Billionaires' biggest business blunders ever

Not everything they touch turns to gold

Like the best of us, the mega-rich aren't immune to making epic mistakes. Even the shrewdest, most money-conscious billionaires, including Jeff Bezos, Elon Musk and Warren Buffett, have committed monumental blunders that have cost them dear.

Read on to discover eight of the most expensive billionaire bungles of all time.

All dollar amounts in US dollars.

Richard Branson's cola fail

Richard Branson may be worth a cool $2.5 billion (£2bn), but the British tycoon has presided over plenty of failed ventures, including turkeys like Virgin Clothing, Virgin Cars and Virgin Brides. His biggest business blunder, though, has got to be the cola brand he launched in 1994.

Richard Branson's cola fail

Grossly underestimating the competition, Branson seriously thought he could take on Coca-Cola and Pepsi and make a meaningful dent in the global soft drinks market. In reality, Virgin Cola bombed, despite massive ad campaigns and product placement in shows like Friends and Ally McBeal.

Sponsored Content

Richard Branson's cola fail

Branson's cola captured just 0.5% of the American market and had to cease US operations in 2001. The brand initially survived in the UK but was pulled from supermarket shelves in 2009 due to its waning popularity. Production halted in 2012, and the drink, a major flop, was consigned to history.

Jeff Bezos' phone fiasco

The second richest person on the planet, Jeff Bezos is sitting on a $236 billion (£190bn) fortune, and few can dispute the Amazon boss has the Midas touch. However, Bezos has made some dire business mistakes in his time...

Jeff Bezos' phone fiasco

Top of the list is the ill-fated Fire Phone. In an attempt to compete with the likes of Apple and Samsung, Amazon launched the device in 2014 to much hype, but the phone's excessive price tag, awkward OS and limited ecosystem spelled its downfall.

Sponsored Content

Jeff Bezos' phone fiasco

The phone failed to sell, even when it was reduced in price from several hundred dollars to just 99¢ (79p). Needless to say, Amazon quietly discontinued the device the following year and had to write off $170 million in the process. That's the equivalent of over $226 million (£181m) in 2025.

Oprah Winfrey's launch flop

Oprah Winfrey has overcome all sorts of obstacles to get to where she is today, and like the other billionaires in this round-up, she hasn't let the mistakes she has made along the way hold her back. But the 'Queen of All Media' suffered a major setback in 2011 when she launched her own TV network.

Oprah Winfrey's launch flop

Winfrey made the mistake of rushing the launch of OWN, and admits in hindsight that she was woefully unprepared. Within a year, ratings had slumped, and several flagship shows, including a pricey Rosie O'Donnell talk show, were axed.

Sponsored Content

Oprah Winfrey's launch flop

The ratings tumble is estimated to have cost the network $330 million, the equivalent of $453 million (£364m) in today's money. Fortunately, Winfrey has since managed to turn it all around, partly thanks to Tyler Perry, and her net worth is currently an impressive $3 billion (£2.4bn), according to Forbes.

Rupert Murdoch's MySpace misfire

Media magnate Rupert Murdoch blundered in 2005 when his company parted with a hefty $580 million – an eye-watering $937 million (£752m) today – to acquire MySpace, which, as you may fondly recall, was the hottest social media site at the time.

Rupert Murdoch's MySpace misfire

At the time, News Corp was looking to cash in on internet advertising and use MySpace to drive traffic to its newspaper sites. A foothold into the wonderful world of the internet, MySpace seemed like a sure-fire bet. Then Facebook happened.

Sponsored Content

Rupert Murdoch's MySpace misfire

The competing social media site exploded in popularity and MySpace began losing users in droves. MySpace was eventually offloaded by News Corp in 2011 for just $35 million, or $49 million (£39.4m) today. But don't feel too sorry for Mr Murdoch. The media baron has a real-time net worth of $22.5 billion (£18bn), so he won't be going broke any time soon.

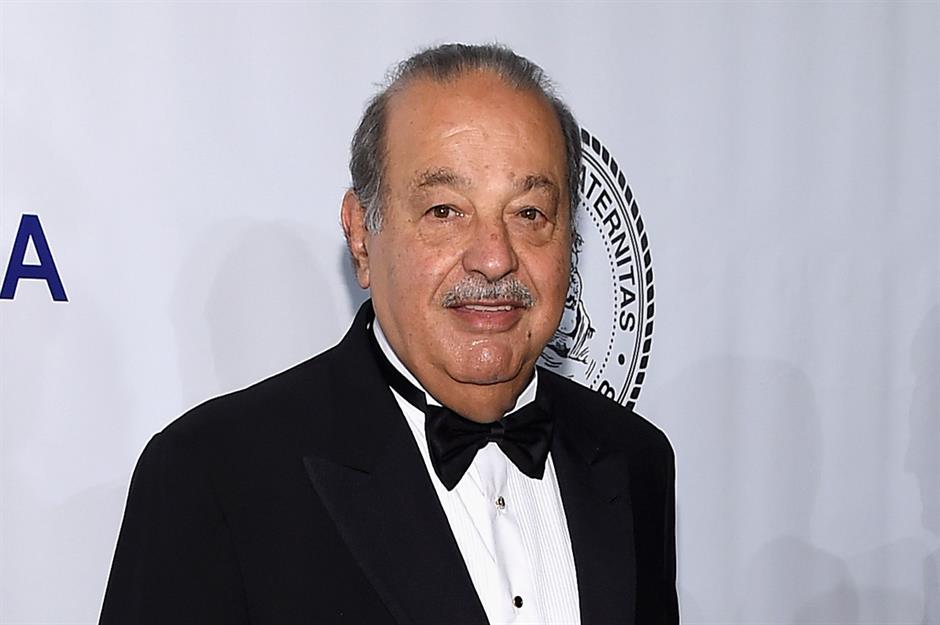

Carlos Slim's CompUSA saga

Confident that he could conquer the fast-growing US PC hardware market, Mexican retail, mining and telecoms tycoon Carlos Slim acquired underperforming computer chain CompUSA in 2000 for around $800 million, a staggering $1.5 billion (£1.2bn) in today's money.

Carlos Slim's CompUSA saga

Slim, who had apparently never used a computer, went on to pump millions of dollars into the failing chain. But try as he might, the magnate, who was the richest person in the world for a number of years, just couldn't make it work.

Sponsored Content

Carlos Slim's CompUSA saga

The rise of the laptop – CompUSA specialised in desktop PCs – and the shift from physical to online stores were the death knells for the chain, which was sold to a private equity firm for peanuts in 2007. Slim, who is currently worth $78.4 billion (£63bn), lost around $2 billion (£1.6bn) on the venture.

George Soros' Russia gamble

Hungarian-American investor George Soros has pulled off some spectacular financial coups in his time, including his audacious short sell of sterling in September 1992, a move that netted his Quantum Fund $1 billion ($2.3bn/£1.8bn today) and made him the 'man who broke the Bank of England'.

George Soros' Russia gamble

Soros may have lucked out with sterling, but his gamble on the Russian ruble in the late 1990s was anything but fortuitous. Quantum Fund had invested heavily in Russia, mainly in equities and bonds.

Sponsored Content

George Soros' Russia gamble

The country's economy came crashing down in 1998, and the Russian government ended up devaluing the ruble and defaulting on its debt. As a result, Soros lost a total of $2 billion ($3.9bn/£3.1bn today). Today, Soros is worth $7.2 billion (£5.8bn), having given away billions to good causes.

Warren Buffett's wasted opportunity

Warren Buffett is one of the world's most successful investors. The 'Oracle of Omaha' is currently worth $141 billion (£113bn), and it seems like everything he touches turns to gold. But even Warren Buffett gets it wrong on occasion.

Warren Buffett's wasted opportunity

Surprisingly, the investor has admitted his biggest mistake was his 1964 acquisition of Berkshire Hathaway, now a major conglomerate. Buffett purchased the failing textile company partly to get back at the CEO, who had upped the price of the firm's stock, reneging on a deal the pair had struck.

Sponsored Content

Warren Buffett's wasted opportunity

Last year, Berkshire Hathaway joined a small club of companies to reach a valuation of $1 trillion (£802bn), becoming the first non-tech business to achieve the historic milestone. Incredibly, Buffett has previously said that he believes if he'd bought an up-and-coming insurance business instead, his holding company would be worth twice as much as it is now!

Elon Musk's expensive tweet

Even before he bought Twitter (and renamed it X), Elon Musk's Twitter rants hit the headlines for all the wrong reasons. Over the years, his posts have made investors very nervous indeed...

Elon Musk's expensive tweet

Musk's misjudged tweet on 7 August 2018 announcing that he was considering taking Tesla private was particularly damaging. The firm's share price surged initially, but when it transpired funding hadn't actually been secured, the price tanked.

Sponsored Content

Elon Musk's expensive tweet

Tesla's market cap lost over $10 billion in the months after Musk's tweet, the equivalent of $12.6 billion (£10.2bn) today. Adding to the tech tycoon's problems, Musk was placed under investigation by the US Department of Justice over the tweet, with the DoJ weighing up whether it broke federal law.

Ultimately, this blunder has done little to damage Musk's long-term wealth. The entrepreneur's net worth has since gone from strength to strength, making him the richest man in the world with a fortune of $415 billion (£333bn). But his decision to purchase Twitter, now X, in 2022 has been widely decried as a disaster. Could it be his worst business move yet? Watch this space...

Now discover who's the wealthiest person in the world's richest countries

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature