Adidas and Puma and other family feuds that spawned two successful companies

Splitting heirs

Aldi Nord and Aldi Süd

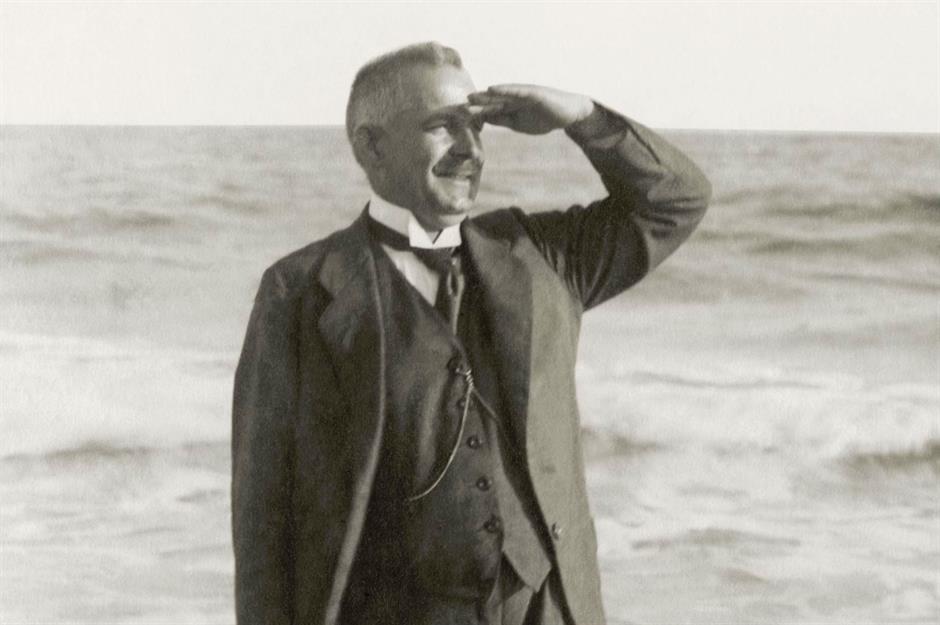

Karl (pictured) and Theo Albrecht took over a small German grocery store in Essen from their mother and turned it into a chain of stores. Aldi – short for Albrecht Diskont – became famous for its limited selection of goods sold at budget prices. But it wasn't to last. They fought over selling cigarettes – and took the extreme solution of splitting their 300 stores through the middle of Germany in 1961, with Theo taking the north and Karl the south. When they expanded outside the country this continued, with Aldi Nord taking France and Poland, and Aldi Süd having stores in the UK, Ireland and Australia.

Aldi Nord and Aldi Süd

There is only one country where both Aldis operate, the US. But you wouldn't know it as in America Aldi Nord operates under the name of Trader Joe’s. After an incident in 1971 where Theo was kidnapped (a year after this photo was taken) and held for 17 days, the brothers became famously reclusive. But it didn't stop them making money. When Karl died in 2014, he was worth an estimated $26.1 billion (£19.8bn), while Theo died four years earlier in 2010, worth just a little less, at around $18.8 billion (£14.2bn).

Read more about Aldi: the German supermarket taking over the world

Sponsored Content

McCain’s and Maple Leaf Foods

McCain’s and Maple Leaf Foods

Hyundai split

Sponsored Content

Hyundai split

Samsung’s breakaway siblings

Samsung’s breakaway siblings

In 2012 Maeng-hee and sister Lee Sook-hee – who married into the family that owns Samsung rival LG – sued their younger brother Kun-hee, accusing him of hiding company shares and demanding $3.54 billion (£2.7bn). Kun-hee won in court in 2014 but had a heart attack the same year and was hospitalised until his death on 25 October 2020, while Maeng-hee died in 2015. Kun-hee's son Lee Jay Hyun (left) is now chairman, and Samsung remains South Korea’s biggest business group, generating 20% of the nation’s gross domestic product.

Sponsored Content

Rothschild vs Rothschild

Rothschild, a 200-year-old European banking dynasty, ended its latest dispute in 2018. Wealth management firm Edmond de Rothschild Asset Management (EdRAM) – run by Ariane de Rothschild (pictured) – and the Rothschild & Co Group agreed to withdraw holdings in each other's firms and settled that neither company would use the single name 'Rothschild' in any of their branding. It was only in 2012 that the French and British arms, Rothschild & Cie Banque of France and NM Rothschild, were brought under one umbrella after years of rivalry.

Rothschild vs Rothschild

But the biggest split in the family came more than 35 years ago when Lord Jacob Rothschild (pictured with Prince Charles) cut his business links with the UK branch of the family after being passed over by his father, Baron Victor, for the chairmanship – which was handed to his cousin. Lord Jacob went on to create the successful investment trust RIT Capital Partners, valued at $4.4 billion (£3.3bn), and St James’s Place Wealth Management. In 2013, he signed a partnership with Edmond de Rothschild Asset Management.

From Rockefellers to Rothschilds: how five old-money family dynasties live today

The Murdochs’ new Fox

Rupert Murdoch’s eldest son Lachlan (pictured right, with his father) was expected to take over the family media empire – until he abruptly left his role as deputy chief operating officer in 2005, reportedly amid friction with his father and other executives. He set up a private investment company Illyria Pty Ltd, with its own media assets. Younger son James was then expected to step into his father’s shoes, but became embroiled in a phone-hacking scandal at UK newspaper the News of the World.

Sponsored Content

The Murdochs’ new Fox

In 2014, Lachlan returned to the fold in time for his father to sell much of 21st Century Fox to Disney for $71 billion (£54bn). Rupert has confirmed that Lachlan will become chief executive of the new, leaner Fox Corp, which will have an estimated $2 billion (£1.5bn) in annual earnings, and share the chairmanship with him. While James (right) had previously been CEO of 21st Century Fox, he has now set up an investment fund and will not be transferring to Fox Corp. In 2020, James also resigned from the board of directors at News Corp, claiming he was leaving "due to disagreements over certain editorial content."

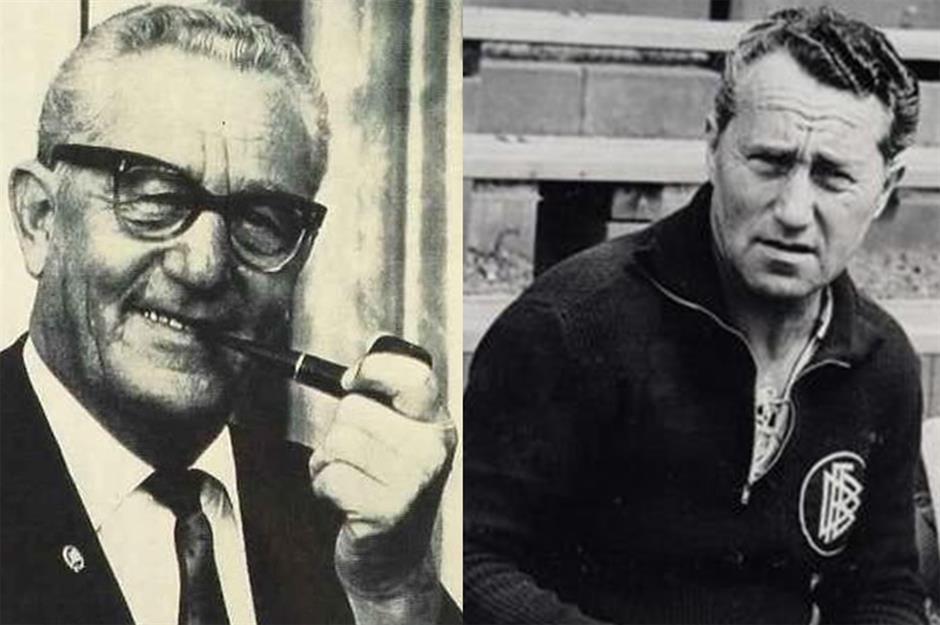

Adidas and Puma

Adidas and Puma

Sponsored Content

Hansgrohe and Grohe

Hansgrohe and Grohe

It wasn’t until the 1980s, when Grohe started to compete against Hansgrohe’s products, that the two companies began a fierce rivalry. Friedrich’s half-brother Klaus had become CEO of Hansgrohe in 1977. To complicate matters further, Grohe bought a stake in Chinese bathroom and kitchen fittings manufacturer Joyou, which was then accused by Hansgrohe of copying its designs. Grohe is now part of the Japanese corporation LIXIL.

Reliance Industries carve-up

Sponsored Content

Reliance Industries carve-up

Elder brother Mukesh kept control of the core oil, gas and petrochemicals businesses while Anil (pictured) took control of the telecoms, finance and power arms. Today Mukesh Ambani, 61, is worth $55.5 billion (£42.2bn) and is India’s richest person while Anil, 59, is worth a comparatively small $2 billion (£1.5bn), his empire having shrunk in value by almost 97% in a decade due to increased competition and loss of market share. Despite their differences, Mukesh stepped in to help Anil repay $77 million (£58.6m) he owed to Swedish telecommunications firm Ericsson in 2019 so that he would avoid jail time.

Read more about Mukesh Ambani, and discover which world-famous pop star he hired for his daughter's wedding

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature