American companies that went from bust to boom

US brands that bounced back

It's all too easy to assume that some of America's biggest and most iconic brands have enjoyed nothing but smooth sailing over the years.

But the road to glory can have countless twists and turns along the way, with many US-born companies facing failure before they hit the big time.

Read on to discover which big-name American companies have gone from bust to boom over the years, and find out how, exactly, they did it.

Converse

Chuck Taylor was a basketball player who joined lifestyle brand Converse as a salesman in 1922.

He proved to be a huge asset to the company and even lent his name to the brand's Chuck Taylor All-Stars line of sneakers. "Chucks" quickly became the most popular shoe in American athletics, particularly favored by the National Basketball Association (NBA).

However, after decades at the top, Converse started to lose its appeal, with brands such as Puma and Adidas proving to be tough competition.

Despite Converse becoming the official footwear sponsor of the 1984 Olympic Games – and the US basketball team scoring an Olympic gold while wearing Converse sneakers – Chucks hadn't been worn by the NBA since 1979.

Converse

In January 2001, nearly a century after the company was first founded, Converse Inc. filed for bankruptcy.

The organization started to restructure and sold its Massachusetts headquarters for $15.4 million in a bid to reduce its debt, which is the equivalent of around $25.5 million today.

In 2003, Nike, one of the rivals that had contributed to Converse's weakening position in the market, offered to buy the company for $305 million.

Sponsored Content

Converse

.jpg)

Nike took Converse under its wing. It revolutionized the brand's image through advertising, changing its association from basketball to rebellious pop culture figures such as James Dean and Janis Joplin.

Converse began to flourish once more, with Nike opening standalone stores for the brand. As an affiliate brand of Nike, Converse generated $2.2 billion in revenue in 2021 and $2.3 billion in 2022.

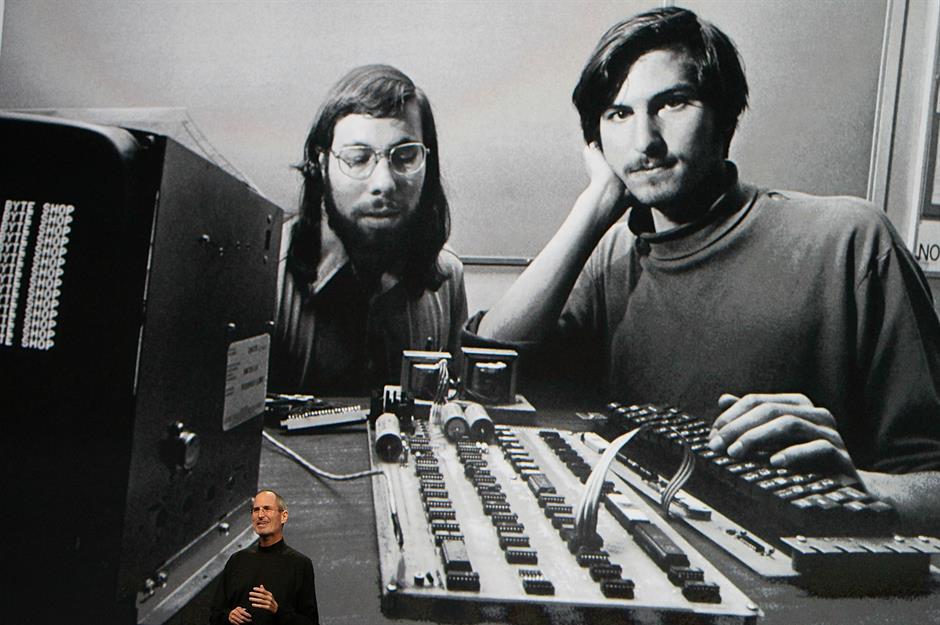

Apple

Steve Jobs and his computer programming partner Steve Wozniak launched Apple in 1976. It went from strength to strength – until Jobs was pushed out and the company failed to innovate.

By 1996, Apple was teetering on the edge of bankruptcy. Poorly managed, the tech company found itself facing severe financial problems, an overabundance of substandard products, and an operating system that was in desperate need of an update.

Apple

The team eventually responded by bringing Steve Jobs back into the fold. He returned to the company in 1997 as interim CEO, and Apple accepted a $150 million cash injection from rival Microsoft, which is the equivalent of around $273.5 million today.

Although the move helped Apple to become a global phenomenon and key competitor, it also paid off handsomely for Microsoft.

Sponsored Content

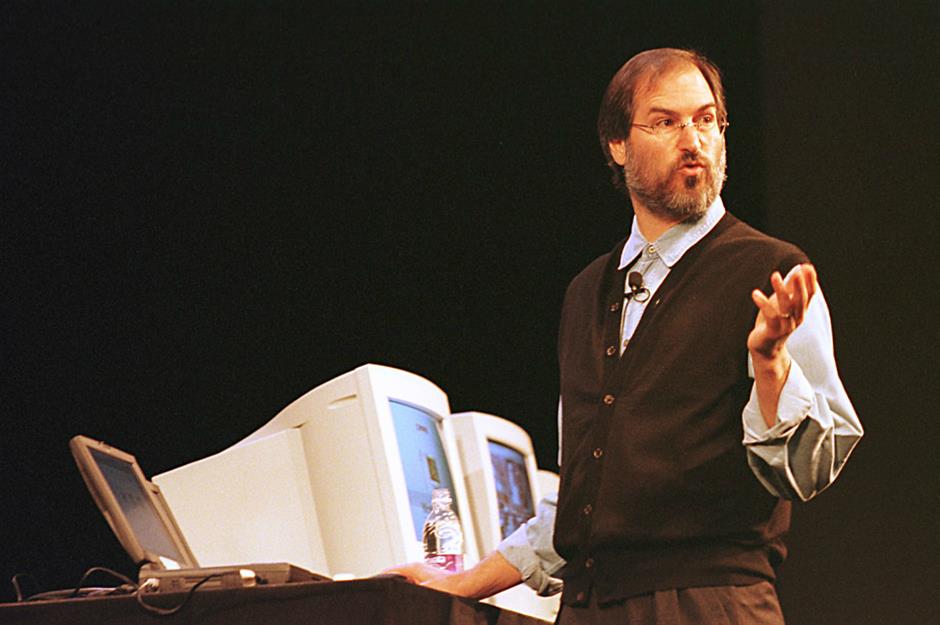

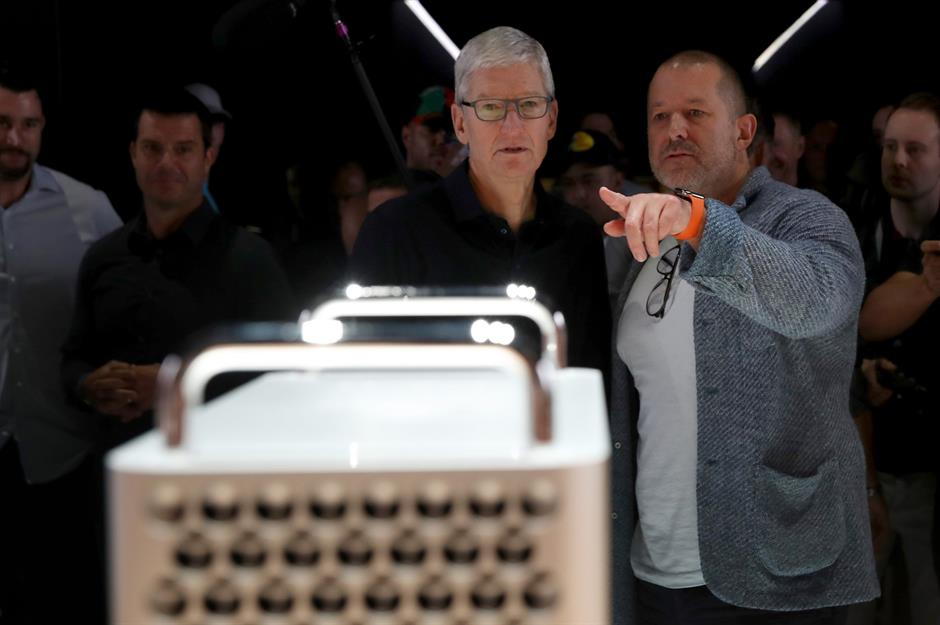

Apple

Jobs turned to industrial designer Jonathan Ive (pictured right), who created the now-iconic minimal Apple look and served as the brand's chief design officer beteen 1997 and 2019.

Since then, Apple has enjoyed unprecedented expansion. In January 2022, it made history when it briefly became the world's first company to be valued at a staggering $3 trillion, having reached the $2 trillion milestone in August 2020.

General Motors

Founded in Michigan in 1908, General Motors was one of the world's largest motor vehicle manufacturing companies throughout the 20th century.

But things took a wrong turn in the early 2000s. By 2005, the firm was losing $10.6 billion a year and it went on to report record losses of $38.7 billion in 2007, which is a staggering $54.6 billion in today’s money.

The financial crisis of 2008 all but finished off the company. In fact, the situation became so bad that General Motors was forced to file for Chapter 11 bankruptcy in 2009, resulting in thousands of workers losing their jobs.

General Motors

But the company didn't give up without a fight.

General Motors streamlined its car lines, focusing on bestsellers such as Chevrolet and Buick, and sold Saab to Dutch car company Spyker.

The Obama administration then gave billions to help the company through the financial crisis of 2007 and 2008, with General Motors receiving a large chunk of the $64 billion spent on bailing out both GM and Chrysler. The business also went public in 2010 to raise extra cash.

Sponsored Content

General Motors

GM quickly returned to profitability and has since posted huge profits despite a number of scandals, including the massive recall of faulty ignition switches in 2014.

Between September 2020 and September 2021, revenue reached an impressive $130.9 billion, rising further to $147.2 billion in 2022.

Despite the difficulties caused by the COVID-19 pandemic and ongoing semiconductor shortages, GM has big plans for the future. By 2025, the company aims to offer 30 different electric vehicles (EVs) and aired a 60-second commercial at the 2022 Super Bowl to showcase its growing fleet of EVs.

It reportedly cost $6.5 million to buy a 30-second slot at the Super Bowl last year, so GM is likely to have dropped more than $13 million on its all-star advertisement.

Marvel

Marvel Comics enjoyed staggering levels of success in the 1960s, 70s, and 80s. But by the 1990s, the comic book bubble had burst and the brand had fallen on hard times.

In December 1996, Marvel filed for bankruptcy and merged with toy company Toy Biz. A series of failed ventures followed, including the ill-fated themed restaurant Marvel Mania at Universal Studios Hollywood, which only intensified the crisis.

Still drowning in debt, the company knew that it had to make some big changes to avoid disappearing altogether...

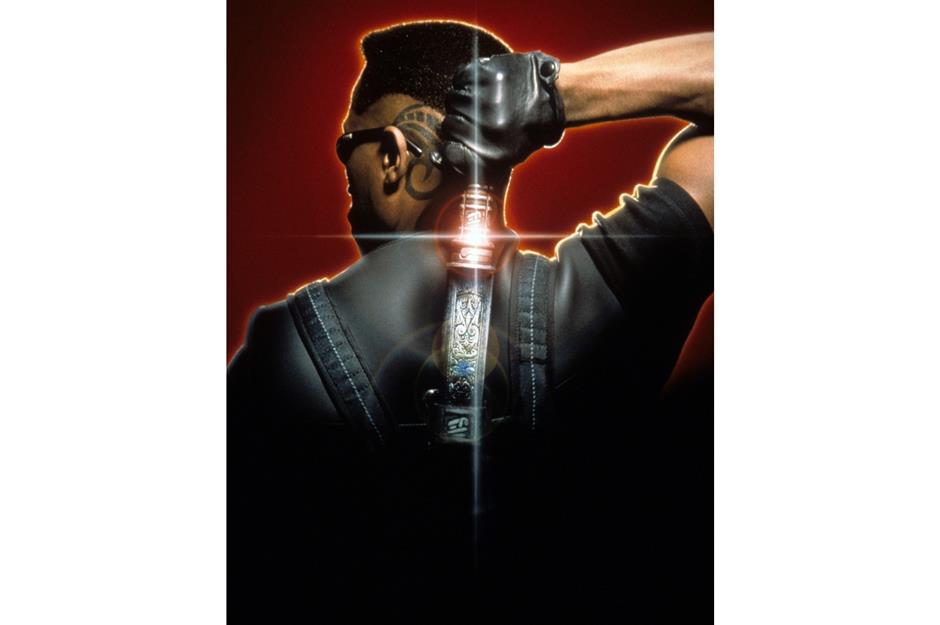

Marvel

Marvel had limited experience in cinema, having only released one movie with Universal Pictures, Howard the Duck, which was a total flop in 1986.

Undeterred, Marvel once again looked to licence out its stories to the big screen. New Line Cinema picked up Blade in 1998 but Marvel only made a meager $25,000 from the flick, the equivalent of around $44,886 today.

Selling X-Men to Fox was yet another source of disappointment and it looked as if Marvel was never going to hit the big time...

Sponsored Content

Marvel

Let down by Hollywood, Marvel made the risky decision to go it alone.

In 2005, the board arranged $525 million in funding from Merrill Lynch, using the rights to its characters as collateral. Marvel Studios was officially born and its first film, Iron Man, was a box office smash, grossing $585 million in 2008.

The following year, the company was acquired by Disney for $4 billion. It's since evolved into a multibillion-dollar franchise, churning out box office hits such as 2019's Avengers: Endgame, which racked up a staggering $2.79 billion in global revenue.

With 11 new Marvel films and series tipped for release over the next four years, it's likely the company's winning streak will continue.

Starbucks

Founded in 1971 in Seattle, Starbucks started out as a shop that sold coffee beans.

However, under the direction of Howard D. Schultz in the 1980s, Starbucks took inspiration from Italian coffee culture and became a café chain, offering customers a personalized service.

It was a great success and expanded quickly. However, the 2008 financial crisis hit Starbucks hard, meaning that it had to close 900 shops between 2008 and 2009, and lay off 6,700 employees...

Starbucks

In January 2008, Schultz, the man who had brought the chain to life in the first place, returned as CEO after an eight-year hiatus.

He identified that Starbucks' stores had lost their appeal to customers and that they needed to up their game in an ever-competitive environment. The business didn't just need to survive the financial crisis – it needed to be able to thrive.

Sponsored Content

Starbucks

Schultz ran an extensive market research campaign titled My Starbucks Idea, inviting customers to share their feedback and suggestions.

This was backed up by a social media marketing campaign, the success of which led Starbucks to become the first brand ever to reach 10 million likes on Facebook.

It worked. Since the drop in sales in 2009, Starbucks has seen global revenue increase every year bar 2020, when the pandemic forced locations to close. The brand made $26.58 billion in worldwide revenue in 2022.

Netflix

Netflix had almost 231 million subscribers in the last quarter of 2022. However, the entertainment platform, which originally started out as a DVD rental service in 1997, hasn't always had a smooth ride...

Netflix

In 2011, CEO Reed Hastings (pictured) decided to get ahead of the curve and focus the business on a streaming service.

He separated the DVD rental side of the business from the video streaming service, raising prices by 60% in the process. Unsurprisingly, this wasn't popular with users, with 800,000 subscribers leaving the platform and its stock price plummeting by 77% in just four months.

Netflix killed off its new DVD rental brand Qwikster just weeks after its launch but that alone wasn't enough...

Sponsored Content

Netflix

Netflix continued to have a tough time in 2012 but thanks to exclusive content and original series such as House of Cards, which launched in 2013, the business risk paid off.

The streaming service has more subscribers than ever as a result of COVID-19 forcing people to stay at home.

In April 2020, the service was valued at $194 billion, making it temporarily more valuable than Disney. However, the House of Mouse has since overtaken Netflix once again.

Delta Air Lines

Delta Air Lines is one of America’s oldest airlines but made headlines for all the wrong reasons when it was declared bankrupt in 2005.

Rising fuel prices and cheaper airlines hit Delta where it hurt, and between 2001 and 2005 the airline lost $12.3 billion. That's the equivalent of $18.4 billion today.

However, things were set to get even worse when the airline began its restructuring plan in 2004 in a bid to avoid bankruptcy. Sadly it failed, and its debt was revealed to be a huge $28.27 billion, or $42 billion today.

Delta Air Lines

As well as filing for bankruptcy in 2005, Delta cut 26% of its flights and began to lay off staff members.

But although it looked as if the business was winding down its operations, the company was actually busy putting a Plan B into action.

During the 19-month bankruptcy period, it implemented a restructuring scheme, which included reducing non-union workers' salaries by a 9% minimum (14% for pilots), laying off between 7,000 and 9,000 employees, rejecting US Airways Group’s proposed takeover and merger, and cutting costs wherever it could.

Sponsored Content

Delta Air Lines

Delta emerged from bankruptcy in 2007 before merging with Northwest Airlines in 2008.

Despite the recession in 2008, which saw the airline lose $8.9 billion ($12bn today), Delta returned to its former glory and still had a pre-tax income of $5.2 billion in 2018.

Compared to the $1.8 billion in pre-tax income it had in 2007 (the equivalent of $2.5 billion in 2023), this was proof that Delta had managed to dramatically reverse its poor fortune.

The airline has been no stranger to controversy over the last few years but it's also been praised for its handling of the COVID-19 pandemic, being one of the first airlines to implement rigorous on-board safety measures.

Levi Strauss

Founded in 1853, this popular clothing brand retreated from the public stock market in 1985 after closing around 60 manufacturing outlets due to poor sales and increased competition.

Levi's, which is best known for its jeans, was also accused of turning a blind eye to alleged sweatshop practices at some of its factories on the island of Saipan, a case which the brand ultimately won.

By 2004 Levi’s had racked up debts of $2.6 billion, which is around $4 billion today.

Levi Strauss

However, Levi’s somehow managed to turn things around.

By signing a collaboration deal with Walmart that ran from 2002 until 2006, focusing more on menswear, and cutting down on marketing costs, Levi’s had sales of over $4 billion by 2007.

By 2016, after initiating a successful deal with the NFL’s San Francisco 49ers, hiring a new CEO, and launching more business deals, Levi’s reported its revenues had reached $4.6 billion.

Sponsored Content

Levi Strauss

Levi's has seen further improvement since then, boosting its annual revenue to $5.5 billion by 2021.

By the end of 2022, the situation was even brighter and the brand posted yearly revenue figures of $6.17 billion.

The brand has stuck to its strategy of reducing the prices of its products in recent years, which is another reason why the company is profitable again.

In March 2019, after its successful debut back on the stock market, the once-struggling clothing brand was valued at $6.6 billion. As of June 2023, its enterprise value is $7.88 billion.

True Religion

Levi's isn't the only all-American denim brand that's hit stormy waters and lived to tell the tale. In 2002, True Religion was founded in California by Kym Gold and Jeff Lubell.

The entrepreneurial Lubell had grand ambitions from the word go. Before selling a single item of clothing, he produced a test run of 14,000 pairs of jeans and convinced a store owner to buy 24 pairs. It paid off.

By 2009, True Religion jeans could be found in an estimated 900 stores around the world. But Lubell's luck wouldn't last...

True Religion

After being acquired by TowerBrook Capital Partners in 2013, the popularity of True Religion jeans began to falter, with analysts suggesting the brand's high price point was alienating customers.

The company filed for bankruptcy in 2017 and had barely recovered when the COVID-19 pandemic dealt it a second heavy blow.

As stay-at-home orders shuttered malls, True Religion reported revenue losses of 80%, while carrying around $180 million in debt. It closed 37 of its 86 locations, having already been forced to close 27 stores in the wake of its first bankruptcy three years before.

Citing it as the only option, the brand filed for bankruptcy again and was truly on the brink of destruction.

Sponsored Content

True Religion

The chain exited bankruptcy in October 2020 after a restructuring plan was approved, which involved paying a $65.8 million settlement to a group of lenders. By that time, it had reduced its footprint to 50 stores.

The brand has enjoyed a remarkable comeback and, according to Vogue Business, brought in revenue of $235 million in 2021.

The clothing company's CEO Michael Buckley – who served as True Religion's president before being appointed to the chief exec role in 2019 – observed at the the time that this was "the most profitable the business has been in the last eight or nine years."

Buckley even hopes to grow True Religion into a billion-dollar business in the years to come, with the company's revenue reportedly topping $460 million last year, so watch this space...

Gold’s Gym

Founded by bodybuilder Joe Gold, the first Gold's Gym opened in Venice Beach, California in 1965, and was frequented by big names such as Dave Draper and Arnold Schwarzenegger.

The gym fell on hard times in the 1970s and was sold to an antiques dealer who reportedly wanted to close the venue down and turn it into a store.

But when the gym was chosen as the filming location for the 1977 docudrama Pumping Iron, Gold's Gym was back in the spotlight. The brand began rapidly expanding in the 1980s.

Gold’s Gym

Gold’s Gym remained popular long into the 21st century, even opening its first location in Jordan in 2017. As of spring 2020, it had 700 gym locations around the world.

But the economic challenges that COVID-19 presented in 2020 took their toll, as did the estimated $80 million of debt that the business had hoped to restructure as part of its bankruptcy...

Sponsored Content

Gold’s Gym

Thankfully, Gold's Gym managed to bounce back. RSG group, a European fitness and lifestyle company, purchased the brand at auction for $100 million in July 2020.

The success of the sale allowed Gold's to emerge from bankruptcy with its gyms open and a healthy balance sheet. The business is now in the process of expanding, having recently opened three new fitness clubs in Dallas, and is also preparing to open a new facility in Washington DC.

Neiman Marcus

Luxury department chain Neiman Marcus was established in 1907 and, after a fire broke out at its first premises, opened its flagship store (pictured) in Dallas, Texas in 1914.

The store made a profit of $40,000 – the equivalent of almost $1.2 million – in its first year of operation. By the mid-1950s the brand had started to expand outside of Texas, with the number of Neiman Marcus stores across the US doubling between 1979 and 1984.

Neiman Marcus

Throughout the 1980s and 90s, the corporate structure of the company changed rapidly but the brand remained commercially successful, acquiring majority stakes in companies including Kate Spade and Laura Mercier.

All seemed to be going well for Neiman Marcus – so when the business suddenly filed for Chapter 11 bankruptcy in spring 2020, people were stunned. According to the luxury department store's CEO Geoffroy van Raemdonck, the pandemic was to blame.

However, The New York Times reported that the chain's Chapter 11 filing in April 2020 might also have been caused by a leveraged buyout by Ares Management and the Canada Pension Plan Investment Board back in 2013, a purchase that reportedly left the business in billions of dollars of debt.

Sponsored Content

Neiman Marcus

Neiman Marcus eliminated $4 billion of its debt when it successfully emerged from bankruptcy in September 2020. More than 20 of its stores permanently closed in the process, including a location in New York City (pictured) that had only opened in 2019.

But 2022 saw brighter times for the department store, which reported in the June of that year that the sales of its 20 best-selling brands had grown by 70% since 2019.

What's more, the company has big plans. In April 2022, online retailer Farfetch announced it would invest $200 million in Neiman Marcus, with goals of expanding the business and launching an international online store. These efforts have apparently been successful; last October, the company revealed its total sales for the financial year ending in July 2022 were up by 40%.

Six Flags

Today, amusement park corporation Six Flags operates 27 theme parks throughout North America. It's known for its record-breaking attractions, which include the world's tallest drop ride and the first-ever virtual reality looping rollercoaster.

Its first park, the Six Flags Over Texas in Arlington, opened back in 1961 and was bought by a subsidiary of the Pennsylvania Railroad in 1966.

The sale injected new cash into the business, enabling the company to open a further five parks throughout the 1960s and 70s.

Six Flags

For decades, Six Flags continued to grow and even expanded overseas. But by 2004, the company had amassed more than just theme parks: it also had a massive debt problem.

It sold off almost all its European parks and a select number of American parks too, a process which brought in $345 million to offset the company's debts – but it wasn't enough.

Five years later, Six Flags was forced to file for bankruptcy, with debts totaling around $2.7 billion.

Sponsored Content

Six Flags

The business reorganized, removing its chairman from the board and giving a group of shareholders – which included major hedge funds – control of the company.

The plan was successful. Six Flags emerged from bankruptcy in May 2010 and has managed to survive both catastrophic storms and the COVID-19 pandemic.

In the company's 2022 annual review, CEO Selim Bassoul declared: "2022 was a year of transition for Six Flags, as we shifted our strategy and rebuilt our foundations. I'm very proud of our team for working tirelessly over the past year to elevate the experience of every guest and lay the groundwork for sustainable earnings growth for the future. While we are still in the early stages of our turnaround, we see the changes beginning to bear fruit, and our record fourth quarter Adjusted EBITDA [earnings before interest, taxes, depreciation and amortization] tells us that we are heading in the right direction."

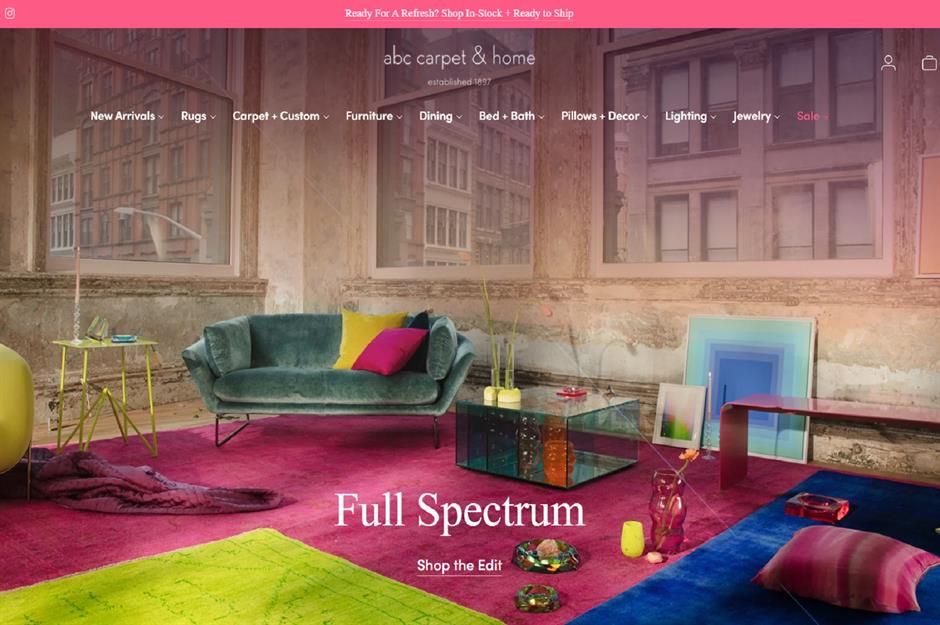

ABC Carpet & Home

ABC Carpet & Home began life in 1887 when founder Samuel Weinrib started selling rugs from a cart in New York.

Although it made $60 million in revenue in 1988, the luxury home goods store has struggled in more recent years and eventually buckled under the pressure of the pandemic.

By September 2021, it owed $3.5 million in back rent and over $15.5 million in bank debt, according to Forbes.

ABC Carpet & Home

CEO Aaron Rose hoped the company would sell at auction before the end of October 2021 – and on 22 October that year, it was announced that a consortium of Persian rug investors had sealed the deal.

The only organization to submit an offer, which was reportedly around $26 million, 888 Capital Partners LLP talked of plans to "continue ABC Carpet & Home's legacy."

The brand has been working towards generating half of its revenue from online sales, and has launched a number of high-profile partnerships, including with Hollywood star Sienna Miller.

Sponsored Content

ABC Carpet & Home

It might still be early days, but it seems the strategy is starting to pay off. Online sources suggest the company made $167.5 million in revenue last year – and although it's not clear what percentage of this came from online sales, ModernRetail has reported the brand saw a 157% year-on-year increase in Black Friday and Cyber Monday sales from 2021 to 2022

Now discover the hidden secrets behind famous American logos

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature