From Netflix to FedEx, brands that profit during global crises

Brands that bucked the trend

The Panic of 1907: General Motors

The Panic of 1907 was the first global financial crisis of the 20th century, when the New York Stock Exchange plummeted by 50% in three weeks. Although the panic lasted just six weeks, its effects were felt for two years and many companies struggled to stay afloat. But from this recession-plagued landscape, General Motors was formed. William "Billy" Durant founded the business in September 1908 with the purchase of the Buick Motor Company, which he followed by scooping up a further 20 automobile firms. Durant put his experience of making horse carriages to cars and GM quickly went on to become a highly successful automaker.

First World War: Marconi Company

Today our televisions and smartphones provide endless access to the news, but 100 years ago everyone caught up on world events via wireless radio. The British firm Marconi's Wireless Telegraph Company, renamed Marconi Company in 1963, fuelled a growth in wartime communications technology. Not only were its wireless stations the first to announce the outbreak of war, it was the first company to develop the technology for transmitting voice over radio. In the US, its subsidiary the Marconi Wireless Telegraph Company of America was the dominant wireless radio provider until 1919.

Sponsored Content

First World War: DuPont Company

DuPont Company was founded in Delaware in 1802 as a biotechnology, chemicals and pharmaceuticals manufacturing firm, although its main product was explosives. During the First World War, DuPont profited from selling high-powered explosives and artillery shells to European Allies and the US, making up 40% of the Allies’ munitions. It paid well: the company’s stock soared by 374% between 1915 and 1918 according to the New York Times, with its revenues coming to a massive $1.245 billion for the wartime period. That's the equivalent of $21.4 billion (£16.4bn) in today's money. At the start of the COVID-19 pandemic the company saw sales suffer slightly, but it secured $3 billion (£2.3bn) in financing to ride the crisis out.

The Great Depression: Procter & Gamble

A decade-long economic downturn known as the worst in the industrialised world, the Great Depression started in October 1929 with the stock market crash. Despite the fact people drastically cut down on spending, there were some essentials that would always be needed – one of which was soap. Procter & Gamble decided to make the most of this, ramping up its advertising by sponsoring radio programmes which came to be known as "soap operas". The tactic worked as faithful listeners became regular buyers of P&G soaps and the company’s revenues reached $230 million in 1937. That would be equivalent to $4.1 billion (£3.5bn) in today’s money. P&G has seen a similar effect during the COVID-19 pandemic, with sales up 5% for the year as of 30 July, as its cleaning products and toiletries are in high demand.

The Great Depression: Sears

The first Sears store was opened in Chicago in 1925 and it expanded quickly, with 300 department stores across the US by 1929. The chain bucked the trend of declining sales during the Great Depression by selling affordable staples, such as socks, underwear, sheets and towels. It didn’t just survive the decade but came out far stronger, having almost doubled the number of its stores and expanded even further across the nation. However, it hasn't been plain sailing for Sears in recent years, with the company filing for bankruptcy in 2018, after which it closed hundreds of stores. Coronavirus has already seen the chain close 78 stores.

It hasn't been as plain sailing for Sears recently. Read more about the business and the most disastrous takeovers ever

Sponsored Content

The Great Depression: E&J Gallo

When Prohibition ended in December 1933, it was believed that the new alcohol industry would create jobs and boost the economy. Yet it also lined the pockets of a number of liquor firms. One of which was E&J Gallo, a California-based winery which gained popularity by selling its wine at just 50 cents per gallon – half the market rate at the time. Within the first year of trading, the winemaker had made an astonishing $34,000 in profits, equivalent to $656,000 (£563k) in today’s money. Today the company achieves annual revenues of $5 billion (£3.8bn) according to Forbes.

The Great Depression: Publix Super Markets

In 1930, George Jenkins opened his first grocery store in White Haven, Florida, calling it Publix Food Store. Despite the tough economic landscape, the business went from strength to strength, with 1934 sales estimated at $120,000 (£103k) in today’s money according to the company's website. By 1940 the concept of supermarkets was gaining traction, so Jenkins opened his first Publix Super Market, which included modern innovations like sliding-glass doors and air conditioning. The chain expanded rapidly in the 1940s and 1950s and today is the largest employee-owned company in America. COVID-19 has boosted the supermarket's sales, which increased by 16% in the first quarter of this year. Publix attributes $1 billion (£763m) of sales to coronavirus-related purchases.

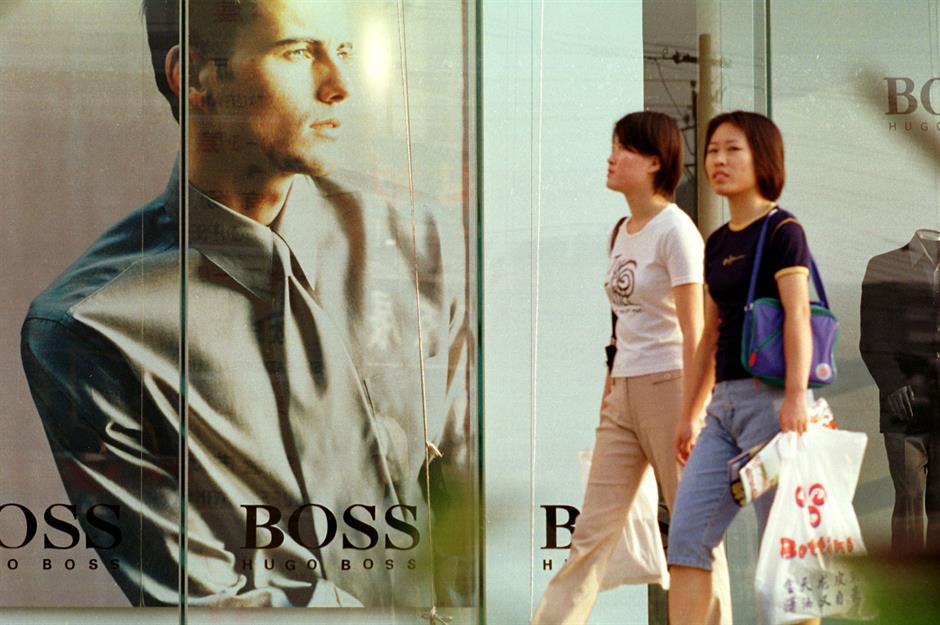

Second World War: Hugo Boss

German fashion house Hugo Boss's role in the Second World War is well-known. Founded in 1924, one of the company’s earliest big contracts was to supply the uniform worn by the Nazi party, before making army uniforms from 1938 onwards. Worse still, it used the forced labour of abducted workers during the war to produce the garments. By 1940, Hugo Boss was reportedly making around one million Reichsmarks – a significant jump from the 200,000 Reichsmarks it made in 1936. In 2011, the company commissioned the publication of an official history of its activities under the Nazi regime, releasing a formal apology for its use of forced labour during the war.

Sponsored Content

Second World War: Ford Motor Company

Ford Motor Company also had a link with Nazi Germany during the Second World War. The company owned a German plant up until 1941, until it lost control of the site when the US entered the war. In 1999, Jim Vella, Ford's global news director, issued a statement saying: "Whatever occurred at the Cologne plant during World War Two was and is the responsibility of the German government, as successor to the Nazi regime.” However, Ford’s headquarters in Dearborn, Michigan had made hefty revenues by producing materials for the German Third Reich up until Pear Harbour in December 1941, according to documents from the US National Archives.

1970s Downturn: FedEx

The 1970s downturn, lasting between 1973 and 1975, was started by the oil crisis of 1973 which saw oil prices skyrocket by 400% in just five months. FedEx was founded in 1971 and began shipping parcels in 1973 just as the oil crisis hit, which caused costs to rise exponentially. Yet the company pumped money into an ad campaign with the tagline “FedEx—when it absolutely, positively has to be there overnight”, which put the brand name on everyone’s lips and helped turn its fortunes around. By 1980, profits reached $38.7 million, equivalent to $121 million (£104m) in today's money. During the COVID-19 pandemic FedEx has scrapped its annual bonus for employees and furloughed some staff, but has since announced it will give employees a 2% pay rise from October to thank its half a million workers for going above and beyond during the crisis.

1990s Downturn: Toyota

The “Big Three” US automakers – Ford, General Motors and Chrysler – didn’t fare well during the 1990s recession, yet Toyota was spared the same fate. The car company undercut its rivals in the US market, as its Japanese-made vehicles were far cheaper than those made in the US – boosted by the strength of the yen against the dollar at the time. As a result, it managed to keep sales steadily rising throughout the decade, save for a slight dip between 1993 and 1995, and revenues increased by 3.6 million yen between 1989 and 1999, according to Toyota’s fiscal reports. It seems like history is repeating itself as Toyota has reported that it sold 200,000 more vehicles than expected between April and June this year, signalling a faster bounce back from the coronavirus crisis than the carmaker anticipated.

Sponsored Content

The Great Recession: L'Oréal

The Great Recession, officially lasting between 2007-2009, was the longest period of economic decline since the 1930s. As with any recession, people stripped back their spending to essentials, which might sound like bad news for a cosmetics company. Yet thanks to a phenomenon called the “lipstick index”, where in hard times shoppers opt for low-value treats such as lipstick instead of higher-value items, L'Oréal managed to buck the trend. In the first half of 2009, it reported higher than expected profits of €1.37 billion, equivalent to €1.58 billion ($1.7bn/£1.46bn) in today’s money, and shares soon jumped by 10%.

The Great Recession: Walmart

Walmart is currently the biggest retailer in the world by revenue according to Forbes, and it’s weathered more than a few storms in its almost 60 years of business. In the first six months of the Great Recession, its stock rose steadily, while in 2008 profits rose by 5.9% to $13.5 billion. That’s because while shoppers were cutting back on luxuries, they still needed food, and many turned to low-cost retailers such as Walmart to provide it. Unsurprisingly, the retailer has benefited from 2020's pandemic, with sales surging 10% in stores and 74% online in the first quarter of the year. Walmart employed 500,000 more employees because of coronavirus, and has rewarded staff with three rounds of bonuses totalling $1.1 billion (£844m) to date. It has since announced it will recruit a further 20,000 workers for the holiday season.

From Walmart to GM: how the world's biggest companies looked 10 years ago

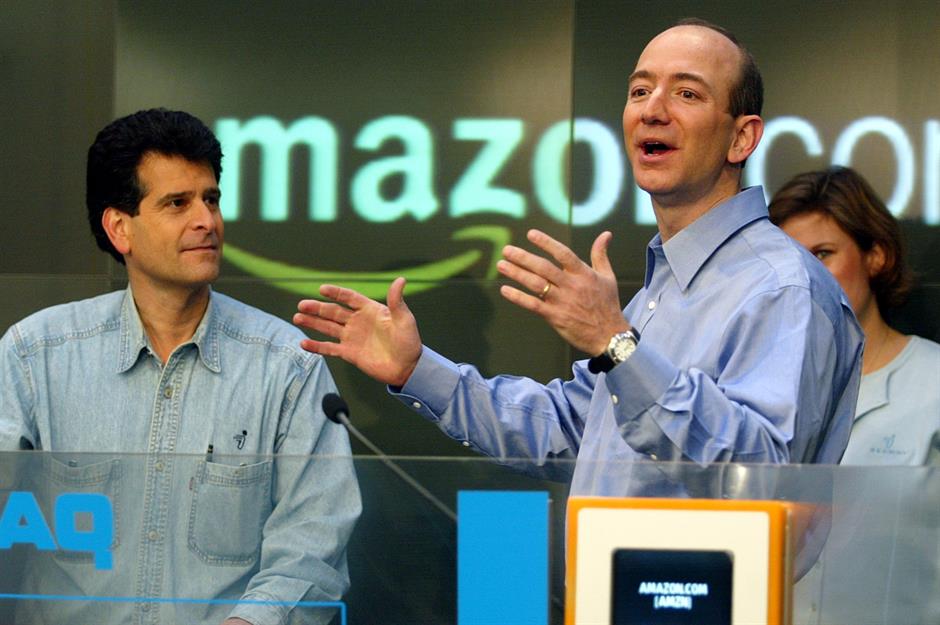

The Great Recession: Amazon

As bricks and mortar retailers struggled to stay afloat during the late 2000s recession, Amazon was seeing a remarkable rise in profits. In 2009, the company grew sales by 28% while competitors were seeing dramatic decreases. International sales accounted for almost half of income and the Kindle was the top-selling product. Similarly the coronavirus pandemic has seen the retailer's net profit double year-on-year as of the end of July. However, it's not been entirely rosy for the online retailer with many of its warehouse workers staging a 'sick-out' in May in protest at the company's working conditions.

Now read some strange facts you didn't know about Amazon

Sponsored Content

The Great Recession: Ford

Much of Ford’s success during the Great Recession has been attributed to CEO Alan Mulally, who took over the reins in 2006. At that time, Ford’s stock price had fallen sharply and in 2006 it made its biggest ever loss of $12.7 billion ($16.3 billion (£14bn) in today’s money). Many expected the company to file for bankruptcy. Yet three years later, the company posted a $2.7 billion net income for 2009 (equivalent to $3.3 billion (£2.8bn) today), causing commentators to dub Ford the “comeback kid”. Mulally’s tactics included focusing on smaller car models and selling off brands, as well as making tough decisions such as cutting jobs.

The Great Recession: Domino’s Pizza

The recession brought about a general shift towards people spending more time at home, which proved beneficial to Domino’s Pizza. Yet it wasn’t all plain sailing – in late 2008, the company’s stock had fallen to just $3.85 a share. Domino’s launched off-piste TV commercials acknowledging complaints that its pizza “tasted like cardboard” and revamped its dough recipe, as well as embracing digital technology to streamline the delivery process. These methods clearly worked, as the company boosted its revenues and profits, coming out of the recession far stronger. The pizza takeaway chain has benefited from people being stuck at home during the COVID-19 pandemic, posting a 16% rise in year-on-year sales in the US on 14 June.

The Great Recession: Snuggie

This novelty blanket with sleeves became so popular that some joked 2009 was the “Year of the Snuggie”. It wasn’t a unique product – the Slanket, a similar sleeved blanket, had come years before – yet it was the Snuggie that found success, kickstarted by an infomercial which got everyone from Oprah Winfrey to Ellen DeGeneres talking about it. By 2013, the in-demand blanket had sold 30 million units and pulled in a massive $500 million (£426m).

Now discover other simple products that made millions

Sponsored Content

The Great Recession: Intel

Intel is the second largest computer chip company in the world after Samsung. The firm employed a strategy of patience during the recession, waiting for demand for technology products to return and withstanding the dip in growth that it experienced between 2008 and 2010. Now, 10 years on, it’s on a huge upswing with revenues for the financial year of 2019 coming in at $72 billion (£60.1bn).

The Great Recession: LEGO

In 2004, Danish toymaker LEGO was on the brink of bankruptcy. Yet new CEO Jørgen Vig Knudstorp, who handed creative direction over to fans and employed smarter fiscal strategies, helped to turn the company’s fortunes around. By 2009, LEGO’s profits were up by 63% on the previous year. Speaking to British newspaper the Independent, Marko Ilincic, the managing director of LEGO UK, said: “Parents spend lots of money on plastic imported toys, but they only do what it says on the tin. But children take Lego to pieces, build them up again and add it to other Lego, and that gives it longevity.”

The Great Recession: McDonald’s

During the economic downturn of the 1990s, McDonald’s average sales per restaurant had declined, yet history didn’t repeat itself during the Great Recession of 2007-2009. In fact, the chain opened nearly 600 new stores in 2008 – at a time while other fast food companies were shutting up stores – while its global same-store sales were up 7.1% in January 2009 compared to the previous year. It’s widely thought that the chain’s competitive prices and convenience made it increasingly popular at a time of economic hardship. However, the change in customer behaviour during the COVID-19 pandemic has made this crisis a lot more challenging for the fast food chain, as it was forced to close its stores for months, and had to rely on drive-thru and delivery. Sales fell by 23.9% in the second quarter of this year. While its restaurants are now mostly open, the pandemic is still having an impact.

Sponsored Content

US hurricanes Harvey, Irma and Maria (2017): Home Depot

From August to October 2017, the US was devastated by three hurricanes: Hurricane Harvey, Hurricane Irma and Hurricane Maria. The combined cost of the disasters was $268 billion (£228bn), yet not everyone lost out. Hardware store chain Home Depot reported that customers had spent $282 million (£240m) on plywood, lumber, bricks, drywall, power generators and roofing material, which drove its annual profits up to 11% higher than the previous year. Profits would have been even higher if it weren’t for temporary store closures, supplier delays and shortages in hurricane-struck areas.

Coronavirus global pandemic: Netflix

The World Health Organization (WHO) declared COVID-19 a pandemic on 11 March 2020, and soon countries started to go into lockdown, staying at home unless travel was necessary. While it is yet to be seen who the ultimate winners and losers of the pandemic may be, there are some companies that have already seen positive results, including Walmart and Amazon as previously mentioned. But few things are more synonymous with staying at home today than Netflix. The number of subscribers has risen by 26 million in the first half of the year alone, not far off the 28 million subscribers the service attracted in the whole of 2019. However, Netflix warned that sign-ups are beginning to slow, an announcement that saw shares drop by 10%.

Read about Netflix's journey to global domination

Coronavirus global pandemic: Gojo Industries

It’s a good time to be a hand sanitiser company. Revenue growth for the hand sanitiser manufacturing industry has been adjusted from 1.9% to 16.6% in 2020 due to rapidly surging demand, according to industry research company IBISWorld. Gojo Industries, the maker of Purell hand sanitiser, has around a quarter of the US hand sanitiser market and generated more than $370 million (£311m) in revenue in 2018. The company has not disclosed figures yet, but a spokesperson told NBC News it had “dramatically increased production” of Purell since the beginning of the year.

Sponsored Content

Coronavirus global pandemic: Zoom

In order to adjust to new home-working arrangements, businesses across the world turned to video technology. And the pandemic has been the making of video communications company Zoom, which has seen its revenues soar astronomically. In the first half of the year it has posted revenues of $328.2 million (£252m), a whopping 169% increase on the same period last year. Net profit jumped from $200,000 (£153k) in the first quarter of 2019 to $27 million (£20.7m) in the same period this year.

Now read about the product changes and rebrands that failed

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature