Mind-boggling mega-mergers that were stopped in their tracks

Daniel Coughlin

31 July 2018

The most epic scrapped mergers and acquisitions

TNS/SIPA USA/PA

Closing a mammoth merger of equals or mounting a successful hostile takeover can be fraught with problems, ranging from regulatory issues to public opposition and resistance from board members and shareholders of the target company. As a consequence, many potential deals are dropped, despite the best intentions. Here are the biggest non-starters of all time, adjusted for inflation.

30. Clariant & Huntsman in 2017: $20.6 billion (£15.7bn)

Courtesy Clariant

A merger of equals, Swiss chemicals colossus Clariant's marriage to America's Huntsman was fought tooth and nail by activist shareholders. In the end, both companies amicably agreed to abandon the misjudged merger.

29. Deutsche Börse & London Stock Exchange Group in 2016: $27.3 billion (£20.8bn)

Wiktor Dabkowski/DPA/PA

The proposed merger of Deutsche Börse and the London Stock Exchange Group was scuppered in 2016 by EU regulators, who ruled the tie-up between the German and British financial institutions would create an unfair monopoly.

Sponsored Content

28. Mylan & Perrigo in 2015: $27.6 billion (£21bn)

Steve Heap/Shutterstock

In April 2015, Netherlands-based generic drugs company Mylan attempted negotiations with the board of Irish pharmaceutical firm Perrigo to buy the company. When the talks collapsed, Mylan mounted a hostile takeover, but was unable to acquire the $26 billion (£19.8bn) of stock needed to complete the deal.

27. PPG Industries & AkzoNobel in 2017: $27.8 billion (£21.2bn)

TY Lim/Shutterstock

Major players in the global paint and coatings market, America's PPG Industries attempted a takeover last year of Dutch multinational AkzoNobel that never happened. The Netherlands-based firm, which makes Dulux paint, concluded the deal would restrict growth and gave it the thumbs down.

26. Emerson Electric & Rockwell Automation in 2017: $29.8 billion (£22.6bn)

Power Best/Shutterstock

US factory automation equipment maker Emerson Electronic failed in its third attempt last year to snag Milwaukee-based competitor Rockwell Automation and create an industrial robotics titan. Rockwell snubbed the final offer, saying the deal undervalued the company and would impede its growth.

Sponsored Content

25. Johnson & Johnson & Guidant in 2004: $33.9 billion (£25.9bn)

Sundry Photography/Shutterstock

Johnson & Johnson withdrew its initial offer for US medical device maker Guidant in 2004 following a scandal over the company's defibrillators, then re-entered the fray, but lost out in 2006 when Boston Scientific made an overinflated bid for Guidant that was enthusiastically accepted.

24. Omnicom & Publicis in 2014: $37.3 billion (£28.5bn)

Bertrand Langlois/AFP/Getty

The proposed coming together of New York's Omnicom and Paris-based Publicis in 2014 would have resulted in a global advertising force to be reckoned with, but the transatlantic companies just couldn't get the process to work and agreed to ditch the $35 billion (£26.6bn) deal, blaming tax and regulatory issues.

23. Qualcomm & NXP Semiconductors in 2016: $38.9 billion (£29.6bn)

VGG via Getty

The long-running Qualcomm and NXP Semiconductors takeover saga ended in July 2018 after antitrust regulators in China refused to approve the deal. The US chip maker had also drawn the ire of activist shareholders, who argued the Dutch firm was undervalued.

Sponsored Content

22. Aetna & Humana in 2015: $39.3 billion (£29.9bn)

Katherine Welles/Shutterstock

Two of America's largest health insurance companies Aetna and Humana closed the deal on a $37 billion (£28.2bn) mega-merger in 2015, only to be thwarted by a US federal judge, who ruled the tie-up would kill competition and do “irreparable harm” to the country's health insurance sector.

21. Halliburton & Baker Hughes in 2016: $39.9 billion (£30.4bn)

Douglas Mack/Shutterstock

Halliburton had to ditch its $38 billion (£28.9bn) takeover of rival Baker Hughes in 2016 following opposition from US and EU antitrust regulators. The powers that be expressed concerns the merger of the leading oil field services companies would reduce competition and innovation, and hike up prices.

20. EchoStar Communications & Hughes Electronics in 2002: $40.6 billion (£30.9bn)

Shaul Schwarz/Getty

US satellite broadcaster EchoStar Communications would have cornered the American market if its 2001 acquisition of competitor Hughes Electronics had come to pass. Instead, the deal was fiercely opposed by antitrust regulators and came crashing down to Earth.

Sponsored Content

19. Teva Pharmaceutical Industries & Mylan in 2015: $42.5 billion (£32.4bn)

Israel's Teva Pharmaceutical Industries was dead set on buying Netherlands-based rival Mylan in 2015, but the Dutch company was far more interested in trying to snap up Perrigo and turned its nose up at the $40 billion (£30.4bn) offer.

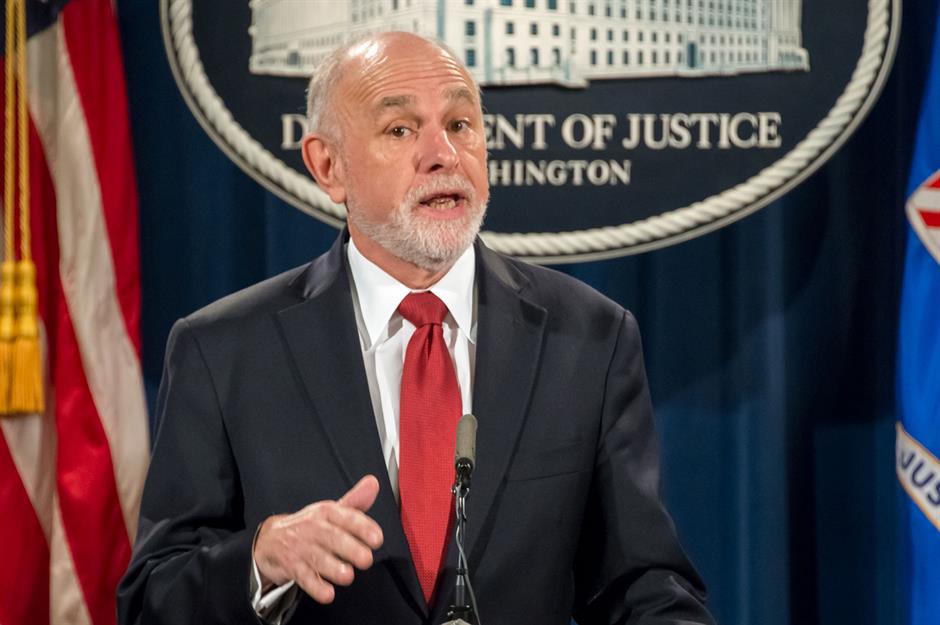

18. AT&T & T-Mobile USA in 2011: $43.7 billion (£33.3bn)

Saul Loeb/AFP/Getty

The coming together of two of America's largest telecommunications companies was never going to sit well with antitrust regulators. Needless to say, the US Department of Justice stepped in to block the 2011 merger of AT&T and T-Mobile USA over concerns the coupling would stifle competition in the market.

17. Comcast & Time Warner Cable in 2014: $48.1 billion (£36.7bn)

Mark Wilson/Getty

US antitrust regulators rained on Comcast's parade in 2014 when they threatened to file a lawsuit barring the cable TV company's acquisition of rival Time Warner Cable. Their hands tied, Comcast executives had no choice but to withdraw the $45.2 billion (£34.4bn) offer and walk away.

Sponsored Content

15. EADS & BAE Systems in 2012: $49.4 billion (£37.6bn)

Johannes Eisele/AFP/Getty

When EADS attempted to purchase Britain's BAE Systems in 2012, the pan-European aerospace company, which is now known as Airbus, met with vehement opposition from shareholders as well as the UK, French and German governments, and the deal failed to get off the ground.

15. Monsanto & Syngenta in 2015: $49.4 billion (£34.6bn)

Lucarista/Shutterstock

Executives and shareholders at Swiss agrichemicals and seed producer Syngenta were less than impressed in 2015 when US competitor Monsanto attempted to mount a hostile takeover of their firm. Wary of the widespread opposition, Monsanto ultimately abandoned the deal.

14. Anthem & Cigna Corp in 2015: $50 billion (£38bn)

Lonnie D Tague/Zuma Press/PA

The proposed hook-up of US healthcare insurance companies Anthem and Cigna in 2015 went the same way as Aetna & Humana's ill-fated merger plans when US regulators blocked the deal, concerned it would reduce competition in the market.

Sponsored Content

13. AbbVie & Shire in 2014: $57.5 billion (£43.8bn)

Kris Tripplaar/SIPA USA/PA

American biopharmaceutical company AbbVie dropped its planned takeover of Dublin-headquartered drugmaker Shire in 2014 after a change in the US tax laws penalised American firms undertaking mergers that reduce their domestic tax liabilities, known as 'tax inversions'.

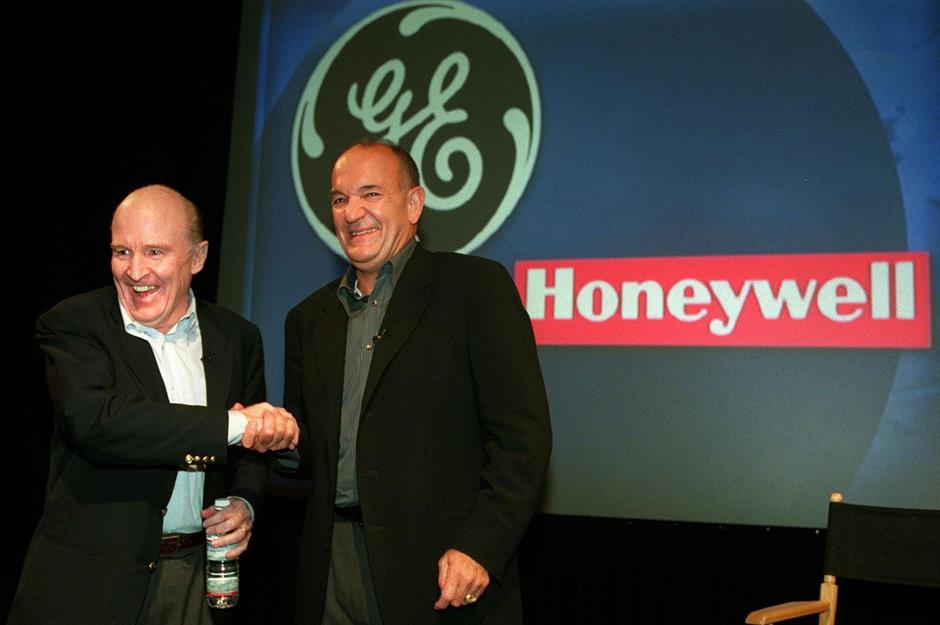

12. General Electric & Honeywell in 2001: $59.8 billion (£45.6bn)

Doug Kranter/AFP/Getty

US conglomerates General Electric and Honeywell planned to merge in 2001, but the deal fell foul of EU antitrust regulators and had to be canned. The European authorities were concerned the tie-up would reduce competition in the aerospace industry.

11. Comcast & 21st Century Fox in 2018: $65 billion (£49.5bn)

Richard B. Levine/SIPA USA/PA

Last month, Comcast muscled in on Disney's hotly anticipated takeover of 21st Century Fox, sparking an intense bidding war. In the end, Disney won out, outbidding the cable TV company by some $5 billion (£3.8bn).

Sponsored Content

10. 21st Century Fox & Time Warner in 2014: $85.2 billion (£64.9bn)

Drop of Light/Shutterstock

Rupert Murdoch's 21st Century Fox was on the receiving end of a knockback in 2014 when its less than amicable takeover of Time Warner was met with derision by the company's board, who refused to talk to Fox executives.

9. Comcast & Disney in 2004: $88 billion (£67bn)

Stephen Chernin/Getty

Comcast locked heads with Disney when it tried to crash the Fox deal. Like a spurned lover, Comcast has been a bitter rival ever since the cable company attempted a hostile takeover of Disney in 2004 that was firmly rebuffed.

8. Wyeth & Warner-Lambert in 2000: £95.1 billion (£72.5bn)

I Viewfinder/Shutterstock

In 2000, Wyeth launched a $65 billion (£49.6bn) bid for rival US pharmaceutical company Warner-Lambert but was pipped at the post. Pfizer, which had partnered with Warner-Lambert on the bestselling statin drug Lipitor and was concerned the collaboration would be threatened, launched a hostile takeover, nixing the deal.

Sponsored Content

7. United Technologies & Honeywell in 2016: $95.2 billion (£72.5bn)

Testing/Shutterstock

US industrial aerospace supplier United Technologies has been trying to hook up with rival Honeywell for years but just can't make it happen. The latest offer of $90.7 billion (£69.1bn) in 2016 was turned down by Honeywell executives on the grounds it undervalued the firm.

6. Broadcom & Qualcomm in 2018: $121 billion (£92.3bn)

TNS/SIPA USA/PA

After tendering three proposals, Broadcom lost its bid to buy rival US chip maker Qualcomm earlier this year. The deal was eventually panned by the Trump administration, which cited national security concerns.

5. Pfizer & AstraZeneca in 2014: $130.9 billion (£99.9bn)

Oli Scarff/Getty

Pfizer's hostile takeover of British-Swedish pharmaceutical competitor AstraZeneca was resisted by politicians in the UK as well AstraZeneca shareholders and board members, who believed the deal undervalued the business.

Sponsored Content

4. Kraft Heinz & Unilever in 2017: $147 billion (£112.2bn)

Marco de Swart/AFP/Getty

Kraft Heinz came a cropper in February 2017 when, out of the blue, the US conglomerate attempted a takeover of British-Dutch consumer goods multinational Unilever. The $143 billion (£109.1bn) bid was speedily rejected by Unilever executives, and quietly withdrawn the following day.

3. Pfizer & Allergan in 2015: $170.1 billion (£129.8bn)

Kris Tripplaar/SIPA USA/PA

After the hostile takeover of AstraZeneca collapsed, Pfrizer tried its luck attempting to buy competing Irish-based pharmaceutical firm Allergan in 2015 for an eye-watering $160 billion (£122bn) but was hindered yet again, this time due to the changes in US tax inversion rules.

2. BHP Billiton & Rio Tinto in 2008: $173.2 billion (£132.1bn)

Adwo/Shutterstock

The two British-Australian mining giants attempted to merge in 2008, but had to call it a day when commodity prices crashed. The proposed merger was to have occurred slap bang in the middle of the worst global financial crisis since the Great Depression.

Sponsored Content

1. MCI WorldCom & Sprint in 1999: $195.1 billion (£148.8bn)

Doug Kanter/AFP/Getty

The biggest business deal in history to have gone awry, American telecommunications titan MCI WorldCom made a bumper $111 billion (£84.7bn) bid for competitor Sprint back in 1999 which, while gigantic, was actually rejected for being too small.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature