A history of gold: from star dust to global obsession

The glittering tale of this prized precious metal

From ancient civilisations to modern economies, gold has played a crucial role in the history of humankind and remains a symbol of wealth, power, and prestige to this day. But why did humans start prizing gold – and why are countries and consumers alike still scrambling to get their hands on some?

With the price of gold hitting record highs of over $4,000 (£3k), read on to discover the fascinating story of the enduring valuable commodity.

All dollar amounts in US dollars

Gold's cosmic origins

Gold's origin story goes way back to before the formation of the solar system. Scientists believe it was created thanks to supernovae and the collision of neutron stars, which means gold is essentially star dust. Along with elements like iron and copper, the precious metal is believed to have formed almost 13 billion years ago following the explosion of a star 25 times more massive than the sun.

Although gold was present on Earth from the very beginning, this original metal sank to the core when the planet formed 4.6 billion years ago. Then, around 3.9 billion years ago, the young Earth was bombarded with gold-rich meteorites. This newly arrived gold remained in the crust, making it accessible to future civilisations.

Gold is discovered by our ancestors

Gold was most likely the first metal known to early hominids, who would have encountered it in rivers, creeks, caves, and dry soils in the form of nuggets and particles. As renowned geologist Robert Boyle has noted, our ancestors would have been undoubtedly attracted to the metal's beauty and then become hooked when they discovered its malleability and virtual indestructibility.

Adding to its allure, gold is scarce and doesn't tarnish or rust. Together, these attributes make it a highly desirable material, with its popularity enduring through millennia.

Sponsored Content

First gold artefacts

Pieces of gold have been found in Spanish caves used by Palaeolithic people around 40,000 BC. However, the earliest definite gold artefacts (pictured) are from Bulgaria's Varna Chalcolithic Necropolis burial site and date from between 4600 BC and 4200 BC.

Gold objects in the form of jewellery and other adornments likely made their debut in Ancient Egypt not long after, around the end of the fifth millennium BC and the start of the fourth millennium BC. They also appeared in the Middle East and parts of Asia, including India, during the early part of the fourth millennium.

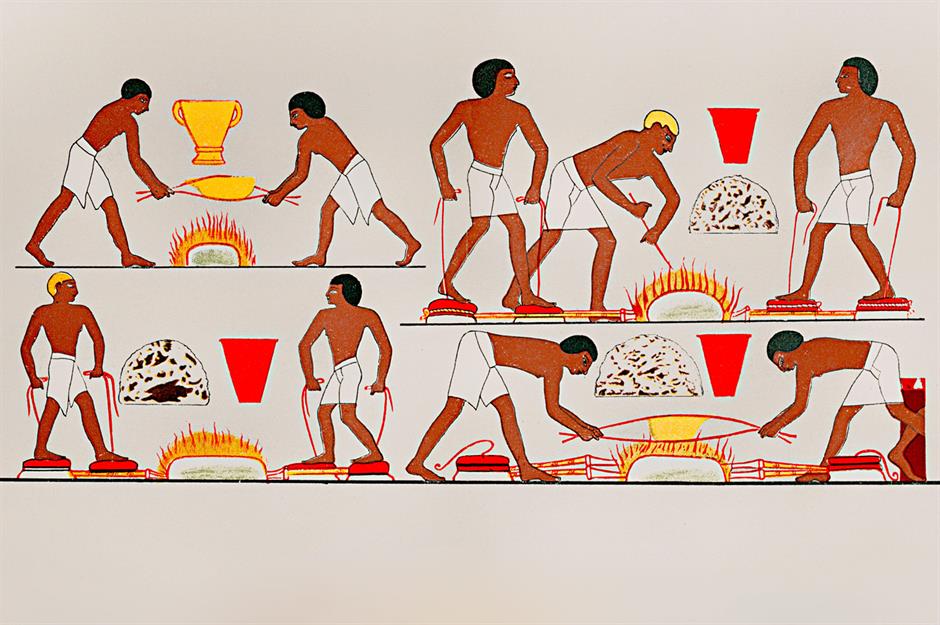

First known gold mine and evidence of smelting

The Sakdrisi site in Georgia is claimed by some to be the first known gold mine. It dates from the fourth or third millennium BC. But the evidence for this is inconclusive, and archaeologists haven't been able to pinpoint with certainty when proper gold mining began.

On the other hand, the earliest evidence of smelting – the extraction of the precious metal from its ore by heating and melting – is confirmed. It dates back to Ancient Egypt in around 3600 BC.

Gold's Bronze Age boost

While it's named after another metal, the Bronze Age – the period from around 3300 BC to 1200 BC – was a golden era for gold.

The precious metal was embraced by civilisations worldwide, from Ancient China to pre-Columbian America and far-flung parts of Europe. (In fact, more Bronze Age gold hoards have been found in Ireland than anywhere else on the continent). But Egypt was number one globally during this time...

Sponsored Content

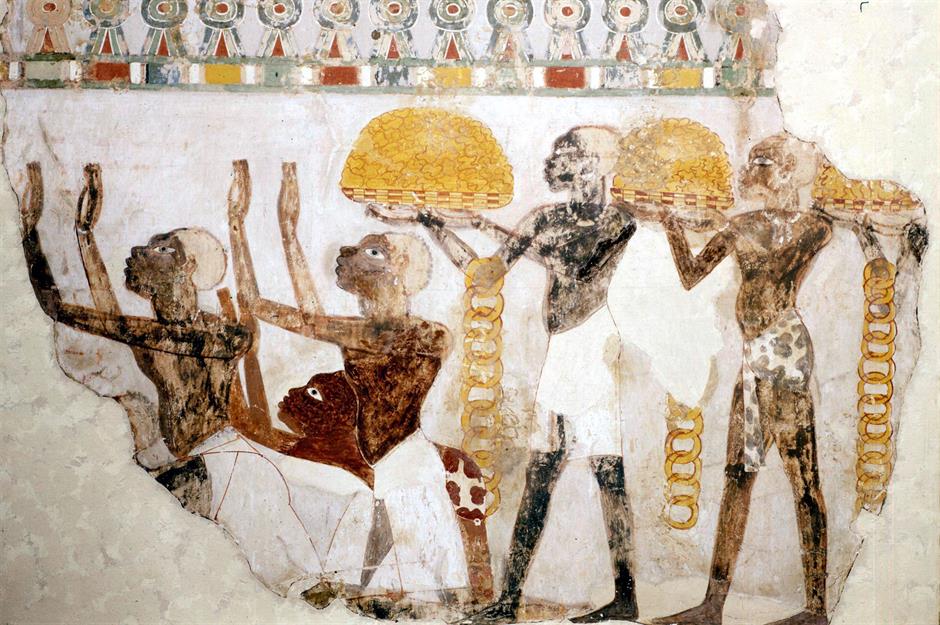

Ancient Egypt's many gold firsts

Ancient Egypt is credited with the first mention of gold, which appeared on hieroglyphs around 2600 BC. Around 1900 BC, during the 12th Dynasty, the ancient civilisation also became the first to mention gold in writing. By the reign of Tutankhamun (around 1332 BC to 1323 BC), gold mining had become a major industry. The pharaoh was buried with 260 pounds (118kg) of gold and his iconic funerary mask (pictured) is dripping in the precious metal.

The so-called 'Goldmine Papyrus', one of the earliest geological maps and the oldest to have survived, was also produced in Ancient Egypt. Dating from the middle of the 20th Dynasty, around 1150 BC, it makes reference to a key gold mine in Nubia.

Nubia's vast gold resources

Nubia, which was located south of Ancient Egypt in southern modern-day Egypt and much of modern-day Sudan, was the civilisation's main source of gold. In fact, the name Nubia in the Ancient Egyptian language was the same as the word for gold.

Successive cultures, including the Kerma Culture and Kingdom of Kush, became very rich indeed during the Bronze Age courtesy of the gold mines in their territory.

First gold alloy coins are minted

As early as the second millennium BC, Assyrian merchants were trading gold from Asia Minor, while Ancient Egypt made gold the first official medium of exchange for international trade in around 1500 BC. Ancient Greek and other Mediterranean cultures followed suit.

The first gold coins, in fact the first coins in existence, were minted around 640 BC in the Kingdom of Lydia in modern-day Türkiye. The kingdom is associated with Midas, the semi-mythological king who, as legend has it, was granted the power to turn everything he touched into gold. The earliest coins were actually composed of electrum, a natural alloy of gold and silver.

Sponsored Content

First pure gold coins are minted

The first pure gold coins were minted in Lydia during the reign of King Croesus, who ruled from 561 BC to 547 BC. The simile “as rich as Croesus” is a common phrase in English used to describe someone extremely wealthy, a testament to the enduring power of gold.

Interestingly, the legend of the golden fleece from Greek mythology is said to be based on the practice of collecting gold in sheepskins.

Roman obsession with gold

The Romans introduced increasingly sophisticated and efficient techniques for mining gold, including hydraulic mining, the use of heat to extract the ore, and other clever innovations.

From the reign of the first Emperor Augustus, who ruled from 27 BC to 14 AD, gold in the form of the aureus coin became the central pillar of Roman currency, making the commodity highly sought after across the Roman Empire.

West Africa's medieval golden empires

During the Middle Ages and the Renaissance, West Africa was the source of gold for much of the Old World. From 700 to 1600, three great African empires, Ancient Ghana, Mali, and Songhai, amassed enormous wealth and power from trading gold. In the medieval era, around 60% of Europe's gold came from West Africa and gold from the region was exported even further afield.

At the helm of the Mali Empire in the early 14th century, Mansa Musa controlled much of the world's gold supply during his illustrious reign. Unsurprisingly, the African ruler was absolutely rolling in it and is widely considered the wealthiest person who ever lived. According to one estimate, the emperor's net worth was the equivalent of around $550 billion (£410bn) in today's money, almost $70 billion (£52bn) more than the fortune of Elon Musk, the world's current richest person.

Sponsored Content

The Inca and Aztec Empires' abundant supplies of gold

The Inca and Aztec Empires of Central and South America, along with various other pre-Columbian cultures, had access to immense quantities of gold. In the early 1500s, the volume of gold in the Inca Empire was almost 14 times greater than all the gold in Europe, according to National Geographic.

Yet, being plentiful and common, gold wasn't highly regarded in these cultures. The Incas put a higher price on feathers and the Aztecs, whose name for gold was teocuitlatl, which translates to 'excrement of the sun god', valued cacao more. Other cultures, including the Maya, prized jade above gold.

Gold fuels Spanish colonisation of the Americas

The Spanish, however, thought very differently. The Spanish conquest was largely fuelled by the desire to purloin the large reserves of gold and silver in the Incan and Aztec Empires.

Beginning in 1492, Spain's colonisation of the Americas flooded Europe with gold and silver to such an extent that it destabilised the continent's economy. Between the late 15th century and early 17th century, Europe was plagued by the Price Revolution, a period of high inflation and sharp declines in the value of currencies caused by the influx of Spain's looted gold and silver.

Gold drives European colonisation

Indeed, the search for gold was a major factor driving European exploration and colonisation. Christopher Columbus was actually setting out to find Japan, which he dubbed the Land of Gold, when he chanced on the Americas, and historians have long used the term God, Gold, and Glory to summarise the key motives for European colonisation. ('Gold' also represents the trading of other commodities such as spices, as well as – troublingly – the buying and selling of enslaved people).

Sponsored Content

Royal gold crowns

Royalty and gold have been linked for thousands of years, though the oldest crown in existence, which was discovered in Israel and is up to 6,400 years old, is made from copper.

Among the oldest surviving gold crowns are the Golden Crown of Byblos, which dates from 1800 BC, and the misleadingly named Iron Crown of Lombardy (pictured). This ancient European crown is around 2,000 years old. The oldest in use is the Swedish monarchy's King Erik XIV's Crown, which dates from 1561.

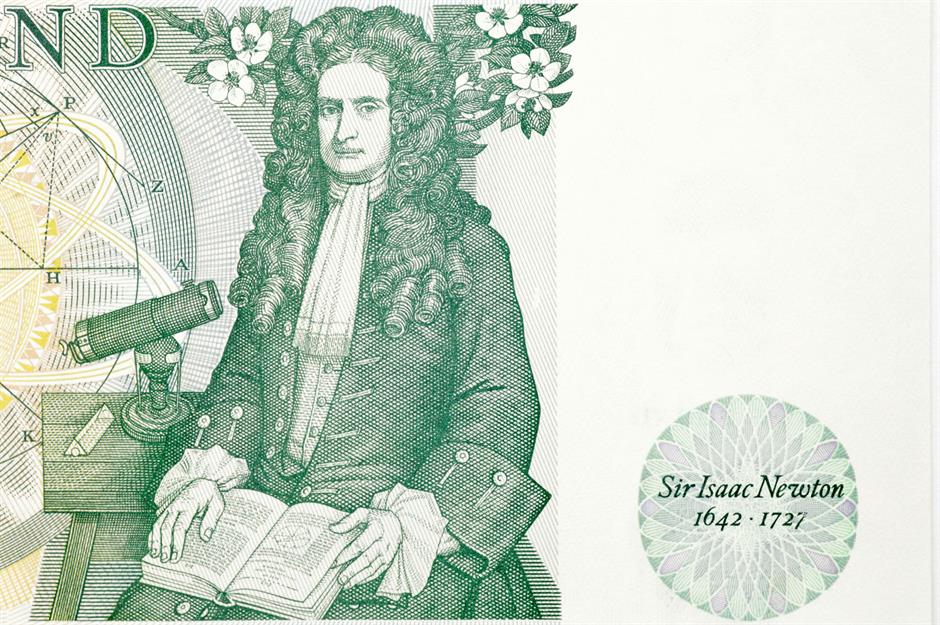

The UK adopts the gold standard

The importance of gold to the global economy soared when governments began using it to control the value of their currency. Master of the Mint Sir Isaac Newton started the process in England in 1717 when he accidentally set the price of silver too high, which boosted the comparative appeal of gold. Around a century later, in 1819, the UK became the first country to adopt the gold standard, tying its currency to the price of the precious metal.

Germany followed suit in 1871, and the US in 1873. The gold standard quickly became the basis for the international monetary system, and nation after nation began to adopt it.

Major cities built on gold rushes

The 19th century saw a succession of frenzied gold rushes as new discoveries of the precious metal drew fortune hunters from far and wide, made possible by improved travel connections and cheaper fares. The first and arguably most famous is the California Gold Rush, which started in 1848 and ended around 1859. This was followed by many more across the US, Canada, Australia, New Zealand, South America, and South Africa.

Gold rushes drove the creation of major cities such as San Francisco (pictured here in 1851) and Denver in the US, Perth in Australia, and Johannesburg, South Africa's biggest city.

Sponsored Content

The Bretton Woods system puts the US dollar in front

But the glory days of gold hit troubled waters in the 20th century. The Great Depression spelt the demise of the gold standard, which ended up proving to be a hindrance rather than a help since it was exacerbating unemployment and other issues. The UK bailed in 1931, abandoning the currency convention it had pioneered.

After the Second World War, gold's importance to the global economy was further downgraded following the adoption of the Bretton Woods system, agreed upon at the Bretton Woods Conference in 1944, which effectively put the US dollar at the centre of the global financial system.

The end of the gold standard

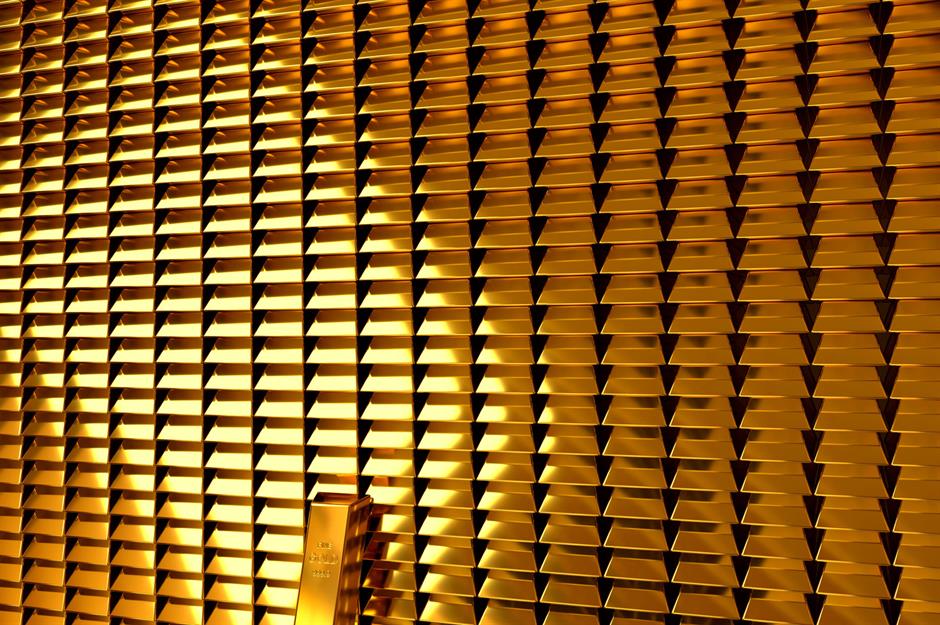

The death knell came in 1971 when the US finally ditched the gold standard. These days, no government or central bank pegs its currency to gold, but the precious metal still plays a major role in the global economy. Many countries keep large reserves of gold to help stabilise their currencies and protect them during periods of volatility.

The value of gold tends to be stable, immune from inflation, and solid in times of crisis, which is when investors typically flock to the asset and bump up its price. The gold standard may be no more, but the precious metal is still widely regarded as the ultimate store of value.

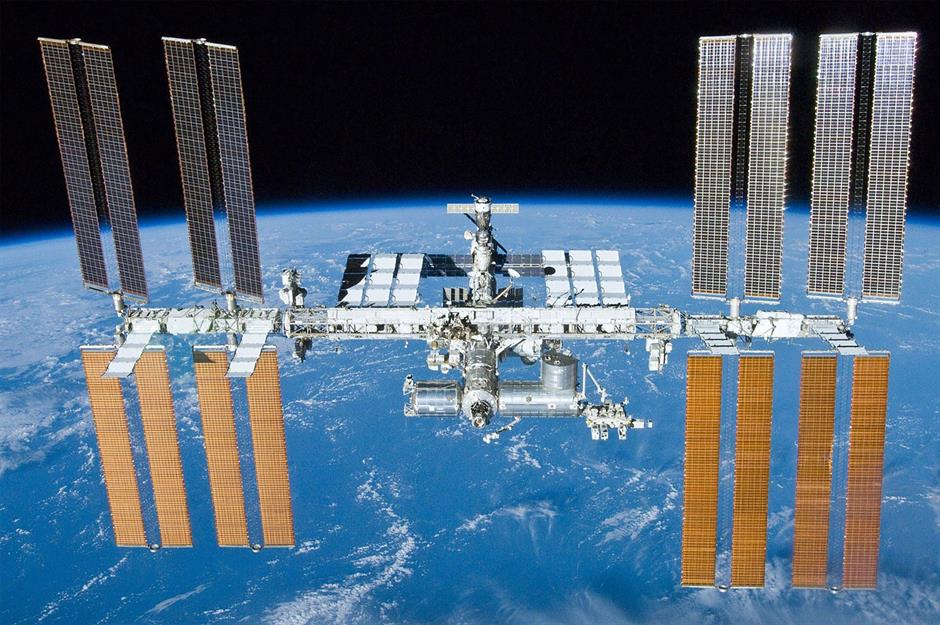

Gold's many uses today

Today, gold has many applications. In addition to its financial uses (bullion, coinage, exchange rate reserves, and other financial instruments) and the pivotal role it plays in the jewellery industry, gold is also essential for many modern technologies and is widely used in advanced electronics and space exploration.

The precious metal finds numerous applications in dentistry and modern medicine too, and it's even used to treat certain illnesses and disorders, including cancer and rheumatoid arthritis.

Sponsored Content

How much gold is there in the world?

Despite its enduring popularity, gold is relatively rare. According to the United States Geological Survey (USGS), a total of 187,000 metric tonnes (206,132 US tons) has been mined to date. All the gold discovered so far could actually fit in a cube 75 feet wide (23m) on each side. Considering there are 57,000 metric tonnes (62,832 US tons) left to extract, all the gold in the world amounts to 244,000 metric tonnes (268,964 US tons).

It's been estimated that a further $5 trillion (£3.9tn) worth of gold is still waiting to be extracted, though the recent price spike means this number is now considerably higher. By way of comparison, the total US government expenditure for the 2024 fiscal year amounted to $6.75 trillion (£5.1tn).

Which countries produce the most gold these days?

China leads the way in gold production. The People's Republic now produces around 10% of the world's gold, according to the USGS. In 2024, it extracted approximately 380 metric tonnes (419 US tons).

Australia and Russia are the next biggest producers – they each produced roughly 300 metric tonnes (331 US tons) in 2024. Canada takes the number four spot with 200 metric tonnes (220 US tons), while the US completes the top five, producing 160 metric tonnes (176 US tons) last year. Other major producers include Kazakhstan, Mexico, Indonesia, and South Africa.

Which countries consume the most gold these days?

In terms of financial reserves of the precious metal, the US leads the world with 8,133 metric tonnes (8,965 US tons), followed by Germany with 3,350 metric tonnes (3,693 US tons) and Italy with 2,452 metric tonnes (2,703 US tons). But many other countries, including Kazakhstan and Russia, have been bolstering their gold reserves in recent years. So why is much of the globe becoming more gold-hungry than ever?

Sponsored Content

The global gold spree

The global gold spree, which is driving the price of the precious metal to record highs, has been caused by a melting pot of factors. As we mentioned previously, investors turn to gold as a comparatively safe investment in times of economic uncertainty. Considering the shocks that have rocked the world's wallet in recent years – COVID-19, the Russian war in Ukraine, soaring inflation – it's not surprising that countries and consumers alike are snapping up the commodity. Russia itself has been buying gold to compensate for Western sanctions that have hit the nation's economy hard, adding approximately $40 billion (£30bn) worth of the metal to its reserves in recent years.

In China, meanwhile, the collapse of the country's property sector has sent demand for gold through the roof. Many people's savings were tied up in real estate. With a lack of alternative investment opportunities, gold (typically in the form of ingots, coins, jewellery, or tiny 'beans') has emerged as a popular hedge for everyday citizens.

What's next for gold?

In September 2024, investment bank Goldman Sachs predicted that the price of gold would continue to climb in 2025, hitting record highs early this year. Strategists highlighted the ongoing conflict in Ukraine, US Federal Reserve rate cuts, and "potential geopolitical shocks" as factors that could drive the price to new heights of $2,700 (£2k) per troy ounce. But the precious metal defied expectations, hitting that number three months early. As previously mentioned, it's currently trending at record highs of over $4,000 (£3k).

It may be one of the world's oldest commodities, but gold will undoubtedly continue to surprise us.

Now discover the most valuable substances on Earth

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature