Dear sir, thanks for your nice co-operatin!

15 companies facing a make-or-break 2020

Troubled firms set for an incredibly challenging year ahead

A slew of big-name businesses have hit the skids for a wide variety of reasons ranging from legal and regulatory setbacks to a failure to adapt to changing consumer tastes. How they respond to their respective problems could determine whether they survive and thrive or suffer and even collapse over the next 12 months. Here are 15 companies that are in for a particularly difficult 2020.

Uber

Another year, another barrage of bad news for the world's largest ride-hailing company. Since it went public in May, Uber's share price has tanked almost 30% and while the firm beat Wall Street expectations in its third quarter, it nonetheless reported over a billion dollars in losses, adding to the $6.2 billion (£4.8bn) the business haemorrhaged during the previous two quarters ($1 billion in the first quarter, and $5.2 billion in the second).

Uber

Uber has a plethora of problems on its plate, none of which are likely to do the share price any favours in the year ahead. The global company has experienced several legal setbacks, and in November 2019 lost its licence to operate in London, the company's leading European market, due to safety breaches. It is also being called on by some US cities to pay drivers a hefty minimum wage, and in India there is a possible commissions cap in the pipeline. This is nothing new for the taxi app which has previously been forced to leave countries such as Denmark in 2016 after a ruling that all taxis need to have a fare meter and Hungary in 2016, among others. Uber even pulled itself out of China in 2016 after making huge losses in the country. Whether Uber will reach profitability by 2021, as promised by its CEO, remains to be seen.

WeWork

WeWork

The filing revealed major holes in the profitability of the business model as well as the management style of CEO Adam Neumann, and a whopping 80% was slashed off the firm's value. The IPO was postponed and Neumann got his marching orders. While major backer SoftBank has stepped in with a bumper rescue package, WeWork is shedding 20% of its workforce to stave off bankruptcy and is in for a very tough 2020 indeed.

Read about the big bosses who profited when their businesses were going under

ByteDance/TikTok

ByteDance/TikTok

Royal Mail

Royal Mail

Kraft Heinz

Kraft Heinz

In September major investor Brazilian private equity firm 3G Capital sold off 25 million shares, causing shares to drop by 4%, and two months later Goldman Sachs downgraded the firm. The firm's largest investor remains Berkshire Hathaway, led by Warren Buffett (pictured), which owns 26.7% of Kraft Heinz and seems to want to hold onto its investment. Yet the condiment maker is grappling with changing tastes as consumers eschew its processed products for healthier alternatives. The company has appointed a new CEO Miguel Patricio and rehired former CFO Paulo Basilio to turn things around and what they do in 2020 will prove crucial.

Successful people who have continued working past retirement age

Revlon

Revlon

Bayer

Bayer

As of 11 October, 42,700 plaintiffs are suing Bayer. The litigation has reportedly cost the conglomerate more than $30 billion (£23.1bn) so far. The group's stock has recovered somewhat since January, and while sales were up 6.1% in the third quarter of this year compared to the same quarter last year, profits were down more than 60%. The ongoing crisis has led to speculation Bayer may have to break up, separating its agrochemicals and pharmaceuticals businesses.

Gap Inc.

The so-called retail apocalypse has claimed countless victims around the globe. Gap Inc. is one of the numerous businesses struggling with declining sales particularly in its brick-and-mortar locations with consumers increasingly moving online and ditching the company's Gap, Banana Republic, Intermix and Hill City brands for more budget-orientated alternatives. Even Gap's once-star Old Navy, the retailer's most profitable concept, is dealing with falling sales.

Gap Inc.

Gap Inc. stock has been flagging as a result. The group is attempting to reverse its fortunes by shuttering 230 stores and spinning off Old Navy. However, the split, which is planned for next year, has been thrown into doubt following the departure of CEO Art Peck (pictured), who was ousted in November. Some analysts have questioned whether it will ever come to pass, despite Gap Inc's insistence that it will.

De La Rue

De La Rue

Last year De La Rue lost its plum UK passport contract and had to write off a hefty debt owed by Venezuela's central bank. Compounding its problems, the company is being investigated for suspected corruption relating to its activities in South Sudan. Needless to say, the De La Rue share price has been in freefall for months. The firm has responded with an ambitious restructuring and cost-cutting plan, but if the turnaround is unsuccessful, chances are it could collapse.

L Brands

L Brands

Johnson & Johnson

Johnson & Johnson

The company has also been sued for its role in the US opioid crisis and was recently ordered to pay $8 billion (£6.2bn) in damages for neglecting to warn that the anti-psychotic drug Risperdal could cause male breast growth. The firm's legal troubles are likely to intensify in 2020. On top of all this, Johnson & Johnson has dropped several spots on Interband's Best Global Brands list, and is also dealing with patent losses that have shaved $2 billion (£1.5bn) off sales this year.

Teva Pharmaceuticals

Teva Pharmaceuticals

The company is also wrestling with generic pricing pressures and a price-fixing lawsuit brought by 44 US state attorneys. Teva's debt levels are another cause for concern. Given all these problems, Biopharma Dive has declared that Teva is at high risk of bankruptcy next year. Be that as it may, Teva is poised to debut 40 new generic products next year, which should provide a much-needed boost for the embattled firm.

Kohl's

Adding to the multitude of traditional retailers that are struggling to thrive, US department store chain Kohl's is having a hard time adapting to the new normal. Though the retailer has introduced a number of innovations, including a collaboration with Amazon that will enable customers to return online purchases in its stores, Kohl's announced the closure of several off-price locations back in June and more recently, reported gloomy results for its third quarter.

Read about the famous-name stores that could disappear in 10 years

Kohl's

The company share price, which stood at $67.80 (£52.20) in early January, plummeted following the earnings report, which fell short of analysts' expectations, and is now 32% lower than it was at the beginning of the year, much to the chagrin of investors. And so, 2020 is likely to be a tricky year and major changes will be needed for the Midwestern chain to regain its mojo.

Alitalia

Teetering on complete collapse, Alitalia hasn't made a profit for an incredible 15 years and is reportedly burning through €700,000 ($775k/£590k) a day. Italy's loss-making national airline, which has been hit hard by high fuel costs and competition from both budget and high-end airlines, went into administration in 2017, and the latest attempt to rescue the airline failed dismally after a consortium of possible buyers declined to make an offer.

Alitalia

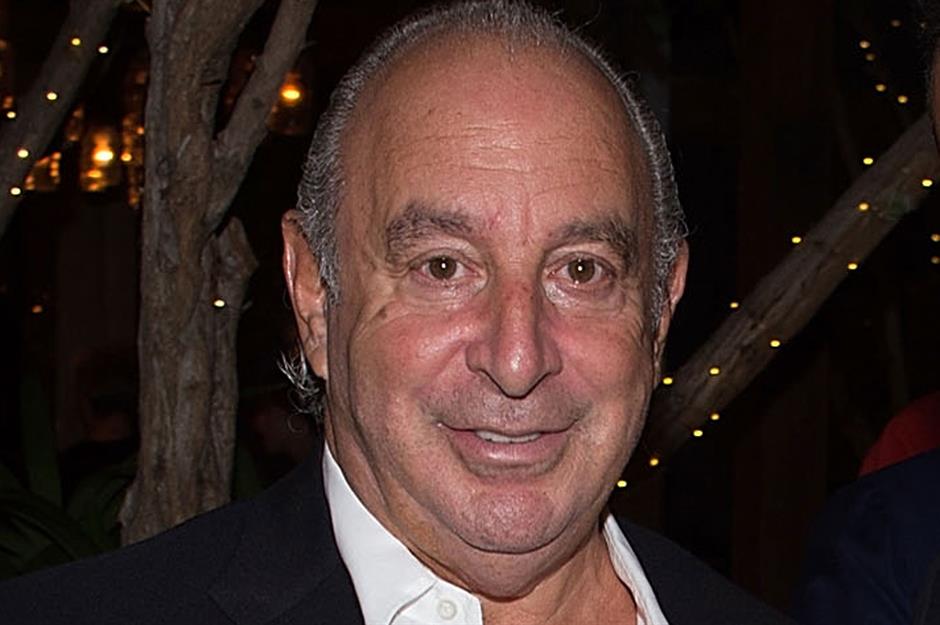

Arcadia

British retail group Arcadia has had a tumultuous 2019. The company, which counts key high-street names such as Topshop, Burton and Dorothy Perkins among its portfolio, posted losses of $179 million (£138m) for the year preceding September along with a 4.5% drop in turnover as growing competition from online retailers and rising property costs eat away at the firm's bottom line.

Arcadia

The group was saved from bankruptcy in June after entering into several company voluntary agreements (CVAs) that have involved rent cuts, the closure of 48 stores and 1,000 job losses, but Arcadia owner Sir Philip Green continues to have his work cut out reviving the beleaguered firm, which has been marred by years of underinvestment.

Now find out how companies facing a make-or-break in 2019 fared

Comments

-

REPORT This comment has been reported.

Do you want to comment on this article? You need to be signed in for this feature

02 February 2020