What is America's debt ceiling, and why does it matter?

Biden's big headache

America's finances are in crisis. On Monday, Treasury Secretary Janet Yellen sounded the alarm, warning that unless the government suspends or raises the "debt ceiling," the country could run out of cash by the end of the month.

But what even is the debt ceiling, and why could it spell catastrophe for America? Read on to find out. All dollar amounts in US dollars.

America's massive debt

First let’s take a look at America’s government debt today. The government gains revenues each year from taxes, customs duties, and various other sources. Meanwhile, it spends money to cover services such as Medicaid, social security, and the military. So far, so good.

But each year, the government spends much more than it takes in, leaving it with a deficit. That deficit has fluctuated between $400 billion and $3 trillion each year over the past decade. Over time, this yearly deficit has built up into a massive mountain of debt. As of 3 May, America's debt stands at a jaw-dropping $31.7 trillion.

As we’ll see, plenty of countries have billions or trillions of dollars of debt without a crisis. So why is America’s debt a problem?

Smashing the ceiling

America's $31.72 trillion debt is an issue because it exceeds the nation's so-called "debt ceiling" – the maximum amount the government is allowed to borrow by law, which is currently set at $31.4 trillion.

President Biden raised the debt ceiling back in December 2021 because exceeding it could signal America's inability to repay its debts – known as a government default – and that could spell turmoil for international markets and the US economy.

But if this is a risk, why does America set a debt limit in the first place?

Sponsored Content

Debt nation

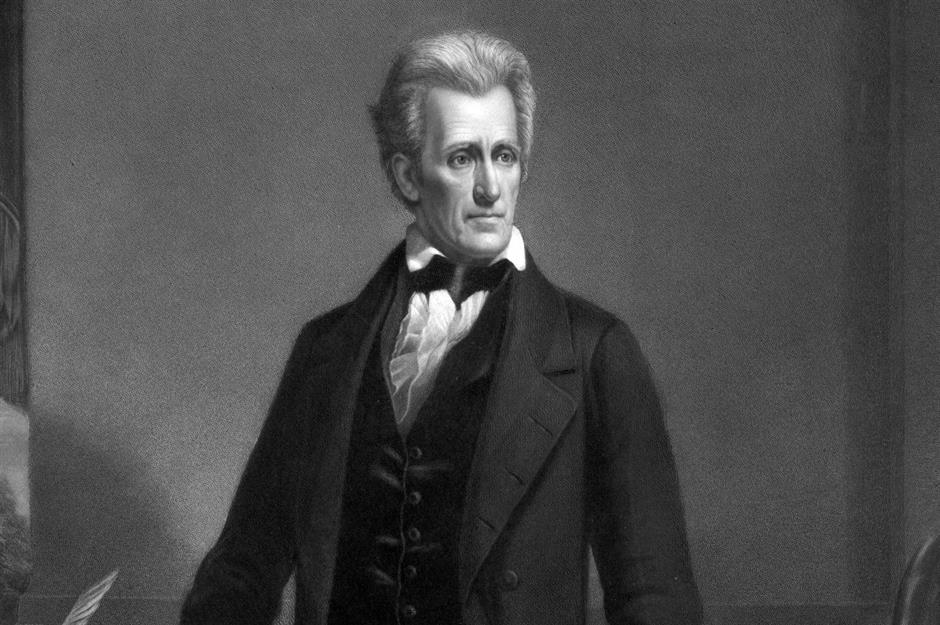

Stretching back in time, the US has been in debt more or less since its formation in 1789. In its 232-year existence, the country has only ever been in the black once. President Andrew Jackson, who served from 1829 to 1837, loathed being in the red and called it the "national curse." He went all out to settle the country's dues, and as a result America was totally debt-free from 8 January 1835 to 1 January 1836.

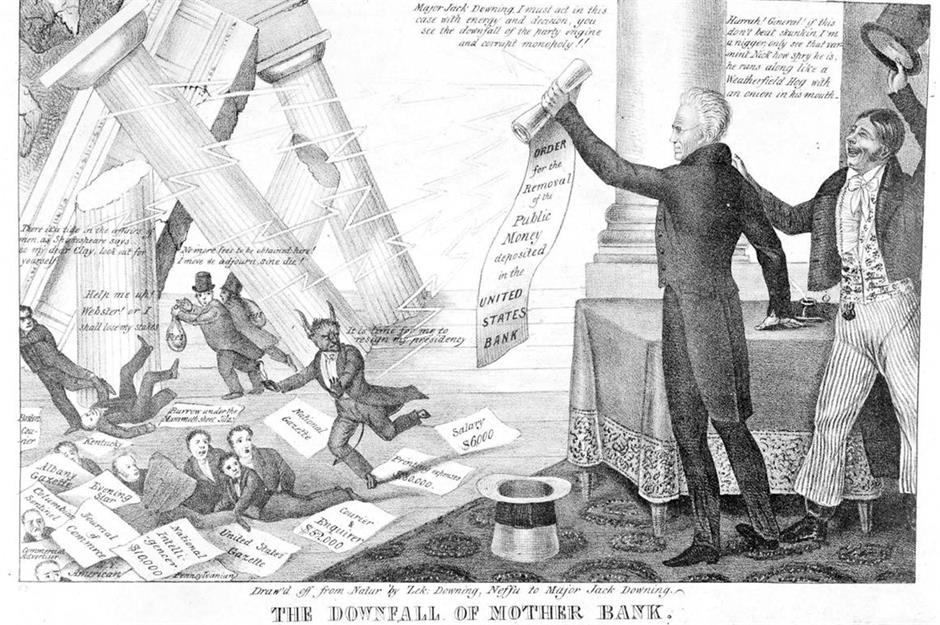

Unintended consequences

Jackson's financial clean-up backfired spectacularly, however. The land he sold off in the West to help pay off the debt, coupled with his abolition of the national bank, led to a real estate bubble. Spending and borrowing also span out of control. These factors contributed to the Panic of 1837 and the subsequent economic depression. In almost no time at all, America was up to its eyeballs in debt once more.

Fluctuating debt

Since then, the national debt has varied wildly, rising significantly during wars and recessions, and dropping back down considerably in peacetime and periods of economic growth. When comparing past debt levels, economists look at the ratio of national debt to gross domestic product (GDP; essentially the country's output), which offers the best indication of how indebted a country really is.

Sponsored Content

Wartime dues

Before the COVID-19 pandemic struck, America's highest debt-to-GDP ratio was recorded in 1946, during President Truman's first term. The US had recently emerged from World War II, which was the country's most costly conflict when figures are adjusted for inflation. In 1946, the debt-to-GDP ratio stood at 119%, up from 44% in 1941, which was the year that the nation entered the war.

Postwar prosperity

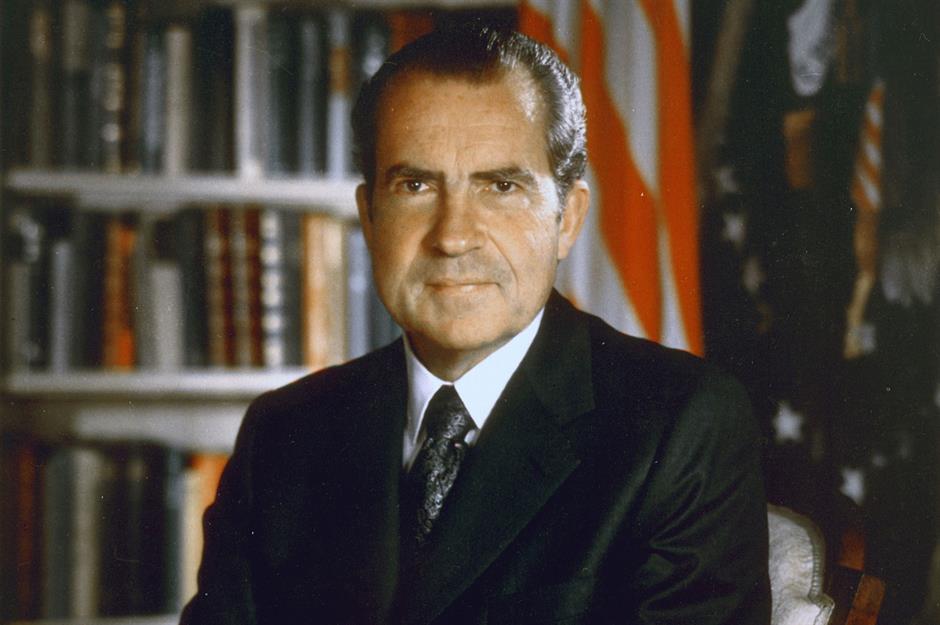

Over the next few decades, the ratio steadily fell again, dropping to just 31% in 1974 under President Nixon's administration. It then rose again by several percentage points over the course of the late 1970s and 1980, before falling again to 31% under President Reagan in 1981. From then on, however, the ratio began to rise, hitting 64% in 1996.

21st-century expenses

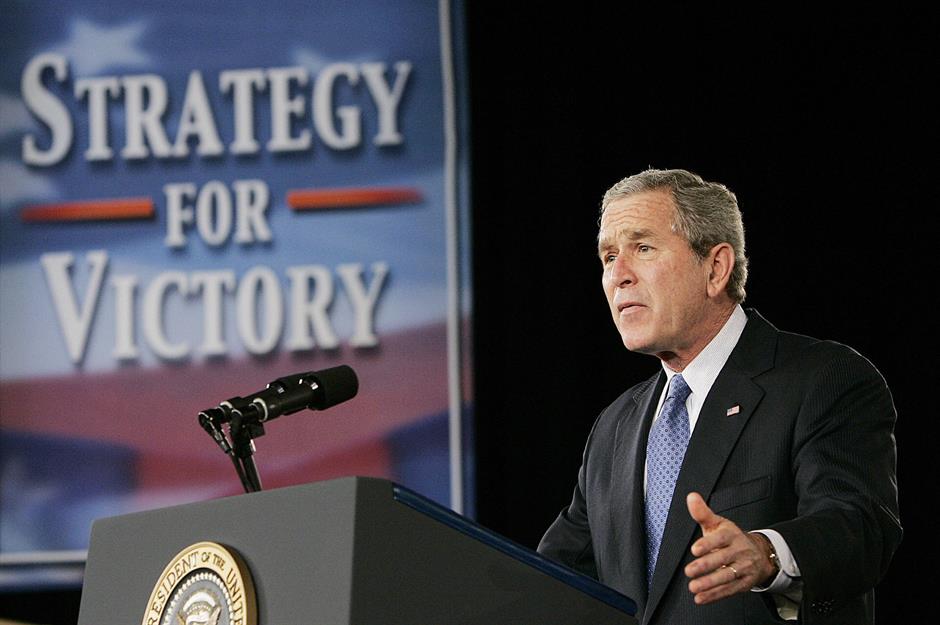

President Clinton's welfare reforms, the recovery from the early 1990s recession, and a range of other positive financial factors helped the ratio drop down again during the late 1990s and first couple of years of the 21st century. However, the War on Terror and the 2008 financial crisis pushed it up again. In 2008, the ratio came in at a painful 68%, and by 2015 it sat at 100%.

Sponsored Content

Rising debt

The ratio has increased year on year, bar 2015 and 2017 when it dropped one percentage point from 101% and 105% respectively. COVID-19 and its associated expenditure and recession led to a massive spike in 2020, with the country's debt-to-GDP ratio hitting a record 129%. The figure fell slightly in 2021 as the US economy started to emerge from the pandemic. But, at 125% in November that year, it remained exceptionally high.

Fortunately, the steep rise in the ratio seems to have come to an end. The figure today sits at just under 134%, according to the US debt clock.

Indebted nations

The US is far from being the world's most indebted country in terms of debt-to-GDP, sitting in a global position of 11th place, according to World Population Review. Japan and Venezuela lead the way, with ratios trending around 262% and 241% respectively, followed by Sudan with 182%, Lebanon with 172%, and Greece with 171%.

World leader

Be that as it may, America's total national debt of over $31.7 trillion is by far the highest on the planet. In fact, it's more than double the national debt of China, which currently owes around $14.39 trillion according to World Debt Clocks.

Putting this into context, the US national debt is greater than the size of the Chinese, Japanese, German, and UK economies combined.

Sponsored Content

Two categories

Breaking it down, America's national debt is divided into two categories: debt the government owes to itself ("intragovernmental holdings"), and debt held by the public. The latter consists of debt owed to foreign governments and investors, US investors, the Federal Reserve, mutual funds, state and local governments, pension funds, hedge funds, and so on.

Intragovernmental holdings

Right now, about $6.76 trillion of the grand total is intragovernmental holdings – money the Treasury owes to other federal agencies that buy Treasury notes with excess money generated from taxes. The largest holder of Treasury notes is the Social Security Trust Fund, followed by the Military Retirement Fund.

Public debt

The bulk of the debt, around $24.69 trillion, is public. Foreign governments and investors are owed the largest share, adding up to over $7.4 trillion as of January 2023. This figure hit a record high in July 2021 and has continued to climb.

Sponsored Content

Who's bought American debt?

According to figures from January, Japan is the biggest foreign holder of American debt, with just over $1.1 trillion. Next up is mainland China with nearly $860 billion, the UK with $668.3 billion, and Belgium with $331.1 billion. Luxembourg, Switzerland, the Cayman Islands, Canada, Ireland, Taiwan, India, Hong Kong, and Brazil all also hold over $200 billion of US debt.

Debt per person

According to the US National Debt Clock, the total national debt works out at $247,766 per taxpayer and $94,769 for each American citizen. The total interest paid on the grand total amounts to a whopping $3.73 trillion, which equates to $14,390 for each adult in the country.

Debt burden

Of course, this doesn't bode well for the average American. The growing debt burden is likely to put untold pressure on the nation's finances, which could result in drastic cuts to spending. Additionally, it could trigger steep tax rises across the board, which would significantly impact the quality of life of people in the country.

Sponsored Content

Key contributors to the debt

So what actually contributes most to the national debt? Government spending is the major factor, which is why cutbacks could be needed in the future to get it under control.

Medicare, Medicaid, and other healthcare programs consume the most, totaling about $1.56 trillion. This is followed by social security and military spending, which account for $1.28 trillion and $783.5 billion respectively.

Tax cuts

Tax cuts also contribute in a massive way to the national debt, as they mean there's less money for government spending and balancing the books.

In recent times, cuts instigated by George W Bush and Donald Trump during their presidencies have both drained the public purse, helping to push up the debt total. The wars in Iraq and Afghanistan, as well as other military interventions, have also been key contributors.

Lifting the ceiling

The debt ceiling was introduced in 1917 by Congress. Since 1960, it's been raised 78 times: 49 times under Republican presidents and 29 times during Democratic administrations. It's never been lowered.

Before Biden raised the debt ceiling in December 2021, the former limit was a major concern. And now that it's broken the latest ceiling of $31.4 trillion, America is in trouble once more...

Sponsored Content

Limit limitations

The limit was introduced to curb government spending, as well as to make the powers-that-be fiscally responsible.

As well as allegedly holding the government to account financially, another advantage of having such a limit was increased efficiency. But there are plenty of downsides too. Congress has to approve any rises, which can create serious problems if the opposing party refuses to play ball.

Congress opposition

If Congress had threatened to block the rise in December 2021, the government would have had to resort to a process called budget reconciliation, which is complex and protracted. This brings with it risks of miscalculation, and the Treasury would also have had to invoke "extraordinary measures" when the limit approached. Such measures include suspending new investments and redeeming existing investments early.

Unconstitutional limit?

There's also an argument that the debt ceiling could be unconstitutional. According to the 14th Amendment: "the validity of the public debt of the United States, authorized by law … shall not be questioned." In essence, this means that any serving president could potentially use the 14th Amendment to bypass the debt ceiling. Although this has never happened, past presidents, including Clinton and Obama, have toyed with the idea – and The New York Times reported this week that Biden's aids are currently exploring this option too.

Sponsored Content

Ineffective tool?

Having been raised every time the maximum was reached, it's debatable whether the debt ceiling is really all that effective. Other countries seem to get by without a limit: in fact, Denmark is actually the only major nation apart from the US that has one. The Danish ceiling is set exceedingly high, which avoids the sort of issues America often encounters.

Economic pain

When Congress leaves it until the 11th hour to raise the limit, borrowing costs for the Treasury increase, affecting the finances of the country. In 2011, for example, the Government Accountability Office estimated that costs went up by $1.3 billion that year due to Congress's hesitancy to raise the debt ceiling. The nation's overall credit rating can also be impacted.

X date

The debt ceiling was suspended in August 2019 after the passing of the Bipartisan Budget Act of 2019. The suspension expired on 31 July 2021, when the limit was reset at $28.4 trillion. The so-called "X date," the date when the Treasury's extraordinary measures and cash reserves run out, was then estimated to occur in the fall.

Sponsored Content

The trillion-dollar coin

A potential solution to America's problem? A trillion-dollar coin. An idea that found fame on social media sites such as Twitter, sparking the hashtag #MintTheCoin, this plan proposes that the US Treasury takes advantage of a 1997 law that gives it the power to mint platinum coins of any denomination.

By minting a coin big enough to pay off its considerable debts, the country could simply write off its losses – or so some economists have argued. Treasury Secretary Janet Yellen has branded the controversial coin a "gimmick" and dismissed the idea.

Catastrophic consequences

In the absence of the trillion-dollar coin, the executive has always managed to get Congress to pass a debt ceiling increase. According to the Treasury, inaction "would have catastrophic economic consequences," causing the government to default on its debts, precipitating a financial crisis that would threaten the jobs and savings of Americans, and ultimately making everyone in the country a whole lot poorer.

Economic fallout

Both White House and Moody's analyses paint a disturbing picture of what could have happen if the debt ceiling in't increased. Welfare and other federal government payments could be "endangered," with the basic functioning of the government such as maintaining defense, national parks, and other public areas at risk. Additionally, the US healthcare system, which is already stretched after battling COVID-19 for two years, would struggle to function adequately.

Furthermore, real GDP could decline by 4%, the dollar would weaken, and the stock market could tank, wiping $15 trillion off US household wealth. Six million Americans could have been made jobless, rates for credit cards, loans, and mortgages could have spiked, and the country would likely have fallen into a deep recession. The resulting ripple effect could last for years as financial markets would lose faith in the US, with the country's credit rating downgraded long-term.

So is America headed for economic meltdown? Watch this space.

Now take a look at America's boomtowns today

Sponsored Content

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature