resignation' and 'the Big Quit'. The issue is particularly acute in the hospitality and retail industries but it's also prevalent in sectors such as construction and haulage, which in turn is worsening the supply chain crisis.

Labor shortages

The labor shortage and resulting boom of job vacancies have given the US workforce more leverage than ever. This has resulted in a wave of industrial action. During October 2021, over 100,000 unionized employees went on strike to campaign for better working conditions, nicknaming the movement 'Striketober'. This trend is apparently going to continue in 2022; already, newly unionized workers at Starbucks in New York have formed picket lines to protest against inadequate COVID measures.

Labor shortages

Disgruntled workers from a wide range of sectors formed picket lines, including 1,400 Kellogg's employees, 10,000 John Deere workers, and McDonald's staff in 10 cities across the country. In industries ranging from healthcare to film and TV, tens of thousands of employees have staged walkouts, and this trend is apparently going to continue in 2022. Aready in January, newly unionized workers at Starbucks in New York have formed picket lines to protest against inadequate COVID measures.

Labor shortages

As businesses strive to appease workers and retain their labor force, many hope that increasing industrial action could lead to considerable wage rises. But these rises could potentially be canceled out by one of the other major threats to America's financial wellbeing: high inflation.

Rampant inflation

As demand exceeds supply, inflation rates are surging well above the Fed's target of 2%. The annual inflation rate for the 12 months ending December 2021 was a whopping 7%, the highest level since 1982. In turn, this is putting pressure on household finances and pushing up bills all over the US.

Rampant inflation

As is the case in many countries around the world, energy prices have skyrocketed in the US. By the end of 2021, oil prices had hit a seven-year high, having risen more than 65% since the start of the year. Meanwhile, the average price of gasoline hit $3.48 and prices were around $1.24 higher than they were in 2020. What's more, natural gas has more than doubled in price over the past six months. On 4 January, the Organisation of Petroleum Exporting Countries (OPEC) announced it will be sticking to plans to increase its oil production by 400,000 barrels a day, but many economists believe prices will remain high through 2022.

Rampant inflation

As well as spending more money to fill up their cars, Americans will have to pay a premium for electricity, along with oil and natural gas to heat their homes over the coming months. According to the Energy Information Administration, households that use natural gas can expect to pay out 30% more this winter compared to previous years.

Rampant inflation

And it's not just energy price that are rising. The cost of groceries rose 6.5% last year, while bills for restaurant meals increased by 6%, apparel by 5.8%, new cars by 11.8%, and used cars by a huge 37%. House prices and rental costs have also soared. Some business leaders warned that the US was heading for hyperinflation – however, the central bank was remarkably sanguine about the situation at first.

Rampant inflation

To tackle the current inflation rates, the Fed announced on 3 November 2021 that it would start reducing its monthly bond purchases of $120 million by around $15 million. It also planned to reduce its $40 billion monthly mortgage-backed securities purchases by $5 billion in November and December. According to CNBC, officials intend to accelerate this reduction further at the start of this year, while early projections have suggested the Fed will see three rate hikes throughout the rest of 2022.

Climate concerns

A record number of billion dollar-plus natural disasters struck America in 2020, while an unprecedented 18 separate billion dollar-plus weather calamities hit the country in the first nine months of 2021 alone. Worsened by climate change, the increasing number of weather-related disasters has already dented the wallets of countless Americans.

Climate concerns

The megadrought affecting California shows no sign of abating, still going strong despite recent snowfall in the state. Almost half of the state is experiencing exceptional drought, while 100% is suffering abnormally dry conditions. The long-range forecast is for drought conditions to continue or worsen as La Niña weather patterns persist, which would affect food prices and increase the risk of catastrophic wildfires in the spring.

Climate concerns

Plus, droughts elsewhere in the country have threatened wheat supplies, which could have a knock-on effect on the prices of bread, pasta, and other wheat products. As well as hoping for rain in the drought-stricken parts of the nation, budget-minded Americans should also be keeping their fingers crossed for a warmer than average winter.

Climate concerns

As we've mentioned, the Energy Information Administration has predicted that natural gas bills will rise by 30% this winter – but this will obviously depend on the weather. If the winter is colder than average, bills could jump by as much as 50%. If the winter is milder than expected, bills could shoot up by 'only' 22%, which is nonetheless cold comfort for squeezed householders.

Climate concerns

Accuweather's winter forecast has predicted a warmer than average season for the East, interior Mountain West, and California, with much of the Upper Midwest colder than normal. Meanwhile, the National Oceanic and Atmospheric Administration foresees a colder than typical winter in the Northwest, which would make it an expensive season for Northwesterners.

Geopolitical headwinds

Another key threat to the financial wellbeing of America is the country's ongoing fractured trade relationship with China. A recent report by Fitch Solutions has revealed that rising tensions between China and Western countries, particularly the US, could lead to slower growth, higher inflation levels, and increased economic volatility over the coming years.

Geopolitical headwinds

The financial information firm predicts that a new 'Cold War' between the US and China will develop, triggered by four main areas of tension: ideological differences, industrial competition, military strength, and geopolitics. These bones of contention could become increasingly challenging to resolve.

Geopolitical headwinds

In early October 2021, the Biden administration confirmed that America's tough economic approach toward China, a legacy of President Trump, would continue. Officials have said that the government won't be lifting tariffs on Chinese goods and the People's Republic will remain accountable for trade commitments made during the Trump years. By the end of November, Biden had added around a dozen Chinese companies to the nation's blacklist due to concerns over security and human rights.

Geopolitical headwinds

US trade representative Katherine Tai slammed Beijing for not sticking to the promises it made to the Trump administration. She stated that the US government would “defend to the hilt” the country's economic interests and take “all steps necessary” to protect the American economy from what it sees as unfair trade practises. This could include imposing further trade tariffs.

Geopolitical headwinds

On the other hand, Tai did strike a somewhat conciliatory tone by saying that the US would ditch a plan to make China reform its “non-market economy”. It will also allow American firms to apply for exemptions from trade tariffs on Chinese imports. Even so, the trade conflict with China isn't going anywhere fast and could make the average American considerably poorer, should the predictions from Fitch Solutions come to pass.

Now take a look at America's debt in numbers

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature